What is Financial Accounting?

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for Free

As you power through your accounting journey, you will come across a key concept known as Financial Accounting. It is one of the four main focus areas of accounting:

- Bookkeeping

- Financial Accounting

- Managerial or Cost Accounting

- Tax Accounting

While bookkeeping is a record of raw data, what makes this data useful for analysis is financial accounting. When compared to managerial accounting, which also extracts insights from financial data, it works in completely the opposite way. In essence, managerial accounting is different from financial accounting in that it is forward-looking. Whereas financial accounting focuses entirely on historical data.

Financial accounting is a great career choice for individuals interested in becoming Financial Analysts, Business Consultants, or even Auditors. Professional qualifications such as ACCA or CPA are a great way to break into the field.

Financial Accounting Definition

So, what exactly is financial accounting? For starters, it’s the process of summarizing and communicating existing data collected via bookkeeping. It is the universal language of finance because it is highly regulated and generally uniform. Data is made meaningful by allocation into the four major financial statements. The preparation and distribution of these documents happens in line with the following frameworks:

- IFRS & IAS (International Financial Reporting Standards and International Accounting Standards)

- US GAAP (Generally Accepted Accounting Principles)

The US GAAP is the set of principles stipulated by the Financial Accounting Standards Board (FASB). Whereas IAS and IFRS come under the International Accounting Standards Board (IASB). Companies have the freedom to choose the framework they wish to follow. However, once they decide to use one, they must stick to it in the future.

What is the Primary Purpose of Financial Accounting?

Summarizing and communicating financial data

As previously stated, the main functions Financial Accounting serves are:

- Summarizing key financial data

- Communicating key financial data

They are both satisfied using the four financial statements, which capture the essence of company performance in a given financial time frame.

For example, any potential investor would be eagerly awaiting the day a company’s audited financials are released. As these documents contain meaningful data that enables key stakeholders to make informed decisions. This is because, financial reports summarize company performance across a range of operations. For instance, the Income Statement contains the company’s revenues, costs, expenses etc. over a period of one year. Similarly, a snapshot of the company’s assets, liabilities and equity is contained within the Balance Sheet. This information allows external stakeholders, such as banks, shareholders, or potential investors to gauge company performance.

Interpreting financial data

Interpretation of financial reports can vary from user to user. For example, for a small investor, a company making losses year on year is a bad sign. As a result, they may consider selling their stock because it doesn’t bring any return in dividends or capital gains.

However, for a bank, the focus might be less on profits and more on working capital cycles, current liabilities, current assets, etc. Or if the bank is lending a running finance line to the company, they will be more interested in its cash conversion cycle.

Similarly, a large-scale investor might be less focused on losses and more focused on cost improvements undertaken by the company. That is because such entities are generally more interested in the long-term potential of a company’s stock.

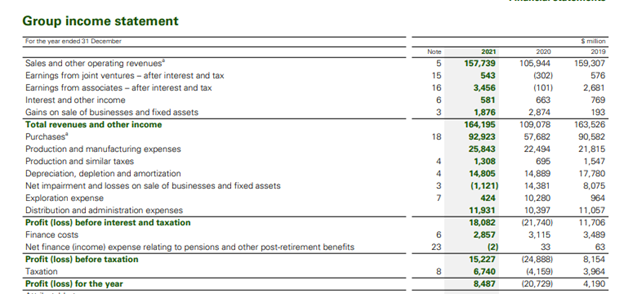

A real-world example of this would be British Petroleum (BP plc). They pivoted their strategy in 2020 from oil and gas exploration to clean energy. The exploration expense fell in 2021. This could mean potential losses in the short term, i.e. 2022 onwards. However, investors from the UK, USA & EU are willing to disregard this in light of the world shifting towards NetZero by 2050.

Why is Financial Accounting Important?

