What Is Internal Rate of Return (IRR)?

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for Free

In corporate finance, the Internal Rate of Return is a common measure for financial analysts to compare various projects. It’s a quick yet solid metric to rule out one investment over another. Although the IRR calculation doesn’t compute the actual dollar value of a project, it is still popular for its property to factor in the time value of money and future cash flows. So, what is IRR?

This article addresses the Internal Rate of Return and its uses, explains the IRR formula and calculation through examples, reviews the IRR in the context of compounding, and lists the key limitations of the metric.

Table of Contents

- What Is Internal Rate of Return (IRR)?

- IRR Uses

- What Is the IRR Formula?

- IRR Calculation in Excel – Example

- IRR and the Effect of Compounding

- Limitations of Internal Rate of Return

- The Bottom Line

- FAQs

What Is Internal Rate of Return (IRR)?

The Internal Rate of Return (IRR)—also known as the discounted cash flow rate—is a measure that evaluates the profitability of an investment. As such, it’s frequently used in capital budgeting and securities valuations. It’s internal because the calculation considers no external factors, including financial risk, inflation, and cost of capital. Companies might base their decision to accept or reject a project on IRR and the Net Present Value (NPV). When computing the IRR, you look for the discount rate at which the project’s NPV equals zero. So, you consider NPV along with IRR.

Projects are accepted if the IRR is greater than the opportunity cost of capital r and rejected if the IRR is less than r—i.e.:

Accept when IRR > r

Reject when IRR < r

Here, the opportunity cost compares one economical choice to the next best. In the context of Internal Rate of Return, it refers to the potential rate of return from the next highest-valued alternative investment. The IRR might then be viewed as a hurdle rate that should be met for a project to get approval.

IRR Uses

Companies have various projects to analyze each year to allocate available resources adequately. In capital planning, for example, the management often considers investments’ Internal Rate of Return to make a final decision. For a manufacturer, an IRR calculation could estimate whether building a new plant or expanding an existing one is more profitable. If both investment options offer the same level of risk and value, the company moves forward with the project yielding a higher IRR.

Corporations also use the Internal Rate of Return to analyze reverse share acquisitions. Based on the IRR calculation, the management decides whether funds should buy back company stock or invest in alternative projects, such as business operations and equipment.

When evaluating investment returns, matters get more complicated. What do you do with interest payments or dividends? Do you reinvest them, or do you pay them out? Will they come in the form of income or cash? Here, the IRR formula could quickly strategize such business decisions by comparing the annual growth of various alternatives.

Understanding how much a house will be worth in 15 years based on its present value makes IRR a popular metric in the real estate community. Many real estate investors also calculate the Internal Rate of Return on a property. Of course, the IRR calculation can be volatile depending on projected cash flows, which may change tremendously over time. So, make sure you take the result with a grain of salt.

Internal Rate of Return can help individuals compare their life insurance plans’ premiums and death benefits. Two policies with equal premiums may have different IRRs. As a rule, you choose the one that gives you a higher IRR. Remember that you’ll see skyrocketing IRR in the first few years after a policy’s inception.

And please remember—IRR doesn’t function as a standalone measure. It’s a proxy for comparing the growth returns of various projects and works best if paired up with other indicators. That’s why you will always see practitioners studying it with more comprehensive measures, such as WACC and RRR.

What Is the IRR Formula?

The formula for calculating the Internal Rate of Return is as follows:

\sum_{t=0}^{n}\frac{{CF}_t}{{(1+IRR)}^t}=0The term is the expected net cash flow at time t, and n is the projected life of the investment.

You can compute IRR in three ways:

- Utilize Excel’s IRR, MIRR, or XIRR function. (Download the free template here.)

- Use a financial calculator.

- Apply a trial and error approach to find the discount rate at which NPV equals zero—Excel’s Goal Seek function will help.

IRR Calculation in Excel – Example

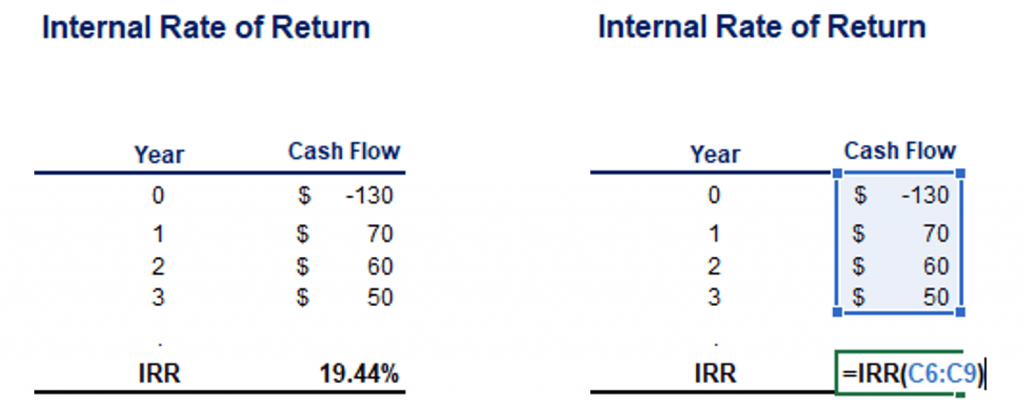

Suppose Alpha is a large company operating in the shipbuilding sector. Its R&D department has made a scientific breakthrough. They’ve developed a new ship prototype that travels 20% faster than existing ship models and will be 10% more efficient in fuel consumption. The project, however, involves the construction of a new shipbuilding plant. An initial investment of $130 million is expected to generate after-tax cash inflows of $70 million for the next year, $60 million in the second year, and $50 million in year three.

