Investment Banking Job Outlook [Research on 1,000 Job Postings in 2025]

What’s the typical investment banking career? Enhance your career prospects with our research on investment banking job outlook—revealing exclusive insights on how to become an investment banker, key skills, and salary trends.

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for FreeThe investment banking career path is the strategic core of finance, connecting companies with capital to drive growth and innovation. The global economy heavily relies on investment banking to support corporate expansion.

The investment banking job outlook remains promising, with steady growth expected in the coming years. By bridging the gap between investors and companies, investment bankers facilitate optimal resource allocation.

According to the U.S. Bureau of Labor Statistics, it is projected to grow by 7% from 2022 to 2032, outpacing the average growth rate for all occupations. On average, there will be about 40,100 job openings annually, mainly due to workforce transitions and retirements.

Our latest research on 1,000 investment banking jobs posted on Indeed analyzes the trends, qualifications, and requirements for investment banking roles in 2024, offering valuable insights and recommendations.

Key Highlights

- New York leads the job market with 21.1% of investment banking jobs.

- Business degrees are most sought after, required in 90.9% of postings.

- Most investment banking salaries range between $100,000 and $200,000.

- Only 3.5% of job postings specify remote work options.

- Proficiency in Excel is crucial, as mentioned in 24.8% of investment banking jobs posted.

- Top investment banking companies for employment include JPMorgan Chase & Co., Morgan Stanley, and Goldman Sachs.

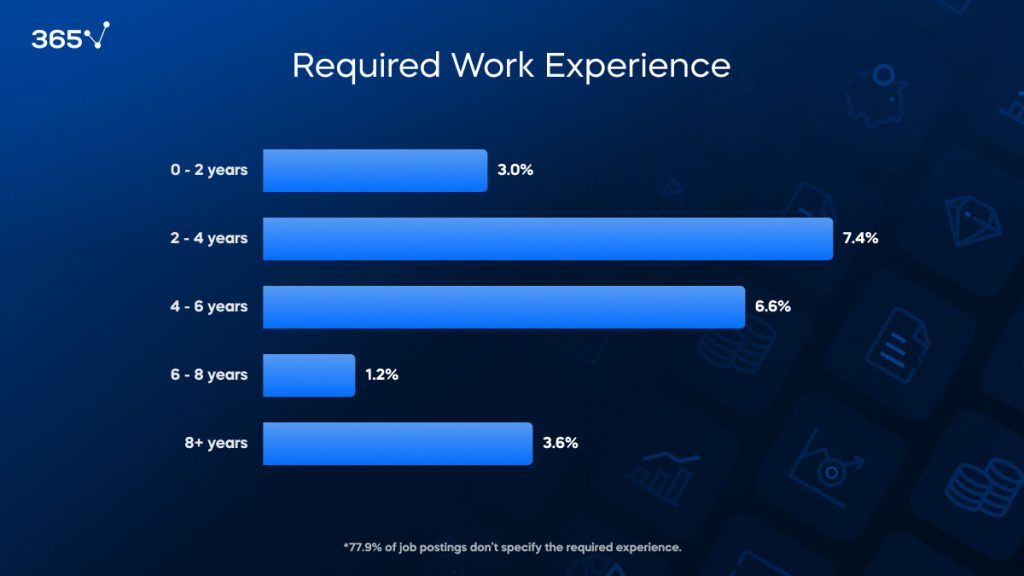

- 77.9% of job postings do not specify work experience required.

- Financial modeling and valuation are the most critical investment banking technical skills, highlighted in nearly half of the job postings.

- In investment banking, soft skills like communication (68.98%) and client management (67.99%) are also highly valued.

- A few companies specify credential requirements, with CA and CFA as the most frequently mentioned investment banking certificates.

- AI and investment banking integration isn’t an emerging trend yet.

Table of Contents

- Investment Banking Job Outlook Research: Methodology

- Investment Banking Job Outlook: Employment Type

- Top Investment Banks for Employment

- Key Investment Banking Skills

- Investment Banking Job Outlook: Certificates

- How to Become an Investment Banker: Education Requirements

- How to Break Into Investment Banking: Work Experience

- Where Do Most Investment Bankers Work?

- Investment Banking Salaries

- What Is the Investment Banking Job Outlook in 2024?

- FAQs

Investment Banking Job Outlook Research: Methodology

Our analysis of the investment banking job market outlook is based on 1,000 job postings from Indeed USA, refined to 906 relevant entries through careful preprocessing. The objective is to uncover key trends, qualifications, and characteristics specific to investment banking careers in the United States.

The investment banking job outlook data was collected using search terms related to these positions during the month of May 2024. This period was chosen to capture a representative snapshot of current job market trends.

To ensure the relevance and quality of our data, we performed several preprocessing steps. This included filtering out irrelevant entries, handling missing data, and normalizing job titles and descriptions to create a consistent dataset for analysis.

Investment Banking Job Outlook: Employment Type

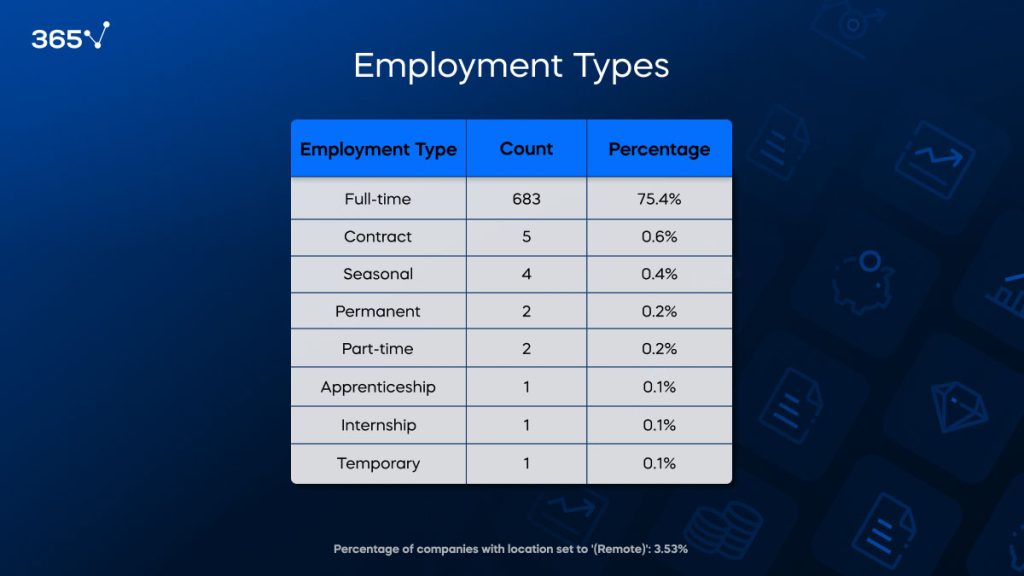

The majority of positions we analyzed are full-time roles (75.4%), indicating a strong preference for dedicated, long-term commitments. This supports the demanding nature of investment banking, where continuity, consistent performance, and rigorous investment banking training determine one’s success.

