What Is an Income Statement?

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for Free

Financial statements convey information about a firm’s financial performance and position. The main reports that companies prepare are an Income Statement, a Balance Sheet, and a Cash Flow Statement. In this article, we focus on the Income Statement. We explain in detail what it contains and how to understand the different revenue, expense, and profit figures in it. But first, let’s define Income Statement.

What Exactly Is an Income Statement?

An Income Statement is a core financial statement that shows a firm’s financial performance over a given accounting period. You can find it in the company’s Annual Report.

In practice, this statement adopts various names, such as the Statement of Operations, the Statement of Earnings, or simply the Profit and Loss Statement. Regardless of the name, you’ll find the same information—a company’s profit, or net income, generated as a result of normal business operations.

The easiest way to understand the structure of an Income Statement is with an example. So, let’s see what it looks like.

What Is the Structure of a Typical Income Statement?

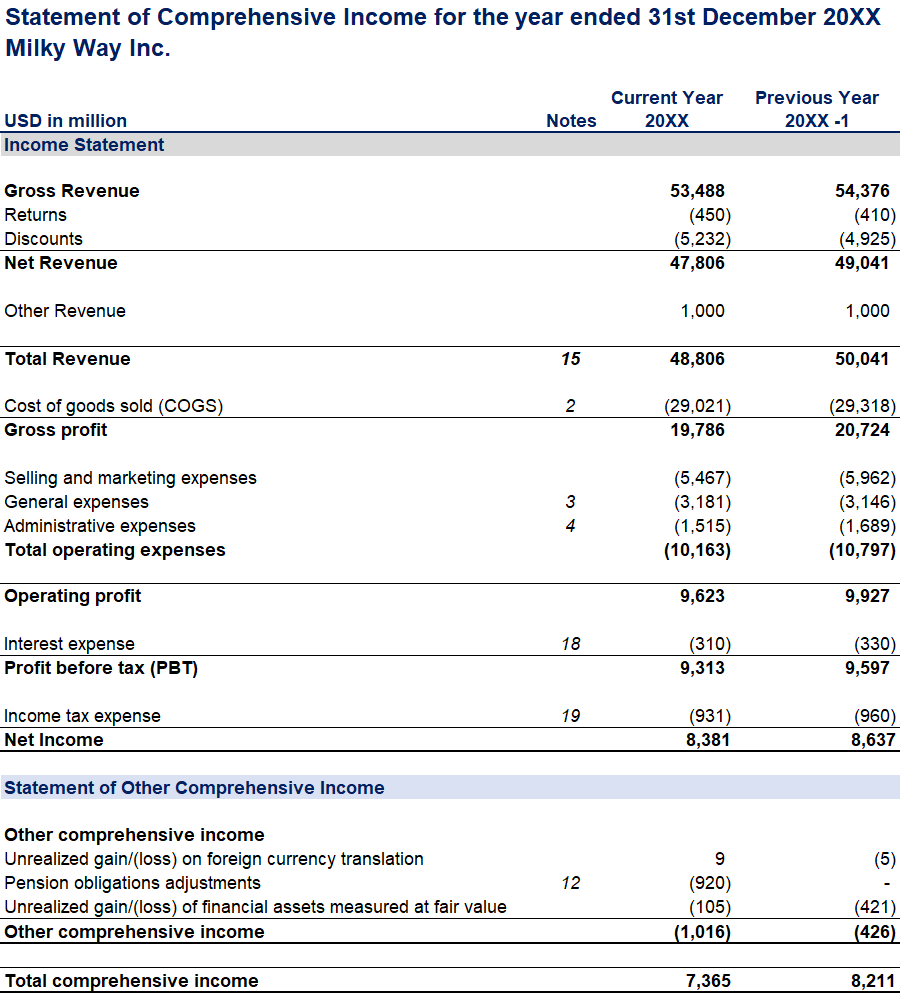

Suppose you work as a financial analyst, and you have been assigned to analyze the Income Statement of Milky Way Inc—a dairy company that produces and sells milk and cheese to supermarket chains. You can see its Income Statement in the image below.

What do we see?

The final product of an Income Statement is the net income. However, we need to consider a few other subtotals to calculate it. The two primary drivers of net income are revenues and expenses.

Net Income = Revenues minus Expenses

Sounds simple, but if we take a closer look at the statement, we’ll see several revenue and expense figures. To help you understand the Income Statement, we explain all of them, starting with the revenues.

Understanding Revenue in the Income Statement

The first figures we see in Milky Way’s Income Statement are its gross, net, and total revenues.

Gross Revenue

Gross revenue is the amount reported from the sales of goods and services in the normal course of business operations. The economic benefits Milky Way receives from selling its products to customers in the latest financial year is $53,488 million.

So, what is the difference between net revenue and gross revenue?

Net Revenue

Consider the following situation.

Some supermarkets don’t sell all Milky Way products and return those that are close to their expiry date. Others may be eligible to trade discounts. If we adjust the gross revenue for such estimated returns and allowances, we get the net revenue. So, Milky Way’s net revenue equals $47,806 million.