The company’s finance department has assessed that the project’s cost of capital is 9%. The firm’s CEO wants to know whether the investment makes economic sense. You can use Excel and its embedded IRR formula to find this:

As the company’s required rate of return (or opportunity cost) is 9%, the investment project appears to be acceptable on a stand-alone basis.

Again, Excel offers three functions for calculating the Internal Rate of Return: IRR, XIRR, and MIRR. The IRR function assumes that all the periods in a series of cash flows are equal.

The XIRR, however, is more versatile. It gives you the flexibility to assign specific dates to each cash flow—making it suitable for cash flow series that occur at irregular intervals.

Finally, the Modified Internal Rate of Return function (MIRR) works just like the IRR function—except it incorporates the cost of borrowing and reinvestment rate.

What does this result mean for Alpha? Since the IRR has nearly doubled the rate of return, the CEO feels it’s profitable to invest in building a new plant. So, the company moves forward with the project.

IRR and the Effect of Compounding

The IRR considers the effect of compounding on investment returns. It assumes that all cash inflows generated by a project are reinvested at the same rate as the IRR, leading to compounded returns. In simple terms, compounding is the interest you earn on interest. It’s most effective over time—especially for investments and projected cash flows.

As a dynamic measure, the Internal Rate of Return could tell investors what impact compounding would have on their return in a certain period. In this way, they can better choose between lump-sum and regular payments.

Suppose you want to invest $100 monthly in the stock market over three years with a 6% IRR. At the end of the third year, your investment would have grown from $3,600 to $3,994. You can then compare this payment option to a lump-sum investment, where you would need to lock in $3,287 today to achieve a future value of $3,994—$313 less than the $100-per-month plan.

Using IRR to compare lump-sum investments with payments over time involves considering the time value of money, the size and timing of cash flows, and the reinvestment of cash flows. And that’s essential information for companies to analyze. Millions of dollars paid at once or in installments will make a big difference on their books. So, in a way, the Internal Rate of Return reveals how compounding works for various investments.

Limitations of Internal Rate of Return

The beauty of the Internal Rate of Return lies in its simplicity. While it’s a good starting point for comparing projects, the IRR has some limitations worth considering.

The most significant pitfall concerns calculating the reinvestment rates. IRR assumes that all earned cash flows would be reinvested at the same rate, while it doesn’t reflect the actual cost of capital. In practice, such reinvestments are relatively rare.

Moreover, better options for comparing projects with different timelines may exist than the Internal Rate of Return. A more extended project may have a low IRR but high NPV, whereas a short-term project will add small value but have a high IRR.

You may also encounter unconventional cash flow patterns with the IRR calculations, which makes computing the metric comprehensive. For instance, you might face the Multiple IRR Problem or the No IRR Problem if the sign of the cash flows changes more than once throughout an investment’s life. That’s when you check whether the metric suits your analysis. Otherwise, you run the risk of misinterpreting the results.

The Bottom Line

The Internal Rate of Return serves as a pointer to the attractiveness of a project and is relatively simple to compute. So, you’ll often see it included in more complex analyses.

IRR provides you with a required (hurdle) rate above which the project is acceptable. It is a yes-or-no tool to decide whether to make a particular investment. Other measures of return might also help you rank multiple tasks, such as the Payback Period and Discounted Payback Period.

As versatile as it may be, the Internal Rate of Return can’t solve all your problems. Future cash flows are difficult to predict with precision, and so are projects’ lifespans. That’s why IRR calculation is a guideline rather than a benchmark for making business decisions. Financial analysts frequently include NPV and IRR in their analyses, as each provides a different perspective.

Learn key principles through hands-on projects and practical examples in our comprehensive Corporate Finance course. You’ll have the opportunity to gain a deep understanding of fundamental concepts while building a complete capital budgeting model in Excel.

If you wish to find out how to calculate the Internal Rate of Return in Excel, consider the IRR Excel template on our website.

FAQs

There’s no universal benchmark for a “good” IRR because it depends on various factors, such as the industry, investment risk level, and the investor’s goals and expectations. In general, a good IRR is higher than the discount rate. It considers both the cost of capital and opportunity costs. If your minimum acceptable rate of return is 5% and an investment has a 10% IRR, you’re looking at a good IRR—an attractive opportunity to explore.

To interpret the Internal Rate of Return, ensure you understand that investments are costs, where you pay now, hoping to make a profit later. The IRR calculation takes the future value of an investment and presents it as if it were valued in today’s dollar. Since most investment costs fluctuate, a good metric must be able to capture these variations in the long run—precisely what IRR does by assessing the cash flows of an investment over time in a dynamic fashion.

No, it isn’t. Return on Investment (ROI) estimates the total growth rate, while the Internal Rate of Return (IRR) calculates the annual growth of an investment. Both figures will likely remain the same in short-term planning (e.g., one year). Over several years, however, the numbers will differ.

А 30% IRR represents the rate of return at which the present value of the future cash flows of an investment equals the initial investment amount. In other words, it reaches breakeven at a 30% IRR.