What Are the Four Major Financial Statements?

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for Free

The financial health and stability of an organization are critical factors for its stakeholders to consider. Typically, they gain valuable insights about a company by using four types of financial statements, found in its Annual Report. These are the Balance Sheet, the Profit and Loss Account, the Cash Flow Statement, and the Statement of Changes in Equity.

The article works through a firm’s Annual Report, teaches you how to read each of the four financial statements, explains the interdependence between them, and lists common users.

Table of Contents

- What Is a Financial Statement?

- The Statement of Financial Position (The Balance Sheet)

- The Statement of Comprehensive Income (Profit & Loss Account)

- The Cash Flow Statement

- The Statement of Changes in Equity

- Users of Financial Statements

- How Are the Four Financial Statements Connected?

- What’s Next?

What Is a Financial Statement?

So, what are financial statements? These reports provide formal written records of a company’s affairs and financial performance. As the U.S. Securities and Exchange Commission (SEC) says, “The financial statements show where a company’s money came from, where it went, and where it is now.” Most organizations prepare and publish this information on a yearly basis, but they can also choose to do so more often.

Of course, businesses differ, and so do some of the line items in their financial statements. And the most common items you will see are revenue, costs of goods sold, cash, inventory, accounts receivable, accounts payable, and marketable securities. Yet, no two Annual reports look alike.

When you study financial statements, you should know that countries around the globe follow different accounting principles. American companies abide by the US Generally Accepted Accounting Principles (GAAP), while international corporations consider the International Financial Reporting Standards (IFRS). That’s why you’ll often notice some distinctions between the financial statements of American and European firms.

And what are the major types of financial statements worldwide?

For-profit businesses typically include four financial statements in their Annual Report—the Statement of Financial Position, the Statement of Comprehensive Income, the Cash Flow Statement, and the Statement of Changes in Equity. Let us consider each of them in more detail.

The Statement of Financial Position (The Balance Sheet)

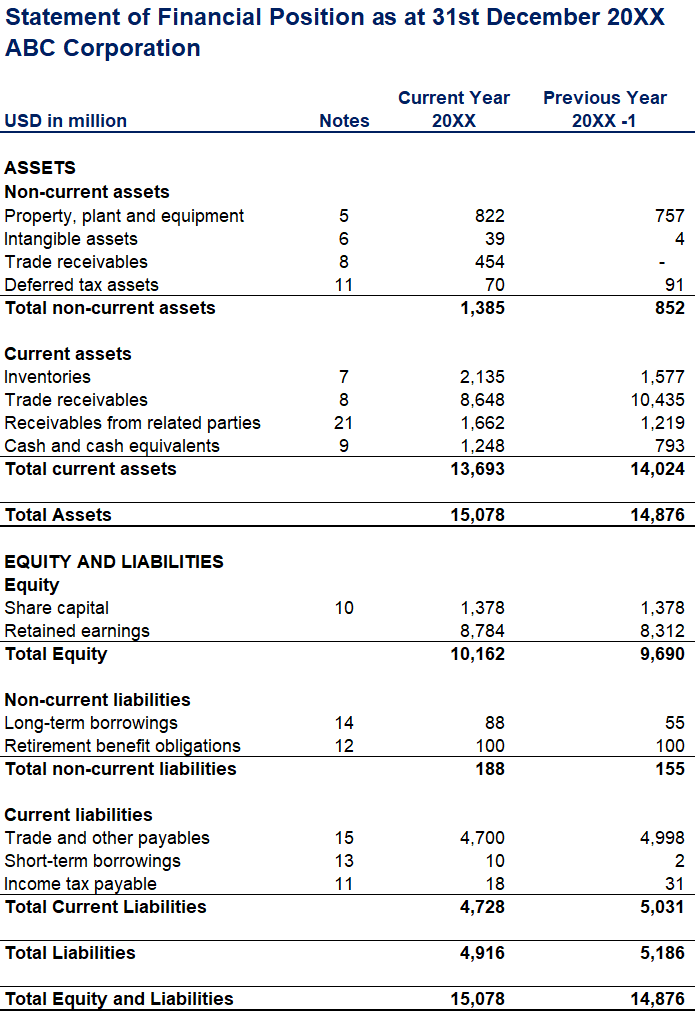

Suppose you want to invest in some common shares of a company called ABC Corporation. How do you know whether this is a good investment? The first thing you do is check its Statement of Financial Position, also known as the Balance Sheet:

What will you find on that financial statement? You’ll have a summary of what ABC Corporation owes and owns at a certain date. Think of it as a “snapshot” of the company’s financial position as at a given point in time. Most firms prepare their Statement of Financial Position as at the 31st of December each year. Normally, such statements are prepared for two consecutive periods—the current year and the comparative previous year. Let’s dig a little deeper now.

