The IPO Process: Steps to Going Public

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for Free

An initial public offering (IPO) is a pivotal moment in a company’s journey, representing its transition from а private entity to а publicly traded enterprise. It allows businesses to raise capital from public investors, which has a significant impact on the business landscape, with notable IPO successes and failures over the years.

This article walks you through the complete IPO process, and it includes a comprehensive IPO definition and a thorough overview of the key financial markets involving IPOs. It examines in detail the IPO steps, pricing mechanism, performance, pros and cons, and alternatives.

Table of Contents

- What Is an IPO?

- IPOs and Financial Markets

- How Does an IPO Work?

- IPO Performance

- Metrics for Evaluating the IPO Process

- Advantages and Disadvantages of IPOs

- IPO Alternatives

- Prominent IPO Examples

- Next Steps

- FAQs

What Is an IPO?

The term initial public offering has been a catchword on Wall Street for years. It all started in 1602 when the Dutch East India Company offered its shares to the public to raise capital. Since then, IPOs have been one of the main ways for businesses to obtain funds.

An initial public offering is the process a company undergoes to offer its new or existing shares to the public for the first time, thereby becoming a publicly traded entity. IPOs enable businesses to raise equity capital from public investors. It also allows private investors to exit their investments and make a profit.

IPOs and Financial Markets

To better understand the mechanism behind the IPO process, consider the two types of financial markets—primary and secondary.

Primary Market

When a company lists its securities for the first time, that trade occurs in the primary market. The IPO is an example of a primary financial market transaction.

Secondary Market

The secondary market is what most people typically associate with the ’stock market.’ It is where investors buy and sell securities they already own.

Note that IPO stocks are sold in the primary market only when they are first issued. After that, they can be traded on the secondary markets, such as the New York Stock Exchange (NYSE) and NASDAQ.

How Does an IPO Work?

The comprehensive IPO process involves a series of steps to go public, taking anywhere from six months to a year.

The IPO Process – Step 1: Decide to Go Public

Once a company decides to go public, it starts preparing for an IPO. This mainly involves evaluating its financial and business models and market conditions. Before initiation, the firm must prepare an IPO checklist of all the important aspects and necessary documents.

Internally, management must ensure they have impeccable accounting systems and policies and the right finance specialists, business plans, and metrics. In addition, they should search for top-tier law and CPA firms to conduct the audit and a lead underwriter in the face of an investment banking firm.

Then, they must notify all employees of the so-called quiet period. This is the time between filing a registration statement with the SEC and the moment it becomes effective. Involved parties aren’t allowed to disclose any information about the IPO process. As the law doesn’t specify the exact time parameters of the quiet period, its duration may differ across companies and even go beyond the IPO date.