Other Revenue

Any additional sources of revenue go under “Other Revenue.” Companies often generate funds outside their core operations. For example, a firm may rent some of its real estate or even benefit from the sales of manufacturing equipment.

If Milky Way Inc rents out one of its warehouses and receives $1,000 million in return, it writes down the pay-off under “Other Revenue.” That way, we can separate core business sales from non-core activities. This allows us to make meaningful comparisons between competing companies’ operating and non-operating financial results.

Total Revenue

Finally, the total revenue on the Income Statement is the sum of net revenue and other revenue. We can see that Milky Way’s total revenue has slightly decreased from $50,041 million in the previous financial year to $48,806 million in the latest accounting period.

That wraps up the revenues segment of the Income Statement. Next, we have expenses.

Understanding Expenses in the Income Statement

We can define expenses as the outflow of economic resources that occurs in the normal course of business activities. To produce, deliver, and sell goods to clients, firms inevitably incur certain expenses.

The typical Income Statement contains:

- Costs of goods sold (COGS)

- Selling and marketing

- General expenses

- Administrative expenses

- Interest expenses

- Tax expenses

Costs of Goods Sold

COGS are expenses incurred to produce the goods that a firm sells.

For example, Milky Way Inc needs to buy raw milk from local producers and transport, process, and package it before selling it to supermarket chains. It also sustains additional costs to produce cheese from the milk. We see that Milky Way spends roughly $29,000 million on production each year.

Remember: The cost of goods sold includes expenses that derive directly from the production of finished goods.

Operating Expenses

In addition, companies bear some operating expenses. These are the ongoing costs for running the business, such as selling, general, and administrative expenses, or SG&A.

This category typically includes:

- Marketing and promotional expenses

- Office-related operating expenses (e.g., management and accounting team’s payroll costs)

- Office rent and utility bills

It seems that Milky Way’s annual operating expenses are stable—approximately $10,000 million per year.

Interest Expense

Then there is the interest expense, or the finance cost that a company bears for borrowing funds externally. In our example, Milky Way Inc. took a bank loan when it acquired a new milk processing system. The bank agreed to lend the necessary funds at an interest rate of 6%.

So, every year, the firm pays interest and other related finance expenses on the total borrowed amount. This resulted in an interest expense of $330 million in the previous financial year and $310 million in the current accounting year.

Finally, what’s an Income Statement without taxes?

Tax Expense

Every firm pays corporate taxes that are proportional to its profit before tax. In the case of Milky Way, this will be $960 million and $910 million in the two consecutive years. Please note that tax rules may vary between jurisdictions.

So, that wraps up the revenues and expenses in the Income Statement. The only figures left to explain are the different types of profit.

Types of Profit

To satisfy different reporting needs, an organization’s Income Statement outlines four types of profit.

- Gross profit

- Operating profit (EBIT)

- Profit before tax (EBT)

- Profit after tax (net profit)

On the Income Statement, gross profit is the difference between the total revenue and cost of goods sold. This is the profit a company makes after deducting its costs of production.

Gross Profit = Total Revenue – Cost of Goods Sold (COGS)

If we subtract all distribution, sales and marketing, and administrative expenses from the gross profit, we get the operating profit. It is also known as “earnings before interest and taxes” or EBIT.

Operating Profit = Gross Profit – Operating Expenses

Next, we can subtract the finance costs (such as interest expense) from the operating profit to arrive at the profit before tax (PBT), or earning before tax.

Profit Before Tax (PBT) = Operating Profit – Finance Costs

The bottom-line figure net income, also called profit after tax, accounts for the tax and all other expenses.

Net Income = Profit before Tax (PBT) – Tax expenses

In other words, this is the excess of revenues over total expenses. The net income figure is crucial as it represents the profitability of a venture after accounting for all its costs.

That wraps up the contents of the typical Income Statement. But as you probably noticed, there is another section in the Milky Way example.

Let’s see what it includes.

Income Statement vs. Statement of Other Comprehensive Income

Below the net income figure, you will find a separate section called “Statement of Other Comprehensive Income.” It summarizes transactions that do not arise from the normal course of the business. As such, they do not affect the stock owners’ equity but not the net income.

This includes unrealized gains or losses from foreign currency translation, pension obligation adjustments, and derivative instruments or financial assets measured at fair value.

Together, the Income Statement and the Statement of Other Comprehensive Income sections comprise the Statement of Comprehensive Income.

Beyond Income

Now that you know what an Income Statement is, you’re one step closer to understanding companies’ financial performance. But as we mentioned above, that’s only one of the financial statements.

To fully grasp an organization’s financial health, you should also review the Cash Flow Statement, Balance Sheet, and Statement of Changes in Equity jointly. You can learn everything about reading, analyzing, and interpreting financial statements in our Fundamentals of Financial Reporting course. Enroll to take your financial analysis and reporting skills to the next level.