The Basic Accounting Equation

Any Balance Sheet consists of three main elements. First, you’ll see Total Assets, which represent the resources controlled by the enterprise. Second, there are Total Liabilities, or the amount of money owed to lenders and other creditors. This is the debt of the company, resulting from past events and business activities. And third, you’ll have an item called Total Equity—this is the owners’ residual interest in a company’s assets after deducting its liabilities. In summary, the Statement of Financial Position relies on the well-known basic accounting equation:

Total Assets – Total Liabilities = Owners’ Equity

The difference between Assets and Liabilities is sometimes referred to as net assets or net worth. In all instances, Total Assets must reconcile with Total Equity and Liabilities.

This holds true for ABC Corporation’s Balance Sheet. Total Assets are $15, 078 million and Total Liabilities are $4,916 million, so Total Equity, or Net Worth, is:

$15,078M – $4,916M = $10,162M

The Statement of Comprehensive Income (Profit & Loss Account)

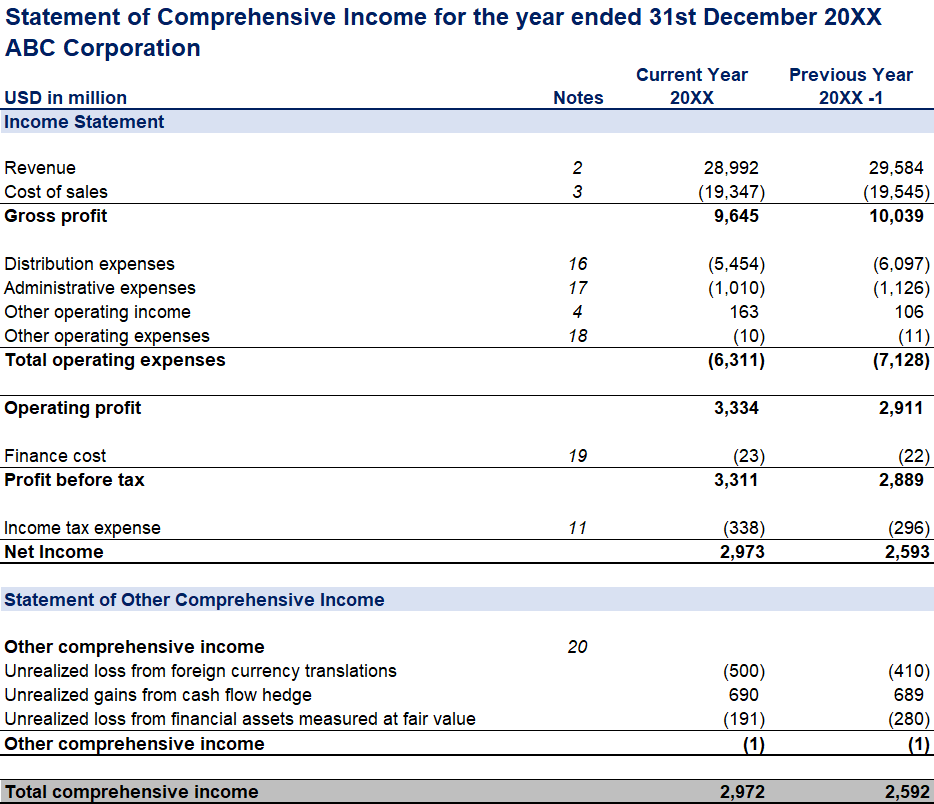

The Statement of Comprehensive Income, commonly known as the Profit and Loss Account, tells you whether an organization generates a profit or a loss for a period of time. This financial statement allows for an indication of important trends, such as revenue growth and the incidence of gross profit, operating profit, and net profit on revenues. Thus, it helps us understand whether the operations of a firm have created economic value over a certain timeframe..

Typically, the Statement of Comprehensive Income is prepared on an annual basis. However, most publicly-traded companies produce a Profit & Loss Statement quarterly or for a 6-month period. In general, it has two primary elements— the Income Statement and the Statement of Other Comprehensive Income.

The Income Statement

All revenues and expenses that stem from the normal course of business operations are recorded in this statement. The bottom line of the Income Statement is the Net Income for the period. A positive Net Income indicates a profit, while a negative number represents a loss.

