Corporate Finance

Master Corporate Finance: Optimize working capital, make optimal investment decisions, and enhance liquidity

Start for Free

Start for Free

What you get:

- 7 hours of content

- 118 Interactive exercises

- 74 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

Corporate Finance

Start for Free

Start for Free

What you get:

- 7 hours of content

- 118 Interactive exercises

- 74 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

$99.00

Lifetime access

Start for Free

Start for Free

What you get:

- 7 hours of content

- 118 Interactive exercises

- 74 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

What You Learn

- Integrate fundamental corporate finance theories with practical knowledge and hands-on learning

- Calculate and interpret a company’s Weighted Average Cost of Capital (WACC) to optimize investment decisions

- Build a comprehensive capital budgeting model in Excel to support the evaluation of investment projects

- Assess project feasibility with proven techniques such as payback period, IRR, and NPV

- Develop an in-depth understanding of financial leverage, considering both its benefits and associated risks

- Design an effective and transparent corporate governance structure to improve organizational alignment and integrity

Top Choice of Leading Companies Worldwide

Industry leaders and professionals globally rely on this top-rated course to enhance their skills.

Course Description

Learn for Free

1.1 Course Introduction

3 min

1.2 Working Capital Management (Definition)

3 min

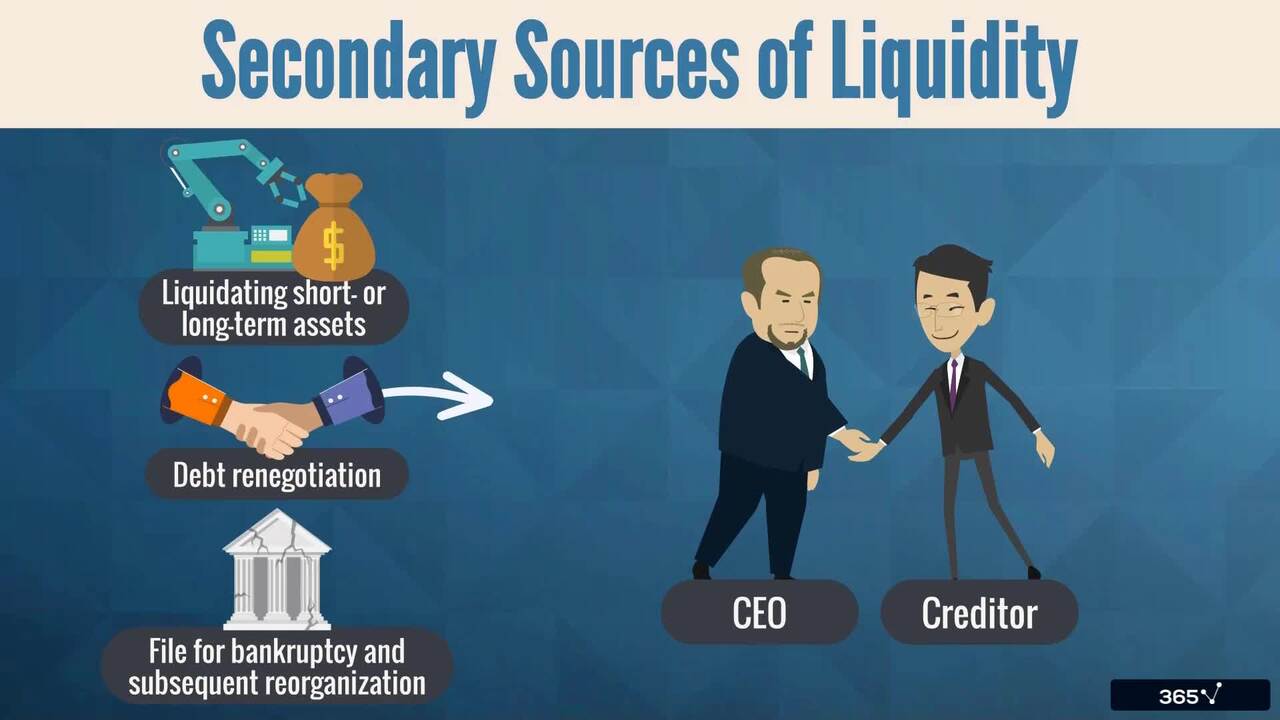

1.3 Liquidity Management

6 min

1.5 Liquidity Measures

6 min

1.6 Asset Management Ratios

4 min

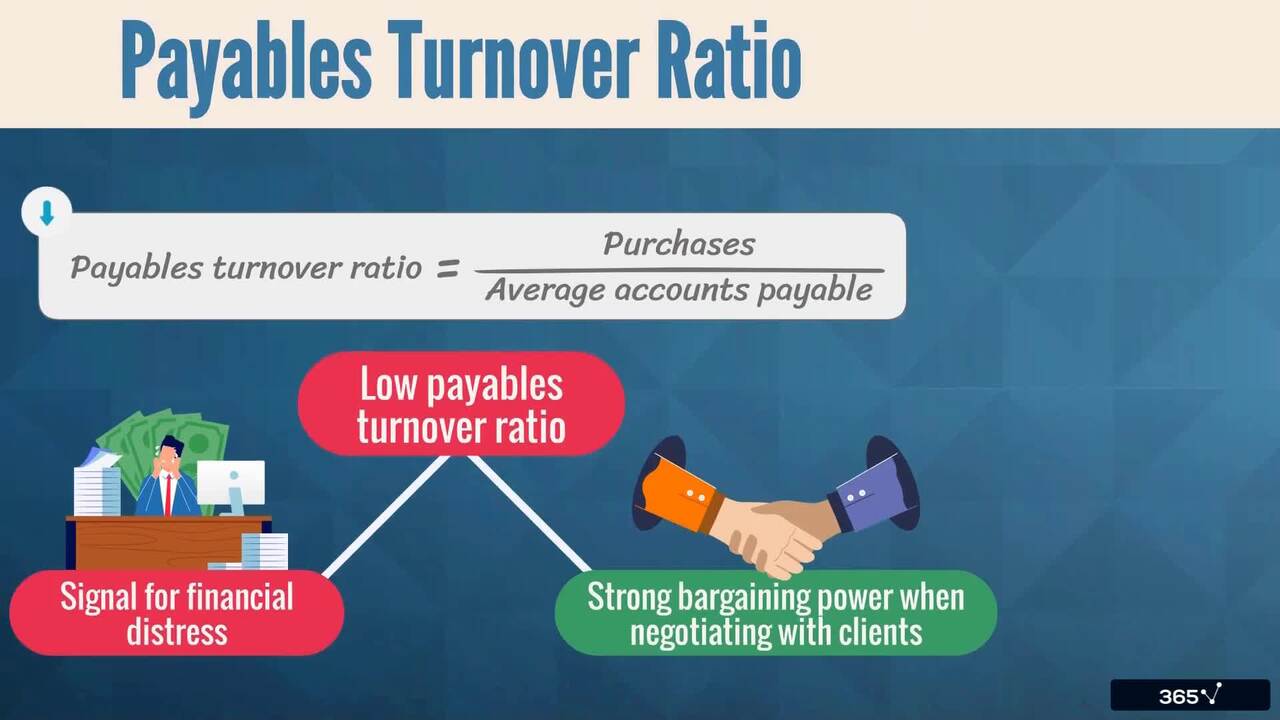

1.7 Payables Turnover Ratio

2 min

Curriculum

