Debits and Credits Cheat Sheet

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for Free

Credits and debits are common terms in our daily lives but a whole new ballgame in accounting. Simply put, they are records of financial transactions in business accounts. This definition may initially appear counterintuitive if you’re new to the field.

This article helps you grasp the concepts by walking you through the meaning and applications of debit and credit in accounting and how they relate to the fundamental accounting equation. It also includes a debits and credits cheat sheet to assist you in determining how to record transactions in a company’s general ledger using the double-entry bookkeеping system.

What Are Debits?

The verb ‘debit’ means to remove an amount of money, typically from a bank account. When we make payments or withdraw cash from debit cards, we debit our savings or earnings accounts.

In accounting, we debit the amount added to assets and expense accounts or deducted from liability, equity, and revenue accounts. For example, when a pizza shop purchases flour from the local supermarket, it debits the company’s bank account (assets).

What Are Credits?

To be on credit means to exceed your available finances. An example from our everyday lives includes using a credit card to purchase items or cover expenses for which we lack funds.

In accounting, credit is the amount added to liability, equity, and revenue accounts and deducted from assets and expense accounts. So, when a business takes on a loan, it credits its liabilities account.

Debits and Credits Cheat Sheet

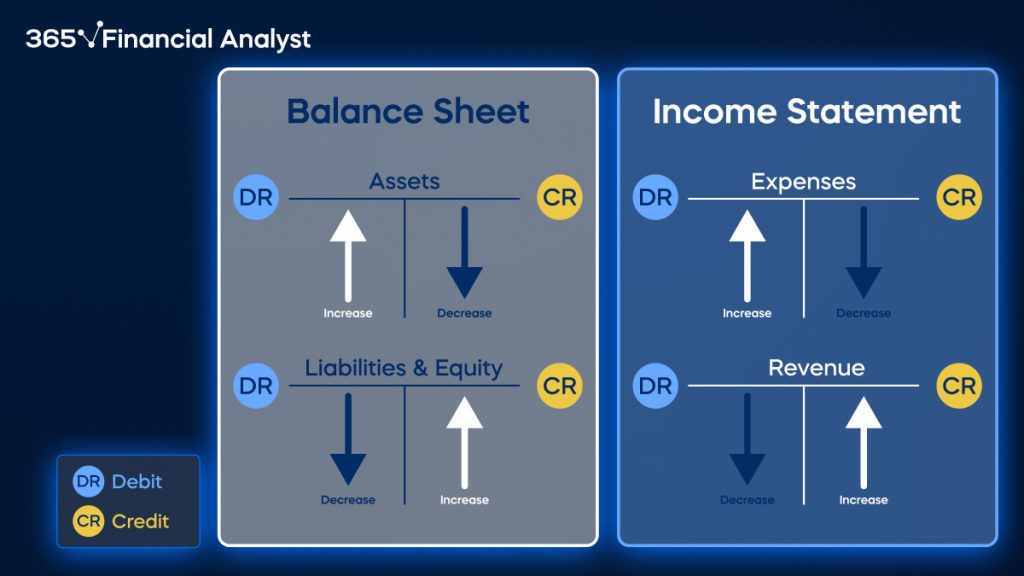

When discussing debit, we refer to money coming into an account. On the other hand, credit is used for money going out. These accounts include assets, liabilities, equity, expenses, and revenue.

Recording Assets, Liabilities, and Equity

Assets, liabilities, and equity are Balance Sheet items and components of the basic accounting equation.

Assets are resources with economic value that the business owns, including its premises, bank balance, company cars, etc. Assets are debit items. When they increase in value, we debit the account. And when an asset decreases, we credit it.

Liabilities represent an outflow of economic benefits, such as utility expenses, interest payments on an overdraft facility, employees’ salaries, etc.

Equity is what is left after a business uses its assets to pay off its liabilities.

Liabilities and equity are credit items. So, every time a liability increases, we credit that line item, and when it decreases, we debit it.

The basic accounting equation asserts that assets must always equal liabilities plus equity.

Assets = Liabilities + Equity

This seemingly simple equation is vital in accounting because it balances the company’s finances. We must define the double-entry bookkeeping system to understand how credits and debits relate to this balance. But first, let’s examine the two Income Statement accounts, revenue and expenses.

Recording Revenue and Expenses

Revenue (income generated from selling goods or services) is a credit line item—meaning we credit it when it increases and debit it when it decreases.

This may initially sound counterintuitive, but consider the following example:

When you receive your salary, it’s credited to your account. And when you withdraw it, you debitit from your bank account. Replace ‘salary’ with ‘revenue,’ and you get an example of debit and credit in accounting.

