Math for Finance

Master financial mathematics: apply key mathematical techniques for improved financial decision-making

Start for Free

Start for Free

What you get:

- 3 hours of content

- 46 Interactive exercises

- 87 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

Math for Finance

Start for Free

Start for Free

What you get:

- 3 hours of content

- 46 Interactive exercises

- 87 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

$99.00

Lifetime access

Start for Free

Start for Free

What you get:

- 3 hours of content

- 46 Interactive exercises

- 87 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

What You Learn

- Identify the key principle of the time value of money and explain its role in financial decision-making

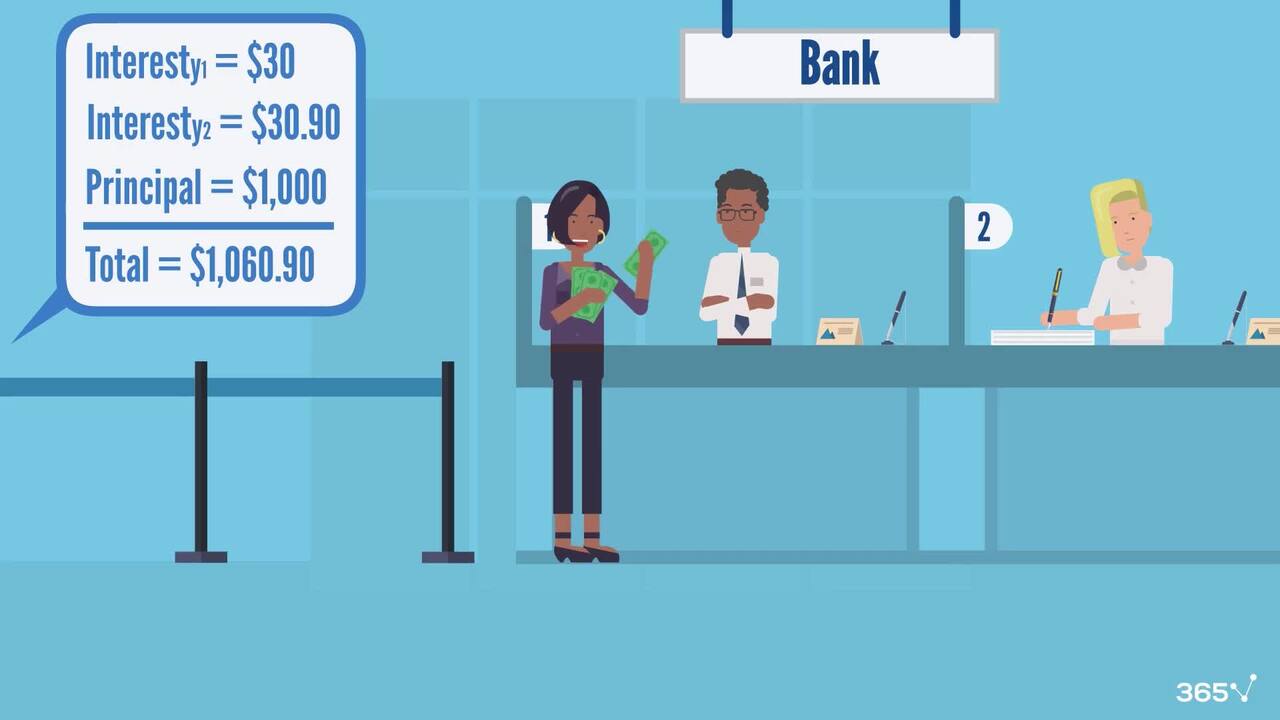

- Differentiate between the core components that determine bank interest rates

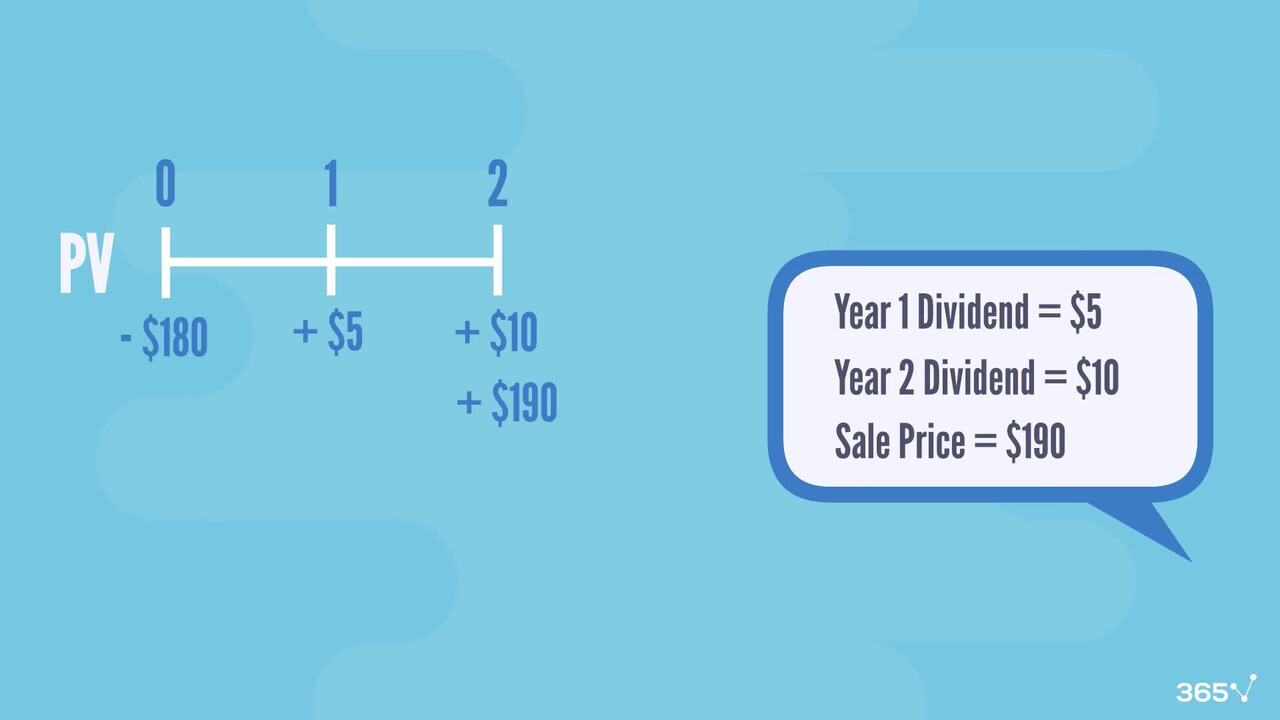

- Compare present and future cash flows to make informed financial decisions

- Calculate investment returns and decide which investment opportunities are preferrable

- Use advanced tools such as Net Present Value (NPV) and Internal Rate of Return (IRR) to assess project financial feasibility

- Apply core financial math concepts such as discounting, compounding, annuities, and bond valuation to solve real-world investment and corporate finance problems

Top Choice of Leading Companies Worldwide

Industry leaders and professionals globally rely on this top-rated course to enhance their skills.