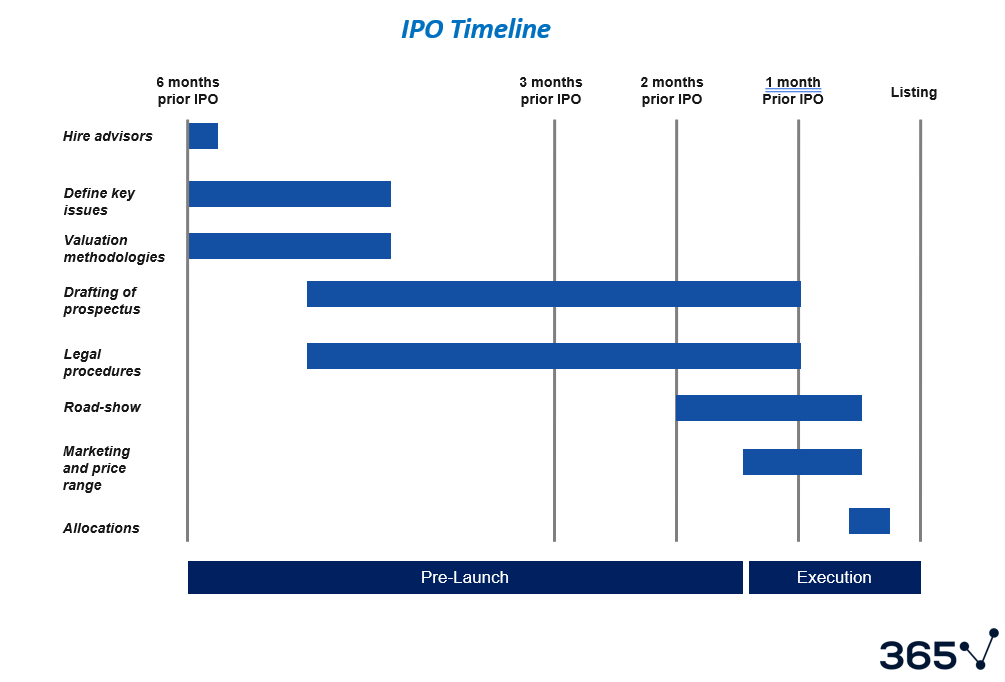

Here’s an example of an IPO timeline:

The IPO Process – Step 2: Select a Lead Underwriter

Investment banks will have established strong relationships with the company seeking to go public. When the time comes, the business approaches its preferred investment bankers to formally request a presentation for the upcoming initial public offering.

Then, the firm evaluates the received proposals (in the form of pitch books). Particularly, it selects the lead underwriter based on the suggested offering price, type and quantity of shares, and marketing offer timeline. Typically, there are one to three banks acting as bookrunners and a few more serving in co-manager roles, although the exact number depends on the IPO’s size.

The IPO Process – Step 3: Hold a Kick-Off Meeting

During this crucial phase of the IPO process, all stakeholders get together to discuss important aspects of the deal, such as the offering price, due diligence, required registration forms, and time of filing. The parties attending this meeting (and all others thereafter) include the management team, chosen CPA firm, company accountants, appointed underwriters, representing law firm, and SEC experts.

The IPO Process – Step 4: Submit the Primary IPO Filing Document

The first three steps result in successfully filing the S-1 Registration Statement in the US (the name may differ between countries). It consists of two parts: the prospectus and the privately held filing information.

This document includes the firm’s major financial statements, key market data, company overview, and risk factors. The S-1 will be revised several times throughout the pre-IPO process.

Keep in mind that financial projections aren’t disclosed in the S-1 Registration Statement, as the company can’t provide any forward guidance until right before the trading starts. Once the SEC reviews the statement, it may return it for corrections to the company’s advisers.

The IPO Process – Step 5: Red Herring

The documents have been submitted and reviewed, and the IPO team is now busy preparing marketing strategies for preselling the offering. The goal is to find investors who would agree to buy parts of the issue. The company may release a preliminary prospectus (red herring), unveiling valuable information to investors about the business and the purpose of raising new capital. But it cannot reveal the offering price and amount of proceeds.

Book Building

Meanwhile, the investment bank can ‘build a book’ by inviting financiers to submit the price they are willing to pay for the securities. These bids are not actual orders but intentions of interest. This step intends to generate and record investors’ demand for shares before even arriving at an issue price that satisfies both the issuer and the market. Operationally, it is the de facto mechanism by which investment banks price the initial public offering.

How does this part of the IPO process work in practice?

Equity research analysts approach various institutional investors and offer them a discount on the price as an incentive to pre-buy shares. These include entities that pool large amounts of money, such as endowment, pension, mutual funds, and insurance companies. Following the investors’ feedback, equity sales teams evaluate their interest in the offering and determine a price range. Then, investment banks revise the S-1 to reflect the estimated price range.

What happens when investors in the book of orders are more than the number of securities offered?

The banks adjust the IPO price upward to accommodate the higher demand. When Facebook started its book building, the target price rose significantly from $28 to $38 prior to the actual IPO. Just two days before the IPO date, the company announced that it will sell 25% more shares than originally planned due to the high interest from investors.