Expenses include the expenses of running a business (SG&A), the costs of manufacturing the company’s products (COGS), and those incurred from the obsolescence of fixed assets (depreciation and amortization).

Expenses are a debit line item. When they rise, we debit them; when they fall, we credit them.

The following cheat sheet summarizes how debits and credits relate to Balance Sheet and Income Statement items.

What Is the Double-Entry Bookkeeping System?

The double-entry system is a method of recording financial transactions in accounting journals. The journal entries are then summarized in the firm’s general ledger (defined in the next section).

According to this system, every accounting entry requires a corresponding and opposite entry to another account. In other words, each transaction has two sides: at least one debit and one credit booking.

Most importantly, the total amount of debits must equal the total amount of credits. Failing to meet this condition indicates an error in journal entries, which will also reflect in the accounting equation.

So, this system helps companies keep accurate records and balance assets, liabilities, and equities—i.e., maintain the basic accounting equation.

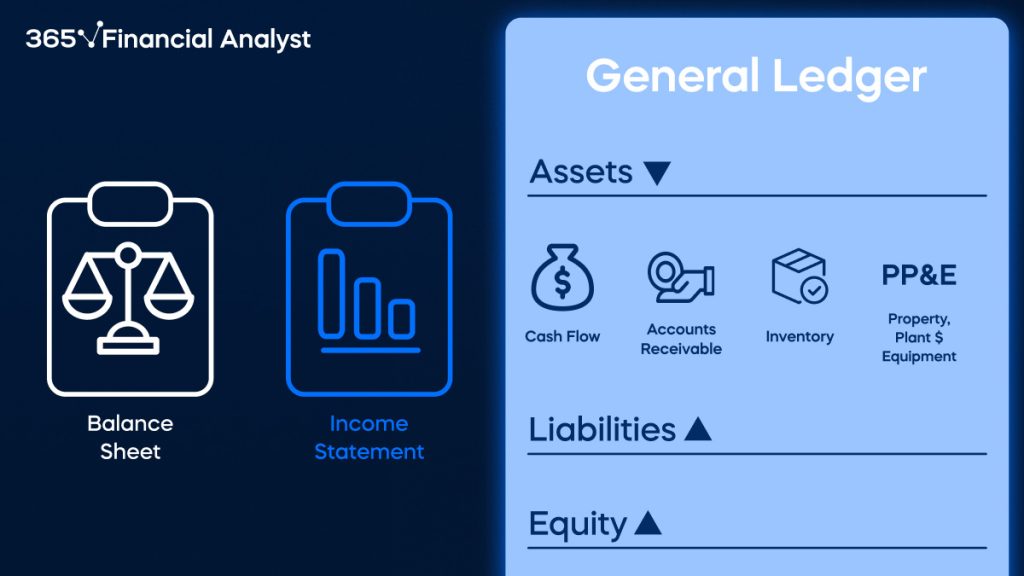

What Is a General Ledger?

The general ledger is a company’s principal accounting record containing information about Balance Sheet and Income Statement items.

In the following example of a firm’s general ledger, the asset side of its Balance Sheet contains cash, accounts receivable, inventory, and property plant and equipment.

Typically, the general ledger consists of subsidiary ledgers containing the respective account details. For instance, an accounts receivable, general ledger will have subsidiary ledgers with information about the amount each customer owes. Similarly, an inventory general ledger will contain subsidiary ledgers showing the breakdown between raw materials, work in progress, and finished goods.

General ledger accounts are known as T-accounts because we draft them in the shape of the letter T. Debit items are always recorded on the left side, while credit items are documented on the right side of the T-account.

Debits and Credits in Accounting: Example

Let’s illustrate everything covered so far with an example.

A burger place called Burger Binge Ltd. owns the following assets:

- A delivery vehicle worth $10,000

- A shop with a market value of $30,000

- Inventory of $8,000

- A bank balance of $5,000

Suppose the burger establishment purchased part of its inventory on credit from a supplier, adding $2,500 to its liabilities.

