Elements in a Thorough Industry Analysis

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for Free

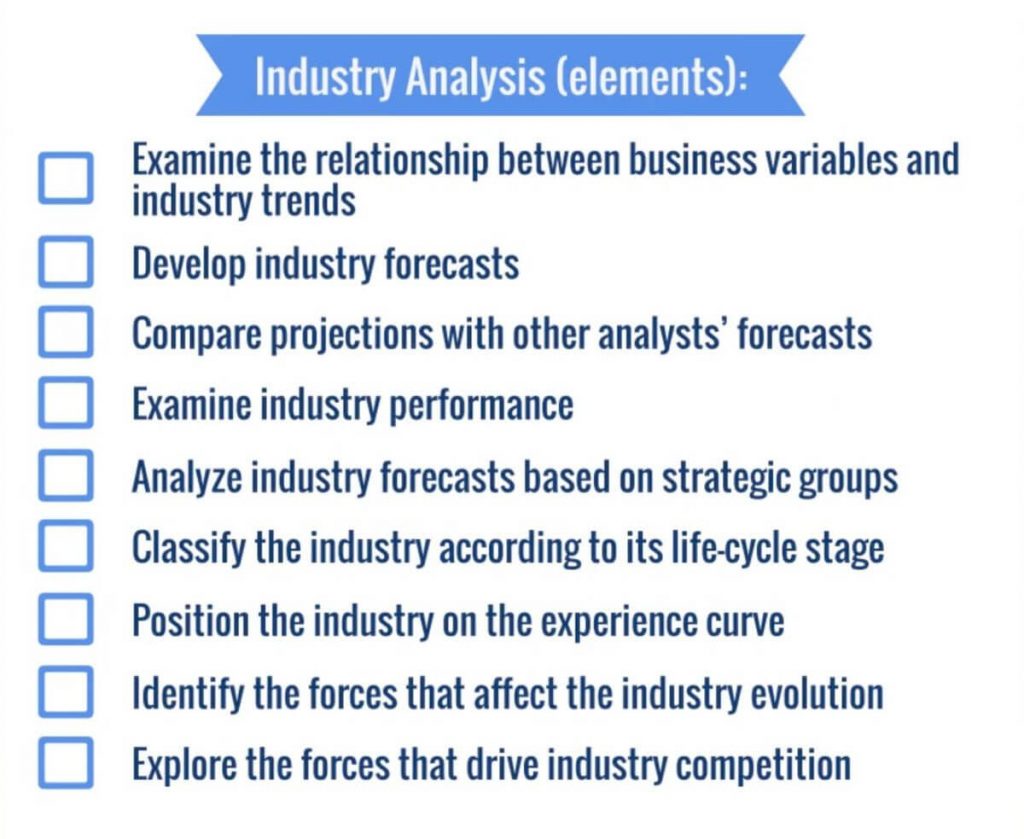

Conducting a detailed industry analysis requires an analyst to gather as much information as possible and analyze it to gain a competitive edge. Commonly, the process includes nine main elements:

Imagine that you have just landed your dream job as a financial analyst and your first task is to evaluate 10 different industries. The objective is to identify those that offer the highest potential risk-adjusted returns. So, you go through all the checkboxes on the list.

1. Examine the Relationship between Business Variables and Industry Trends

An analyst with superior knowledge of an industry’s characteristics and trends is more likely to give you an advantage over your competitors.

Factors such as GDP growth rate and interest rates often impact average returns. To examine these relationships, we need to gather information from a wide range of sources like economic, industry and business publications, the internet, associations, constituent firms, competitors, suppliers, and customers.

2. Develop Industry Forecasts

Your next task is to develop industry forecasts using different approaches and scenarios. You may want to test out possibilities of what the market size during the next period would be. In fact, a range of projections is especially useful when the economic environment is uncertain.

3. Compare Projections

Once Step 2 is complete, you can compare the results with other analysts’ projections. When doing this, you look for two things – to confirm the validity of your methodology and to identify any differences with the relevant forecasts. If your estimates are statistically valid but rather different from the common view, you might be able to generate superior investment returns from buying undervalued securities.

4. Examine Industry Performance

A financial analyst should also examine the industry performance from two different angles.

First, we should set industries side by side and identify those expected to generate superior returns.

Second, we need to compare our valuations over time and track the volatility of performance. In the context of sector rotation strategy, for instance, we need to determine which industries will benefit from the next stage in the business cycle.