Course Description

Learn for Free

1.2 Course Introduction

3 min

1.3 Time Value of Money (Key Concepts)

5 min

1.4 The Timeline

3 min

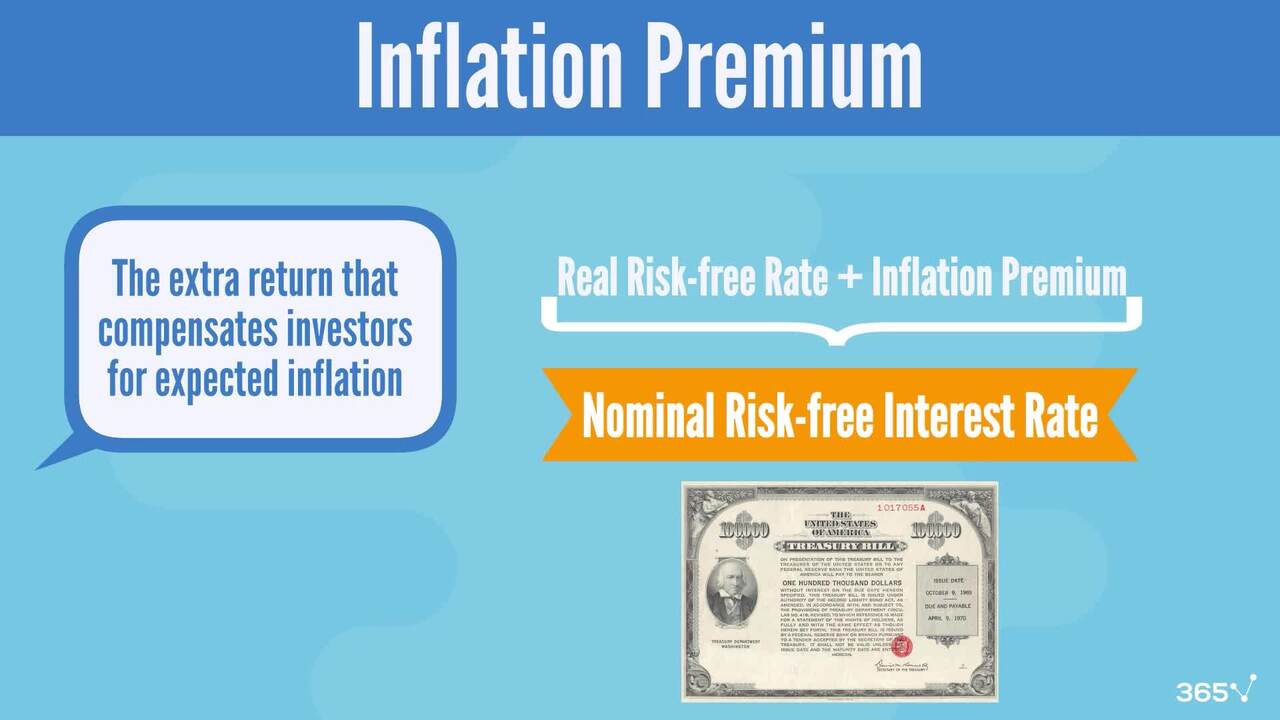

1.5 Interest Rate (Interpretations)

3 min

1.6 Interest Rate (Components)

5 min

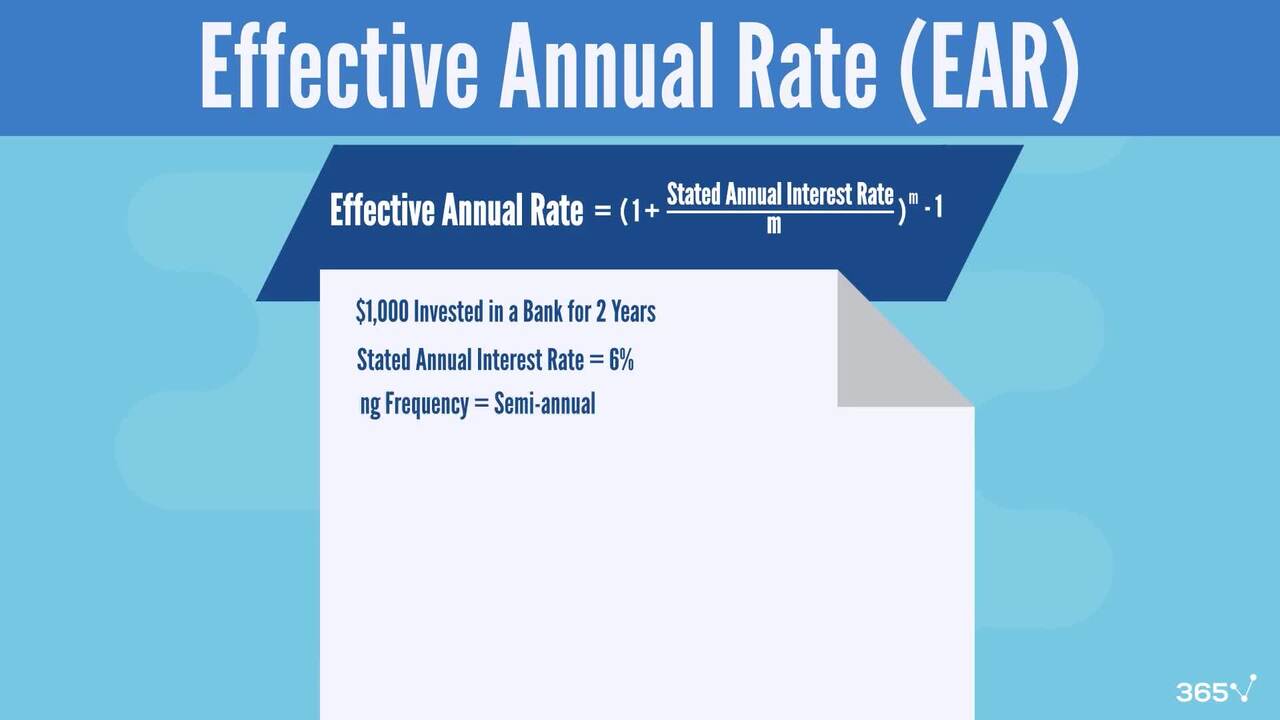

1.7 The Effective Annual Rate (EAR)

3 min

Curriculum

- 2. Moving Money Through Time9 Lessons 39 MinIn this section of the financial mathematics course, we examine the relationship between present and future value and learn how to move money through time. We discuss the importance of compounding frequency, how it affects the present and future value of our investments, and the different types of cash flow streams. Lastly, you will learn how to calculate the future and the present value of ordinary and annuity due and unequal cash flows.Section 2: Learning Objectives Read now1 minThe Relationship Between PV and FV4 minMoving Money Through Time5 minThe Effect Of Compounding Frequency3 minOrdinary Annuity9 minAnnuity Due6 minPerpetuity3 minGrowing Perpetuity3 minFV and PV Of Unequal Cash Flows5 min

