FP&A: Building a Company's Budget

bestseller

Master Financial Planning and Analysis: Prepare a company’s budget from scratch

Start for Free

Start for Free

What you get:

- 4 hours of content

- 33 Interactive exercises

- 27 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

FP&A: Building a Company's Budget

bestseller

Start for Free

Start for Free

What you get:

- 4 hours of content

- 33 Interactive exercises

- 27 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

$99.00

Lifetime access

Start for Free

Start for Free

What you get:

- 4 hours of content

- 33 Interactive exercises

- 27 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

What You Learn

- Gain practical experience in budgeting, forecasting, and measuring financial performance to enhance your technical skills in financial analysis

- Build a detailed and professional budget model in Excel

- Learn how to model revenue and make various expense predictions (payroll, SG&A, production costs, overhead)

- Forecast current and non-current assets and liabilities and seamlessly integrate these items in your budgeting model

- Build an integrated 3-statement model in Excel that puts together all financial forecasts

- Improve your financial modeling skills by working on real-world examples

Top Choice of Leading Companies Worldwide

Industry leaders and professionals globally rely on this top-rated course to enhance their skills.

Course Description

Learn for Free

1.1 What Does the Course Cover

3 min

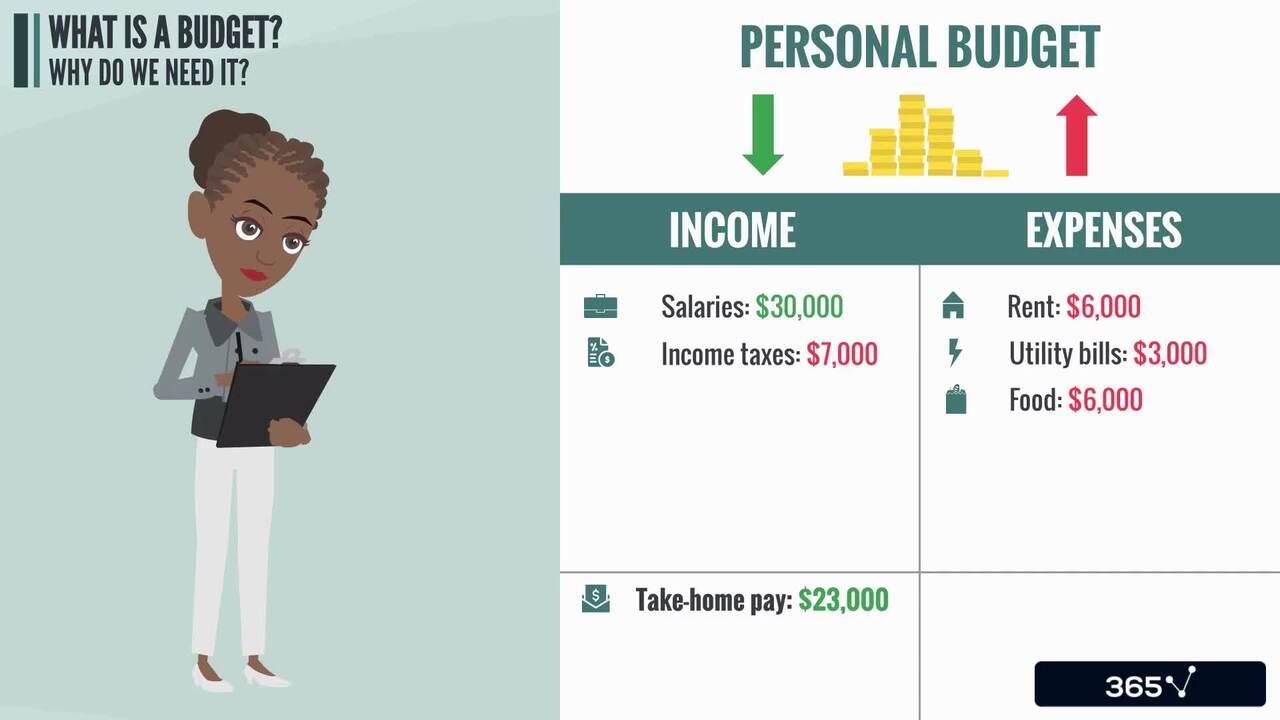

1.2 What is a Budget and Why do we Need it?

6 min

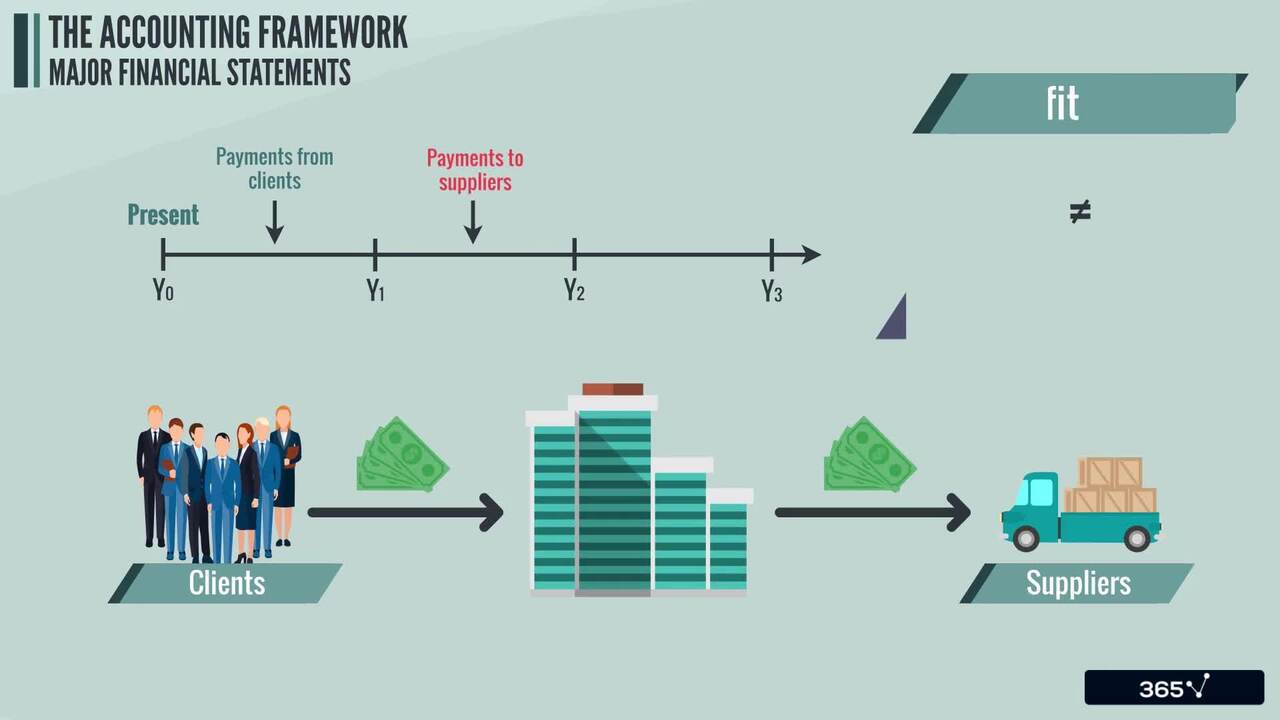

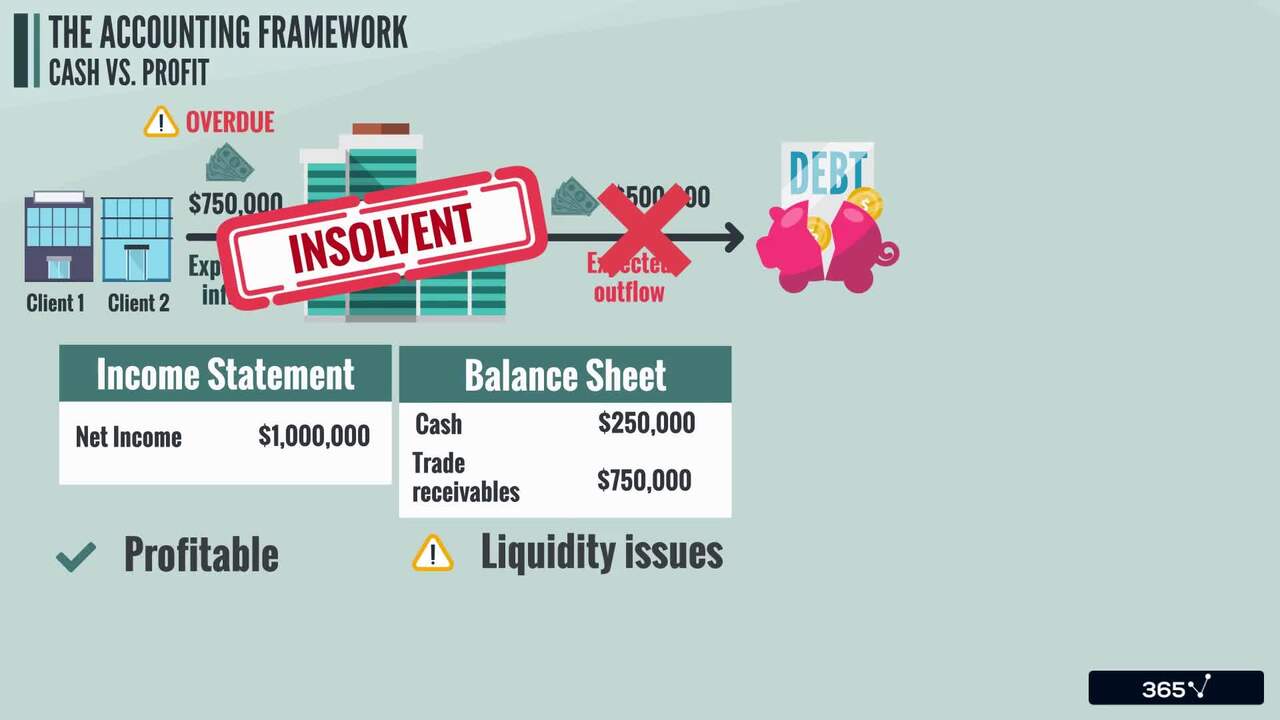

2.1 Major Financial Statements

4 min

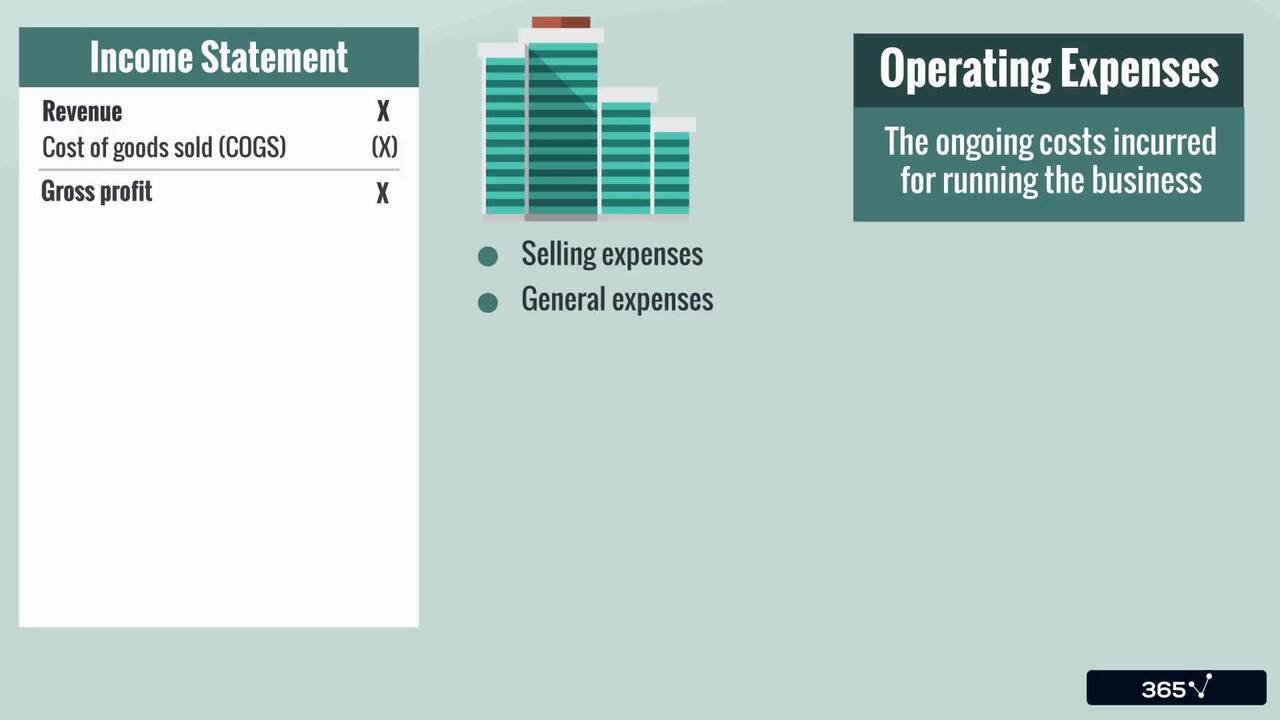

2.2 Understanding the Income Statement

8 min

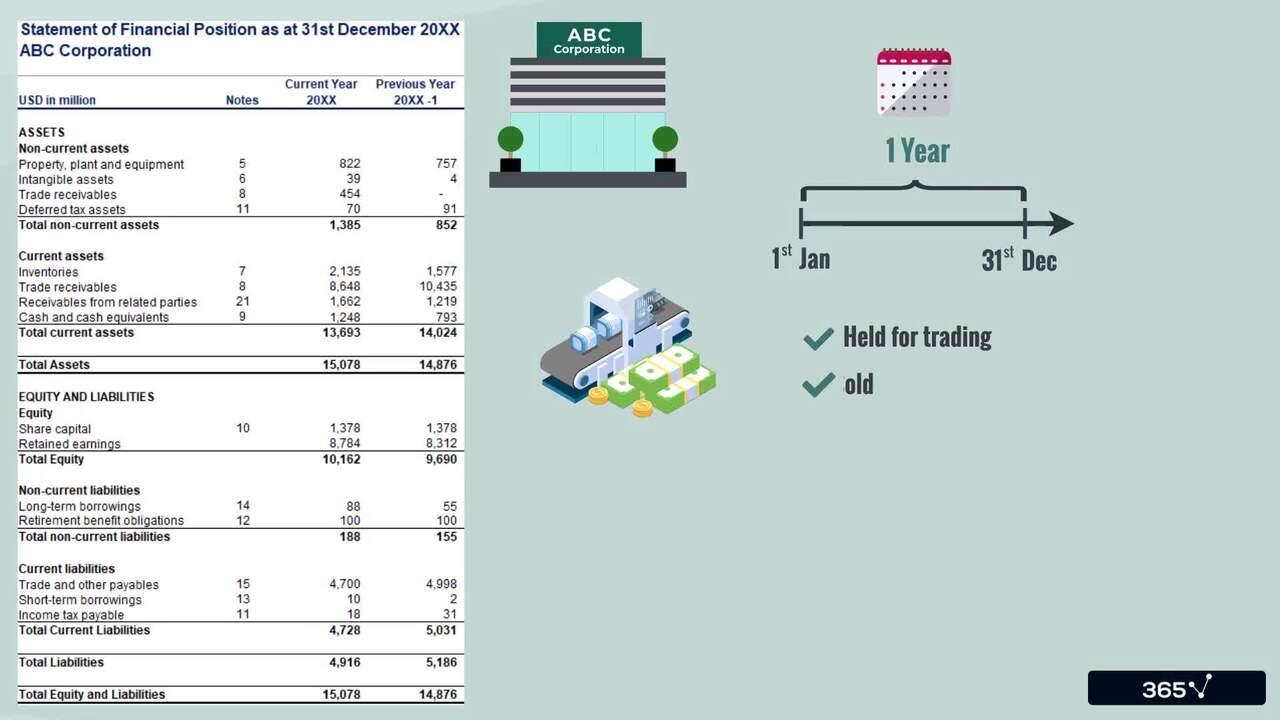

2.4 Understanding the Balance Sheet

7 min

2.5 Understanding the Cash Flow Statement_Part 1

5 min

Curriculum

- 2. The Accounting Framework7 Lessons 42 MinThis section provides the foundational accounting knowledge and skills required to earn a financial planning and analysis certification. We examine the core financial statements that companies prepare—the Income Statement, Balance Sheet, and Cash Flow Statement. Exploring how these interrelate will help us use them in a complete budgeting model later on.Major Financial Statements4 minUnderstanding the Income Statement8 minUnderstanding the Balance Sheet7 minUnderstanding the Cash Flow Statement_Part 15 minUnderstanding the Cash Flow Statement_Part 27 minDirect vs. Indirect Cash Flow Statement6 minMajor Interrelationships between the Financial Statements5 min