Accelerated Book Building

When companies don’t have enough time for a thorough book building, they implement accelerated book building. This may be the case when a firm wishes to make an offer to acquire another one, and the offer period is open for one to two days, with little to no marketing. So, the time between pricing and issuance shrinks to 48 hours or less. After that, the organization is ready to move to phase two—the IPO itself.

The IPO Process – Step 6: The IPO Roadshow

During book building, underwriters and the management team also attend the initial public offering roadshow to market the shares and collect feedback on the price from investors. That’s when investment banks accept orders from investors and use the data to revise the filing statement. It typically lasts for about a month, and it may require a change in the number of shares issued and the price range.

The IPO Process – Step 7: The IPO Pricing

It’s time for the SEC to approve the IPO, and the involved parties to confirm the effective date. A day prior to the effective date, the company management and the lead underwriter meet to close the order book and define the final offer price and number of shares to be sold. The price is based on the orders received, and the company advisers must be careful not to overprice or underprice the offering significantly.

There aren’t any specific IPO valuation models. In fact, you value the firm as you would any other company—with a DCF model and relevant valuation ratios. Please note that offering a small discount on the IPO price aims to attract investors and meet market expectations.

Investment banks provide two major offering types: underwritten and best effort.

Underwritten Offering

The vast majority choose this type of offering, whereby an investment bank underwrites the security. Essentially, the bank agrees to purchase the entire issue at an offering price that has been negotiated with the issuer. In other words, the firm sells the entire issue to the investment bank, which then sells it to other investors through the book-building process. If the initial public offering is undersubscribed, the bank buys the unsold portion.

The investment bank also agrees to ‘make a market’ for the security for about a month and support the secondary market, so that the price doesn’t fall after the initial offering. When the issue is too large for a single bank to underwrite, several investment banks create a syndicate to help build the book.

For instance, in 2012, Facebook used the services of over 25 banks during its IPO. In exchange, the issuer usually pays an underwriting fee of about 7% of the offering price.

As good as it sounds, an underwritten offering presupposes a conflict of interest. As the issuer’s agent, the bank must set the offering price high to raise as much capital as possible.

But as the issuer’s underwriter, the bank could choose a low price on the IPO stocks to make an easy profit from selling undervalued shares to their clients.

And if the price is high, the underwriter runs the risk of not selling the issue entirely, forcing it to buy overvalued shares. On top of that, negative publicity from unsold issues puts even more pressure on investment banks. All this could result in underpriced IPOs and rising prices in the secondary market.

Best Effort Offering

In this mechanism for disseminating securities to the general public, investment banks act as commissioners. They put their best effort into selling the securities without owning any of them or committing to purchasing the unsold IPO stock if the issue is undersubscribed. As such, investment banks bear a lower risk compared to an underwritten transaction.

The IPO Process – Step 8: Allocate Shares to Investors

Once the company and the lead underwriter finalize the IPO pricing, the equity syndicate allocates the shares. Typically, a significant portion of the offering goes to institutional investors, while the remaining stock is made available for retail investors. Internally, the capital is recorded as stockholders’ equity on the issuing company’s Balance Sheet.

The IPO Process – Step 9: Start Trading

On the effective IPO date, the agreed number of shares are issued, and the general public can start buying and selling the IPO stock.

The IPO Process – Step 10: Manage the Post-IPO Period

After the initial issue, investment bankers must present analyst recommendations and take care of the after-market stabilization. If required, they must make a market for the stock.

IPO Performance

The IPO process is lengthy and exhausting but well worth it once the company starts realizing profits. Some crucial factors to consider include:

Offer Price vs Opening Price

To properly evaluate an IPO performance, you must differentiate between offer and opening prices. The offer price is the value at which a company sells its shares for the first time to investors, while the opening price refers to subsequent stock prices in the public market. The difference between these two indicates whether the public believes the IPO has been overpriced, which greatly impacts its overall performance.

