What Is a Cash Flow Statement?

Someone’s holding a folder and reading a Statement of Cash Flows of a company.

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for Free

A Cash Flow Statement shows how well a company manages its cash balances. It summarizes how much cash comes in and goes out of a company’s accounts within a given period.

This article provides key cash flow definitions, outlines the main components of a Cash Flow Statement, gives a practical example and established methods for preparing such a report, highlights its significance and limitations, and compares it to other financial statements.

Table of Contents

- What Is a Cash Flow Statement?

- Cash Flow Statement Sections

- Cash Flow Statement Example

- How to Prepare a Cash Flow Statement

- How to Read a Cash Flow Statement

- Importance of Cash Flow Statements

- Cash Flow Statement vs Income Statement vs Balance Sheet

- Next Steps

- FAQs

What Is a Cash Flow Statement?

A Cash Flow Statement is a financial statement that illustrates the sources and uses of cash during a specified period. It gives valuable insight into an organization’s financial position and working capital. How much does a firm generate and spend in a month, a quarter, or a year? You can easily find this information in their Cash Flow Statement.

So, when you talk about the collective term cash flows, remember that it refers to any cash inflows and outflows within a company—the money it spends and generates.

After all the payments to suppliers have been made at the end of the accounting period, the firm will have available funds, which they call a cash balance. Company owners can use this money to grow their businesses, pay dividends, or make investments.

Cash bank deposits, short-term investments, overdrafts, or other readily convertible assets that aren’t cash but are still relatively easy to liquidate go under cash equivalents.

These are some of the items you’ll find in a typical Cash Flow Statement. You’ll need these cash flow definitions to read financial statements in your line of work properly.

Cash Flow Statement Sections

Each Statement of Cash Flow consists of three major components:

- Cash flows from operating activities (CFO)

- Cash flows from investing activities (CFI)

- Cash flows from financing activities (CFF)

1. Cash Flows From Operating Activities (CFO)

This is a vital part of each Cash Flow Statement. It shows whether—and to what extent—companies generate cash from their core operations. The net operating cash flows must cover all cash outflows from the other two sections.

Cash flows from operating activities arise from all the transactions that affect a firm’s net income. That’s why most of the components of the operating activities section overlap with those determining the net profit or loss for the year—e.g.:

- Cash receipts from the sale of goods and the rendering of services

- Cash payments to suppliers for goods and services

- Cash payments to and on behalf of employees

Although part of the Statement of Cash Flows, these items impact the Income Statement and are simultaneously classified as cash flows from operating activities.

Please note that there are a few exceptions to this rule. If ABC Corporation sells one of its production machines at a profit, it will increase Net Income for the year. But this is not a core business activity for the company. Therefore, the sale proceeds are not reported as operating cash inflows; they fall into the cash flows from investing activities.

2. Cash Flows From Investing Activities (CFI)

These cash flows outline the extent to which asset investments will generate profit and cash flows. We observe that investments in (or proceeds from) the sale of tangible and intangible assets are often included in this section in the Statement of Cash Flows. In addition, it records cash receipts from sales or payments to acquire financial instruments issued by other enterprises.

So, the most common cash flows from investing activities include:

- A purchase or sale of an asset

- Loans made to vendors or received from clients

- M&A payments

It’s essential to understand the difference between CFO and CFI. The purchase and sale of debt or equity instruments are indeed reported as investing activities. But the income related to these instruments—in the form of interest or dividends received—is an operating activity in the Statement of Cash Flows. The same goes for interest paid. [The International Financial Reporting Standards (IFRS) and the US Generally Accepted Accounting Principles (GAAP) treat some of these items separately.]

3. Cash Flows From Financing Activities (CFF)

These refer to the share of cash transactions that affect a company’s capital structure. Typical cash flows from financing activities include:

- Cash proceeds from the issuance of new shares

- Cash payments to stockholders to redeem shares

- Cash dividends paid

- Cash proceeds from the issuance of bonds, loans, notes, and other short-and long-term borrowings

- Repayment of borrowings

Logically, the sum of cash flows from operating, investing, and financing activities gives us the company’s net increase or decrease in cash. This is the total cash generated (shown with a plus symbol) or used (indicated by a negative sign) during a period, which you can find in the Statement of Cash Flow.

Cash Flow Statement Example

Here’s what we know so far:

- Cash flows from operating activities consist of cash transactions affecting a firm’s net income.

- Cash flows from investing activities result from investments in fixed assets and other long-term investments.

- Cash flows from financing activities include transactions affecting an entity’s capital structure (debt and equity).

