EBITDAR vs. EBITDA vs. EBITA vs. EBIT vs. EBT vs. EBIAT vs. Adjusted EBITDA

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for Free

There are very few financial indicators that are as important and well-known as EBITDA. It stands for Earnings before Interest, Taxes, Depreciation, and Amortization. This is a popular measure because it gives us an idea about a company’s operating profitability. Very often, EBITDA serves as a proxy for operating profit, and some financial professionals say that it is one of the best ‘quick and dirty’ proxies for operating cash flow.

How Do You Derive EBITDA?

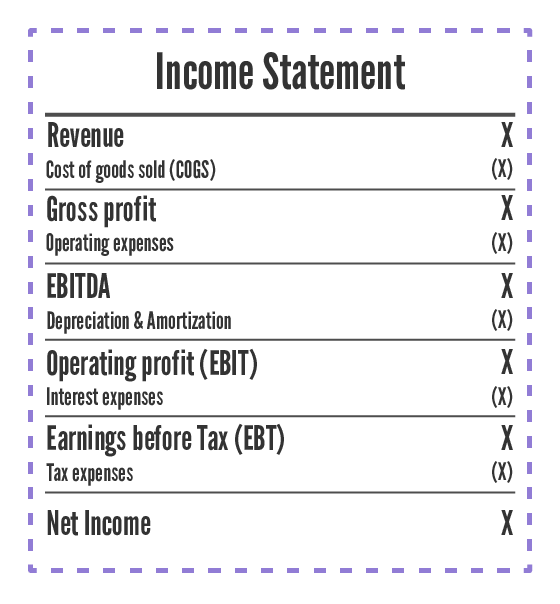

If we consider a standard Profit & Loss statement, we will have the following:

So, EBITDA is what we obtain once we have taken into consideration the cost of the goods that we have sold, along with the operating expenses necessary for running the company.

EBITDA is frequently used as a profitability multiple, which shows how much a company can be sold for. You’ll often hear investment bankers and other investment professionals say that a company has ‘’an Enterprise Value of 5x EBITDA’’.

The fact that this measure can be used to determine transaction values makes it quite important to investors. Before acquiring a firm, for instance, buy-side investors send their due diligence consultants, typically represented by a big 4 company, to ‘adjust’ EBITDA. The main idea is to isolate any non-operating and one-off items and come up with a clean EBITDA figure.

EBITDA vs EBITDAR

In some industries, it is common practice to calculate Earnings Before Interest, Taxes, Depreciation, Amortization, and Research costs. The reason lies in the fact that R&D is a long-term investment. However, Research costs cannot always be capitalized, which could potentially lower operational profitability. So, EBITDAR adjusts for this and shows the stipulated earnings before taking Research costs into consideration.

EBITDA vs EBITA

Consulting firm McKinsey’s ‘Valuation’ textbook is a big proponent of the EBITA measure. At its core, it takes depreciation costs into account upon calculating operating profitability. EBITA is a more conservative approach, but the idea is that companies have to invest in Property, Plant, and Equipment on a continuous basis, and therefore depreciation needs to be incorporated when calculating profitability.

EBITDA vs EBIT

The main difference between EBITDA and EBIT has to do with Depreciation and Amortization (D&A). EBIT takes both line items into consideration. That’s why it is a measure closer to the firm’s actual profitability, while EBITDA is a better approximation of cash flow, given that D&A is a non-cash expense item.

EBITDA vs EBIAT

EBIAT means Earnings before Interest after Taxes. Clearly, all companies pay taxes, but not every one of them has debt on its balance sheet. So, it makes sense to consider taxes when calculating profitability, but sometimes it might be even more useful to leave interest expenses aside.

Beyond EBITDA

Although EBITDA has become a widespread profitability metric, it should not be used as a substitute for measuring cash flows. Cash flow from operations remains an invaluable source of information for finance professionals, as it provides a more thorough look at a firm’s cash expenses. Ultimately, an analyst should consider all major financial statements before jumping to conclusions about a firm’s financial health.