Lock-Up Periods

In many IPO charts, you’ll notice a significant decline in the stock price after a few months. One of the reasons is the expiration of the lock-up agreement. This is a period of three to 24 months during which employees aren’t allowed to sell their company stock. Once this legally binding document expires and insiders start selling their shares to realize profits, the IPO stock price plummets because of the excess supply of shares.

Flipping

Flipping is the act of reselling shares in the first few days of the IPO to realize quick profits. These are usually investors who bought the stock at a discount and want to resell it while the price is skyrocketing on the first day of trading.

IPO Trading: Spin-Offs

That’s when an existing company separates a small part of its business, presents it as an independent, publicly traded entity, and creates tracking stock. Owners usually do it to gain benefits, believing that some divisions exert higher value as a standalone business rather than belonging to the parent organization.

Some investors are convinced that spin-offs provide valuable IPO opportunities and reflect on a firm’s performance, particularly in terms of information about the parent company and its stake in the divested entity. Spin-offs experience less initial volatility as investors are more aware of the dynamics of the newly formed company. So, seasoned traders may find interesting IPO opportunities in these scenarios.

Metrics for Evaluating the IPO Process

The two most popular metrics for evaluating an initial public offering include market capitalization and market pricing.

Market Capitalization

We can determine the success of an IPO by multiplying the number of shares by the stock price. If an IPO’s market capitalization equals or surpasses the industry average within 30 days of the IPO date, it’s considered a good IPO. But if its performance falls short, doubts may arise regarding its effectiveness.

We can obtain market capitalization with the following formula:

Market~capitalization = Stock~price \times Total~number~of~a~company’s~outstanding~shares

Market Pricing

For an initial public offering to be a success, the difference between the offer price and market capitalization of the issuing company must be below 20% within 30 days of the IPO date. This number indicates the IPO’s overall performance.

Advantages and Disadvantages of IPOs

Companies go public to secure funding for future growth. But not all businesses are suitable or prepared for this transformative undertaking. That’s why you should evaluate the potential advantages and disadvantages before making a decision.

Some advantages include:

- Access to capital: By offering their shares to the public, companies can raise a lot of money to fuel business growth.

- Transparency: The buzz surrounding a new IPO often results in high exposure, which can enhance trust and reputation, potentially providing easier access to borrowing funds.

- Attractive exit strategy: An initial public offering serves as an ideal exit strategy for early investors who placed their trust in the company and are now ready to cash in on their investment.

There are some disadvantages to consider, including:

- High requirements: Publicly traded companies must comply with strict requirements by the SEC to maintain full transparency in terms of disclosing detailed financial data.

- Expensive: IPOs are a financially demanding endeavor, and they’re worth millions of dollars. Once a company goes public, it will keep encountering costs for keeping up with public regulations. Some companies can’t even find investment banks to facilitate the IPO process. After the disappointing results during the COVID-19 pandemic, investors switched their focus to unicorn companies—private entities worth over $1 billion.

- Share price fluctuations: Publicly traded stocks heavily depend on economic conditions and market speculation, making their value hard to predict. In the dynamic investing environment, share prices often fluctuate, indicating their volatility.

IPO Alternatives

Special Purpose Acquisition Company (SPAC)

This is a new approach to going public where a shell company is established for the sole purpose of acquiring a private firm. Upon taking over, the public shell company transforms the private entity into a public one.

Direct Listing

A direct listing mirrors the IPO process but without any underwriters involved. The company runs the risk of failing if it doesn’t position itself properly, especially without the help of an investment bank. So, businesses that have established strong brand presence are some of the few entities that qualify for a direct listing.

Dutch Auction

In a Dutch auction, a company and its underwriters don’t predetermine the price. Rather, they let investors bid on the price, and the shares go to the highest bidder. Auctioneers start with a high asking price and gradually lower it until the bidding reaches a level where all shares can be sold.

Prominent IPO Examples

Below are some of the legendary IPO deals to leave a lasting mark on the history of investment banking.