- The sum of the three gives a company’s Net Cash Flow. This figure must reconcile the difference between the cash balance at the end of the current period and the amount of cash outstanding at the end of the previous period.

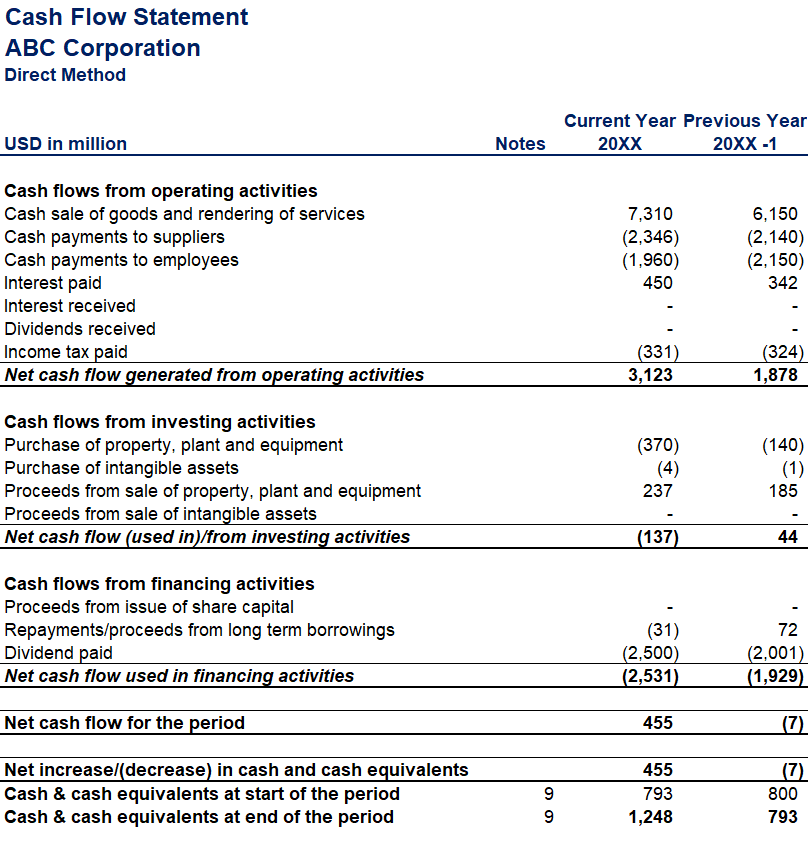

Let’s look at ABC Corporation’s Statement of Cash Flows below. It generated $3,123 million from operating activities in the latest financial year, using $137 million for investing and $2,531 million for financing activities.

This results in a net increase in cash flows of $455 million during the currently reported year:

$3,123M – $137M – $2,531M = $455M

To cross-check whether this number is correct, we can refer to the Cash and Cash Equivalents in ABC Corporation’s Statement of Financial Position. At the end of the previous year, the company had an outstanding cash balance of $793 million. At the end of this reporting period, it has $1,248 million:

$1,248M – $793M = $455M

Once again, we arrive at the exact figure as the net change in cash reported in the Cash Flow Statement.

Why do we need to cluster cash flows from different business activities? Distinguishing between the sources and uses of cash from operating, investing, and financing activities gives us a better idea of how a company makes and spends its money. Digging deeper, users of financial statements may see the impact of business transactions on each component and their relationships with each other.

How to Prepare a Cash Flow Statement

There are two approaches to preparing a Statement of Cash Flows: direct and indirect.

Direct Cash Flow Method

As the name suggests, the direct method takes actual cash inflows and outflows from operating activities. These are invoices paid to suppliers (money received from clients) and employee salaries. It’s a detailed summary of all completed cash transactions within a period. As a result, the net income equals the actual cash flows from operating activities in the Statement of Cash Flow. Companies that work with cash basis accounting typically use the direct method.

It’s important to remember that not all transactions involve actual cash, so you’ll mostly see a difference between cash flow from operating activities and net income.

Indirect Cash Flow Method

The direct cash flow method adjusts net income for non-cash transactions. And it follows accrual accounting, which records transactions when they occur, not when payments are made and received. So, that makes the totals of net income and cash flows from operating activities differ. Because of this, you’ll need to take the net income figure from the Income Statement and adjust for any accruals arising in this period. Common examples include depreciation and amortization—subtract these from the Revenue to calculate net income.

Which one’s better—the direct or indirect method? Neither is better or worse. But the indirect approach provides a clear picture of the impact of non-cash transactions on the Balance Sheet, which you won’t find with the direct method.

