What Are the Big 4 Accounting Firms?

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for Free

The Big 4 accounting firms are the leaders in the broad accounting and professional services field. Together, they boast the largest network of clients and gross revenue in the industry worldwide and audit about 80% of public companies in the US.

Table of Contents:

- What are the Big 4?

- Local Regulations

- How the Big 8 Became the Big4

- Career Opportunities at the Big 4

- What’s Next?

What Are the Big 4?

KPMG, EY, PwC, and Deloitte specialize in financial accounting and auditing services. But as the accounting profession has grown over the years, so has their sphere of operations. Now, the Big 4 firms offer a wide range of professional services, including management consulting, corporate finance advisory, tax, data assurance, digital transformation, and Fintech.

Klynveld Peat Marwick Goerdeler (KPMG)

With offices in all major financial centers of the world, KPMG has an established presence in over 145 countries. With over 250,000 employees worldwide and a global revenue of $34.6 billion in 2022, KPMG is the smallest of the Big 4 accounting firms.

Ernst & Young (EY)

Ranking third by global revenue ($45.2 billion in 2022), EY has office locations in over 150 countries. With approximately 365,000 employees worldwide, EY is a strong contender for the top slot.

PricewaterhouseCoopers (PwC)

The second largest of the Big 4 accounting companies ($50.3 billion global revenue) is PwC. Its network spans almost 328,000 employees in 2022 in 157 countries.

Deloitte

The largest of the Big 4, Deloitte, earned $59.3 billion in revenue in 2022. It operates in more than 150 countries and employs 412,000 professionals.

Local Regulations

Because of the scale and complexity of their operations, the Big 4 accounting firms have to follow strict regulations when providing financial accounting services at home or overseas. Thus, they adhere to different requirements from relevant governing bodies depending on the location.

For example, the Institute of Chartered Accountants of Pakistan (ICAP) regulates the CA (Chartered Accountancy) qualification in Pakistan. Therefore, all CPA firms in Pakistan are contractually obliged to recruit and train accountants with ICAP.

Similarly, the Institute of Chartered Accountants of England and Wales (ICAEW) is the governing body in the UK. Hence, accounting firms in the UK must hire employees who have obtained qualifications from ICAEW.

Additionally, different parts of the world follow different conceptual accounting frameworks to which the Big 4 adhere. The US follows guidelines issued by The Financial Accounting Services Board (FASB) known as US GAAP (Generally Accepted Accounting Principles). Meanwhile, Big 4 accounting firms in the UK adhere to the International Accounting Services Board (IASB) guidelines. These are the IFRS (International Financial Reporting Standards) and IAS (International Accounting Standards).

How the Big 8 Became the Big 4

The Big 4 accounting firms started out as the Big 8: Arthur Andersen, Arthur Young, Coopers & Lybrand, Deloitte Haskins & Sells, Ernst & Whitney, Peat, Marwick, Mitchell, Price Waterhouse, and Touche Ross.

Industry mergers and acquisitions led to consolidations, narrowing them down to the Big 5: PwC, KPMG, EY, Deloitte, and Arthur Anderson. They became the Big 4 after the collapse of Arthur Anderson following the Enron and WorldCom scandals.

Similar scandals continue to occur but none has damaged the reputation of the Big 4 accounting firms irreversibly.

For example, the recent fall of WireCard in 2020 brought the role of EY under scrutiny. Similarly, in 2017, KPMG was accused of being part of the collapse of Halifax Bank of Scotland (HBOS). Later, however, Lloyds bought HBOS and KPMG was cleared of all charges.

In such cases, the Big 4 accounting firms invariably stick to a common defense: an auditor’s report is simply an opinion. In other words, the audit opinion provides only a reasonable assurance that there are no material misstatements in the financial statements of a company. The forensic advisory team is responsible for gauging whether or not a company is involved in any fraudulent actions.