Contract positions constitute only 0.6% of the job postings, while seasonal, permanent, part-time, apprenticeship, internship, and temporary roles each makeup less than 0.5% individually. These numbers highlight that investment banking largely relies on full-time employees who have undergone extensive investment banking training rather than flexible or short-term arrangements.

Interestingly, only 3.53% of the investment banking jobs analyzed offer remote work opportunities. This suggests that despite the increasing trend towards flexibility on the job, investment banking remains predominantly office-based. The need for close collaboration, access to secure systems, and real-time decision-making likely contribute to this preference.

Top Investment Banks for Employment

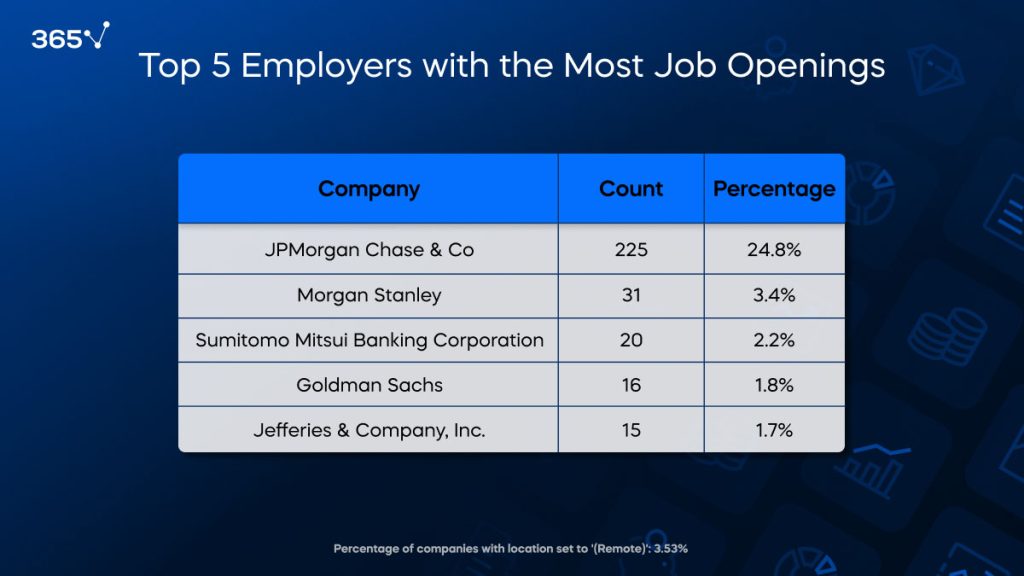

Our data indicates that a few key players dominate the investment banking job market. JPMorgan Chase & Co. leads significantly, accounting for 24.8% of all job postings. This reflects the company’s extensive operations and its prominent position in the financial sector.

Following JPMorgan Chase, Morgan Stanley (3.4%), Sumitomo Mitsui Banking Corporation (2.2%), Goldman Sachs (1.8%), and Jefferies & Company, Inc. (1.7%) also feature prominently among top employers. These institutions are well-known for their robust investment banking divisions and their significant roles in global financial markets.

The concentration of investment banking jobs posted on Indeed among these top employers suggests that the largest financial institutions continue to be the primary sources of employment in investment banking. This trend underscores their importance in shaping the investment banking job outlook.

Key Investment Banking Skills

Investment Banking Technical Skills

Proficiency in various technical skills remains crucial for an investment banking resume and career.

Financial Modeling Skills

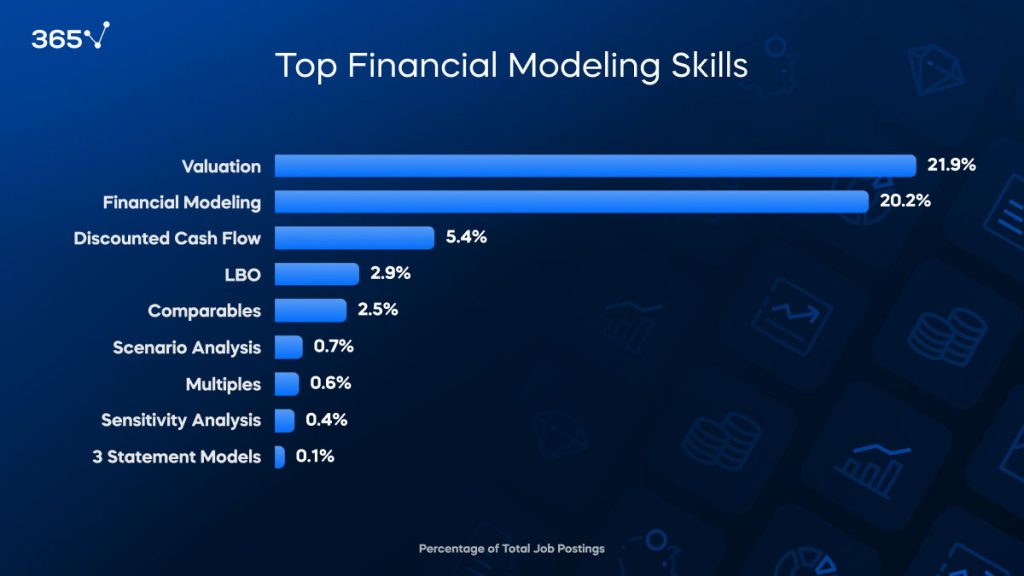

In investment banking, financial modeling proficiency is essential. Our analysis of 906 job postings on Indeed USA highlights the most sought-after abilities.

Valuation (21.9%) and financial modeling skills (20.2%) are paramount in investment banking jobs, reflecting the industry’s reliance on precise and accurate data to make informed decisions.

Besides, the emphasis on specific techniques like DCF (3.2%) and LBO (2.9%) indicates the need for investment bankers to be proficient in various valuation methods tailored to different scenarios.

