What is OPEX and how does it impact EBITDA?

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for Free

How do accountants and management determine if a company is on the right track financially? There are various metrics to consider, but OPEX and EBITDA are perhaps the most intuitive and easy to grasp, even for a newcomer to the field. Does their interdependence reveal enough about a company’s health, however? Let’s find out!

What is OPEX?

OPEX stands for OPerating EXpenses that incur by the everyday operations of a firm. However, the production process itself is not covered by this definition, and is to be considered under COGS (which stands for cost of goods sold.) Operating expenses include rents, administrative worker wages (but not wages of workers directly involved in the production process), and energy bills. They also include marketing costs, costs for maintaining inventory, and R&D costs.

To identify if a certain expense should be regarded as OPEX, consider whether it has the following characteristics:

- It incurs in the short term (daily/ weekly/ monthly.)

- It incurs repeatedly (wages must be paid by the end of every month.)

- It is directly related to a business’s core activity.

Operating expenses can be either fixed or variable. For instance, an administrative worker’s wage is a fixed operating expense as she/he will be paid the same amount of money every month. On the other hand, energy bills are a variable operating expense as a firm is unlikely to consume the exact same amount of energy every month.

How is OPEX different from other types of expenses?

Apart from operating expenses, there are two other major categories of expenses a firm has: non-operating expenses and capital expenses (CAPEX.)

Non-operating expenses are similar to OPEX as they incur in the short term and in a repeated manner, but they are not directly related to a business’s core function. The most common example of a non-operating expense is interest charges.

Capital expenses, on the other hand, may be directly related to a firm’s core function but they incur or are written off in longer terms. Usual examples of CAPEX are long-term investments a business makes, such as building a new factory.

Distinguishing between types of expenses: An example

A firm gets a loan of $100.000 to buy a new piece of equipment. The new equipment is more efficient in consuming energy but requires specialized personnel to be operated, thus the business owner decides to hire a specialized worker.

(Before continuing, take a moment to consider what expenses this firm has incurred.)

-The cost of purchasing the equipment ($100.000) is a capital expense. This is because the expense is directly related to the firm’s production process but will be paid over the long term (most likely in several installments.)

-Interest payments on the $100.000 loan are non-operating expenses, as they are not directly related to the firm’s production process, but they are the cost of getting that loan.

-The specialized worker’s wage is included in the COGS. But the less energy this new equipment needs to operate is a reduction on (variable) operating expenses.

Are taxes to be considered as OPEX?

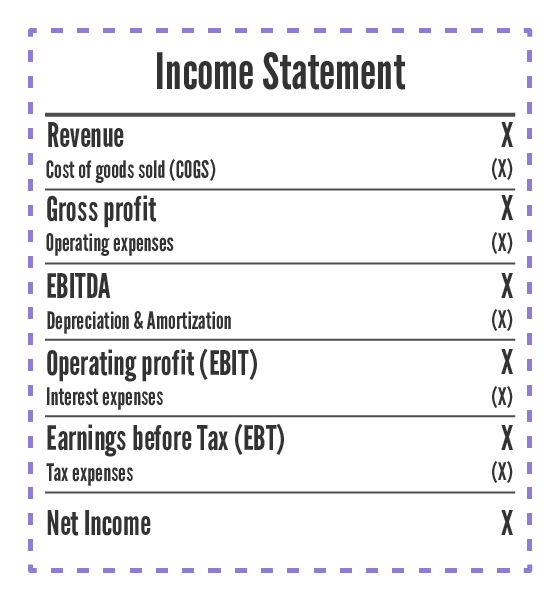

By reading the above definitions one might wonder whether or not taxes are considered an operating expense. Especially because taxes are related to a firm’s production process and profitability and many of the taxes incur in the short-term (monthly, quarterly, or annually). Taxes, however, are not to be considered an operating expense as they are not directly related to a business’s core function but are imposed on the firm afterward (and along with interest charges, depreciations and amortizations are recorded after EBITDA.) This is why the elements of a typical income statement are ordered in the following way:

Why is OPEX important?

Operational expenses are important because they can give us an indication of how efficient a firm is:

- Compared to similar firms: If two firms are similar in every other aspect, the one with lower operating expenses is the more competitive

- For one firm across time: If a firm experiences a sharp increase in its operational expenses, this can be an indication that it is becoming less competitive. On the other hand, if a firm demonstrates a decrease in operational expenses, it can be an indication that a firm is becoming more competitive.

However, we must take caution as a single measure can rarely give us the full picture. One way to examine whether a firm is truly becoming more competitive is to examine OPEX jointly with a measure of operational profitability such as EBITDA.

How is OPEX connected to EBITDA?

Recall that EBITDA is defined as net income BEFORE taxes, interest, depreciation, and amortization. We can calculate EBITDA simply by subtracting COGS and OPEX from total revenue. As a result (holding everything else equal) higher OPEX leads to lower EBITDA.

This means that when we examine a firm’s OPEX and EBITDA we can witness three possible outcomes:

- The firm’s OPEX is increasing faster than its EBITDA (in percentage terms.) This means that the firm is becoming less competitive and that additional expenses bring fewer and fewer earnings. Should this situation continue, eventually expenses will be higher than sales and the firm will generate losses.

- OPEX is increasing at the same rate as EBITDA. This means that the firm while increasing in size does not achieve economies of scale and its efficiency remains the same.

- OPEX is increasing slower than EBITDA. This means that the firm is growing and becomes more efficient along the way, hence it is more likely to eventually outperform its competitors.

What’s Next?

In conclusion, both OPEX and EBITDA are measures of operational efficiency. They are very effective in giving an indication of how well a firm performs its core function (selling of a specific product or service.)

On their own they don’t tell us enough to determine the overall health of an enterprise. For that we will have to take into account non-operating variables as well, such as interest payable and working capital. To learn how these and other key analytic terms are used in practice, sign onto our Accounting and Financial Statement Analysis course.

Do you want to take your career in Finance to the next level?

Our Financial Analyst Career Track will build up your knowledge to develop a deep understanding of financial concepts and principles. You’ll gain practical experience in using financial analysis tools to interpret data and make informed decisions. You’ll be dealing with lots of aspects of a business and will learn how to accurately use your expertise in a dynamic and competitive field. Start learning today!