Porter’s Five Forces Analysis Example – Walmart

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for FreePorter’s Five Forces framework evaluates the competitive landscape of an industry and reveals valuable insights into the key dynamics within a market. The results of the analysis allow for making well-informed strategic decisions with confidence. In this article, we’ll explore a real-life Porter’s Five Forces analysis example, assessing the competitive position of the retail giant Walmart.

We’ll break down the entire process into the following four stages:

Stage 1: Define the area of interest

Stage 2: Collect data

Stage 3: Analyze the data

Stage 4: Draw conclusions and recommendations

Stage 1: Define the Area of Interest

Suppose you’re a strategy manager at Walmart. Today’s business environment dynamics are constantly changing, especially in the retail industry. Competing against big players like Amazon, Costco Wholesale, and Target requires regular industry analysis. To assess Walmart’s competitive position, you decide to conduct Porter’s Five Forces analysis.

Many business professionals analyze a whole industry rather than an individual organization. Threats and opportunities within an industry will typically coincide with those of a particular company. But not always—at the end of the day, it all comes down to the specific business insights you need.

Stage 2: Collect Data

This stage is all about data collection. You look for valuable information about the retail industry, focusing on Walmart’s competitors, buyers, suppliers, newcomers, and substitutes. You can use this data to evaluate the factors that make up the five forces. You should also look up Walmart’s Annual Reports.

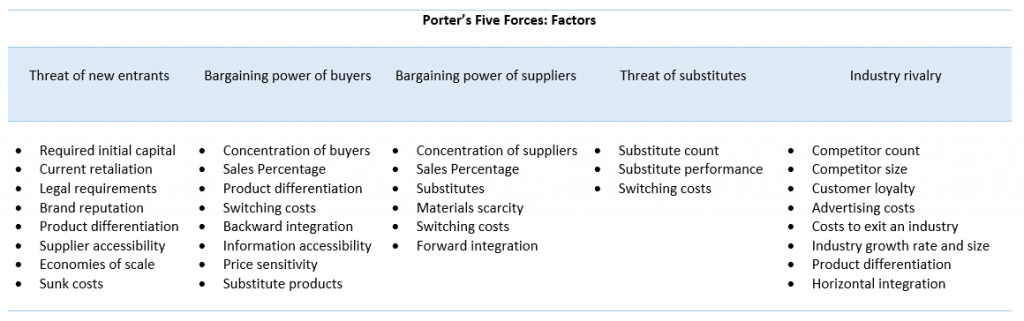

Below, you can find a handy table that outlines the most prominent factors to consider when collecting industry-specific information for each force.

These pointers will help you organize your findings better, serving as a valuable guide for our Porter’s Five Forces analysis example. The list isn’t exhaustive, so if there’s anything you think will make a big difference for a company’s competitive position, write it down—even if it’s not in this table.

Stage 3: Analyze the Data

The following is the information you gather after carefully examining Walmart’s Annual Reports and other relevant business data in our Porter’s Five Forces analysis example.

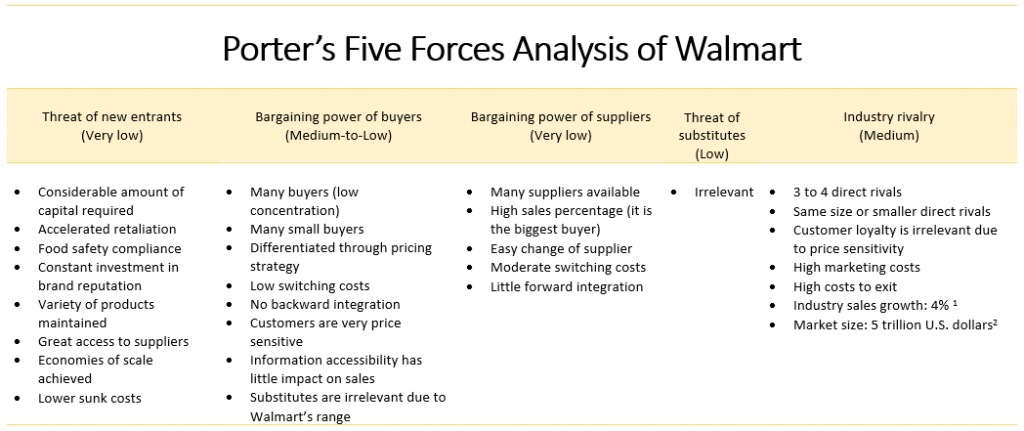

Threat of New Entrants (Very Low)

Walmart is a giant in the retail industry. It invests a lot in sales, marketing, distribution, and product development. If another party wants to join the industry, they should put down considerable initial capital to compete against existing players. After all, all retailers strive for the same number of buyers while offering somewhat similar products. Overall, severe retaliation makes it difficult to survive in the retail business.

