Financial Auditing: Ultimate Guide

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for Free

Financial auditing entails producing an opinion on the truth and fairness of the financial statements of a company. Only licensed accounting professionals (auditors) authorized by the relevant governing bodies for the territories they operate in can carry out the auditing of financial statements.

Audits were first regulated with the 1844 Joint Stock Companies Act. The need for an independent review of financial information stemmed from the principal-agent problem. Up until then, investors couldn’t always be sure that managers were acting in the best interest of the company. So, following the Act, investors ceased to accept financial statements unless they were verified to be accurate by a licensed third party.

However, investors still couldn’t be sure whether auditors were independent of management as no organized accountancy profession existed. Today, this has changed, and auditing has become heavily regulated The Sarbanes Oxley Act of 2002 (USA) and the 2006 Companies Act (UK) being the most recent regulations.

The licensed third party, or the auditor, is a neutral professional. Their obligation lies towards the investors and general public at large. Again, auditors express their professional opinion on the truth and fairness of the published financial statements. Unlike forensic accountants, they are under no obligation to detect and investigate fraud.

Table of Contents

- Do All Companies Need Their Financial Statements Audited?

- What is Financial Auditing?

- Financial Statements Audit Opinions

- What Types of Auditing Exist?

- Purpose of Financial Statements Audits

- Why Is It so Important for Businesses to Get Audited?

Do All Companies Need Their Financial Statements Audited?

Simply put, no. Private companies are exempt from the audit requirement. However, they can choose to get one if at least 10% of their shareholders request it.

Crucially, the following companies are all required under law to provide audited financial statements:

- Public companies (unless dormant)

- Subsidiaries of public companies

- Insurance companies

- Banks

- Pensions funds

- Labor unions

Overall, the mandatory audit requirement affects companies that owe a duty of care to the public at large.

What Is Financial Auditing?

Most companies draft up financial statements annually to present a picture of their financial affairs to stakeholders. This is the task of financial accounting.

A financial statement audit engagement involves the auditor assessing the financial reports of the company in line with accounting and legal regulations. Most US companies follow FASB’s GAAP (Generally Accepted Accounting Principles). Whereas others outside the US adhere to IASB’s IFRS (International Financial Reporting Standards) and IAS (International Accounting Standards). It is imperative for the auditor to assess financial statements in light of the accounting framework used. This is because different accounting standards exist for treatments of various line items. Let’s consider an example.

Case Study

Exxon Mobil is one of the globes largest oil and gas companies. Headquartered in the US, Exxon Mobil adheres to US GAAP accounting standards.

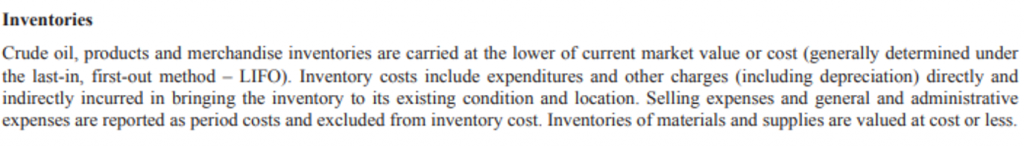

In the course of the audit, Jim notices something about Exxon Mobil’s inventory valuation methods. Exxon Mobil employs LIFO (last in-first out) method of valuing Inventory. This is allowed under US GAAP. However, if Exxon Mobil was following IFRS, this would raise an audit objection since IFRS do not allow companies to use LIFO as an Inventory valuation methodology.

Figure 1: Extract from the financial statements of Exxon Mobil detailing their inventory valuation method (LIFO)

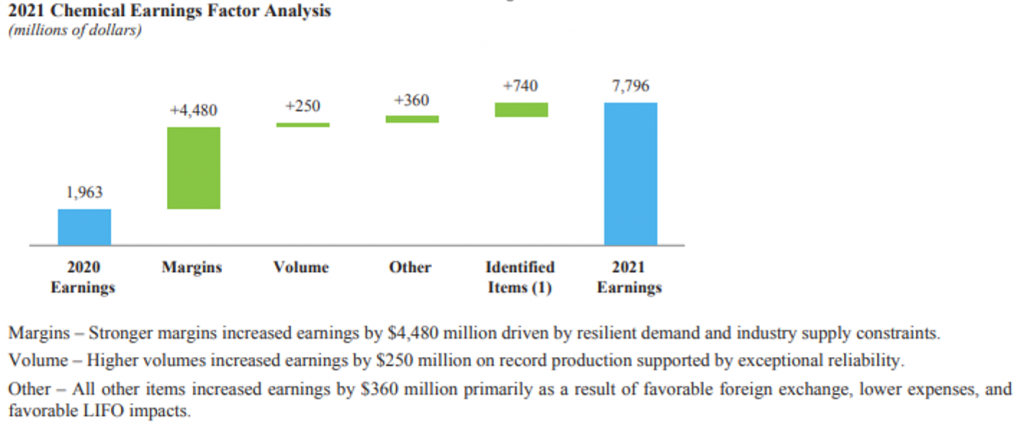

Figure 2: Extract from Exxon’s financial statement showing favorable impact of inventory valuing methodology which initially raised investor concerns.

