What Is a Balance Sheet?

A notepad on a desk with a sticky note, implying it’s a “What is a Balance Sheet” post, and a calculator placed right next to it.

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for Free

A Balance Sheet, also known as the Statement of Financial Position, is one of the four major financial statements of a company. Whether you are a business owner, employee, or investor, understanding the numbers in a Balance Sheet is a fundamental skill to acquire.

In this article, we outline the Balance Sheet accounts, demonstrate how the Balance Sheet equation works, provide detailed examples and templates, and talk about its significance and limitations.

Table of Contents

- What Is a Balance Sheet?

- Balance Sheet Accounts

- What Is the Balance Sheet Equation?

- The Balance Sheet Format: Example

- How to Read a Balance Sheet

- Importance of Balance Sheets

- Do Balance Sheets Have Limitations?

- Next Steps

- FAQs

What Is a Balance Sheet?

A Balance Sheet summarizes what a company owns and owes. In other words, it portrays how an organization invests its resources (assets), and what sources of financing allow such investments (liabilities). It’s a snapshot of a firm’s financial position at the end of a period.

You will often see companies preparing their Balance Sheets on a monthly or quarterly basis. This is a way for business owners and investors to keep track of how much the company is worth.

Balance Sheet Accounts

A Statement of Financial Position has three major components:

- Assets: these are resources controlled by the entity that will bring future economic benefits.

- Liabilities: they represent the obligations of a company, arising from past events and business transactions. The settlement of these will result in a future outflow of economic resources.

- Equity: it displays the owners’ residual interest in an organization after deducting liabilities from assets.

Each Balance Sheet account is based on specific accounting principles companies must follow, and consists of various line items. It’s important for you to know the proper classification of any sub-categories in the Balance Sheet right from the start.

1. Assets

An asset is anything a company owns that has quantifiable value. A business owner should be able to convert an asset into cash—a process called liquidation. Most of the time, they are positives (+) and are further divided into two sub-categories: current and non-current assets.

The simplest way to differentiate between these two groups is to set a threshold of one year after the balance sheet date. Think about it this way—if assets are primarily held for trading or are expected to be sold, used, or otherwise realized in cash within one year, they are labeled as current assets.

Common examples of current assets in the Balance Sheet include:

- Inventories

- Trade receivables

- Cash and cash equivalents

- Marketable securities

From an accounting perspective, assets that will be used over a longer period are defined as non-current, long-term, long-lived, or fixed assets. They won’t be converted into cash within the next 12 months.

Common examples of non-current assets in the Balance Sheet include:

- Property, plant, and equipment (PP&E)

- Intangible assets, such as Intellectual Property

- Financial assets

- Deferred tax assets

To understand the difference between the two sub-categories, here’s a simplified Balance Sheet example. If receivables from clients are to be collected by the end of next year, then we report them as trade receivables under the current assets. Some of them, however, may be overdue or scheduled for receipt later than 31st December next year. That’s longer than a year, so we label such receivables as non-current.

2. Liabilities

In Financial Analysis, assets and liabilities are the two sides of the same coin. They are two Balance Sheet accounts that affect each other. While an asset has a positive value, liabilities are tallied as negatives (-) because they represent the debts owed by a company.

Those to be settled within a year after the reporting date are classified as current liabilities. For example, most companies pay their suppliers in 30 to 90 days, and even though various payment periods may apply, they are usually shorter than 1 year. That’s why trade and other payables are always included in the current liabilities section of the Balance Sheet.

Current income tax payable is normally due three months after the balance sheet date, so you will find it in the current liabilities section, too. So are borrowings which are due within 12 months.

Other examples of current liabilities in the Balance Sheet include:

- Payroll liabilities

- Utilities due

- Rent liabilities

Non-current liabilities, on the other hand, are obligations expected to be settled after more than one year of the balance sheet date. Some of the common items in this group are long-term borrowings and retirement benefit obligations owed to employees.

Other examples of non-current liabilities in the Balance Sheet include:

- Leases

- Deferred tax liabilities

- Bonds payable

Here’s a balance sheet example to better understand the difference between current and non-current liabilities. Suppose your company has just taken out a loan for $100,000 with a repayment term of 5 years, which you’ll pay in equal annual installments. The first portion of $20,000 that’s due within the next 12 months falls into the current liabilities section because it is an obligation you must settle in the short term. And the remaining $80,000 are considered non-current, as you have longer than a year to pay it off.

3. Equity

Total Equity, also known as net worth, represents the owners’ residual interest in a company’s assets, after paying off its liabilities. To calculate the Owners’ Equity of an organization, one must subtract Total Liabilities from Total Assets. If a firm was to liquidate its assets and liabilities, Owners’ Equity would be the amount shareholders received. Therefore, many consider it to be an illustration of a firm’s net worth or book value.

What Is the Balance Sheet Equation?

Now that you know that Assets minus Liabilities is equal to Equity, you can further reorganize it to obtain the following equation:

Assets = Liabilities + Equity

This is the so-called fundamental accounting equation.