On top of that, Walmart sustains a great relationship with suppliers and sells to many customers. So, economies of scale indeed work in its favor. Because of its well-designed distribution systems and range, we observe low sunk costs, too.

Knowing all this, the risk of new joiners seems mitigated. As a result, the threat of new entrants is ranked very low.

Bargaining Power of Buyers (Medium-to-Low)

Walmart deals with many small buyers daily, which disseminates the purchasing power of those buyers. Contrary to popular belief, those customers exert moderate-to-low control over the retail giant. That’s because the store’s low-price approach and convenience are difficult to find anywhere else. As a result, the company doesn’t feel much pressure from customers regarding pricing.

At the same time, the constant need for specific new brands currently not in stock weakens Walmart’s power as a buyer and strengthens the customers’ potency. Besides, switching costs are low—anyone can shop at a different store. But buyers are highly sensitive to price changes and find Walmart the best choice to satisfy their needs. As for substitutes, Walmart is too big to worry about that—its product variety, low prices, and locations can’t be beaten.

That’s why the bargaining power of buyers is evaluated as medium-to-low.

Bargaining Power of Suppliers (Very Low)

The store chain purchases products from different suppliers. Walmart—one of the leading players in supplying products and services—is a buyer for those producers. With its large purchasing volumes and broad customer reach, Walmart is a buyer of high power. That’s why its suppliers ensure they cater to its needs as best as possible. They even build operational centers adjacent to the store locations to meet Walmart’s demands. And if a supplier can’t accommodate its requests, Walmart is confident enough to switch to a different one.

Only a handful of companies—such as Coca-Cola—can surpass Walmart in strength and independently cater to end customers, but those are rare exceptions. Besides, Walmart has long employed a Supplier Diversity Program as part of its Corporate Social Responsibility outlook, further mitigating its dependency on a single distributor.

In short, Walmart is a strong buyer whose suppliers exert meager power.

Threat of Substitutes (Low)

Walmart offers various products and item categories—from groceries to household appliances. It’s unlikely that a product isn’t available at Walmart but is accessible elsewhere. With its broad range, the retailer fights no strong substitution. A product and all its substitutes will probably be on the shelves of Walmart. The retail giant should only worry about industry rivals like Target, which may attract individuals by offering comparable product diversity. But this has to do with industry rivalry and not product substitution.

Since almost all product variations are easily found on the store shelves of Walmart, there’s no real threat of substitutes to consider.

Industry Rivalry (Medium)

With nearly 4% industry growth and over $6.5 trillion market size in 2021, the US retail industry maintains high competition. Regarding Walmart, however, the department store chain meets no significant challenges from small contenders. The competitive advantage economies of scale and price strategy bring to Walmart can hardly be found elsewhere. There are, however, a few rivals the company must keep a vigilant eye on, including Costco, Target, Kroger, and Amazon. Still, their distribution channels and pricing strategies are yet to outperform Walmart’s.

In a nutshell, the retail giant scores medium industry rivalry in the US retail business.

Stage 4: Draw conclusions and recommendations

Porter’s Five Forces analysis aims to identify which areas companies should focus on when making strategic decisions. For Walmart, this is industry rivalry because it’s the only one that exerts medium power to its competitive position. That’s why the retailer must continuously strengthen its capacity in relation to existing players. To do that, the company should further invest in the following:

- Automation of internal processes for supply chain management

- Human resource development

With improved supply chain operations, Walmart can live up to its mission and vision to be cost-effective. As for human resource development, skilled employees and executives will inevitably bring fresh strategic ideas on overcoming industry threats while benefiting from emerging business opportunities.

The bottom line is that these strategic approaches may contribute to better efficiency and business growth. As a result, Walmart can remain persistent in beating the competition.

Porter’s Five Forces Analysis Example: Key Takeaway

Fundamentally, Walmart should leverage its economies of scale and pricing strategies to reduce industry rivalry and mitigate the risk of new entrants and substitutes. While suppliers and buyers hold limited bargaining power, the retailer should continue to allocate resources to meet their needs. Implementing strategies related to human resources and automation could be viable options for the company’s long-term success.

Next Steps

Do you wonder what tools companies employ to survive competition in today’s world?

Porter’s Five Forces model is central to competitive analysis, but analysts often employ other approaches in conjunction. Our Introduction to Industry and Company Analysis course contains fundamental models companies of all sizes use to sustain their position in the market. Discover insights about industry concentration and capacity, pricing power, industry lifecycle stages, and economic determinants.

Enroll in our platform today and join a community of experts committed to success.