The financial statements of a company allow users to make a variety of decisions. These stakeholders each individually decide what their metrics of company performance would be. For example, the UK is one of the signatory countries of the Paris Climate Agreement (2016). Therefore, the government would evaluate how companies headquartered in UK are making changes to shift to Net Zero by 2050. So, the financial statements of most UK companies must mention carbon neutral investments in fixed assets. Communicating compliance with government regulations so as to avoid sanctions is a crucial facet of financial accounting.

Another example is regulation such as Anti Money Laundering (AML) and Combatting Financing of Terrorism Guidelines (CFT). Companies such as online trading brokerages must make certain disclosures in their financials. These disclosures affirm that all their financial operations are in compliance with AML and CFT guidelines.

Similarly, a bank wishing to conduct business with a grocery delivery startup would like to evaluate certain financial growth metrics. These could be their inventory turnover, inventory held, profit margins, liquidity ratios etc. Furthermore, a shareholder could use a company’s Common Size Income Statement to calculate year on year profit growth.

In other words, financial accounting makes it possible for companies to receive external funding. Without a clear picture of company finances, no landing institution or investor would put their money up. Hence, financial accounting is key for ensuring companies get the funds they need to survive in the competitive world of business.

Financial Accounting in Action

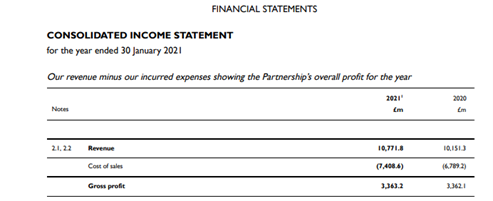

To better understand the crucial role financial accounting plays in the corporate sphere, let’s consider an example. John Lewis and Partners is a chain of department stores in the UK. The following is an extract from their Income Statement:

During the COVID-19 pandemic (2020-2021), they faced a number of stiff lockdowns. These forced closures naturally impacted sales. Looking at this report, a financial analyst would first spot that Year on Year (YoY) sales rose by 6.12%. However, Cost of Goods Sold (COGS) also rose by 9.13%. Since Costs rose faster than Revenues, Gross Profit margins fell from 3.31% in 2020 to 3.12% in 2021.

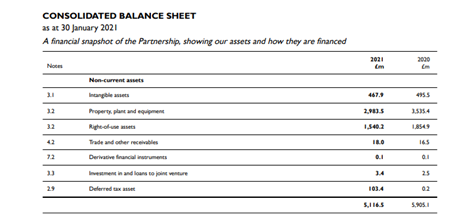

Next, if we look at an extract from John Lewis’ Balance Sheet, we see the following:

This section highlights long term (or fixed) assets. We can witness the year-on-year increase or decrease in each line item to determine how well these assets were utilized.

Since John Lewis focuses highly on Goodwill and brand image, the fall in intangible assets by 5.65% should raise an alarm. In addition, how did online sales compare with competitors? There’s another question that will pique the interest of a financial analyst.

The years 2020-21 were signified by the pandemic. Therefore, a more adequate picture for John Lewis would emerge between the end of 2020 and the coming 2023. An informed finance manager would be aware of this. Moreover, they would know to look towards underlying causes in their interpretation and analysis.

What’s Next?

While summarizing, communicating, and interpreting reports is the backbone of financial accounting, the potential uses of these operations don’t just stop at the accountant’s office. For example, auditors specializing in drafting Annual Audit Reports, finance managers specializing in financial analysis and tax accountants all make use of financial accounting in one form or another. As a result, the field is perpetually expanding.

Upgrade your skillset with cutting-edge tools and start making a difference in the corporate world by enrolling in our Accounting and Financial Statement Analysis course!

Ready to take the next step toward a career in Finance?

Our team of industry experts has designed a Financial Analyst Career Track to prepare you for the world of Finance as it is today. Whether you are a total beginner or a working professional, our expert-led courses offer the opportunity to upskill at your own pace. Find the right fit for you and start learning today!