Let’s calculate Burger Binge Ltd.’s equity using the accounting equation:

Assets = Liabilities + Equity

Total~assets = Vehicles + Shop + Inventory + Cash~at~bank =

= \$10,000 + \$30,000 + \$8,000 + \$5,000 = \$53,000

Total~liabilities = Credit~purchases = \$2,500

Therefore:

Total~Equity = Assets - Liabilities = \$53,000 - \$2,500 = \$50,500

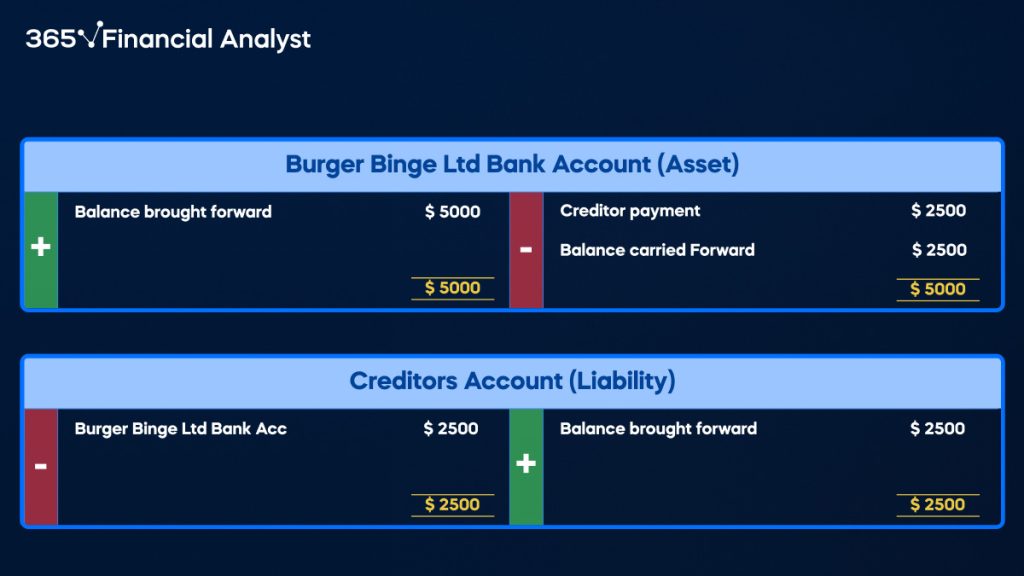

What happens when Burger Binge repays its debt?

Upon repayment to its supplier, the company will credit its bank account with $2,500 as the cash at the bank (an asset) decreases. At the same time, the firm will debit the creditor’s account since it eliminates liability.

This preserves the balance in the accounting equation—assets and liabilities decrease, but equity remains the same.

We record this transaction as follows:

Creditors account (Liability) $2,500 Dr | Bank account (Asset) $2,500 Cr

*Dr refers to debit, and Cr relates to credit.

The following is a T-account of this transaction:

What’s Next?

Debits and credits form the backbone of an effective bookkeeping system. If you wish to build a career in the field, it’s essential to understand and learn to apply them. You can save the debits and credits cheat sheet and refer to it until you become skilled at recording transactions. But be patient; this takes time and practice.

Check out our Accounting and Financial Statement Analysis course to take your accounting skills to the next level. It dives deeper into these (and other) fundamental concepts, helping you build a solid foundation for future career development. Sign up for 365 Financial Analyst and start building your skills for free.

FAQs

Credits and debits are records of transactions in business accounts. According to the double-entry principle, every transaction has an equal and opposite entry to another account. So, if you debit one account by a given amount, you must credit another by the same amount. For example, if you take on a loan to purchase an item, you credit your liabilities account and debit your assets account by the same amount.

Accounts are increased or decreased with a credit or debit. The following questions will help you determine which accounts to debit and credit.

1. Which accounts are affected by the transaction? If you purchase an item on credit, the affected accounts would be assets (the acquired item) and liabilities (the borrowed amount).

2. What is the nature of the transaction? If it increases the account balance, you debit the asset or expense accounts or credit the liability, equity, or revenue accounts. If it decreases the balance, you do the opposite.

3. Are there other affected accounts? A transaction might affect more than two accounts. For instance, when you sell a product, your cash account increases (i.e., you debit the assets account), and so does your revenue (i.e., you credit the revenue account). But the transaction also decreases your inventory (assets) and increases the cost of goods sold (expense) accounts. So, you must also credit the assets (inventory) and debit the expenses (COGS).

The easiest way to remember the meaning of debit and credit in accounting is as follows:

– Assets increase on the debit side and decrease on the credit side.

– Liabilities increase on the credit side and decrease on the debit side.

– Equity increases on the credit side and decreases on the debit side.

– Revenue increases on the credit side and decreases on the debit side.

– Expenses increase on the debit side and decrease on the credit side.

These principles are illustrated in the T-accounts example above. Download the debits and credits cheat sheet and refer to it whenever needed.