5. Analyze Industry Forecasts Based on Strategic Groups

Oftentimes, our job as analysts includes focusing on specific strategic groups. These are entities sharing distinct business models. You can also think of strategic groups as separate industries within the industries. For instance, low-cost carriers, such as Southwest Airlines and Ryanair comprise a strategic group within the airline industry. Similarly, firms that produce proprietary drugs (those protected by patents) are distinct from companies selling generic medicines.

6. Classify the Industry

Analysts spend a lot of time classifying industries according to their life-cycle stage. To scratch the surface, they go through different phases such as embryonic, growth, shakeout, mature, or declining. Using predetermined models, practitioners are better able to find out more about the firms’ development phase.

7. Position the Industry

Depending on the life-cycle stage, industries exhibit different costs per unit relative to the output produced. This relationship is captured by the so-called experience curve. In general, as the production output increase, the costs per unit decrease.

That’s because companies realize economies of scale. To put it plainly, their fixed costs spread over a higher number of units produced. Tesla’s success is based on the economies of scale of its two most important components- batteries and solar power generation cells. The more of them the company produces, the cheaper they get per unit. In fact, it is this obsession with economies of scale that sets Elon Musk’s impressive business career apart.

The specialization of labor and the subsequent rise in productivity are also factors that lead to a declining curve. Real-life examples exist in almost all industries, especially those with high fixed overhead costs and repetitive production operations, such as electronics and automobiles. Think about Henry Ford and his assembly line that changed the modern industrial world. By increased efficiency of manufacturing and decreased cost of production, he managed to capture 48% of the automobile market at that time.

8. Identify Forces that Affect Industry Evolution

To enrich our analysis, it’s also important to consider the factors that influence industries on a more general level. These include demographic, macroeconomic, governmental, social, and technological influences.

9. Identify Forces that Drive Industry Competition

Finally, we need to study the factors that drive industry competition, also known as Michael Porter’s Five Forces. These are the rivalry among existing competitors, threat of new entrants, customer and supplier bargaining forces, and the threat of substitute products.

Summary

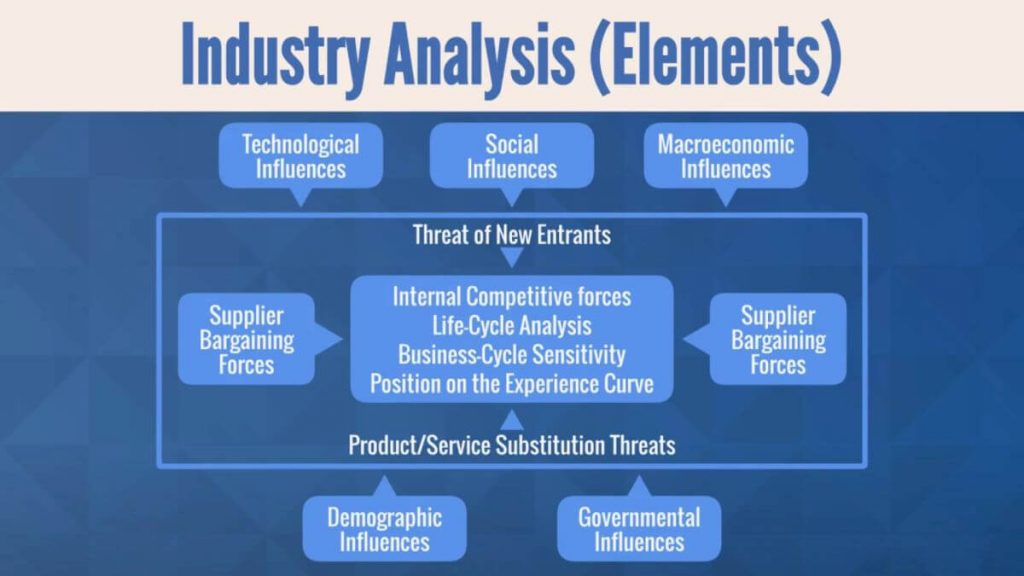

Performing industry analysis is a long and comprehensive process. Let’s put what we learned so far in a graphical framework, designed to identify the forces that affect every industry:

At the macro level, there are five factors – technological, social, macroeconomic, demographic, and governmental.

When it comes to the competitiveness of the business environment, we can employ Porter’s five forces, along with life cycle and business cycle analyses, and the industry’s position on the experience curve.

Naturally, each industry is different, and implementing one universal approach leads to problems. Therefore, we should first figure out what type of evaluation to work with.

We have prepared a brief review of the major industry classification methods and systems!