Preparing the Master Budget: Step-by-Step Guide

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for Free

Knowing what a Budget is and how to prepare one from scratch are two of the most fundamental skills a financial analyst needs to have under their belt. But to unlock the full potential of budgets, you need to have a clear sense of the specificities that go into handling them. Most large-scale organizations will have not one but several documents that all feed into the holistic Master Budget. Understanding its purpose, typical structure, and contents is the next step towards perfecting the budgeting process.

What is the Master Budget?

The Master Budget is a comprehensive financial planning document that aggregates all of the inputs submitted by the various departments. More specifically, it compiles the business units’, departments’, and cost centers’ expectations and consolidates them in Budgeted financial statements. To a certain extent, The Master Budget resembles the Annual Report of a company. However, while any Annual Report looks into the past and depicts the firm’s historical performance, the Master Budget is all about the future of an organization.

How to Prepare a Company’s Master Budget?

Bringing together various streams of interrelated information can be a cumbersome task. Should we start with projecting the units to be produced? Or, do the units to be sold come first? How much would the firm pay for marketing campaigns and product promotions? Shouldn’t that amount be based on the units produced? Or maybe units to be sold? There are a lot of question marks when it comes to business planning.

That’s why a standard Budgeting Framework might come in handy here – this is a step-by-step guide on how to prepare a firm’s Master Budget.

Preparing the Master Budget – step-by-step guide

To make better sense of the theory, let’s look into a practical example.

Step 1: Sales Budget

Suppose that you are part of a team that is responsible for creating ABC Corporation’s Master Budget. Every budgeting process starts with the prediction of sales. So, the sales, or revenue expectations are the foundation of every annual business plan.

But how do we actually calculate the expected amount of revenue?

At its most fundamental level, financial planning as a whole begins with selecting a budgeting method. By now, you should know that we could either use the bottom-up or the top-down approach. Once you have that out of the way, you are ready to calculate projected sales.

For short-term planning, you can simply multiply the number of units to be sold from each product times their price. Keep in mind that both quantity and price estimates for the future depend on the company’s strategy and objectives.

Step 2: Production Budget

Once you have the revenue prediction, you can move on to estimating the Production Budget which tells you how many products a firm needs to manufacture in the future. It reflects the Sales Budget, along with various other factors, such as inventory value at the beginning of the year, buffer stock levels, production capacity, and so on. That said, the inventory balance in the predicted Balance Sheet and the Cost of Goods Sold in the projected Income Statement are closely related.

Equipped with this information, you can now calculate the expected costs to produce the units to be sold, or COGS.

As easy as it might seem, however, the cost of manufacturing is probably the hardest thing to predict. To simplify the process, we usually divide the Production Budget into three main parts:

- We begin with the Direct Material Budget, which comprises the raw materials to be used in manufacturing the final product.

- Then, we have the Direct Labor Budget, or the payroll cost of personnel directly involved in the production process.

- And the third component is the Manufacturing Overheads Budget. It includes all production expenses beyond direct materials and direct labor. Electricity and water supply, as well as depreciation and amortization expenses related to the Production facility go into this cost category.

Direct Material, Direct Labor, and Manufacturing Overheads Budgets coupled together give you the Cost of Goods Sold prediction.

Once you have that, you can easily calculate the expected gross profit. Recall that:

Gross Profit = Revenue - COGS

Step 3: SG&A Budget

After completing this step, you will need to estimate a budget for Selling, General, and Administrative Expenses. Some of these do not directly derive from the sales that the firm will have because they are mostly fixed in nature. For example, there might be legal expenses, office supplies, salaries of non-production personnel, as well as rent or utility bills. All these expected costs are gathered and provided to you by the person responsible for the SG&A budgeting process.

Next, you have to work on the budget for financial income and expenses. Here, you should consider interest expenses or debt repayments.

As you can see, all these are examples of Operating Budgets – everything that affects the Net Income figure goes into this section.

