What’s the Difference Between Direct and Indirect Cash Flow Methods?

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for Free

Cash flows arise from the operating, investing, and financing activities of a company. When it comes to cash flows from operations, the standards allow us to choose between two distinct approaches. They are commonly known as Direct and Indirect methods.

Direct Cash Flow Statement

Companies applying the Direct method disclose major classes of gross cash receipts and cash payments. As a result, you can see a summary of all cash transactions that the firm has made during the reporting period, which can include items like a cash flow loan to cover short-term operational needs. The cash accounting approach recognizes all transactions when cash is collected or paid. In this instance, Net Income will therefore be equal to a firm’s actual cash flows from operations.

Nevertheless, not all business transactions are cash in nature. This is why the Conceptual Framework for Financial Reporting requires the use of accrual accounting: Revenue is recognized when it is earned, not when cash is collected. The same goes for costs. They are recorded when incurred, not when paid. So, we will normally see a difference between Net Income and Cash flow from operations. Such variances need to be eliminated when using the indirect method.

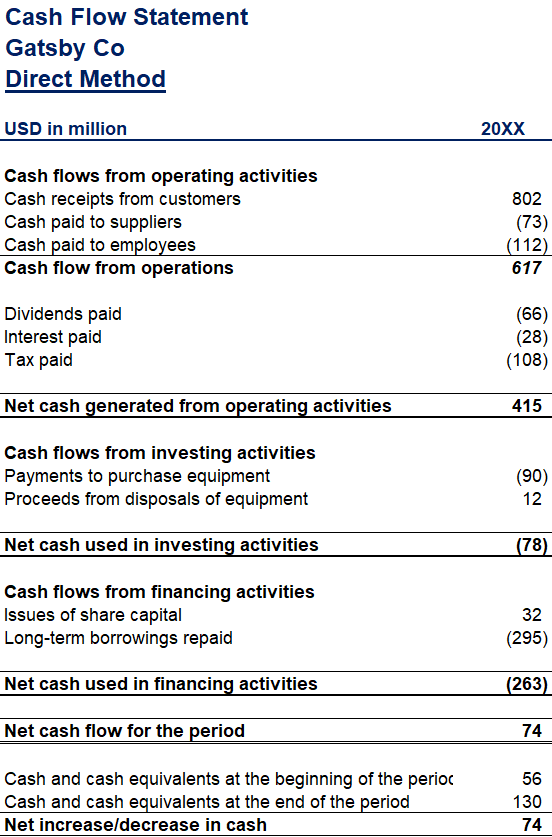

Let’s look at the Cash Flow Statement of a company called Gatsby:

A Direct Cash Flow Statement lists “Cash collections from customers”. These are the actual cash inflows that Gatsby generated from the sale of goods or rendering of services. Besides, we have various cash outflows to consider, such as payments to suppliers, employees, and all sorts of operating and non-operating expenses.

The sum of these items gives us the net cash flow from operating activities. For Gatsby, net cash flow from operations equals 415 million.

Indirect Cash Flow Statement

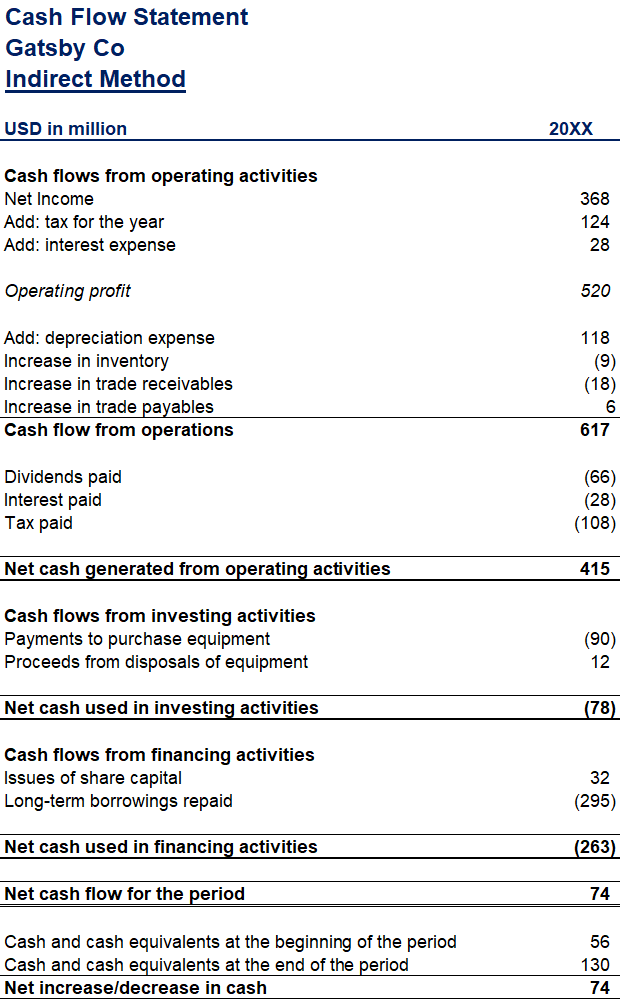

The Indirect method focuses on net income and non-cash adjustments. Unlike the direct approach, the net profit or loss from the Income Statement is adjusted for the effect of non-cash transactions. Such adjustments include eliminating any deferrals or accruals, non-cash expenses (e.g. depreciation and amortization), and any non-operating gains and losses.

We start with the net income figure that is perceived as the “bottom line” of the income statement. Next, we make adjustments for various non-cash items. Thus, we add depreciation and amortization expense for the period. This expense reduces net income but does not affect cash, as we don’t make any payments related to it. It’s just an accounting concept.

Changes in trade payables, trade receivables, inventory, accruals, and deferrals are also considered non-cash transactions that affect net income but are irrelevant to cash flows. Therefore, they are added or subtracted from the net income. In our example, Gatsby’s net cash flows from operations under the indirect method equals 415 million as well:

Once again, you need to remember that the net cash flow from operations remains the same irrespective of the method used; it is just derived differently.

Apart from that, the cash flows from investing and financing activities are processed in the very same way under both methods.

The Bottom Line

The benefit of having two distinct presentation formats lies in the fact that they serve different purposes and allow companies some flexibility.

The direct method discloses information that is not available in any other section of the financial statements. For professionals, it could be a useful tool when making cash flow projections.

In turn, the indirect method is easier for companies to implement. As such, it ties up the Cash Flow Statement with a firm’s other financial statements. In an attempt to streamline their accounting practices, most companies nowadays apply the Indirect method for their statement of cash flows. To gain a deeper insight into the mechanics behind Direct and Indirect cash flow methods, we recommend you work on a practical example we have prepared for you.

If you want an example of a Direct vs Indirect Cash Flow Statement, take a look at our Direct vs Indirect Cash Flow Statement Excel template.