At the same time, the lower frequency of mentions for scenario and sensitivity analysis suggests that while these investment banking technical skills are in demand, they may be more specialized or advanced competencies.

Lastly, the comprehensive integration of financial statements, though mentioned less frequently, further shows the importance of having a holistic understanding of a company’s financial health.

In short, the data proves that valuation and financial modeling skills are the most essential in investment banking. With nearly half of the job postings emphasizing valuation and financial modeling, these competencies form the backbone of an investment banker’s analytical toolkit. So, how to break into investment banking begins with mastering financial modeling and valuation.

Ensure you also gain practical experience with DCF and LBO models through finance internships, workshops, or simulation exercises. Scenario and sensitivity analysis skills further enable investment bankers to anticipate and prepare for various financial outcomes, which is essential for a positive investment banker job outlook.

Overall, demonstrating proficiency in these investment banking technical skills enhances your employability to top firms.

In-Demand Financial Analysis Skills

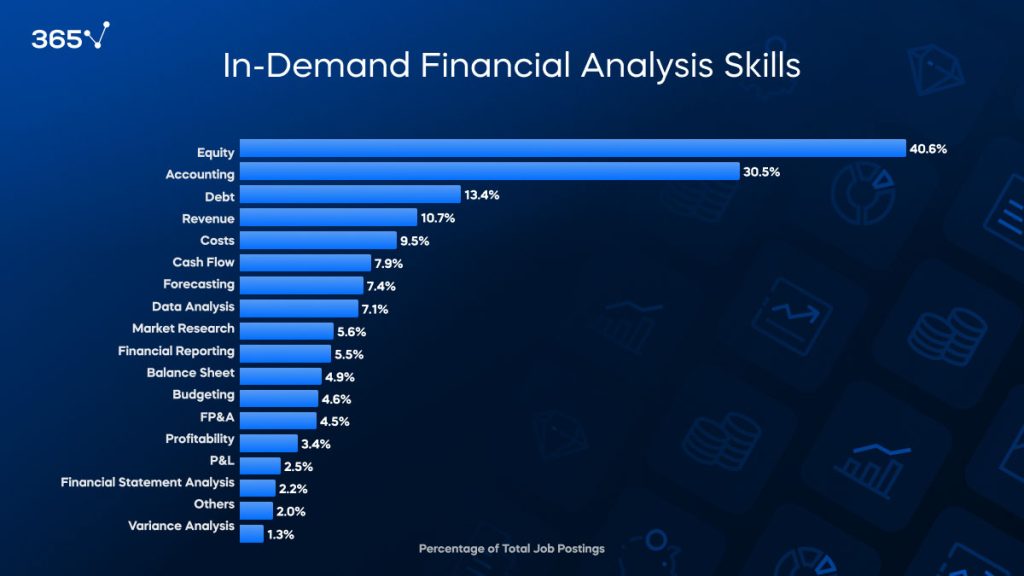

Before we go into more detail, please examine the graph and notice the diverse skillset an investment banker is expected to have. This highlights the multidisciplinary nature of the field and is likely related to the high investment banking salaries most people earn.

Our research on investment banking jobs shows that equity analysis (40.6%) is the most in-demand skill, crucial for evaluating stock investments, analyzing financial statements, and making informed recommendations. That’s because an investment banker needs to make accurate valuations and provide sound investment advice to clients, influencing major decisions.

Accounting (30.5%) is also foundational as it enables an investment banker to interpret financial data correctly and maintain regulatory compliance.

Debt analysis (13.4%) is another investment banking skill that top employers look for in an applicant. It evaluates the sustainability of a company’s debt levels, informing lending and investment decisions, and managing financial risks.

Additional investment banking technical skills include:

- Revenue Analysis

- Cost Analysis

- Cash Flow Analysis

- Forecasting

- Data Analysis

- Market Research

- Financial Reporting

- P&L Analysis

- Profitability Analysis

- Budgeting and FP&A

- Variance Analysis

These are crucial for advancing investment banking careers as they provide the detailed understanding needed to manage and advise on complex financial transactions. Analyzing business performance, liquidity, and future trends are all vital for making informed decisions, often using Excel for investment banking.

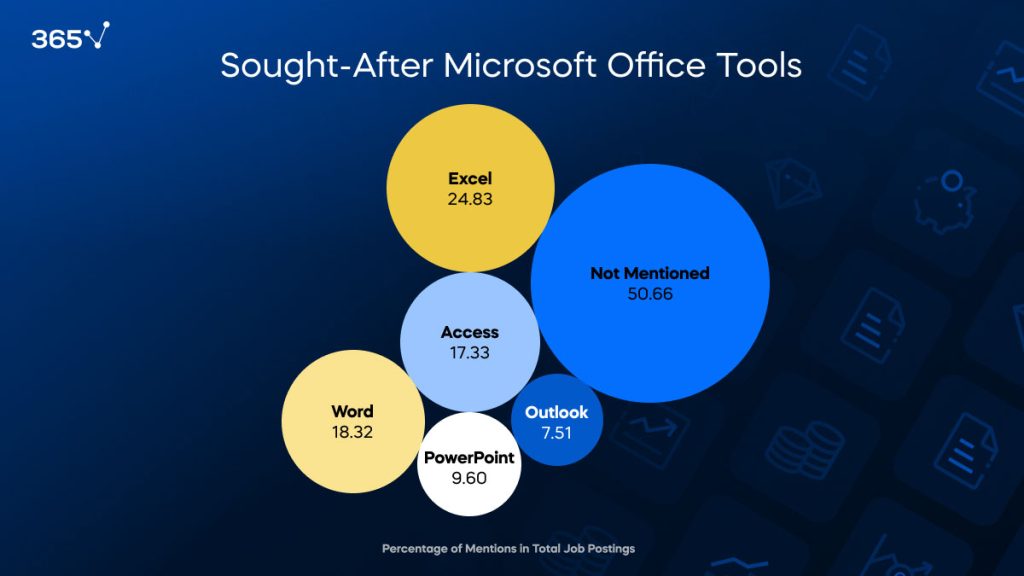

Sought-After Microsoft Office Tools

Over 50% of the job postings don’t mention a specific Microsoft Office tool as a requirement, suggesting that employers may prioritize other skills and qualifications. This could indicate an investment banking job outlook shift towards valuing broader competencies and adaptability over specific software proficiencies, assuming that candidates already possess fundamental Microsoft Office skills.