If we say that the left-hand side reflects the resources controlled by a company, then the right-hand side shows how the firm financed the acquisition of these resources—it can be incurring obligations to third parties or increasing owners’ share in the business. In all instances, the Balance Sheet must “balance”, there are no exceptions to this rule!

The Balance Sheet Format: Example

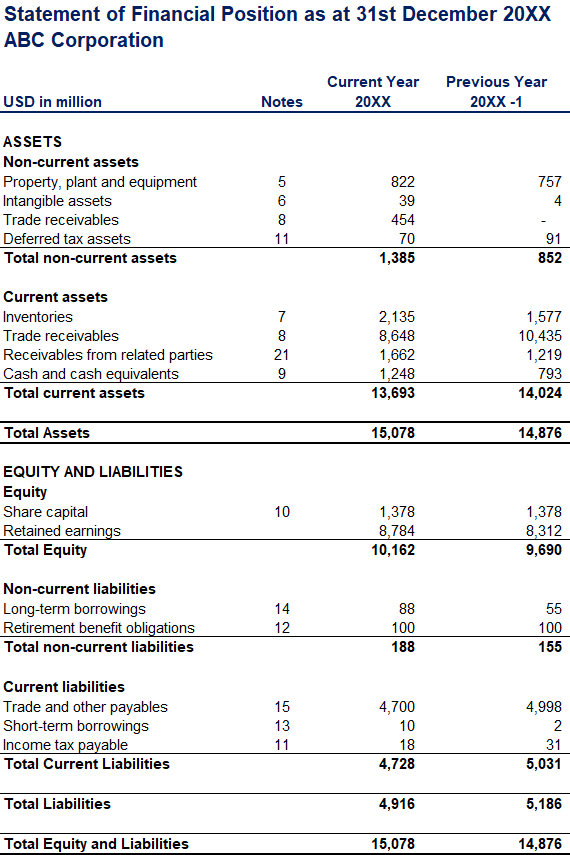

Below is the Statement of Financial Position, or Balance Sheet, of ABC Corporation. Since it must always pertain to a specific point in time, here we say that the balance sheet date is the 31st of December.

One can distinguish between three major sections: Total Assets, Total Liabilities, and Total Equity. As you can see, in each section, there are sub-totals—current and non-current assets, as well as current and non-current liabilities:

You can gain valuable insights into ABC Corporation by looking at its Balance Sheet. For example, its inventory balance piled up in the current year. Why? The Balance Sheet will not give you an in-depth answer, but it will guide you toward asking the right questions. You can browse through Note 7, which you can find in ABC Corporation’s Balance Sheet, and see a more detailed breakdown into inventory classes.

Do you also notice that this year, unlike the previous one, ABC has got some non-current trade receivables? By nature, trade receivables get paid within a few months and belong to current assets. So, how come they are now classified as long-term? This should tell you that ABC Corporation has incurred some overdue receivables from clients which might bear the risk of bad debts. These are all valid observations to consider when looking at the numbers.

Also, keep in mind that the Balance Sheet format a company adopts will depend on the location of that organization. While the fundamentals remain the same, it is normal for the structures of two Balance Sheets to vary.

If your business is based in the United States, you will have to comply with the Generally Accepted Accounting Principles (GAAP). ABC Corporation in our example operates outside the USA, so they adhere to a different set of rules—the International Financial Reporting Standards (IFRS).

How to Read a Balance Sheet

Investors often use the Statement of Financial Position to determine the financial health of a company. They can analyze it on their own before examining it alongside other statements. Reading a Balance Sheet may feel pretty overwhelming at first, but with some practice and a basic understanding of the main accounting concepts, it will soon become much easier to grasp.

Once you are well familiar with its main components, you should go ahead and consider the relationship between them—that’s the most challenging yet insightful part of reading a Balance Sheet. And this requires more advanced skills in Financial Analysis.

And how do you do that? You can use financial ratios and other analytical tools to find meaningful links between the Balance Sheet accounts. Some of the most common liquidity ratios to calculate with the information available in a Balance Sheet are the current ratio, quick ratio, debt-to-equity ratio, and defensive interval.

Importance of Balance Sheets

Balance Sheets summarize the financial position of a company at a specific point in time. Assets and liabilities can tell you a lot about the financial health and stability of a business. Equity is a solid indicator of a firm’s ownership structure and overall value. All this is a great starting point for determining the potential for future growth of an organization. A Balance Sheet is a valuable source of information for both internal and external users.

For Internal Users

For business owners, employees, and key stakeholders, the financial statement reveals whether the company is thriving or failing. An internal audience can then take corrective actions and change policies to ensure the business is steering in the right direction. You can think of it as a tool for determining risk.

For External Users

External parties, such as investors, gain valuable insights into a company’s resource allocation and financing through its Balance Sheets. This helps them make informed decisions about whether to invest in the business and what potential future growth to expect. That’s why many people find this financial statement useful for securing capital.