- 2. Capital Budgeting14 Lessons 69 MinThis section covers the basic principles of capital budgeting. We describe the capital budgeting process, the categories of capital projects, and the difference between independent and mutually exclusive projects. Next, you will learn how to make investment decisions based on some of the most frequently used measures: Net Present Value, Internal Rate of Return, payback period, and profitability index. Lastly, we examine in detail the advantages and disadvantages of Net Present Value and Internal Rate of Return.The Capital Budgeting Process5 minCapital Budgeting (Basic Principles)7 minEngaging with Multiple Projects at a Time4 minNet Present Value (NPV)7 minNet Present Value: Example4 minInternal Rate of Return (IRR)7 minPayback Period4 minDiscounted Payback Period (DPBP)4 minAverage Accounting Rate of Return (AAR)5 minProfitability Index (PI)4 minNPV Profile3 minNPV vs IRR8 minProblems Associated with IRR5 minThe Relation Between NPV and Share Price2 min

- 3. Cost of Capital16 Lessons 72 MinThis section of the Corporate Finance course is dedicated to the cost of capital. We explain how to calculate a company’s Weighted Average Cost of Capital (WACC) and how taxes affect the various sources of capital. Then, we describe the use of target capital structure in the WACC calculation. You will how the Marginal Cost of Capital affects the investment opportunity schedule and a project’s NPV. Next, we examine the ways to calculate the cost of equity, preferred equity, and debt. At the end of the section, we discuss a project’s beta and flotation costs.3.1 The Weighted Average Cost of Capital (WACC)7 minEffect of Taxes on the Cost of Capital3 minUse of Target Capital Structure in Estimating WACC5 minMarginal Cost of Capital (MCC)8 minThe MCC's Role in Determining the NPV3 minCost of Debt5 minCost of Preferred Stock2 minCost of Equity (using CAPM)3 minCAPM (Components)5 minCost of Equity (using the Dividend Discount Model)3 minCost of Equity (using the Bond Yield Plus Risk Premium Approach)3 minCalculate and Interpret Beta5 minCalculate a Project's Beta6 minEstimate the Cost of Equity for Developing Countries2 minMarginal Cost of Capital Schedule5 minFlotation Costs7 min