From those that do mention certain tools, Excel (24.8%) is among the most frequently mentioned investment banking tools, important for financial modeling, data analysis, and managing large datasets. For every investment banker, Excel skills enable them to create complex financial models, perform detailed analyses, and automate tasks to increase productivity.

We discovered that most investment banking companies list Excel as a general skill. Broad proficiency is typically sufficient, though mastering advanced functions, including pivot tables, VLOOKUPs, and macros, can provide a competitive edge for aspiring professionals.

Investment banking jobs also require strong Word skills (18.3%) to produce high-quality, professional documents that communicate financial information clearly and effectively.

Access (17.33%) is another essential investment banking tool for managing and querying large databases. This skill is particularly valuable for organizing client information, tracking deal progress, and analyzing market data.

PowerPoint (9.6%) is key for creating compelling presentations to pitch ideas, present financial analyses, and communicate strategies to clients and stakeholders.

Our research further suggests that the overall demand for ERP investment banking skills is relatively low compared to other financial analysis skills, with Oracle being mentioned only 1%, followed by SAP and NetSuite at 0.6% each, and Microsoft Dynamics at 0.1%.

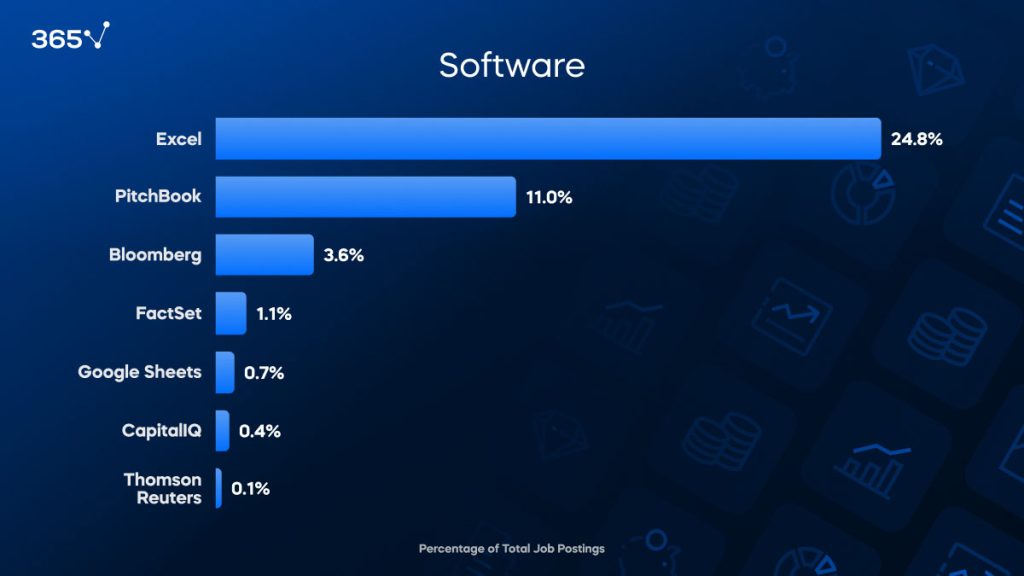

Software Proficiency

Proficiency in these tools is essential for managing financial data, conducting analysis, and supporting decision-making processes. Again, Excel for investment banking (24.8%) holds the leading position as the most required software, underscoring its role in financial modeling, data analysis, and reporting.

Mastery of Excel enables investment bankers to create complex financial models, perform detailed analyses, and automate tasks to increase productivity.

In their investment banker career path, many professionals use PitchBook (11%) for research, deal sourcing, due diligence, and market analysis. Such investment banking tools help you identify investment opportunities and understand market trends. With this software, an investment banker gets access to private market data, including information on private equity, venture capital, and M&A transactions.

Companies also look for people with experience in Bloomberg (3.65%) to make informed investment decisions and overall daily tasks in their jobs in investment banking. Real-time financial data, news, and analytics provide comprehensive market information and analytical tools.

Moreover, you should gain familiarity with FactSet (1.1%) to enhance your research and portfolio management capabilities. Using FactSet can provide a holistic view of financial markets and support informed decision-making for various jobs in investment banking.

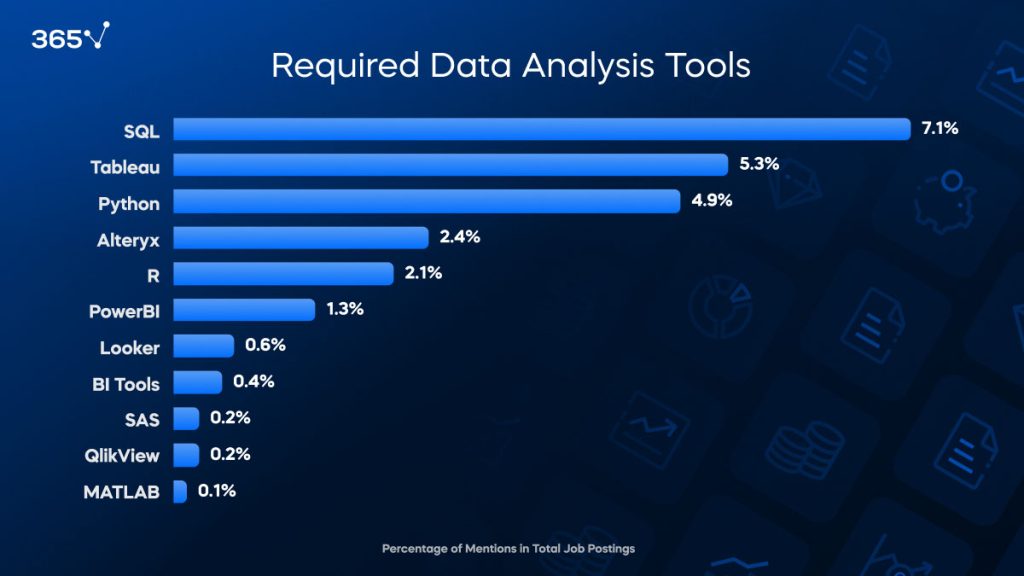

Data Analysis Tools

Our research reveals that while data analysis tools are valuable, not many job ads emphasize these skills—favoring a general knowledge of Excel for investment banking roles.

The relatively low emphasis on specific data analysis tools in job postings suggests that while these skills are beneficial, they are not universally required for most investment banking jobs.