So, what else do you need to compute?

Step 4: Cash Flow Budget

You need the schedule of expected inflows from clients and outflows to suppliers to calculate the net cash position of the firm.

The Cash Budget is an important piece of the Master Budget, as it illustrates the company’s expected liquidity indicators. Profitability and liquidity rarely go hand in hand.

Step 5: Capital Budget

The last part of the Annual Business Plan is the Investment or Capital Budget. It shows the total amount that a company plans to generate by selling (or acquiring) fixed assets such as machinery, plants, or cars.

What’s Next?

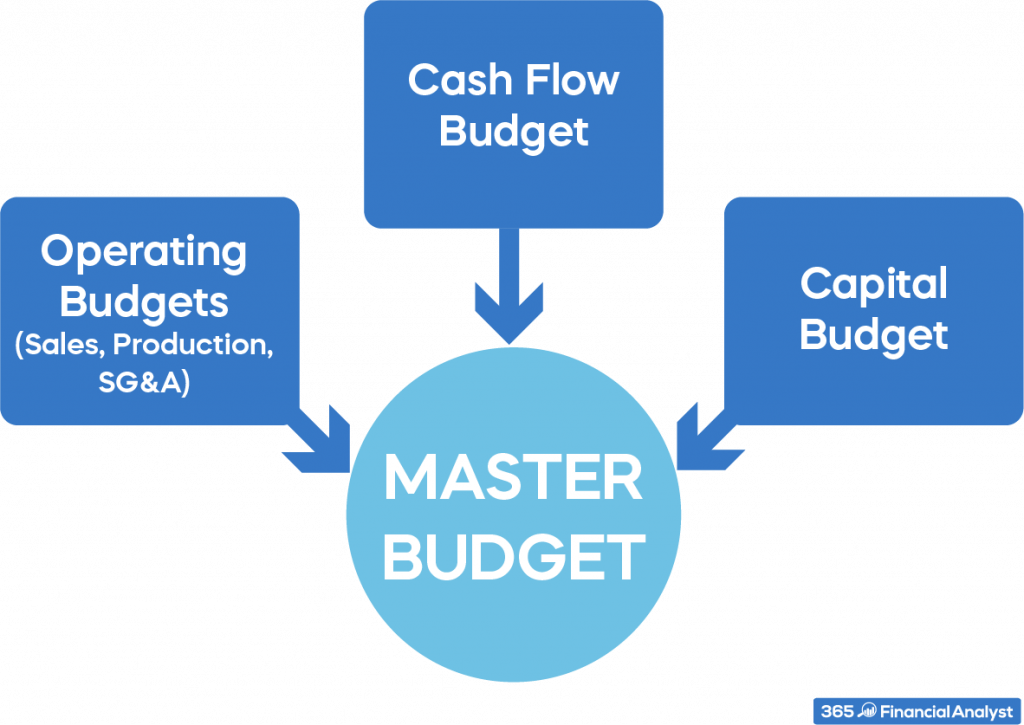

Altogether, the Operating, Cash Flow, and Capital Budgets depict a company’s expected financial performance. As such, these reports make up the Master Budget. Essentially, viewed from a different angle, the Master Budget consists of the firm’s projected Income Statement, Balance Sheet, and Cash Flow Statement for the upcoming years.

Of course, the numbers in the Master Budget must align with the company’s long-term goals. And it is the top management of the company that should ensure the budget figures reflect properly its strategic objectives. As a financial analyst, your input into the budgeting process is equally important. With the course FP&A: Building a Company’s Budget, you can learn how to create top-of-the-line integrated financial models and perform forecasting with optimum results, all at your own pace.

Are you ready for the next big step in your career?

Take your skills to the next level and unlock your full potential with the Financial Analyst Career Track. Our expert-led courses provide real-life case studies, along with many practical examples and quizzes. Try our program today and learn at your own pace.