Statement of Other Comprehensive Income

It reports all income and expense items that are not recorded in the Income statement but affect Owners’ Equity. These may include—revaluation losses and gains on property, plants and equipment, foreign currency translation adjustments, and changes in the fair value of cash flow hedges. Here’s ABC’s Profit and Loss Account Statement:

The Cash Flow Statement

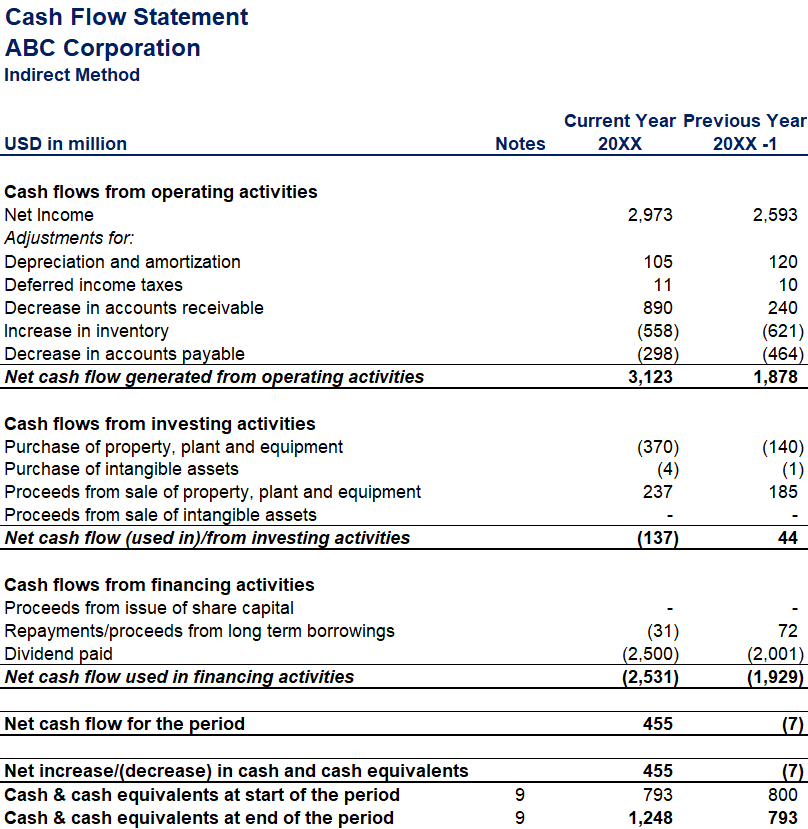

Profit and cash generation are two different things, that’s why companies also need a statement to illustrate any changes in the cash balances during a given period. In this way, they can evaluate their liquidity more precisely. The Cash Flow Statement compiles cash and cash equivalents that have been generated (cash inflows) and spent (cash outflows) within a fiscal period. Based on the specific business activities for which a firm pays or receives cash, the Cash Flow Statement consists of three major sections—these are operating activities, investing activities, and financial activities.

Organizations prepare Cash Flow Statements using either the Direct or Indirect Method. ABC Corporation takes the indirect approach to presenting its cash flows:

In practice, firms that seemingly generate profits but are not liquid enough to maintain their operations are at risk of going out of business. Therefore, analyzing a company’s Cash Flow Statement is an inextricable part of a thorough financial statements analysis.

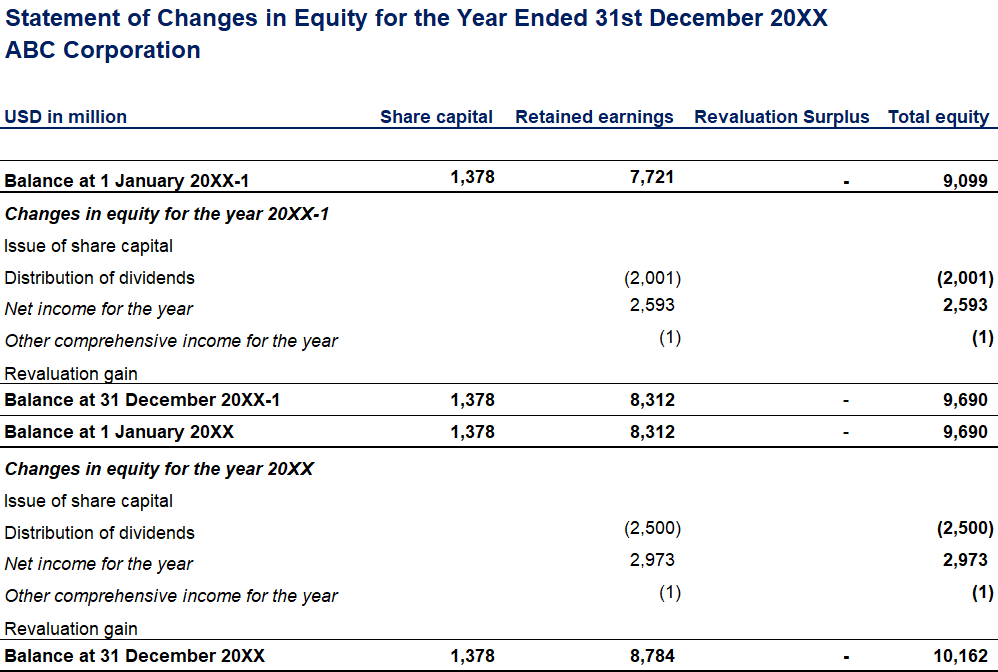

The Statement of Changes in Equity

The Statement of Changes in Equity compounds the changes in Owners’ Equity that have occurred during a certain period. If ABC Corporation issued some share capital or distributed dividends to its stockholders, one can see that in the Statement of Changes in Equity:

To understand why Equity has changed this way, you should take a step back and review the Profit and Loss Account again. In fact, the Net Income in the Profit and Loss Statements flows directly into the value of Equity, making both financial statements closely related.