Employers may prioritize general data analysis capabilities and proficiency in broadly applicable tools like Excel for investment banking over specialized software.

In terms of investment banking job growth, having expertise in SQL (7.1%), Tableau (5.3%), and Python (4.9%) can provide a competitive edge in the future, enhancing your ability to handle complex data and present actionable insights. These tools are often mentioned due to the specificity of certain investment banking jobs rather than a common requirement.

AI and Investment Banking

None of the AI tools listed in our keywords—including ChatGPT, Truewind, prompt engineering, and Bard—appeared in the investment banking jobs we analyzed. This may be because the investment banking industry traditionally emphasizes human expertise and judgment over automated tools, or it could indicate that the adoption of these AI technologies is still in its early stages within this sector. However, as technology evolves, integrating AI tools with traditional investment banking training could potentially become more prevalent.

While not yet a requirement, mastering AI tools like ChatGPT is becoming increasingly relevant for the investment banking job outlook. By automating mundane tasks such as data analysis, these tools free up more time for high-level activities like strategic planning and decision-making.

Bonus Tip: Now is the ideal time to start using ChatGPT, as not everyone in finance has adopted it yet. Enroll in our Data Analysis with ChatGPT course and stay a step ahead of most professionals in the industry.

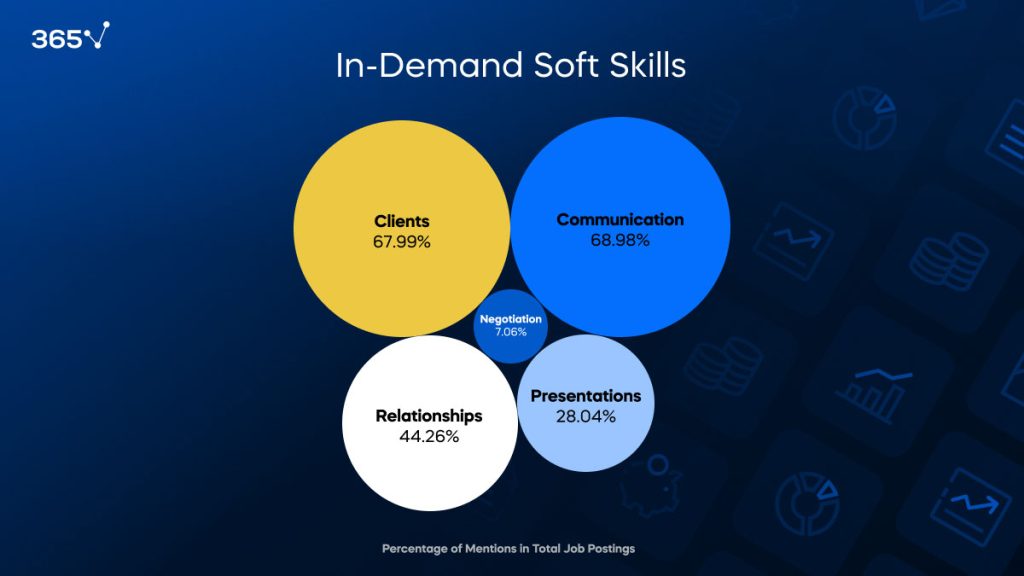

Investment Banking Soft Skills

Our analysis of investment banking job outlook highlights the most sought-after soft skills in the industry. These abilities are crucial for building strong professional relationships, effective communication, and successful negotiation.

Effective Communication

Communication (68.98%) is the most frequently mentioned of all investment banking soft skills, reflecting its importance in effectively conveying ideas, presenting information, and collaborating with team members and clients. Strong communication skills are essential for explaining complex financial concepts clearly and persuasively, making it one of the critical investment banking skills.

Managing Clients

Managing clients (67.99%) is almost equally important. This involves understanding client needs, providing tailored financial advice, and maintaining trust and satisfaction. Strong client management ensures long-term relationships and repeat business, which is key for investment banking jobs.

Relationships

Investment banking careers thrive on building and maintaining professional stakeholder relationships (44.26%) within the industry. Networking with colleagues, industry professionals, clients, and stakeholders can open doors to new opportunities and collaborations, enhancing your profile in the investment banking jobs arena.

Presentation Skills

In investment banking, soft skills like the ability to deliver effective presentations are highly valued. Investment bankers frequently present their analyses, proposals, and recommendations to clients and senior management, making presentation skills essential (28.04%) for engagingly conveying complex information.

Negotiation

While less frequently mentioned, negotiation skills (7.06%) are still important for investment banking jobs. Essentially, successful negotiation can lead to better deals and favorable terms in transactions such as mergers and acquisitions, financing agreements, and client contracts.

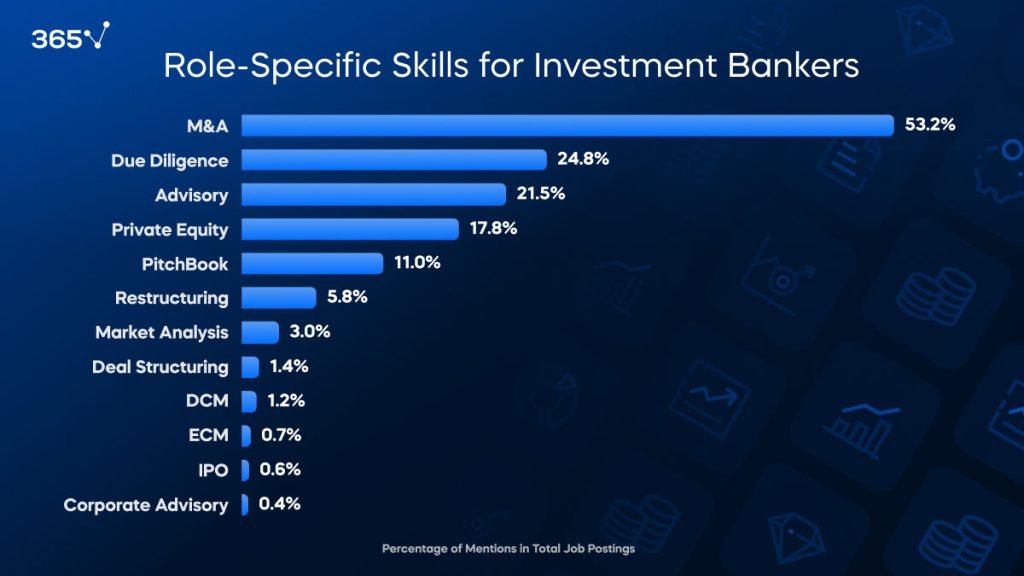

Role-Specific Skills

From the role-specific investment banking skills, M&A (53.2%) is the most frequently mentioned competency, reflecting the critical role these transactions play. M&A activities require complex financial analysis, negotiation, and strategic planning, making this a cornerstone of the profession and a driver of investment banking job growth.

