What Is Financial Forecasting and Why Is It Important?

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for FreeFinancial forecasting helps stakeholders like investors, financiers, management, and others make informed decisions and manage financial risks. And while the process doesn’t eliminate uncertainty, it helps businesses plan and prepare for the future.

In a financial planning and analysis (FP&A) context, financial forecasting refers to the process of estimating and projecting future financial outcomes based on historical data, trends, and assumptions. It is a critical component of financial planning as it helps organizations anticipate and prepare for future scenarios.

The following article is an introduction to financial forecasting, which details the types, methods, and best practices. It’s intended for financial analysts, investors, and anyone looking to improve their financial planning and analysis skills.

Table of Contents

- What Is Financial Forecasting?

- Why Is Financial Forecasting Important?

- Types of Financial Forecasting

- The Main Steps in Financial Forecasting

- Frequency of Financial Forecasting

- What’s Next?

- FAQs

What Is Financial Forecasting?

Financial forecasting refers to the process of estimating a company’s future financial health by examining historical data provided by various financial disclosures, financial statements, and positioning statements (describing a company’s products or services and how they solve a particular problem in the target market). In addition, the process should consider the prevailing market conditions and historical financial trends.

The primary goal is to provide insights into future financial performance, allowing companies to make informed decisions and develop strategic plans. By analyzing past financial data, market trends, and other relevant factors, FP&A professionals can generate forecasts for key financial metrics, such as revenue, expenses, profits, cash flow, and balance sheet items.

Financial forecasting helps businesses in many ways, including:

- Providing cohesive and comprehensive reports for establishing feasible and realistic targets or goals;

- Giving useful insights into how past performance will compare to future performance;

- Presenting valuable data to stakeholders, such as investors, financiers, creditors, and suppliers.

Why Is Financial Forecasting Important?

Financial forecasting helps different stakeholders to make informed decisions—entrepreneurs and CEOs in terms of management, and external parties in terms of investments. Other applications and benefits include:

- Attracting new investors if the company is performing well

- Setting realistic objectives and targets

- Understanding a firm’s financial future and adjusting current operations accordingly

- Making critical decisions about dividend payments or the type of financing (debt vs. equity)

- Finding practical solutions to meet targets and goals

Types of Financial Forecasting

Financial plans can be divided into two groups: quantitative and qualitative. Quantitative forecasts are suitable for businesses with a lot of historical data, while qualitative works better for companies with little historical data.

Quantitative Forecasts

Quantitative forecasts can be used to project sales, variable, and fixed costs to determine a company’s growth. They are based on pro-forma financial statements—the Income Statement, Balance Sheet, and Cash Flow Statement—with projected future financial data and assumptions based on past performance.

The following financial forecasting examples illustrate the process better.

Imagine that company X Inc. has the following expected performance figures for the next five years. You’re required to come up with a comparative financial statement for that period and evaluate the firm’s growth potential:

| Year | Sales | Operating Expenses | Non-Operating Expenses |

| 1 | 500,000 | 150,000 | 100,000 |

| 2 | 600,000 | 200,000 | 115,000 |

| 3 | 850,000 | 350,000 | 210,000 |

| 4 | 1,050,000 | 420,000 | 260,000 |

| 5 | 1,200,000 | 300,000 | 310,000 |

Comparative Income Statement

| Item | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Sales | 500,000 | 600,000 | 850,000 | 1,050,000 | 1,200,000 |

| Operating Expenses | 150,000 | 200,000 | 350,000 | 420,000 | 300,000 |

| Non-Operating Expenses | 100,000 | 115,000 | 210,000 | 260,000 | 310,000 |

| Net Profit | 250,000 | 285,000 | 290,000 | 370,000 | 590,000 |

Cash Position

| Item | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| Opening Cash Balance | 100,000 | 300,000 | 534,000 | 820,000 | 1,188,000 |

| Add Cash Sales | 300,000 | 360,000 | 510,000 | 630,000 | 720,000 |

| Less Cash Expense | 100,000 | 126,000 | 224,000 | 272,000 | 244,000 |

| Closing Cash Balance | 300,000 | 534,000 | 820,000 | 1,188,000 | 1,664,000 |

Top Quantitative Forecasting Methods

Percent of Sales Forecasting

This method involves calculating certain line items, such as the Cost of goods sold (COGS), inventory, and cash, as a percentage of sales. Then, financial analysts can estimate future sales and obtain the pro-forma statements’ line items from them. Although quick and easy, this method applies only to items relevant to sales.