Investors are concerned that Exxon is evading tax by using LIFO. This is because in inflationary periods LIFO provides a lower Gross Profit figure due to higher Cost of Goods Sold. The lowered profit figures lead to low tax payments to the exchequer. However, Auditor Jim’s opinion provides investors with reasonable assurance that they need not worry. Reasonable assurance means that the auditor believes there is little likelihood of material misstatement. Since Exxon Mobil follows US GAAP and the framework allows for this treatment, this does not amount to tax evasion.

This is just one aspect of financial auditing – to piece together treatments of various line items within the financial statements.

Alongside verifying if any material misstatements exist, a financial statement audit also verifies if the business is a going concern. This means whether or not the business has potential to continue in the upcoming year.

Financial Statements Audit Opinions

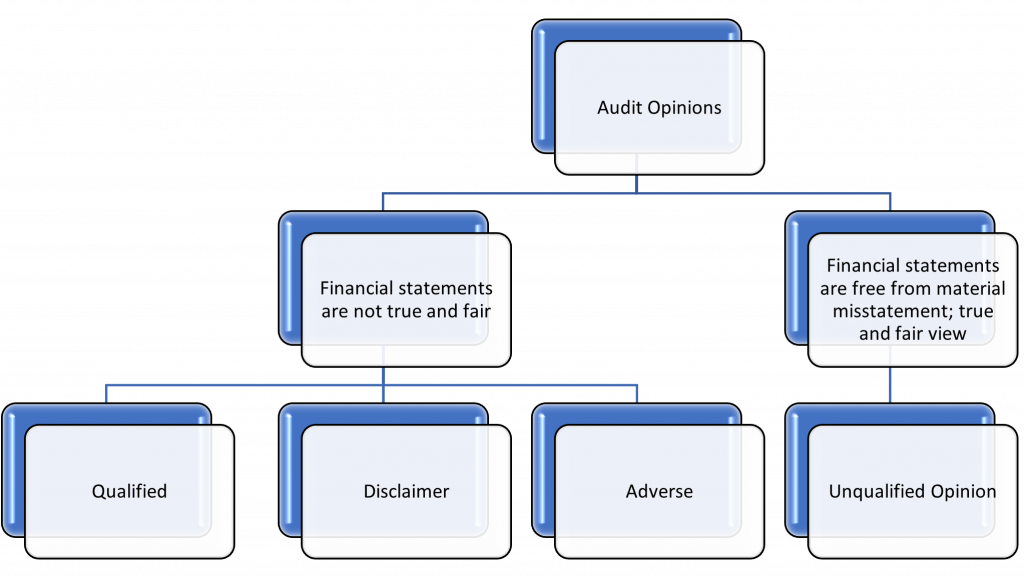

Generally, the audit report presents the user of financial statements with the auditor’s opinion. This opinion can be Unqualified (Clean), Qualified, Disclaimer and Adverse.

- Unqualified opinion means that the financial statements of a company are free from material misstatements.

- Qualified, Adverse, and Disclaimer are variations of an unclean, i.e. problematic opinion.

Qualified opinions can be summarized in a qualification matrix to help the end user understand what caused the qualification. Or more importantly, how serious the material misstatements were.

| Circumstances | Material but not Pervasive | Material and Pervasive |

| Limitation of scope: when auditors are prevented from accessing records or the money trail has been disrupted, e.g., a fire destroying records. | Qualified | Disclaimer |

| Disagreement: when management and auditors are unable to agree on the treatment of a particular matter | Qualified | Adverse |

Pervasive refers to the matter affecting a number of items within the financial statements.

Material refers to the matter being of considerable value. Often auditors set materiality levels before the start of the audit engagement. For example, if the company has annual sales of $1 Billion, auditors wouldn’t consider a $5 discrepancy as material. However, if a company has annual sales of $10,000, then a $1,000 discrepancy will be deemed material in nature.

What Types of Auditing Exist?