- 3. Mechanics of The Budgeting Process9 Lessons 40 MinIn the last theoretical section of this FP&A course, we discuss the importance and mechanics of the budgeting process, the key budget preparation steps, and the difference between short-term and long-term planning. You will also learn the difference between budgeting and forecasting, who is responsible for preparing and updating the budget, and the meaning of a Master Budget.The Importance of Budgeting5 minKey Steps in the Budget Preparation4 minThe Budget Horizon7 minThe Budgeting Levels of Detail3 minBudgeting Approaches4 minUpdating the Budget3 minWho Prepares the Budget?5 minThe Master Budget6 minThe Budget Sign-off3 min

- 4. Time for a Case Study: Henry's Hats15 Lessons 84 MinIn this section, you will have the chance to apply everything you have learned in this FP&A training. Together, we will build a complete budget model in Excel using the historical financial information of a fictitious company called Henry’s Hats. You will learn how to forecast revenue, COGS, various types of expenses, fixed assets, long-term liabilities, and others.Henry's Hats - Company Overview5 minThe Bottom-up Approach8 minThe Top-Down Approach6 minUnderstanding COGS Calculation3 minVolume of Production6 minDirect Materials and Direct Labor5 minProduction Overheads5 minThe COGS Budget2 minThe Payroll Budget9 minThe SG&A Budget5 minBalance Sheet Items6 minThe Cash Conversion Cycle6 minThe Working Capital Budget6 minThe Fixed Assets Budget7 minLoan Repayment Schedule5 min

- 5. Putting It All Together5 Lessons 31 MinIn the final section of the FP&A course, you will prepare Henry’s Hats' budgeted financial statements and learn how companies typically present their budget models. Last but not least, you will prepare a budget model on your own as part of the Course Challenge we created for you!The Income Statement Budget6 minThe Balance Sheet Budget7 minThe Cash Flow Budget13 minPresenting the Budget4 minCourse Challenge1 min

Topics

Course Requirements

- Highly recommended to take the Intro to Excel and Accounting and Financial Statement Analysis courses first

- You will need Microsoft Excel 2016, 2020, or Microsoft Excel 365

Who Should Take This Course?

Level of difficulty: Beginner

- Aspiring financial analysts, FP&A analysts, financial controllers

- Existing financial analysts, FP&A analysts, financial controllers who want to improve their financial modeling and forecasting skills

- Everyone who wants to work in Corporate Finance

Exams and Certification

A 365 Financial Analyst Course Certificate is an excellent addition to your LinkedIn profile—demonstrating your expertise and willingness to go the extra mile to accomplish your goals.

Meet Your Instructor

Antoniya is a finance professional with vast experience in accounting, auditing, financial management, and multiple high-level finance roles. She holds two master’s degrees—in Finance and in Contemporary Educational Technologies. She has worked as an auditor at PwC, as a financial controller at Atos, as an FP&A Manager and Senior Manager at Coca-Cola, and currently, as a Finance Manager at 365. Her passion for finance and teaching brought her to the 365 Тeam. She has been tutoring on various topics, including accounting, financial reporting, financial planning and analysis, economics, etc. Antoniya’s qualifications and engaging teaching style make the learning process enjoyable, and her courses have helped numerous students progress in their careers.

What Our Learners Say

365 Financial Analyst Is Featured at

Our top-rated courses are trusted by business worldwide.