At the same time, due diligence (24.8%) is crucial in assessing the viability and risks associated with potential investments and transactions. This process ensures that all aspects of a deal are thoroughly evaluated, contributing to informed decision-making and successful outcomes.

Providing strategic advice to clients is also key, with advisory (21.5%) involving guidance on financial decisions, restructuring, and strategic planning as part of the wide spectrum of investment banking skills.

Private equity knowledge (17.8%) is essential for managing investments in private companies, which includes identifying investment opportunities, conducting thorough analyses, and managing portfolios, contributing further to investment banking job growth.

Other notable skills include using PitchBook (11%), which is crucial for securing deals and investments through compelling presentations, including the preparation of your pitch book to showcase detailed financial analyses to potential investors.

Restructuring (5.8%) involves advising on reorganizing operations to improve efficiency and financial health. Market analysis (3%) also goes hand in hand with investment banking jobs to help professionals make informed decisions based on trends and dynamics.

Overall, the diverse range of investment banking skills reveals the multifaceted nature of the field, where professionals must be adept at various tasks to succeed.

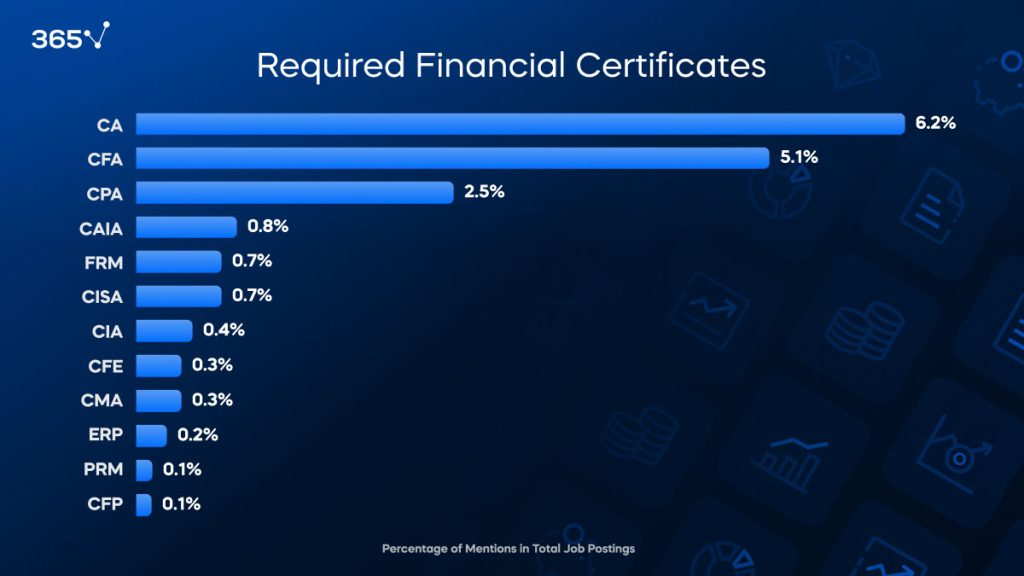

Investment Banking Job Outlook: Certificates

We discovered that only a minority of job ads specify investment banking certificate requirements. The relatively low percentage of job postings listing certification requirements suggests that while these credentials are highly valued, they are not always essential in an investment banking career.

From the ones that do have a credential requirement, the most frequently mentioned certification is the Chartered Accountant (CA) designation, appearing in 6.2% of the job postings. This highlights the value investment banking roles can have by knowing comprehensive accounting expertise and the ability to manage complex financial operations.

Following closely is the Chartered Financial Analyst (CFA) certification, cited in 5.1% of the job postings. The CFA designation is highly regarded for its rigorous focus on investment management and financial analysis, making it a sought-after investment banking certificate for roles that require great analytical skills and investment acumen.

The Certified Public Accountant (CPA) certification appears in 2.5% of the investment banking jobs we analyzed, emphasizing the need for proficiency in accounting practices, regulatory compliance, and financial reporting. The CPA credential is particularly valued in roles that involve auditing and tax preparation.

How to get into investment banking with less popular credentials? Less commonly mentioned investment banking certificates are the Enterprise Risk Professional (ERP), Professional Risk Manager (PRM), and Certified Financial Planner (CFP), each appearing in 0.2% or fewer job postings. This could likely reflect their specialized application in the investment banking jobs landscape.

Bonus Tip: Take it one step at a time. Begin by enrolling in our Investment Banker Career Track and earn a 365 Financial Analyst Certificate of Achievement to enhance your resume.

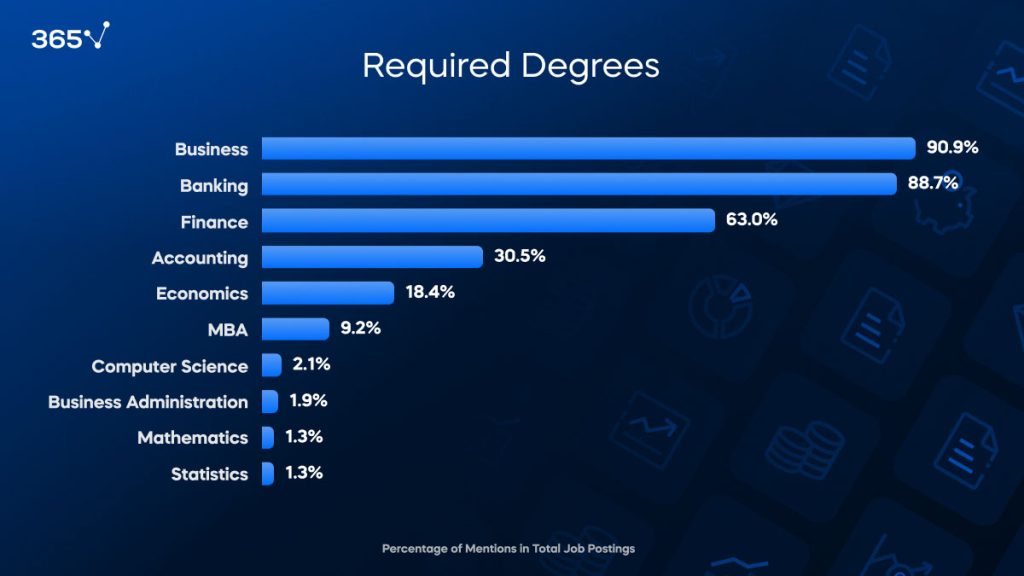

How to Become an Investment Banker: Education Requirements

What’s the best degree for investment banking? Our analysis of 906 investment banking jobs posted on Indeed USA reveals a clear preference for certain educational backgrounds.

