Income Statement Items Explained (With Examples)

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for Free

Trying to invest in a company or business but don’t have an idea how it performed or is likely to perform in the future? Going through and understanding the four major financial statements is crucial when gauging the profitability and growth prospects of an investment but it can also be a hassle. Let’s explore the most common type of financial report – the income statement – and it’s different elements, so you can start handling financial reports like a pro!

What is an Income Statement?

The purpose of an income statement is to show the profits and losses a company made over a specified period of time. It is used to ascertain the health of a business entity at a particular moment. Together with the Balance Sheet and Cash Flow Statement, it is included in every company’s Annual Report – the publicly available, comprehensive overview of a business’ health and financial standing.

Commonly referred to as the profit and loss statement, or statement of comprehensive income, it focuses on revenues, expenses, gains, and losses. There are two types of income statement:

Single-Step Income Statement

A single-step income statement is synonymous with small business as it offers a simple report of business profit. This income statement format uses a single equation to come up with the Net Income. It presents revenue, expenses and ultimately, profit or loss in a straightforward way that involves a single calculation.

Multi-step income statement

It is a statement prepared by companies that operate globally offering a wide range of products and services and consequently incurring an array of expenses. Given the nature of their operations, such entities have a complex list of activities and costs to account for.

A multi-step income statement differs from a single-step income statement in that it uses multiple equations to ascertain the underlying Net Income.

Elements of a Singe-Step Income Statement

As we noted, the single-step is the simplified version of an income statement. Usually it contains no more than four elements:

Revenue

This is the money a company makes from selling its goods or services.

Gains

Gains are similar to Revenue, but with one crucial difference. While both of these metrics denote profits made, Gains refer to profits that don’t relate to the core business of the company. They are mostly made from one-time non-business activities that might not re-occur in the future. For instance, these could be assets accrued from the sale of land or an old vehicle.

Expenditures

It refers to the costs incurred to run a business. In the income statement, expenditures are recorded at the time of purchase. For instance, if a business were to acquire a printer for $5,000 and pay for it in two weeks’ time, it would be recorded as an expenditure on the income statement today (not when the cash payment is made.)

Expenses

In the income statement, expenses are costs incurred by a business to generate revenue. Some of the common expenses recorded in the income statement include equipment depreciation, employee wages, and supplier payments.

Expenditure vs. Expenses: Expenditures denote the amount of money that a business uses to purchase a fixed asset or for increasing fixed asset value. In contrast expenses denote the amount of money spent on an ongoing basis to ensure generation of revenues.

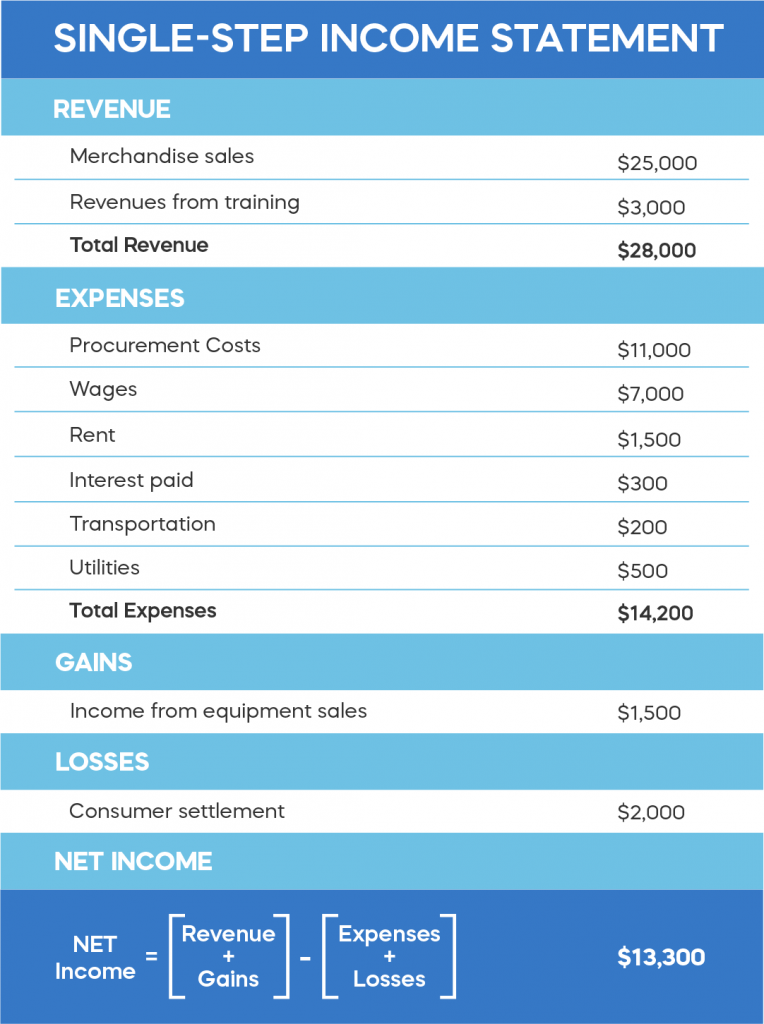

Single-Step Income statement Example

Consider business XYZ that earned $25,000 from the sale of goods and $3,000 as revenue from training personnel. In return, the business spent money on various activities, including wages, rent, transportation, etc., leading to $14,200 in expenses. The business also gained $1,500 from the sale of an old van and incurred a $2,000 loss from a pending lawsuit. Let’s calculate its Net Income in a single-step format.

