Free Cash Flow to the Firm (FCFF)

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for Free

A firm’s Cash Flow Statement can be an invaluable source of information for any financial analyst. It shows how the business generates cash, what it uses it for, and how it manages its cash balance.

Analysts can also calculate certain cash flow metrics that will get them even more insight. The most frequently used ones are:

- Free Cash Flow to the Firm (FCFF);

- Free Cash Flow to Equity (FCFE);

- Cash flow ratios

What Is Free Cash Flow to the Firm (FCFF)?

Free cash flow is defined as the cash available to a company after operating and capital expenditures are covered.

In that regard, FCFF is the cash flow available for the business to use after all its operating and capital expenses have been covered. That includes – COGS, running (operating) costs, taxes, working capital, and fixed capital expenditures. The excess cash is available to the business to spend at its discretion – it can keep it at hand, schedule it for reinvestment, use it to pay off debt, or distribute it to shareholders as dividends.

One peculiarity about FCFF is that it calculates free cash flow to the business while completely disregarding the firm’s financing sources. In other words, it ignores whether the business is financed by debt or equity and so, the equation for FCFF omits all interest and debt payments.

How Do You Calculate FCFF?

Below is a summary of the steps you should take and components you need to calculate Free Cash Flow to the Firm:

FCFF = Net~Income + NCC + [Int \times (1-tax~rate)] - FCInv - WCInv

| Net Income | By taking the net income straight from the Income Statement, we have already removed most of the operating expenses – COGS, running costs, depreciation, interest, and taxes. | |

| + | Non-Cash Charges | As we are trying to calculate free cash flow, we need to consider that all the non-cash charges (such as depreciation and amortization) are included in the Cash Flow Statement. There was no cash paid here but they have been subtracted as an operating expense. So, we need to add them back. |

| + | Interest*(1-Tax Rate) | As noted, FCFF disregards the firm’s sources of finance, and so we have to add back the interest expense, which has been already subtracted in the Income Statement. However, interest is a tax-deductible expense, and so if we paid no interest, we would have paid more taxes. So, when adding it back, we need to multiply by (1-Tax Rate) to get a more precise FCFF measure. |

| – | Working Capital Investment | Changes in working capital (receivables, payables, and inventory) are not reflected in the Income Statement but do represent real cash flows. An increase in receivables for example means the firm got less cash for its revenue and it needed to use available cash to cover it. |

| – | Fixed Capital Investment | The purchase of a large asset will not be reflected in the Income Statement but would instead be capitalized and depreciated over time. It nevertheless is a cash flow that has to be reflected to calculate FCFF. |

| = | Free Cash Flow to the Firm | The cash available to the firm after all of its operating and capital, but not financing, expenses. This is the cash the business earned regardless of its financing structure and financing costs. |