- 4. Capital Budgeting: Practical Example12 Lessons 45 MinIn this section, you will apply everything you have learned so far to a fictional case study in which Home Depot decides to expand its operations from North America to Europe and open its first store in France. In this practical exercise, we will build a complete capital budgeting model in Excel and learn how to forecast revenue and various types of expenses. We will also prepare a fixed asset roll forward schedule and calculate the cash impact of extra working capital and the projected cash flows. Lastly, we will perform a sensitivity analysis and explore the factors behind these results.Case Study (Introduction)2 minOrganizing Inputs Into Drivers Sheet8 minSales Forecast Sheet2 minPreparing a Fixed Asset Rollforward Schedule4 minCalculate Cash Impact of Extra Working Capital2 minDebt Repayments and Interest Expenses2 minProject's P&L Sheet1 minProject’s Cash Flows3 minWACC7 minCalculate Beta in Excel8 minDiscounting Project Cash Flows2 minPerformance Evaluation and Sensitivity Analysis4 min

- 5. Measures of Leverage8 Lessons 31 MinNext, the Corporate Finance course covers the definition of leverage and the different types of risks a company faces. We calculate and interpret the degrees of operating and financial leverage, which help us determine a company’s total leverage. Next, we analyze the effects of financial leverage on a company’s net income and return on equity. Towards the end, we explain how to calculate the breakeven quantity of sales by taking into account a firm’s fixed and variable costs.Measures of Leverage5 minBusiness and Financial Risk2 minCalculate the Degree of Operating Leverage (DOL)6 minCalculate the Degree of Financial Leverage (DFL)4 minCalculate the Degree of Total Leverage (DTL)2 minThe Effect of Financial Leverage on a Company's NI and ROE6 minCalculate the Breakeven Quantity of Sales4 minCalculate the Operating Breakeven Quantity of Sales2 min

- 6. Corporate Governance and ESG Investing13 Lessons 44 MinIn the last section of the Corporate Finance course, we discuss the components of an effective corporate governance structure. Then, we list some of the major stakeholders and how their opposing interests are balanced through stakeholder management. You will fully understand the structure, composition, and responsibilities of a company’s Board of Directors and the main committees it appoints. And lastly, we discuss the corporate governance factors relevant to investment analysis and the environmental and social causes influencing the investment process.Corporate Governance: Description2 minStakeholder Groups and Their Interests5 minStakeholder Conflicts5 minStakeholder Management2 minGovernance Mechanisms3 minBoard of Directors3 minBoard of Directors Committees3 minFactors Influencing Corporate Governance6 minCorporate Governance: Risks and Benefits4 minPrinciples of Corporate Governance Analysis4 minEnvironmental Factors and Social Considerations in Investment Analysis2 minESG Investing4 minESG Investing vs Fiduciary Duties1 min

Topics

Course Requirements

- Highly recommended to take the Intro to Excel and Accounting for Financial Statement Analysis courses first

- You will need Microsoft Excel 2010, 2013, 2016, 2020, or Microsoft Excel 365

Who Should Take This Course?

Level of difficulty: Beginner

- Aspiring financial analysts, investment bankers, investment analysts, financial controllers

- Business executives and entrepreneurs looking to enhance their financial decision-making skills

- Business and finance students

Exams and Certification

A 365 Financial Analyst Course Certificate is an excellent addition to your LinkedIn profile—demonstrating your expertise and willingness to go the extra mile to accomplish your goals.

Meet Your Instructor

Ivan is the COO of 365 Data Science and a CFA charterholder with over 12 years of professional experience in the financial sector. He earned his Master’s degree in Financial Economics from the Erasmus University of Rotterdam, the Netherlands in 2010 and has been fascinated by the world of artificial intelligence and machine learning ever since. Seeing how data science truly redefined the finance industry over the last decade, Ivan knew that he couldn’t stay on the sidelines. In 2019, he published his first online course on corporate finance, combining his expertise with his love of teaching. His goal is to establish 365 Data Science as the best learning platform for aspiring data professionals in the world.

What Our Learners Say

365 Financial Analyst Is Featured at

Our top-rated courses are trusted by business worldwide.