Straight-Line Method

Businesses and investors can make a financial projection about future revenue based on historical data. Simply put, they multiply a recent period’s revenue by its growth rate. But this method assumes a firm’s revenue growth rate will remain stable and completely disregards market fluctuations or other external factors.

Moving Average

The moving average takes the average of previous periods (e.g., three or five months) to forecast future trends, thus revealing underlying patterns that allow for a more objective forecast. Longer periods smooth out fluctuations, while shorter ones reflect reality more closely.

Linear Regression

This statistical approach to financial forecasting allows analysts to examine the relationship between one or several independent variables—aspects of a company’s current or past performance—and one dependent variable—the forecasted parameter.

Analysts don’t need profound statistical knowledge to perform this forecasting technique. They can simply input the data into a linear regression calculator and derive insights from the output.

Although still simply a projection, financial forecasting models based on larger amounts of data and statistical analyses allow us to make more accurate predictions. But what do we do if we lack sufficient historical data?

Let’s see how to make a qualitative forecast.

Qualitative Forecasts

Qualitative forecasts are based on speculation due to the lack of sufficient quantitative data to predict a company’s financial well-being. As such, they are considered subjective and prone to bias.

Still, they’re useful forecasting tools for small businesses with little historical data.

This type of forecasting also brings an enormous benefit—unlike quantitative methods, it could predict certain market changes that require expert insight.

Top Qualitative Forecasting Techniques

The Delphi Method

This method involves consulting professionals whose expertise can provide insights into market conditions and businesses’ likely performance. Typically, selected experts complete a series of questionnaires, which are then analyzed, and the process repeats until they reach a consensus.

Market Research

This popular method has various informative purposes, including financial planning and forecasting. Researching competitors, target audiences, and market conditions contributes to the informed decision-making of businesses of all sizes. It can also help with budgeting and forecasting in the absence of historical financial data or when introducing new products and features.

The Main Steps in Financial Forecasting

1. Define the Purpose of Forecasting

Whether you’re conducting a forecasting report for internal purposes or assessing an investment opportunity, you need clear goals. What do you hope to learn? Are you forecasting revenue, expenses, cash flow, or overall financial performance? This step will help you determine how to approach the financial forecast.

2. Gather Historical Data

Based on your goals, determine what data you need to collect. Can you find the financial statements of the company you’re forecasting for? Do you have a sufficient amount of historical data to make an accurate forecast? If not, how will you obtain the necessary information? These are all important to consider.

3. Select a Method

The available data will determine your approach to financial forecasting to a great extent. For example, an FP&A specialist analyzing a small company with little historical data will probably use a qualitative technique. We listed the most commonly used methods above, but there are others you can choose depending on your needs and purposes.

4. Project Future Values

Use the selected financial forecasting method to project future values. Consider different scenarios and assumptions to account for potential risks and uncertainties. Document your results and save them for future reference.

5. Monitor and Repeat the Process

Regularly review and update your forecast based on your company’s ongoing performance and new information. Being able to compare the projected values with actual results and future projections will help you adjust and improve your forecasting capabilities. Keep in mind that comparisons are most informative if the results were obtained using the same method.

Frequency of Forecasting

How often should companies update forecasts? How detailed should they be? Is it better to create less granular and more frequently updated projections? Or should firms prepare a detailed budget once per year disregarding monthly or quarterly forecasts?

FP&A professionals often raise these questions. Yet, there isn’t a straightforward answer.

While users of financial information prefer very detailed breakdowns and regular updates, these require more time and effort. So, how do we effectively navigate the trade-off between forecasting granularity and frequency?