Users of Financial Statements

Financial statements have been broadly used by many stakeholders. Customers, suppliers, potential investors, employees, and creditors are just among a few of them. Those directly concerned with the financial health of a particular business analyze their Annual Report to obtain relevant data.

Scholars incorporate essential information in their business studies and economic analysis; governments examine the reports while tailoring regulations, and even authorities turn to them when dealing with labor disputes. From a broader perspective, financial statements provide for a more accurate assessment of political and social policies.

In a nutshell, you can’t conduct a thorough review of a company’s true financial performance without using the four major financial statements.

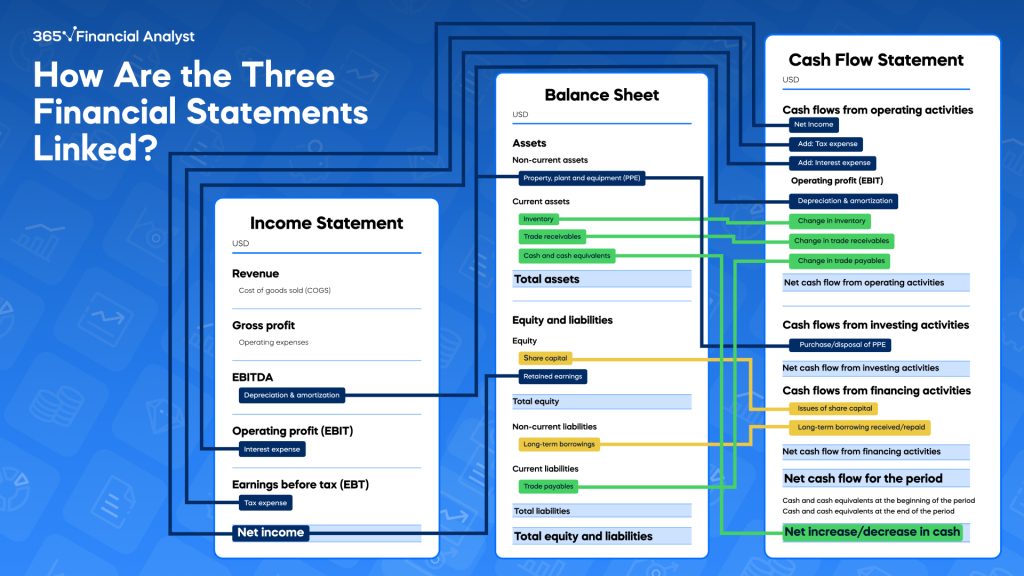

How Are the Financial Statements Connected?

All four financial statements are interrelated, and users must look at them jointly. Business transactions are intricate, and they influence many items in the financial reports simultaneously.

For example, the profit figure for the year appears in both, the Income Statements and the Statement of Changes in Equity. In another instance, if an enterprise raises additional share capital, this will induce modification of its Statement of Owners’ Equity and Statement of Financial Position concurrently. It may almost seem magical that all line items eventually mesh together and balance.

What’s Next?

Financial statements are essential to provide a true reflection of a company’s performance and financial position. They can tell you what business decisions have been made and which aspects of the operations are worth investigating in more detail. Comparing all four financial statements over a period can also help the management steer the company in the right direction. And it is the starting point for predicting a firm’s growth potential. Understanding them is essential for making informed decisions and communicating financial information to users.

If you want to pursue a career in Financial Analysis, your practical skills are what set you apart from the crowd. With the most popular accounting and auditing tools at hand, you’ll have a better chance at enhancing your job prospects, irrespective of your background.

Are you ready to take the next steps toward becoming a financial analyst?

With our comprehensive Fundamentals of Financial Reporting Course, you’ll acquire the skills and knowledge necessary to excel in your first job interview in accounting. And our Financial Analyst Career Track will help you learn the ropes of financial analysis, with tons of practical examples and in-depth analysis on a variety of relevant topics. While doing that, you will get valuable know-how from industry experts and become a certified professional.

Whether you are just starting out or you have been in the field for years, our courses let you learn at your own pace. Choose the right course for you and start your financial analyst journey today!

You can also download our Statement of Financial Position Excel template and Statement of Comprehensive Income Excel template.