A Legacy of Trust

Over the years, many accounting firms tried to dethrone the Big 4 without success. This is primarily due to the legacy of the global CPA firms and the trust embedded within them by millions of customers worldwide.

And despite the high-pressure environment, professionals employed at the Big 4 enjoy some of the highest levels of job satisfaction in the industry. In fact, the top accounting firms boast higher employee ratings than other accounting firms on all components except work-life balance—compensation, culture, senior management, and most significantly, career opportunities. This makes them a desired working place for many financial specialists.

Career Opportunities at the Big 4

As the accounting world progresses, so do the recruitment process and career opportunities at the Big 4. You don’t have to be an accountant to land a job with them. You could start as a trainee in one of their non-accounting departments or join as an experienced professional from another field.

For example, if you have experience as a digital transformation consultant, you can become part of their data advisory team. Similarly, if you have commercial banking experience, you can find work at a consultancy department.

And if you wish to work in auditing, payroll, tax, or accounting but don’t have the necessary credentials yet, these companies will facilitate you in obtaining a professional qualification. The Big 4 accounting firms value talent over experience but success won’t come easy.

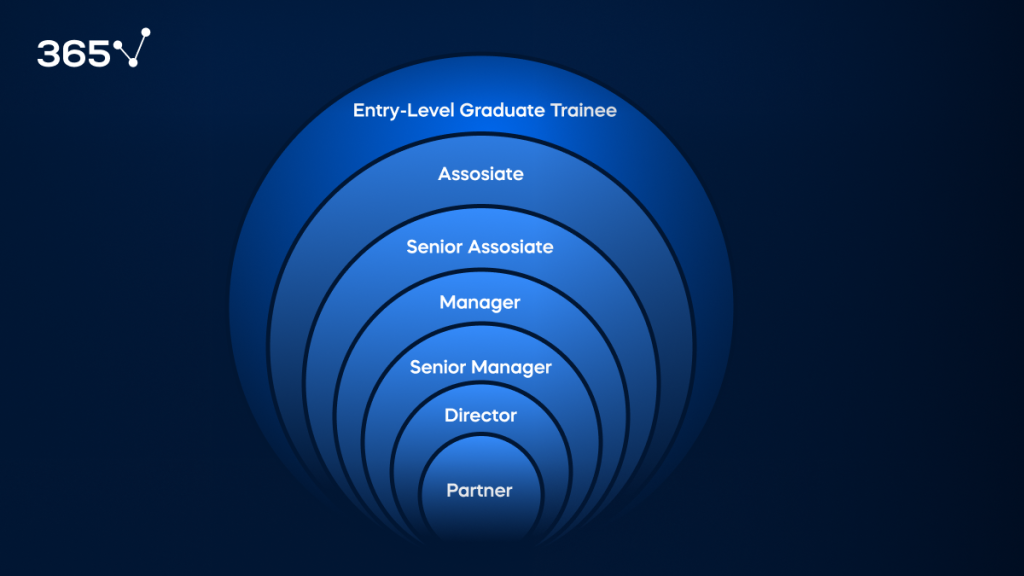

Career Ladder

If you have just finished your undergraduate degree, you can apply for a trainee program across a range of departments. If you put in the work and have the ambition to progress, your career map may look something like this:

Partner is the highest level in the Big 4 career ladder. It takes an accountant between ten to fifteen years to become a partner.

What’s Next?

If you’re set on a career at one of the global CPA firms, your practical skills will be what keeps your resume from falling into the rejection pile. By learning the ropes of the most in-demand accounting and auditing tools, you can outshine the competition regardless of your background.

Ready to take the next step toward a successful career in finance?

Our Fundamentals of Financial Reporting course will give you the practical insights and skills to land your first job in accounting. And our complete Financial Analyst Career Track will equip you with the analysis and reporting skills to become a certified professional and a good match for the Big 4 accounting firms.

Whether you’re a total beginner or a working professional, our expert-led courses offer the opportunity to upskill at your own pace. Find the right fit for you and start learning today! You can sign up and try the program for free.