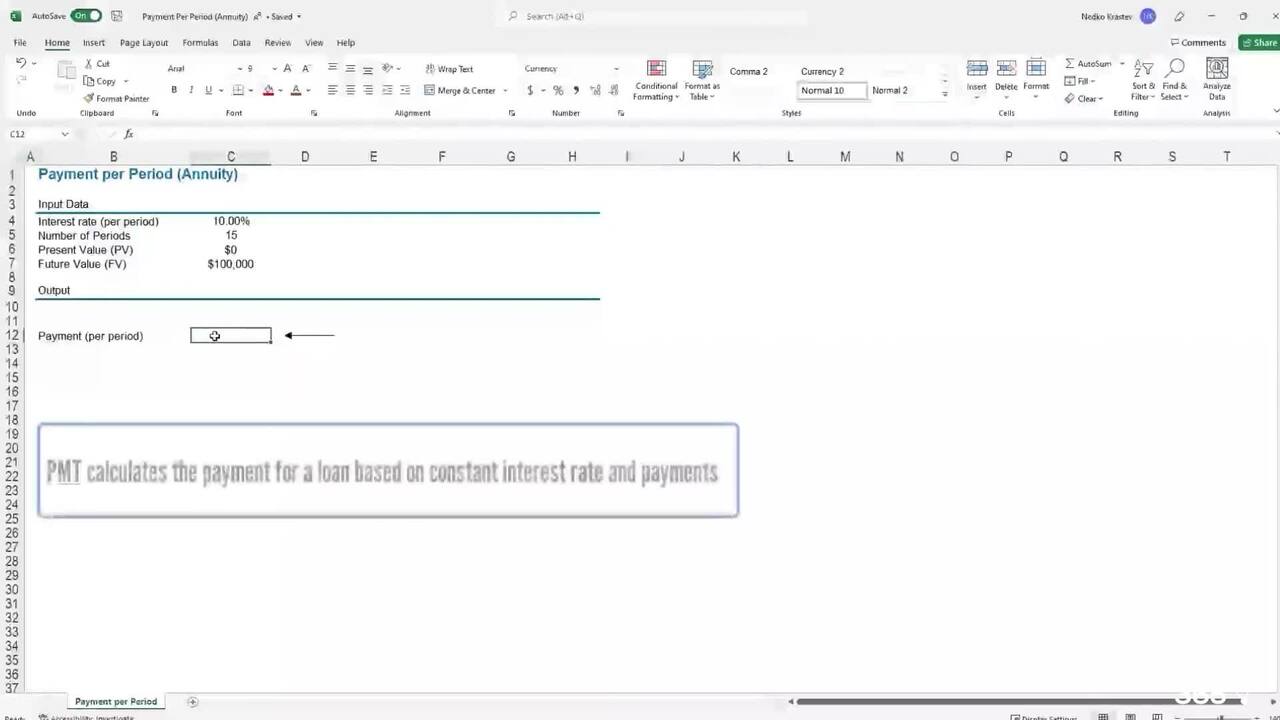

- 3. Modeling and Solving Time Value of Money Problems5 Lessons 21 MinIn this core section of the Math for Finance course, you will learn to model and solve time value of money problems. We show you how to obtain the size of annuity payments manually and in Excel. You will learn how to calculate the number of years it takes to reach your financial goal and find investments' growth rates. At the end of this section, we examine the cash flow additivity principle.Section 3: Learning Objectives Read now1 minSolving for the Size of Annuity Payments8 minCalculate the Number of Years It Takes to Reach Your Financial Goal4 minWhat Is The Rate Of Return On My Investment5 minThe Cash Flow Additivity Principle3 min

- 4. NPV and IRR5 Lessons 34 MinHaving covered interest rates, we can discuss several discounted cash flow applications. In this practical section, we introduce the Net Present Value and Internal Rate of Return techniques. They help us determine whether a project is feasible and advantageous from a financial perspective. Finally, you will learn how to choose the most profitable project when the two measures produce conflicting results.Section 4: Learning Objectives Read now1 minNet Present Value (NPV)5 minNet Present Value (Calculation)10 minInternal Rate of Return (IRR)9 minNPV vs IRR9 min

- 5. Return Measures6 Lessons 27 MinThis section of the finance mathematics course is dedicated to the different return measures. First, we examine the holding period yield, the logarithmic return, and the differences between them. Then, we explore the two most common portfolio return measurements: the Money-Weighted Rate of Return and the Time-Weighted Rate of Return.Section 5: Learning Objectives Read now1 minThe holding period return4 minLog Return7 minArithmetic vs Geometric Mean Return3 minMoney-weighted rate of return7 minTime-weighted rate of return5 min

- 6. Bond Pricing and Yields8 Lessons 42 MinIn the final section of the Math for Finance course, we discuss bond pricing and yields. You will learn how to calculate yield measures, such as current yield and yield to maturity, and determine whether a bond trades at a discount, par, or premium. At the end of this section, we examine the short-term debt market. You will learn how to calculate different money market yields, such as the bank discount, effective annual, and money market yields.Section 6: Learning Objectives Read now1 minIntroduction6 minPar Value4 minValuing a Bond6 minBond Yield8 minBank Discount Yield5 minMoney Market Instruments (Yield Measures)6 minYield Measures (Conversion)6 min

Topics

Course Requirements

- A basic knowledge of high school math is necessary to follow along with the course

Who Should Take This Course?

Level of difficulty: Beginner

- Aspiring finance professionals

- Individuals seeking to enhance their financial math skills

Exams and Certification

A 365 Financial Analyst Course Certificate is an excellent addition to your LinkedIn profile—demonstrating your expertise and willingness to go the extra mile to accomplish your goals.

Meet Your Instructor

Nedko earned a Master’s degree in Finance from Bocconi University (Milan, Italy) in 2012. Then, he gained valuable working experience with exciting firms like PwC Italy (Financial Advisory and M&A), Coca-Cola European Partners (Financial Analyst), and Infineon Technologies (M&A). In 2014, he published his first online course on financial modeling and valuation when he realized that creating educational materials is his true calling. The amazing students and content creators in the data science community, the 365 team, and the strong desire to build the perfect learning platform drive Nedko to continue on this exciting journey. His goal is to establish 365 Data Science as the learning platform that bridges the gap between theoretical knowledge and practical business application.

What Our Learners Say

365 Financial Analyst Is Featured at

Our top-rated courses are trusted by business worldwide.