Practical Example

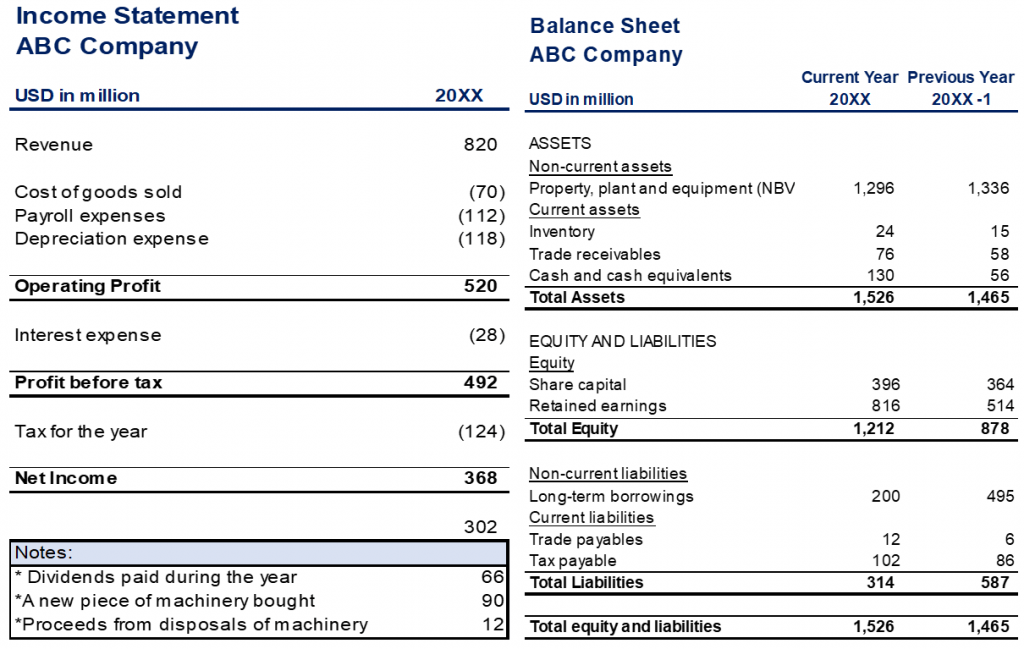

Suppose that you have been assigned to calculate and interpret the cash flow metrics of ABC Company. Your first task is to estimate the Free Cash Flow to the Firm (FCFF) by using the firm’s Income Statement and Balance Sheet:

You start by looking for all the figures you need to calculate the FCFF. Some of the numbers you require are readily available in ABC’s Income Statement:

- Net Income = 368m

- Non-Cash Charges = Depreciation + Interest + Tax = 118m + 28m + 124m = 270m

- Interest Expense = 28m

Afterward, you derive the figures that are not immediately available:

- To obtain the tax rate, you simply divide the tax paid for the year by the profit before tax:

Tax rate = \frac {124m} {492m} \times 100\% = 25\%- For the Working Capital Investment, you need the change in receivables, inventory, and payables. This is the difference between the amount of last year’s ending value and the amount of the current year’s ending value of an item. These amounts are recorded in the Balance Sheet:

Change in Receivables = 76m – 58m = 18m

Change in Inventory = 24m – 15m = 9m

Change in Payables = 6m – 12m = -6m

Working Capital Investment = Changes in Receivables + Changes in Inventory + Changes in Payables =

= 18m + 9m – 6m = 21m

- Finally, you work out the Fixed Capital Investment by calculating the changes in Property, Plant, and Equipment (PP&E) in a similar manner:

Fixed Capital Investment = Ending PP&E – (Beginning PP&E – Depreciation) = 1,296m – (1.336m – 118m) = 78m

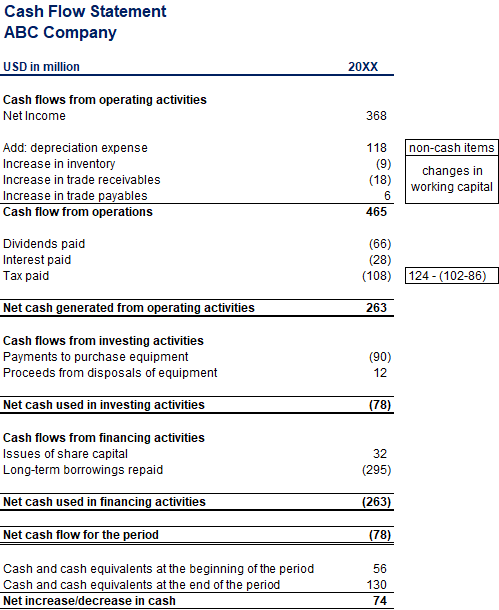

As a matter of fact, all of the listed items can be found on the firm’s Cash Flow Statement. In this example, we did not take the shortcut because we wanted you to better understand the mechanics of the 3 financial statements. In reality, analysts would mostly refer to the Cash Flow Statement to obtain these figures.

And so, having all the necessary information, you are now ready to calculate Company ABC’s Free Cash Flow to the Firm by using the following formula:

FCFF = Net~Income + NCC + [Int \times (1-tax~rate)] - FCInv - WCInv

FCFF = 368m + 270m + 28m *(1-0.25) – 21m – 78m

FCFF = 561.4m

Alternatively, you can use the cash flow from operations (CFO) figure directly from the Cash Flow Statement:

We know that CFO = Net Income + NCC - WCInv .

So, FCFF = CFO + [Int times (1-t)] - FCInv.

This is another useful formula you can use to calculate the Free Cash Flow to the Firm.

Concluding words

A business generates cash by selling goods and services, and a portion of these earnings goes to the company’s fixed and working capital. Any excess cash a firm has at hand after processing its operating expenses and re-investments in the business is classified as FCFF. With the Free Cash Flow to the Firm, an organization is at liberty to either pay for its debt obligations or distribute it as dividends to equity owners. That’s why investors are particularly interested in this indicator.

Generally, free cash flow measures are very useful for analyzing a firm’s ability to pay its stakeholders in cash. Thus, financiers often look into another measure, called the Cash Flow from Equity (FCFE). It is basically a more conservative iteration of the FCFF because it deducts debt-related payments in addition to subtracting working and fixed capital.