Managerial vs Financial Accounting

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for Free

Accounting refers to the gathering, analysis, and reporting of financial information. It can be divided into various types depending on its function, with the three major ones being tax, financial, and managerial accounting. In practice, finance managers utilize various accounting tools without distinguishing between them. Still, each branch of accounting requires a different set of skills and specializations.

And while the specifics of tax accounting are clear, the line is blurry when it comes to the other two branches. This article sheds light on the matter by examining the managerial accounting vs financial accounting juxtaposition.

We define the terms and provide examples of the functions involved, then compare the related regulations, time perspectives, and reporting conventions.

What Is Managerial Accounting?

Managerial accounting, as the name suggests, is primarily intended for business managers and other internal stakeholders. A crucial function is to keep expenses in check, as they are among the key growth drivers a business should analyze to succeed.

Moreover, in increasingly competitive environments, even the slightest cost fluctuations can cause ripple effects down the supply chain. So, effectively managing costs and their impact on the company’s profitability is key to ruling the market.

Let’s see the primary functions in practice.

Managerial Accounting Example

Suppose the fashion brands Primark and Monsoon are known for having similar designs but different prices. For instance, a cotton jersey dress sells for $10 at Primark and for $15 at Monsoon.

For now, we ignore the value of brand image and investigate this issue purely from the perspective of Cost of Goods Sold (COGS).

Primark sources its cotton from and outsources the manufacturing to factories in Pakistan. In contrast, Monsoon sources cotton from Pakistan but manufactures in Bangladesh, so they pay significant freight charges.

The dress’s production cost in Pakistan and Bangladesh is $5, but Monsoon incurs a shipping charge of $8 per dress for the cotton. Therefore, the same design and dress cost Monsoon $13 and Primark only $5. This way, Primark profits $5 per dress, whereas Monsoon only profits $2 per dress.

A managerial accountant’s job is to identify this issue and help Monsson gain a competitive advantage. It can bring down the cost of production through alternative suppliers and offer the same dress for $10. Then, revenue generation and competition will hinge on brand image and customer loyalty alone.

What Is Financial Accounting?

Financial accounting involves the analysis of business transactions, reporting to external parties, and preparing financial statements for public use.

The primary difference between managerial and financial accounting is that the former improves internal financial reporting, while the latter targets external stakeholders, such as investors and banks. In addition, financial accounting aims to present a comprehensive picture of an organization’s year-on-year performance and financial position.

Consider the following example of the financial accountant’s functions.

Financial Accounting Example

Suppose that Primark prepares its annual financial statements. The company is a public entity and reports its performance quarterly.

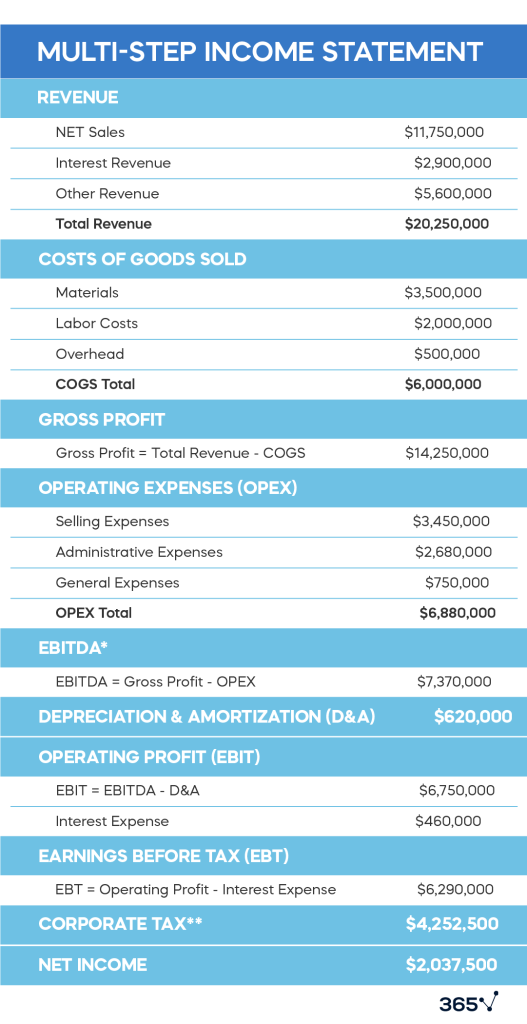

Melony is a financial accountant at Primark. Her responsibilities involve preparing monthly financial highlights, processing and analyzing financial data, providing profit and loss analysis, etc. One of Melony’s tasks is to book the latest accrual-related adjustments before publishing the quarterly Income Statement. After the accruals (which affect both the COGS and OPEX accounts), she prepares Primark’s Income Statement for a final review.