Amazon (1997)

In 1997, Amazon raised $54 million in its IPO at $18 per share. At the time, Amazon marketed itself as the leading online book retailer, with a bit over 250 employees. And although relatively new (three years old), it had a huge success and a flawless IPO process. Interestingly, a CNBC reporter mentioned that “Amazon and its hired hands got its S-1 together in 12 days.” Since then, the company has experienced significant growth to become one of the world’s leading providers.

Google (2004)

Google’s IPO raised $1.67 billion and marked its debut on the stock market just six years after its foundation. But the IPO auction didn’t meet expectations, and the underwriters cut down the IPO pricing to sell the shares at $85. And that’s $50 less than the originally planned $135 per stock. Going public paved the way for Google’s subsequent breakthroughs and its dominance in the tech industry.

Alibaba Group (2014)

The Chinese e-commerce retail giant went public in 2014, with its IPO raising $21.8 billion. However, overwhelming demand required an additional share issue, and the IPO reached a record-breaking price of $25 billion. It was the largest IPO in history at the time, surpassing the records of Visa and Facebook. Alibaba’s listing of its shares on the New York Stock Exchange enabled NYSE to join the prestigious ranks of A-list technology companies that went public on the Big Board within one year.

Saudi Aramco (2019)

Saudi Aramco has had the largest IPO in history. Impressively, the Saudi Arabian oil giant raised $25.6 billion and issued three billion shares. This accounted for just 1.5% of its total value, letting the Saudi Arabian government retain control. As one of the world’s largest oil and gas companies, its IPO drove significant interest among international investors. The initial public offering took place on the Saudi Stock Exchange. With the help of a greenshoe option, Saudi Aramco increased its IPO to $29.4 billion after issuing 450 million additional shares.

Next Steps

The IPO steps are just a fraction of what you’ll be expected to know as a financial analyst. You must also learn more about mergers and acquisitions, asset management, debt underwriting, and corporate restructuring. Our Investment Banking course will help you understand how investment banks create value for companies and earn millions on their services.

Are you ready to take the next step toward advancing your career?

Enroll in our Investment Banker Career Track and obtain the fundamental skills to thrive in your chosen role. Industry experts will teach you important company valuation and financial modeling techniques and demonstrate how to leverage Excel in investment banking. Complete the career track and earn a verifiable certificate to showcase what you’ve learned.

FAQs

An initial public offering (IPO) refers to the process of selling a company’s shares to the public for the first time. It involves hiring underwriters, filing documents with the SEC, determining the offering price, and attracting investors. On the day of the IPO, a firm’s shares are listed on a stock exchange, available to the general public to trade. The IPO process and timeline vary across companies and countries, depending on the market conditions and regulatory requirements.

The IPO steps that companies take differ, but there are 10 crucial IPO stages:

1. Decide to go public

2. Select a lead underwriter

3. Hold a kick-off meeting

4. Submit primary IPO filing documents to the SEC

5. Red herring

6. Start a roadshow

7. IPO pricing

8. Allocation of shares to investors

9. Start trading

10. Manage the post-IPO period

An IPO’s primary purpose is to raise the capital needed for business growth and provide liquidity for existing shareholders. A secondary reason involves increasing the company’s visibility and credibility in the market to enhance brand recognition and its reputation.

Yes, a company can conduct multiple IPOs over time to raise additional capital by issuing more shares to the public. The secondary IPO follows a similar timeline to the initial public offering.

IPO pricing is a collaborative act between the company and its underwriters to find the perfect balance between raising capital for the company and determining a reasonable valuation that appeals to investors. Underwriters evaluate investors’ interest in the shares and current market conditions through the so-called book-building process to set the IPO’s final price.

The IPO process’s duration depends on various factors, including market conditions, regulations, and the IPO team’s efficiency. Typically, it starts around six months before the offering’s intended date. Ringing the bell is the most exciting part of the journey, but the hours after the shares start trading on public markets are essential. The bank needs to ensure the company’s shares increase in price and are attractive enough for investors, to consider an IPO successful.