What is Burn Rate Analysis?

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for Free

In the world of business, cash is very much king, and even profitable companies with cash flow problems can soon collapse. The prevalence of cash is why burn rate analysis is critical for businesses, especially startups. And while a company’s cash flow statement can reveal crucial historical patterns, decision-makers need a metric to forecast potential cash flow concerns.

What is Burn Rate?

Burn rate is the amount of cash you expect to use (burn)over a predetermined period. To illustrate, financial analysts could say “The company’s operations burned cash at a rate of $100K per month.”

Although this statement uses cash from operations, analysts could also include the cash used on capital expenditures and other investments. The reason we have different cash flow categories is self-evident. We want to know how long a business can sustain itself before any funding is made.

Moreover, many financial analysts use a monthly figure for the set period. But this can vary. For instance, three to six months might make sense for analysts who like to normalize the impact of seasonality. So, we could say “The cash burn rate is $600K over six months.”

On the other hand, some companies and analysts prefer to calculate burn rates weekly or daily, particularly under crisis management — when firms deal with disruptive and unexpected events like a global pandemic.

Why is Burn Rate Important for Startups?

Burn rate analysis is especially important for startups because these companies require considerable spending at the pre-revenue stage. In other words, founders and their analysts want to know how long they have until the cash runs out. Also, venture capitalists and other early-stage investors often provide funding based on burn rate.

Besides large burn rates, the alternative – no cash burn – may also be a bad sign for startups. All things equal, a startup with no additional investments into the business will likely succumb to its competitors. Company growth is tied to capital expenditures, but this is a generality that is better addressed with proper financial ratio analysis — more on this in a bit.

Calculating Burn Rate

The easiest way to calculate a company’s burn rate is to acquire its cash flow from operations. Some use net income as a proxy, but this is a poor measure for capital-intensive businesses with a lot of accruals. Others use a gross burn rate, which takes into account a company’s operating expenses but not its cash inflows.

What we’re specifically looking for is the net change in cash position. This means considering both cash inflow and outflow over a set period.

For example, we can take the firm’s cash flow from operations over the year and divide that by the desired time period. Thus, the burn rate formula can be stated as:

Burn Rate = Change in Cash / Set Time

So, if the total change in cash position over the year was $1.2M, then we could say the company’s burn rate is $100K per month. And if its current cash balance is $600K, then we may infer that the business has six months left if the burn rate doesn’t slow down.

Applications in Financial Modeling

Burn rate is an excellent forecast metric that goes hand in hand with full-on financial modeling. Robust financial models will have interlinking financial statements, and that means everything you need will be there.

Specifically, we can derive the cash flow from operations net income in two steps. The first is to add back depreciation, amortization, and other non-cash charges to net income. Next is to deduct the necessary investments in working capital — the changes in receivables, payables, and inventory.

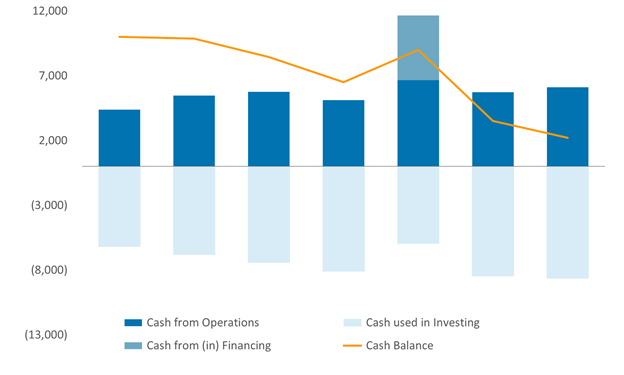

When the financial model details are ready, visualization tools help demonstrate the impact of burning cash over a select period. A stacked column chart, in combination with a line chart of the cash balance, is very insightful in burn rate analyses.

This chart shows how the cash balance changes over the forecast period. With burn rate analysis, we are considering the impact of cash flow from operations on the firm’s cash balance. That said, a well-made financial model makes it easy to add the effects of financing and investing cash flows.

There is a cash infusion (cash flow from financing) on the fifth interval of the forecast.

When we have considered the cash-flow categories, we can determine the company’s leeway before the next round of financing.

Reducing Burn Rate

To control the company’s burn rate, management has several levers at its disposal. One is its control over capital expenditures. Although it sounds counterintuitive, the company can speed up its capital spending if it that will mean accelerated revenue generation and unchanging fixed costs. Startups could also ramp up customer acquisition campaigns if these would allow them to realize profits earlier.

Alternatively, a firm could decide to cut its workforce and save on costs. This is effective if we assume that there are unnecessary redundancies, to begin with. Regardless of the strategy, financial analysts will need to consider the drawbacks of burn rate analysis.

What’s Next?

Even though the burn rate tells us how long we have left, it fails to help us understand the reasonability of this rate.

Balancing between burning too much money and not spending enough is a tough choice. Startups, in particular, need to stay competitive by spending on investments. We also expect more capital-intensive industries to burn more.

Sound financial analyses don’t happen in a vacuum, and the same holds true for burn rate analysis. To properly assess a company’s situation, analysts need to evaluate the business in its entirety. That is why an understanding of financial ratio analysis is key. Sign onto our Introduction to Financial Ratio Analysis course and learn to calculate and interpret various profitability, efficiency, and turnover ratios that drive businesses.

Ready to take the next step towards a career in Finance?

From foundational topics in Accounting and Financial Analysis, through Corporate Finance and M&A, to specialized Fintech and Economics courses, the 365 Financial Analyst curriculum is designed to prepare you for the world of Finance as it is today. Whether you are a total beginner or a working professional, our expert-led courses offer the opportunity to upskill at your own pace. Find the right fit for you and start learning today!