Business degrees (90.9%) are the most sought-after, highlighting the need for a broad understanding of business principles. Investment banker education requirements also consider degrees in Banking (88.7%) and Finance (63.0%) as highly valued, emphasizing the importance of financial knowledge and analytical skills. Some employers mention an education in Accounting (30.5%) and Economics (18.4%) mostly because investment banking careers thrive on financial reporting and understanding of economic impacts.

Less commonly mentioned are degrees in Computer Science (2.1%), Business Administration (1.9%), Mathematics (1.3%), and Statistics (1.3%), representing the specialized skills some employers require.

In summary, what degree do you need for investment banking? It depends on the job scope and skills sought by employers. We can summarize the education requirements as predominantly finance and business-oriented. Broadly speaking, the high demand for such degrees for investment banking education shows the critical need for expertise in financial systems, market dynamics, and economic principles in the field.

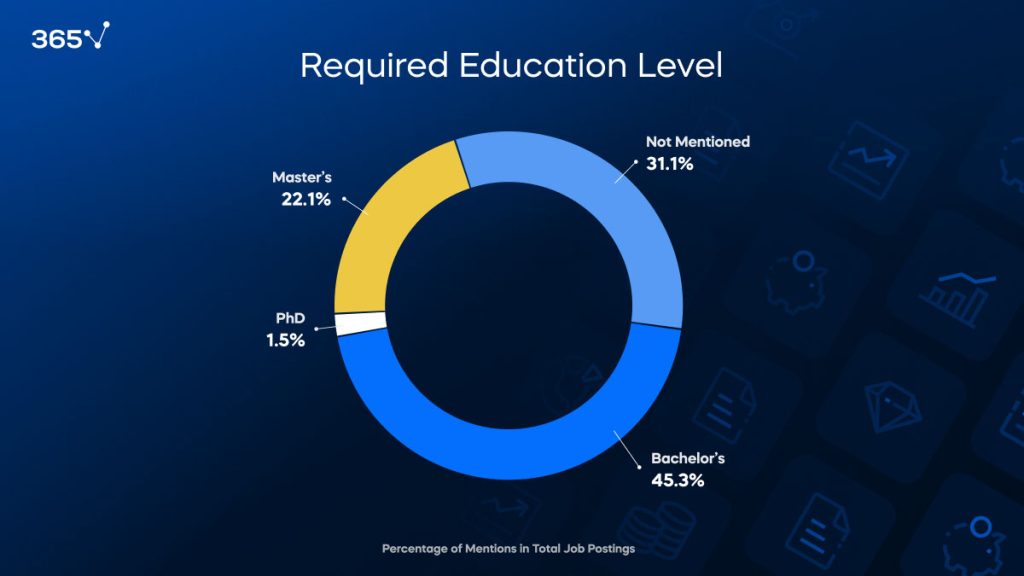

In terms of educational level, jobs in investment banking mostly require a Bachelor’s degree (45.3%), suitable for entry-level and mid-level roles. Master’s degrees are preferred in 22.1% of postings, indicating a need for advanced knowledge and leadership capabilities. Employers mention PhDs in only 1.5% of the investment banking jobs we analyzed, typically for highly specialized roles.

Interestingly, 31.1% of job postings do not specify an education level, suggesting flexibility and a potential focus on practical experience and skills over formal education. This flexibility indicates that while it is important, relevant experience and demonstrated skills can be equally valuable if you want to pursue an investment banking career path.

How to Break Into Investment Banking: Work Experience

Notably, a significant majority of job ads (77.9%) do not specify the required experience, which suggests a flexible approach to hiring and a focus on broader qualifications and potential. Breaking into investment banking can therefore be accessible with strong analytical skills and financial acumen, even without direct experience.

Pro Tip: Discover how to become an investment banker by gaining valuable skills in our investment banking career track.

Among the investment banking jobs that do mention specific experience requirements, the most common range is 2 to 4 years, representing 7.7% of the postings. This indicates a preference for candidates with some professional background, yet still relatively early in their careers. Such investment bankers are likely valued for their foundational skills combined with a fresh perspective and adaptability, which is important for breaking into investment banking overall.

Following this, roles requiring 4 to 6 years of experience account for 6.6% of the postings. These mid-level positions demand more seasoned professionals who can handle increased responsibilities and demonstrate excellent financial modeling skills and strategic decision-making.

Senior roles, requiring over 8 years of experience, makeup 3.6% of the investment banking jobs we processed, reflecting the need for highly experienced professionals to lead complex transactions and guide strategic initiatives.

Positions seeking 0 to 2 years of experience are slightly less common, at 3.0%, suggesting fewer entry-level opportunities but highlighting the importance of early career roles for organizational growth.

Pro Tip: For those seeking how to become an investment banker, gaining experience through internships or entry-level positions can be vital at this stage—you can start by tackling some of our real-life finance and business projects from scratch and showcase your achievements in your resume as a way to compensate for lack of experience.

The fact that 77.9% of job postings do not specify required experience levels suggests that top investment banks prioritize a candidate’s overall qualifications, skills, and potential over strict experience metrics.

This flexible approach can open the door to a diverse range of applicants, allowing firms to find the best talent fit for their specific needs. Include relevant experiences and skills on your investment banking resume to enhance your chances of being noticed.

The emphasis on 2 to 4 years and 4 to 6 years of experience highlights the demand for both early-career and mid-level professionals who can bring a balance of fresh insights and practical experience to their roles.

Where Do Most Investment Bankers Work?

The US is among the top countries for investment banking. Overall, our findings show a strong geographic concentration of investment banking careers in key financial centers, with a modest allowance for remote work.