Elements of a Multi-Step Income Statement

Because of how complex the operations involved in a multi-step income statement are, operating revenues and operating expenses are separated from non-operating expenses and revenues. Moreover, Losses and Gains are not usually recorded as such in this kind of statement but fall under one of the above categories.

Operating Revenue

Simply put, this is the money a business or company earns by offering services or goods. For a manufacturing company, operating revenue will be the money earned on selling the final product. For a company offering subscription or consulting services, operating revenue will be the fees earned for services rendered.

Non-Operating Revenue

Refers to the money earned from non-core businesses activities. For instance, a consulting company may earn some rental revenue from properties owned. This will be non-operating revenue, not tied to the core consulting business. In addition, interest income earned from capital lying in the bank is also part of a non-operating revenue portfolio.

The sum of Operating and Non-Operating Revenue gives us the Total Revenue of a company.

Operating expenses (OPEX)

These denote costs linked to the goods and services offered by a business, such as rent, office, supplies etc.. Sales commission, pension contributions, and payroll account also contribute to OPEX.

Non-operating expenses

Non-operating expenses, on the other hand, refer to costs incurred but not linked directly to the core functions of a business. Such expenses include obsolete inventory charges or even the settlement of a lawsuit.

There are also additional elements, not present in a single-step income statement:

Costs of Goods Sold and Services Rendered (COGS)

Cost of goods and services in an income statement denote the expenses incurred to sell the final goods. They also include the costs of materials used to develop the products and the labor needed to get the goods to market.

Depreciation & Amortization (D&A)

These are special types of expenses that are spread over a long period. They include the decline in the value of equipment used in producing goods and services. Depreciation expenses depend on the type of equipment in the business. Amortization is similar to depreciation but entails spreading the costs of an intangible asset over its useful life. Some of the intangible assets that can be amortized include patents, trademarks, and franchise agreements.

Earnings Before Tax (EBT)

EBT is a financial metric in a multi-step income statement that indicates a company’s performance. It is arrived at by subtracting all the income expenses before any taxes are levied. Aside from EBT, there’s also EBITDA, EBIT and a slew of other abbreviations you might want to familiarize yourself with to be even more confident when reading an income statement.

Interest Expenses

Interest expenses are the costs that a company bears for receiving financing. Typically firms receive bank loans and pay interest expenses for the amounts they owe.

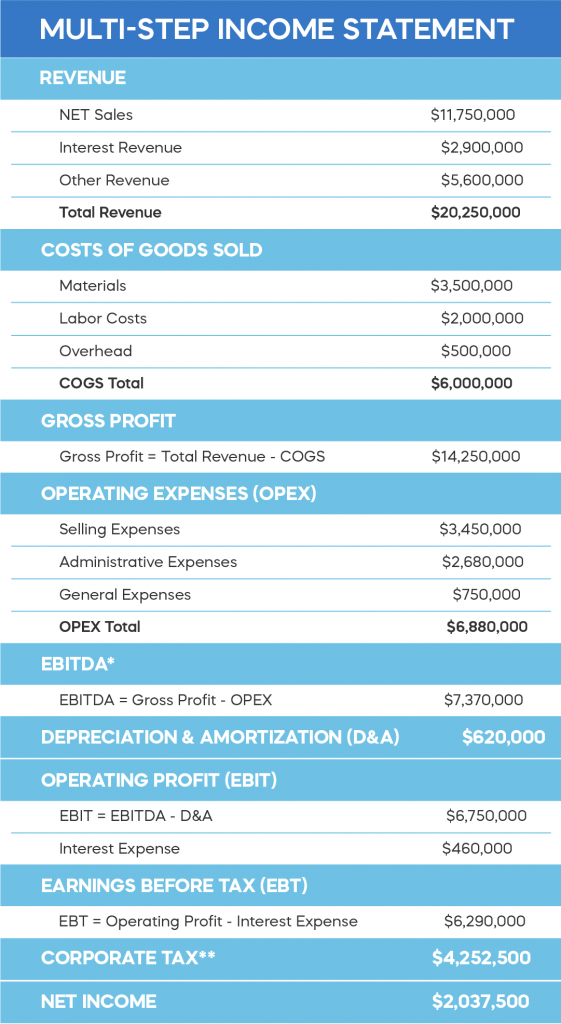

Multi-step Income Statement Example

Company ABC is a much bigger venture; it produces car parts. Analyzing the items in its accounting books, let’s compute the Net Income in a multi-step format.

**Corporate Tax – in the USA corporate tax is 21%.

What’s Next?

An income statement is an important financial report that provides rich information on how a business or company is doing and how it’s likely to perform in the future. Used in both managerial and financial accounting, it is an invaluable resource to internal and external stakeholders alike. Just as management personnel benefits from its insights to make timely decisions and ascertain if an entity is on the right track financially, experienced investors use the information it provides to expand their portfolio of investments.

As we saw, while a single-step income statement is straightforward and easy to understand, a multi-step could pose significant challenges, especially if you’re just starting out in accounting. By taking our course Fundamentals of Financial Reporting you’ll be ready to tackle these and most other accounting scenarios you’re likely to encounter in your practice.

Do you want to advance your financial analysis and reporting skills?

Build a successful career with our Financial Analyst Career Track where you’ll learn how to interpret data and identify patterns with lots of practical examples and simple explanations. You can also include the certificate you’ll earn at the end to showcase your new skills on your resume. Get the exposure you need to succeed in the field!