Within the financial statement audit, we have three sub types of audit engagements. Each serves a unique purpose. These are:

- The External Audit is for the benefit of third parties such as shareholders and investors. The external auditors’ opinion that the financial statements are clean.

- The Internal Audit has as its intended users managers and other stakeholders within the company. This attests to robustness of internal controls within the organization. Management benefits from this information in the decision-making process.

- Tax Audit is for tax return purposes. Authorities randomly select companies and audit revenue figures. Tax Audits ensure that the company isn’t evading tax or getting any tax benefits (deductibles) they aren’t eligible for.

Purpose Of Financial Statement Audits

The most common purpose of auditing is the authentication of financial statements. This objective has existed since the Sumerian Era (3000 BC). Identification marks on cargo shipments sufficed as proof of physical verification. To this day, regulatory requirements in many geographic locations make financial auditing an imperative for certain organizations.

The second reason why financial auditing is necessary is raising funds. If a company has great investment potential, its financials are going to reflect that. But they can only be credible if they are audited.

Similarly, any company wishing to go public may need an audit before proceeding with an IPO (Initial Public Offering). Valuation of company stock price will be based on the figures in the audited financials.

Top public companies worldwide get audited by the Big 4 Audit Firms. These are world leaders in auditing and have the largest network of firms worldwide.

Why Is It so Important for Businesses to Get Audited?

Consider the following example:

Felon Dusk is a businessman currently in talks to purchase Slitter, a startup social media platform. Slitter’s accountant, Pablo Escobar, values the business at $44 Billion. However, Felon has doubts.

Slitter has also provided Felon with detailed financial statements prepared by Pablo. These financial statements chart the year-on-year growth of Slitter for the past three years.

Pablo is a Chartered Accountant from ICAEW and has fifteen years of work experience as an accountant.

However, Felon wishes to bring on board an auditor from one of the Big 4. He needs to be sure that Slitter deserves the price its shareholders are demanding.

So, he engages a fellow called Berlin, who is a partner at KPMG, to audit the financial statements. Berlin has with him his audit team with senior manager Tokyo and audit trainees Nairobi, Rio, and Denver.

The team sets out to conduct the audit and relevant due diligence measures. In the process, they discover that Slitter grossly overvalued their assets. Furthermore, Slitter is embroiled in a legal battle with Twitter, a rival platform. Yet Pablo failed to record any contingent liabilities that may result from this dispute. Also, the financials fail to comply with most requirements stipulated by IFRS, the framework of choice for Slitter.

Berlin signs off the audit report with an adverse opinion. His analysis is that the financial statements are materially misstated, and the impacts of that are both material and pervasive. Also, Berlin mentions that as an auditor, he does not believe Slitter is a going concern.

Following these revelations, Felon withdraws his takeover bid of Slitter. The audit report is damaging to Slitter’s reputation, and they are forced to file for liquidation.

Takeaway

It is not necessary that this was an attempt on Slitter’s part to defraud potential investors. Perhaps Slitter’s management were not aware of the requirements and disclosures necessary under IFRS. Or maybe Pablo failed to alert the management to various inconsistencies occurring year on year. It also might be that the accountant who worked at Slitter before Pablo took over could be at fault. In any case there is a clear failure of managerial accounting at work in Slitter’s case.

If Slitter had decided to get its financials audited before announcing intentions to be purchased, they may have been able to rectify the pressing issues identified during the process of financial auditing.

By the time the final audit opinion was issued, however, the report was so damaging to their reputation that they were forced out of business.

What’s Next?

As an inquisitive finance professional, you will be intrigued about the various tenets surrounding financial statements. As it turns out, it is a huge responsibility to work as an accountant. Nowhere is this truer than in one of the many auditing firms in business today.

From the perspective of a finance manager, it also pays off to keep abreast of recent updates in the auditing world. This way you will be able to engage in effective decision-making and ask better, more informed questions during meetings with auditors. If the company you own or work for received a negative audit report, how best can you deal with it? How to ease the concerns of stakeholders? What to do in preparation for an IPO? Solidify your grasp of these and other foundational business topics with our Accounting and Financial Statements Analysis Course.

Ready to take the next step towards a career in Finance?

From foundational topics in Accounting and Financial Analysis, through Corporate Finance and M&A, to specialized Fintech and Economics courses, the 365 Financial Analyst curriculum is designed to prepare you for the world of Finance as it is today. Whether you are a total beginner or a working professional, our expert-led courses offer the opportunity to upskill at your own pace. Find the right fit for you and start learning today!