External auditors also find a company’s Balance Sheets to be important. They review a firm’s financial statements to assess how well the business complies with reporting standards. The opinion of auditors is crucial for potential investors, creditors, lenders, suppliers, and customers—it’s an assurance that a company provides accurate information and can be trusted.

While a Balance Sheet provides an overview of a company’s financial health, it is a snapshot of past events at a specific time. Although excellent past performance can never guarantee future success, it can provide a level of confidence for investors. It also reveals trends in a firm’s financial position over time, which is crucial information for investors who consider long-term investments in a company.

Do Balance Sheets Have Limitations?

Balance Sheets Are Static

The statement of Financial Position represents information about a company as of a certain date, so it may be hard to assess the financial health of a business on its data alone. Without a proper point of comparison, Balance Sheets will not provide a complete picture of a firm’s stability and potential. Analysts need more context in terms of previous cash balances and operating demands to calculate more dynamic measures. That’s why they typically use the data from the Income Statement and the Cash Flow Statement alongside the Balance Sheet.

Balance Sheet Formats Differ

Depending on the location, companies adhere to different accounting systems and ways of dealing with inventories and depreciation. As a result, bottom line figures among Balance Sheets will vary. This gives room for managers to cook the books and to represent a more optimistic picture of a firm’s financial position. That’s why one should check a Balance Sheet’s footnotes, check for any red flags, and make sure there’s no massaging of the numbers.

Some Estimates Require Professional Judgment

Certain areas of the Balance Sheet require professional judgment, and these assumptions may materially change the outlook of the report. Let’s take accounts receivable as a point in case. Companies should be vigilant about any impairment, which requires estimating how likely it is for some customers to delay or not pay their bills. This calls for professional judgment and adjusting to ensure that the final figures accurately mirror the underlying assumptions. That’s why one should know that a Balance Sheet isn’t an exact representation of a company’s financial status, but rather a reflection of the best estimates made by a company’s accountants and auditors.

Next Steps

A Balance Sheet is a valuable summary of a company’s status and is widely used for financial analysis in conjunction with other reports. It can tell you a lot about the assets and liabilities of an organization at a certain time. But knowing how to read a Balance sheet won’t be enough to paint a full picture of a business. You know that practical skills are what set you apart from the competition.

Are you ready to take your financial analysis career to the next level?

Our Fundamentals of Financial Reporting course is the perfect starting point for anyone who wants to ace their first job interview in the field of finance. No matter your background, we’ll prepare you well enough to enhance your job prospects.

You can enroll in a Financial Analyst Career Track to help you learn fundamental financial analysis techniques, with valuable tips and tricks by seasoned professionals in the field. And you can further excel your knowledge with the many practical examples and analyses on relevant topics. With our team of top industry experts, you’ll be ready to take on any challenge that comes your way and receive verifiable certificates to prove your successes.

We let you learn at your own pace, so choose the right courses for you and achieve great things in the industry. Take the first step toward a successful career in financial analysis!

If you need a quick fix to calculating liquidity ratios, consider our template with Liquidity Ratios in Excel, which includes all the relevant formulas for your analysis.

FAQs

Because it contains data about the financial health of an organization you can’t find anywhere else. It shows how well a company manages its assets and liabilities, what the book value is, and which areas of the business require more thorough analysis. A typical Balance Sheet format will have the numbers of a previous period alongside the current one, which further allows for identifying any trends and changes over time.

Any Balance Sheet includes three main components—assets, liabilities, and equity. Assets represent what a company owns at a particular point in time, while liabilities are what the business owes to others. And there’s also equity, which is the owners’ share of the business after it pays out liabilities. Assets should always balance with the sum of liabilities and equity.

It depends on the company’s size and internal policies. Accountants will typically prepare Balance Sheets for big corporations. A bookkeeper or business owner will prepare them for smaller firms.

Here are some of the main domains one can use Balance Sheets for:

Working Capital—that’s the difference between current assets and current liabilities, indicating what’s left after all dues have been paid. A company with too little working capital may be at risk of bankruptcy. With a Balance Sheet, you can estimate whether the working capital is sufficient for the business to thrive.

Net Worth– It tells you how rich or poor an organization is. That’s how much investors and business owners are left with after all liabilities have been paid. In other words, it’s the equity figure, which you calculate by deducting total liabilities from total assets.

Future business operations—although a Balance Sheet is a snapshot of a business’s position at a certain date, it can still help you understand where an organization is heading in the long run. If you notice that non-current assets are higher than current assets, the company is most likely to sustain future operations and grow its potential.

Issuance of dividends–every Balance Sheet includes what we call retained earnings, and you can use it to calculate whether it is sufficient for you as a business owner and investor.

Here’s the fundamental accounting equation that is the cornerstone of every Balance Sheet:

Assets = Liabilities + Equity

This Balance Sheet formula represents the relationship between a company’s assets and liabilities, along with equity. The total value of assets must always balance with the sum of liabilities and equity.