The top states for investment banking jobs are:

- New York (21.1%)

- California (9.9%)

- Texas (6.5%)

- New Jersey (6.3%)

- Illinois (4.0%)

- Remote (3.5%)

- Florida (3.0%)

- Missouri (2.4%)

- Massachusetts (2.4%)

- North Carolina (2.3%)

New York, as expected, dominates the investment banking job market with 21.1% of the postings, reflecting its status as the financial hub of the United States.

California, known for its significant tech and finance sectors, follows with 9.9%. Texas and New Jersey also have substantial offerings, representing 6.5% and 6.3% respectively, likely due to their growing financial services industries.

Interestingly, 3.5% of job postings specify remote work, indicating some flexibility in work location, though this is lower compared to other industries. This relatively low percentage suggests that, despite the broader movement towards remote work, an investment banker career path is largely returning to traditional or hybrid work environments in 2024. The preference for on-site roles could be due to the collaborative nature of the work, the need for secure data handling, and the high stakes associated with financial transactions.

Investment Banking Salaries

Our research into 906 investment banking jobs posted on Indeed USA reveals a wide range of salary expectations, reflecting the diverse roles and levels of experience within the industry. Although more than half of the job ads did not disclose salary information, we were still able to derive meaningful insights into compensation trends in the sector from those that did.

Investment banking salaries are known for their potential to be highly lucrative, and our findings support this. The majority of investment banking salaries fall between $100,000 and $200,000.

Specifically, the most frequently mentioned investment banker salary range is $160,000 to $200,000, accounting for 12.4% of the job postings. This suggests that many positions offer substantial compensation, likely tied to the high demands, responsibilities, and bonuses associated with these roles. According to Glassdoor, the average salary of an investment banker in the US for 2024 is approximately $172,531, which coincides with our results.

Investment banking salaries between $100,000 and $120,000 are also common, representing 10.4%. These figures typically reflect mid-level positions, where bankers have developed significant expertise and contribute to high-stakes financial activities.

In the $120,000 to $160,000 range, 6.0% of postings indicate investment banking salaries for experienced professionals who bring advanced skills and a track record of successful deals and financial strategies. Similarly, salaries from $80,000 to $100,000 (6.0%) suggest entry-level to early-career roles that still offer competitive compensation.

Higher investment banking salaries, exceeding $200,000, are mentioned in 5.2% of job postings. These positions are likely for senior roles or specialized functions that require extensive experience and a proven ability to generate significant revenue.

Interestingly, only a small fraction of postings (3.6%) list investment banking salaries between $60,000 and $80,000, indicating fewer opportunities at the lower end of the compensation spectrum. Even rarer are roles offering less than $60,000 annually (0.4%), underscoring the overall lucrative nature of investment banking.

What Is the Investment Banking Job Outlook in 2024?

Investment banking is in line for a dynamic year ahead, with significant growth and opportunities on the horizon. According to the U.S. Bureau of Labor Statistics, employment for securities, commodities, and financial services sales agents, which includes investment banking careers, is projected to grow by 7% from 2022 to 2032.

This rate outpaces the average growth for all occupations, indicating a robust investment banking job outlook for professionals in this sector. On average, there will be about 40,100 openings annually, primarily driven by the need to replace workers who transition to different careers or exit the workforce, such as through retirement.

Our comprehensive analysis of 906 investment banking jobs has provided valuable insights into the investment banking job market outlook. Salaries in this field are known for their potential to be highly lucrative. Our research shows that the most frequently mentioned salaries for various investment banking careers range between $160,000 to $200,000, reflecting the high demands and responsibilities associated with these roles. Even entry-level positions offer competitive compensation, typically ranging from $80,000 to $100,000.

Top employers in the investment banking careers sector include prominent names such as JPMorgan Chase & Co., which accounts for 24.8% of the job postings, reflecting its significant influence in the financial sector. Other key employers include Morgan Stanley, Sumitomo Mitsui Banking Corporation, Goldman Sachs, and Jefferies & Company Inc.

New York remains the epicenter of investment banking careers, accounting for 21.1% of the job postings, followed by California (9.9%) and Texas (6.5%). This geographical concentration demonstrates the continued importance of major financial hubs. Interestingly, only 3.5% of job postings specify remote work options, reflecting a return to traditional office environments for this highly collaborative and high-stakes field.

Work experience also plays a crucial role, though interestingly, 77.9% of job postings do not specify a required level of experience but rather focus on investment banking job growth. Among those that do, 2 to 4 years of experience is most commonly mentioned (7.7%), highlighting a preference for candidates with some professional background but still relatively early in their investment banking careers.

When it comes to investment banker education requirements, a staggering 90.9% of job postings that mention education require a degree in Business, highlighting the critical need for comprehensive business knowledge. Degrees in Banking (88.7%) and Finance (63.0%) are also highly sought after. And while 45.3% of postings require a Bachelor’s degree, 22.1% prefer candidates with a Master’s degree, indicating a demand for advanced expertise, which is already impacting the investment banking job outlook.

On the skills front, proficiency in financial modeling and valuation is paramount. Nearly half of the job postings emphasize the importance of these competencies. Considering the interpersonal nature of investment banking careers, strong communication skills (68.98%) and client relationship management (67.99%) is crucial. Interestingly, AI and investment banking are yet to fully integrate, with many firms still prioritizing human expertise and judgment over automated solutions.

FAQs

Yes, investment bankers are in high demand due to their critical role in financial markets. They assist companies in raising capital, facilitate mergers and acquisitions, and provide strategic financial advice. The demand is particularly strong in major financial hubs like New York, London, and Hong Kong.

The future outlook for investment banking is positive. The U.S. Bureau of Labor Statistics (BLS) projects a 7% growth in employment for securities, commodities, and financial services sales agents, which includes investment bankers, from 2022 to 2032. This growth is driven by economic expansion and the increasing complexity of financial transactions.

Investment bankers can make $500k a year, especially at higher levels and in major financial centers. Senior investment bankers and managing directors at top firms often earn total compensation packages (including bonuses) that can exceed $500k annually. However, entry-level and mid-level bankers typically earn less, with starting salaries around $100k to $150k plus bonuses.

The odds of getting an investment banking job can be competitive due to the high demand and rigorous qualifications required. Candidates typically need a strong educational background (often from prestigious universities), relevant internships, and excellent analytical and communication skills. Networking and connections also play a crucial role in securing positions in this field. While challenging, persistence, preparation, and leveraging professional networks can improve one’s chances.