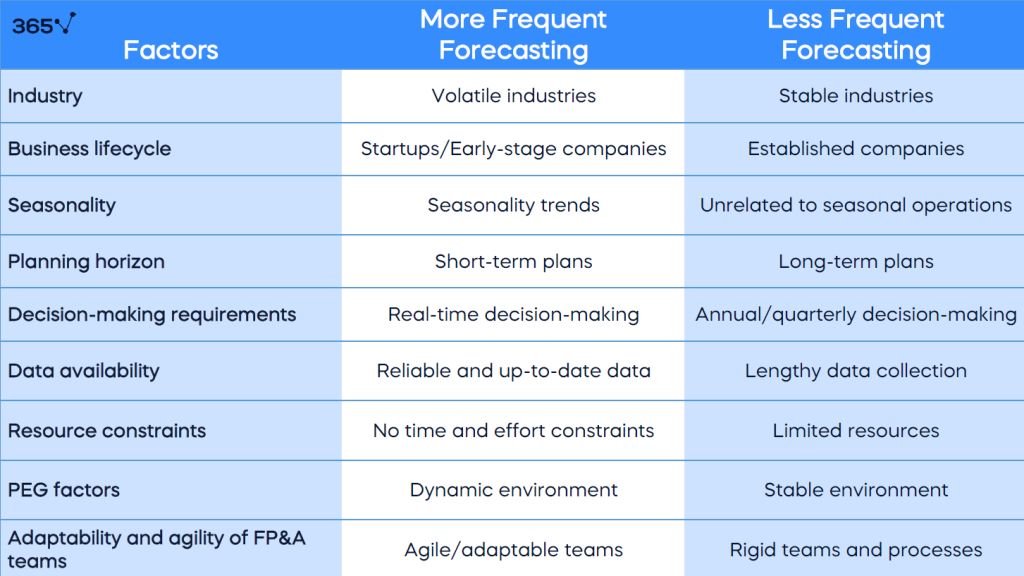

Consider the following key factors that influence the frequency of forecasting.

Industry Volatility

If a business operates in a highly volatile industry or experiences significant fluctuations in demand, it’ll need to prepare financial forecasts more frequently. This allows companies to respond quickly to changing market conditions and make informed decisions.

Business Lifecycle

The optimal forecast frequency may also vary depending on the stage of a company’s lifecycle. Startups and early-stage businesses may need to update their financial plans more often to closely monitor and manage their cash flow, while more established businesses will require less frequent forecasting.

Seasonality

Some businesses experience seasonal variations in sales or operations. In such cases, more frequent forecasting may be necessary to accurately capture and anticipate seasonal patterns.

Planning Horizon

The required time horizon for a financial forecast can impact the frequency of forecasting. Companies should perform short-term forecasting more often (typically over a few months’ time) to ensure effective operational planning and budgeting. By contrast, long-term forecasting is typically executed less frequently (annually or quarterly).

Decision-Making Requirements

The frequency of forecasting also depends on the organization‘s decision-making needs. If a company requires real-time or near-real-time data for decision-making, this will prompt more frequent forecasting.

Data Availability

The availability and quality of data needed for forecasting also impact the frequency. If there are reliable and up-to-date data sources, it may be feasible to conduct more frequent forecasting. But if the data collection and analysis are time-consuming, this may reduce the frequency.

Resource Constraints

Preparing a financial forecast requires time, effort, and resources. Organizations with limited resources— such as small businesses—may seldom conduct forecasting due to constraints on staffing, expertise, or technology.

Political, Economical, and Geographical (PEG) Factors

External factors like changes in political regimes, regulations, or significant economic and environmental conditions can also impact the frequency of forecasting. When significant changes occur, it may be necessary to perform this process more often to adapt to the new circumstances.

Agility and Adaptability

As forecasting trends are continuously transforming, FP&A teams’ agility and adaptability to new systems and processes also influence the financial forecast’s frequency.

To sum up, organizations must assess their needs, objectives, and environment to determine the appropriate frequency of forecasting for their financial planning and analysis processes.

What’s Next?

Financial forecasting is an essential part of FP&A, along with financial planning, budgeting, predicting performance, managing risk exposure, and other analytical activities that support decision-making.

If you wish to become a financial analyst, you need to master these skills. Our comprehensive FP&A: Building a Company’s Budget course covers everything you need to know. Sign up for free to try our learning program.

FAQs

Financial forecasting methods can be quantitative or qualitative. The former includes calculating the percentage of sales, moving averages, simple and multiple linear regression models, etc. Common examples of qualitative forecasts are the Delphi technique and market research, among others. Learn more about them in the current article.

A budget is a plan for a business’s operations with outlined goals and fixed spending limits. Meanwhile, a financial forecast includes expected outcomes and financial projections. While the former is useful as a short-term planning tool and rarely adjusted, the latter needs to be updated regularly and can be used to plan for the short and long term.

Financial forecasting and financial modeling have distinct but complementary functions. Both processes are essential for a company’s financial planning. But while forecasting uses historical data to predict future performance, modeling relies on the information from these forecasts to simulate different scenarios and how they can impact expected performance. Thus, financial forecasting always precedes financial modeling.