Audit Reports

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for Free

Financial statements are prepared according to a specific set of rules – either local accounting principles or International Financial Reporting Standards. A question then arises, “Who oversees whether companies comply with financial regulation guidelines?”

Use of Auditor’s Report

Financial statements provide valuable information about the financial performance and position of an organization. That’s why they are actively used by a wide range of stakeholders – investors, employees, suppliers, creditors, and customers, to name a few. Once prepared by the company’s accounting team, the information presented in the financial statements is reviewed by external auditors to ensure that the facts and figures have not been manipulated. Based on the findings, auditors issue the so-called Independent Auditor’s Report.

Understanding Independent Auditor’s Report

In reality, audit companies examine the first financial statements and disclosures prepared by the management; and then issue an Auditor’s Report. This is their opinion on the accuracy and completeness of the published financial data. In short, this is an appraisal of an organization’s financial status and performance, completed by external audit professionals.

The audit opinion confirms whether the financial statements present a true and fair view of the company’s performance and position. In essence, it certifies (or doesn’t) the credibility of the figures within the Annual Report. In most cases, this is a legal requirement. The Big Four Audit market leaders at present are:

- Deloitte

- PricewaterhouseCoopers (PwC)

- Ernst & Young

- KPMG

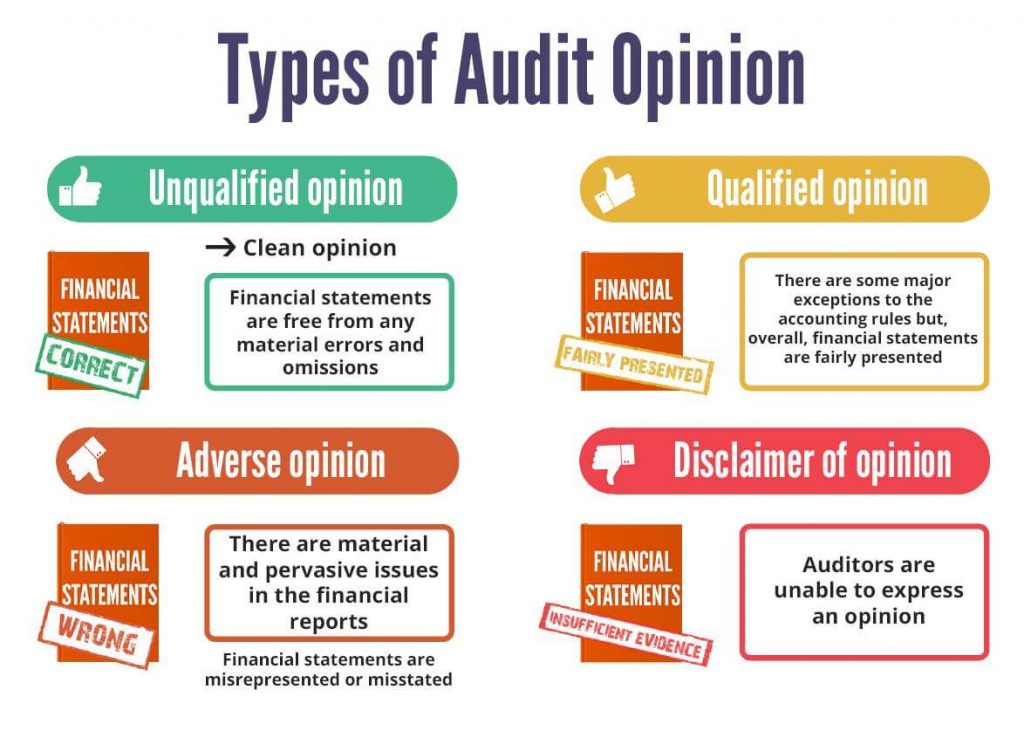

Types of Audit Opinion

If a company’s reported figures are a true representation of the business, then auditors issue an unqualified or clean opinion. It basically states that the financial statements are free from any material omissions and errors.

If auditors find out any major exceptions to the accounting rules, they may issue a qualified opinion. This means that they’ve spotted a few reporting issues which need to be corrected, but overall, financials are fairly presented.

Things get serious when auditors find out material and pervasive issues in the financial reports. In this case, they issue an adverse opinion, indicating that the financial statements are misrepresented, misstated, or do not reflect accurately on a company’s financial performance.

And finally, an auditor may be unable to express an opinion on financial statements. For example, when companies submit insufficient audit evidence, auditors may claim they have scope limitations, and release a disclaimer of opinion.

The Importance of Internal Controls

In most countries, external auditors are required to express an opinion, not only on the financial statements’ fairness, accuracy, and completeness but also on the firm’s effectiveness of internal controls. Normally, this is included in the last paragraph of a standard audit opinion. These are mechanisms, rules, and procedures that ensure the integrity of financial information. By right, a company’s management is responsible for designing a sound internal control environment.

Think of internal controls as process gateways. A rigorous financial statement preparation would involve a lot of checks and balances. If strong internal controls are in place, then the financial data may be deemed true and fair. Weak internal controls, on the other hand, tend to lead to erroneous, inaccurate, and incomplete financial information.

The Bottom Line

The Auditor’s Report enhances the degree of confidence in the financial information shared externally. Therefore, audit reports are imperative as they help analysts gain confidence in the validity of published financial information. If a firm reports significant profits and growth, but its financial statements are accompanied by an adverse audit opinion, you should question the reliability of the reported figures.