Please remember that investing and financing activities in both methods remain the same. The main difference lies in how you estimate cash flows from operating activities. Whatever method you choose, you’ll get identical results—only the Statement of Cash Flows’ formats differ.

How to Read a Cash Flow Statement

Cash Flow Statements provide investors, department heads, and internal operations with valuable business insights. These financial statements let you quickly estimate whether you’re dealing with a hot startup or a mature, profitable organization. Internally, managers may build up their budgeting plans and shift business activities because of the Cash Flow Statement.

Typically, cash flows are either positive or negative, depending on the amount of cash generated and spent.

Positive Cash Flow

A business with a positive Statement of Cash Flows will have more money coming in than out of it within a certain period. And that’s what any company wishes for—a cash surplus to grow the business, pay off debts, and even reinvest.

But here’s the tricky part to remember. A positive cash flow doesn’t always mean profitable business. An organization can be profitable and still have a negative cash flow. Alternatively, your company may have an excess of cash and be unprofitable at the same time.

Negative Cash Flow

Your Cash Flow Statement’s balance is negative when you spend more than you generate. But this isn’t necessarily a bad performance. There may be various reasons for this mismatch, so don’t be too quick to judge that a company is losing profit.

Sometimes, owners may decide to penetrate new markets, start new production lines, and expand the business. That’s why you should compare cash flow results from different periods to track performances over time.

Negative cash flows are expected, particularly for small businesses. But if they persist for too long, the financial health of an organization may be at risk. And investors will perceive the company as unstable, which might harm its reputation and investment prospects.

Importance of Cash Flow Statements

Understanding Liquidity

A Statement of Cash Flows records any cash transactions within a company that may not be visible in other financial statements. It summarizes spending and receipts to help you evaluate whether the company can meet its financial obligations on time.

Identifying Potential Issues

By knowing how much cash a company has, owners can make informed decisions about improving its financial health. With a healthy surplus of funds, a firm may consider buying equipment and investing to grow. If a company funds losses from operations through debt, you’ll easily spot this when looking at the numbers. A Cash Flow Statement can reveal potential issues and help stakeholders take action before it’s too late.

Planning and Forecasting

This financial report is valuable for steering an organization in the right direction. A proper cash flow analysis of cash inflows and outflows will reveal interesting spending patterns essential in planning and forecasting financial activities and investments.

Attracting Investors

Investors and suppliers often look at the Statement of Cash Flows to determine the financial stability of an organization and whether they should invest or lend money to it.

Cash Flow Statement vs Income Statement vs Balance Sheet

A Statement of Cash Flows doesn’t consider future cash inflows or outflows—it strictly focuses on actual spending and receipts. And in doing so, it bridges the Income Statement and the Balance Sheet by illustrating how assets and liabilities transform into revenues.

It also provides a more realistic overview of available funds than the Income Statement, where some revenues and expenses may not yet have been realized. So, the Cash Flow Statement deals with the actual cash a company has spent and collected over a certain period.

Remember that for a robust cash flow analysis, one must consider all major financial statements together. Rather than evaluating each report in isolation, you should recognize they complement each other to provide a comprehensive picture of a company’s financial standing.

Next Steps

Reading a Statement of Cash Flows is just a fraction of what you’ll be expected to do as a financial analyst.

Do you wish to take your financial analysis and reporting skills to the next level?

In our Fundamentals of Financial Reporting course, you’ll find all you need to know about reading, interpreting, and analyzing financial statements. Our team of industry experts includes many practical examples and valuable know-how to help you get up to speed with your knowledge in the field. You can also enroll in our Financial Analyst Career Track to advance your career more comprehensively.

FAQs

A Statement of Cash Flows is a financial statement that depicts all cash inflows and outflows from a company’s operations, investments, and financing activities in a specified period. In simple terms, this report reveals how much cash a business has coming in and going out and where these funds are coming from and going.

A Cash Flow Statement tells you how much cash flows in and out of a company due to its operations, investments, and financing activities over a specified period. It’s essential for evaluating a firm’s liquidity, identifying potential cash issues, and budgeting. For business owners, it’s a smart way to monitor their cash and cash equivalents to make informed decisions.

Common examples of cash flows from operating activities include:

· Cash sales

· Cash payments

· Income tax paid

· Dividends received

Typical examples of cash flows from investing activities include:

· Purchase of property, plant, and equipment

· Purchase of intangible assets

· Proceeds from sales of property, plant, and equipment

· Proceeds from sales of intangible assets

Familiar examples of cash flows from financing activities include:

· Repayment of long-term borrowings

· Dividend paid

· Proceeds from the issue of share capital

You can also see a cash flow statement example in ABC Corporation’s Annual Report.