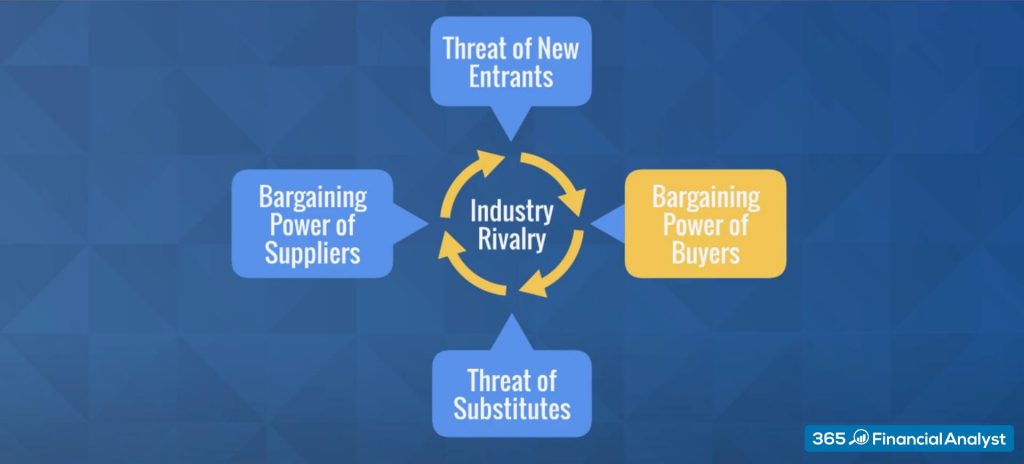

Porter’s 5 Forces Model: Bargaining Power of Buyers

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for Free

Buyers are the people who pay for a company’s products and services. In fact, consumer behavior is what really drives a firm’s profits. As such, buyers often demand low prices and high quality. Lowering prices may affect revenues while increasing quality could inflate production costs. Basically, the power of buyers determines how you set your prices. Knowing the bargaining power of your customers creates a strong competitive advantage for your organization.

Determining Factors

When we talk about buyers, you should know that those are not necessarily the end-users! A large toy manufacturer, for example, may have a number of store chains as customers. Broadly speaking, a buyer power analysis includes the following industry-specific determinants:

Concentration of buyers deals with the number of customers that purchase goods and services from a producer. As scarce client concentration makes companies highly dependent on their consumers, any transaction makes a big difference for producers. Thus, such buyers exert strong bargaining power. By contrast, a densely populated client base undermines buyer power.

Sales Percentage has to do with the size of a client. For example, a buyer that contributes to 50% of a company’s annual revenue is surely more powerful than the ones bringing 1% or less.

Undifferentiated products are usually a prerequisite for a high buyer power, where brand loyalty is low. Many firms selling the same thing allows buyers to become more powerful and look for the best deal on the market. In this way, customers can easily switch providers as they like.

Switching costs relate to the costs involved in changing providers. High switching costs mostly presuppose low buyer power.

Backward integration is another factor to consider. A buyer that starts manufacturing a product or service in-house will no longer need to purchase it from a provider. This is what we call a threat of backward integration.

Information accessibility plays a key role in the bargaining power of buyers as well. If customers know too much about a product, its features and production costs, they may ask for lower prices.

Price sensitivity touches on the price sentiment of buyers. Sensitive buyers may switch providers because of a price change. If so, producers are then forced to respect clients’ wishes, giving them the upper hand in the bargaining process.

Substitutes refer to market alternatives. Customers with many product options to choose from outpower the providers selling them.

Strong Bargaining Power of Buyers

When you buy a plane ticket, you usually have many airlines to choose from. You usually enter your travel criteria on the internet and look for the best deal. You are not obliged to use a particular airline; in fact, you may try out a new one every time you travel, so no switching costs are involved. Some itineraries even allow for different means of transportation. For the most part, you focus on the price rather than the brand. Nowadays, flying has turned into a commodity product, thus buyers have high bargaining power.

Typically, a strong buyer power presupposes that:

- Buyers are relatively fewer than sellers

- Switching costs are low

- Backward integration is attainable

- Substitutes are available

- Buyers are very price sensitive

- Products are not differentiated

- Buyers acquire the product in bulk

Weak Bargaining Power of Buyers

Microsoft’s former general managers wrote the following to Bill Gates back in 1997:

“It is this switching cost that has given our customers the patience to stick with Windows through all our mistakes, our buggy drivers, and many other difficulties.”

This is a typical example of weak buyer power.

In practice, the bargaining power of buyers is considered low (or weak) when:

- Buyers are more than sellers

- Switching costs are high

- Backward integration is unattainable

- No substitutes are available

- Products are differentiated

Buyer Bargaining Power: A Practical Look

Let’s take a look at the bargaining power of buyers from a more practical perspective.

With over 11,000 stores, Walmart stands as one of the biggest international retail stores in the world. It sells hundreds of different brands to its customers, but it is quite a buyer itself, too. In other words, it functions as both – seller and buyer.

As a seller, Walmart deals with many buyers on a daily basis. Contrary to popular belief, those customers exert moderate power over the retail giant. That’s because the store’s low prices and convenience are difficult to find anywhere else. As a result, the company does not feel much pressure from customers when it comes to pricing. At the same time, the constant need for specific new brands that are currently not in stock weakens Walmart’s power as a buyer and strengthens the power of its customers.

Now, let’s analyze Walmart as a buyer. As such, the store chain purchases products from different suppliers. For those producers, Walmart is a buyer, one of the main players to supply products or services to. With the large purchasing volumes and broad customer reach, Walmart thus appears to be a buyer of high power. That’s why its suppliers make sure they cater to its needs at all times. They even build their operational centers adjacent to the store locations, simply to meet Walmart’s demands. And if a supplier isn’t able to accommodate its requests, Walmart is confident enough to just switch to a different one. All this makes the department store a remarkably powerful buyer. Of course, companies like Coca Cola are some of the very few that can overpower Walmart, as they are equally strong and can supply the end customers by themselves.

The Bottom Line

The bargaining power of buyers is extremely important to providers, but it does not tell us the whole story. The bargaining power of suppliers and the threat of new entrants are other key components involved in the model which we recommend reviewing next.

To gain a better understanding of a firm’s competitive position, one should conduct a complete Porter’s 5 Forces analysis.