Melony updates Primark’s quarterly P/E ratio based on the Net Income figure.

P/E=\frac{Price/Share}{Earnigns/Share}Assuming a current market price of $100/share and 1,000,000 outstanding common shares, Primark’s latest P/E would be:

P/E=\frac{\$100}{\$2.0375}=\$ 49.01The company’s published financial statements (prepared by financial accountants) allow external stakeholders to make informed decisions. An investor interested in Primark can then combine insights from the major financial statements with ratio analysis to evaluate the firm’s performance.

How Does Managerial Accounting Differ from Financial Accounting?

Managerial accounting deals with the strategic elements of company affairs and benefits internal stakeholders. As such, it is a suitable career path for individuals who wish to partake in the organization’s future strategy and business trajectory.

Financial accounting, on the other hand, requires an eye for detail and an ability to adhere to strict guidelines. It involves presenting data understandably and thoroughly primarily to external stakeholders. Other financial vs managerial accounting differences are summarized in the table.

| Managerial Accounting | Financial Accounting |

| Forward-looking | Looks to the past |

| Strategic insights | Analytical insights |

| For internal users | For external users |

| Incorporates financial and non-financial information | Only financial information is assessed |

| No audit required | Audited |

| No universally recognized standards | IAS, IFRS, US GAAP |

| Short-term insights | Long-term projections |

Managerial Accounting vs Financial Accounting: Regulations

Financial accounting is regulated by two major bodies: FASB (Financial Accounting Standards Board) and IASB (International Accounting Standards Board). Specialists must comply with the international accounting standards issued by the financial reporting bodies (depending on the firm’s location)—US GAAP (issued by FASB) or IAS and IFRS (issued by IASB).

In contrast, managerial accounting is not governed by any regulatory body or mechanism. This gives companies the freedom to use the concepts and methods that best fit their needs instead of following a strict framework.

Managerial Accounting vs Financial Accounting: Time Perspectives

Financial accounting examines past data (i.e., historical records) as a meaningful metric of company performance. For example, year-on-year trends allow external stakeholders to build financial models of expected growth.

In contrast, managerial accountants work with present data and set targets for the near future. It is forward-looking and involves tasks like preparing the Master Budget and forecasting revenue and expenses for the upcoming periods based on data from the current period.

Managerial Accounting vs Financial Accounting: Reporting Conventions

What is the difference between managerial and financial accounting in terms of reporting conventions?

The former enables effective decision-making by expanding existing data, and the latter—by summarizing existing data.

Financial accounting involves aggregating chunks of bookkeeping data concisely. For instance, a financial accountant may have to analyze company performance in a year-end Income Statement.

In contrast, managerial accounting’s insights are often highly detailed, in-depth analyses of various cost functions. For instance, managerial accountants are often tasked with reporting on overhead cost absorption.

Thus, they regularly present Activity-Based or Traditional Absorption Costing reports to managers using snippets of information from electricity bills, payrolls, transportation charges, etc. They divide it into chunks and calculate cost rates.

Accounting Career Paths

If you prefer a multifaceted role in a fast-paced environment (e.g., working in a startup finance team) managerial accounting is a suitable path. And if you’re looking for a more integrated, analytical role (e.g., at one of the Big Four firms), financial accounting is the right choice.

But as you grow in your finance career, distinctions such as managerial accounting vs financial accounting are blurred in business practice.

What’s Next?

Ready to take the next step toward a career in finance?

Our Accounting and Financial Statement Analysis course will give you the foundational knowledge to begin your career. And our FP&A: Building a Company’s Budget course will teach you the skills to reach your desired role.

Whether you’re a complete beginner or a working professional, our expert-led courses help you upskill at your pace. Sign up for free, find the right fit for you, and start learning today.