Investment Banking popular

Launch your investment banking career: gain a comprehensive overview of the investment banking industry and how investment bankers create value for their clients

$99.00

Lifetime access

What you get:

- 4 hours of content

- 5 Downloadable resources

- Interactive exercises

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

Investment Banking popular

$99.00

Lifetime access

What you get:

- 4 hours of content

- 5 Downloadable resources

- Interactive exercises

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

$99.00

Lifetime access

What you get:

- 4 hours of content

- 5 Downloadable resources

- Interactive exercises

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

What You Learn

- Prepare for a successful career in investment banking by gaining a comprehensive understanding of the industry

- Acquire in-depth knowledge of key investment banking services such as Initial Public Offerings (IPOs), Secondary Equity Offerings (SEO), Mergers and Acquisitions (M&A), and Restructuring

- Become familiar with investment banking language and frequently used abbreviations and expressions

- Improve your business acumen by studying a company’s lifecycle model and the specific investment banking services that support each stage of corporate development

- Learn how investment bankers create value for businesses through advisory and deal structuring

- Distinguish between different investment asset classes and understand the risk-return profile of each of these investment opportunities

Top Choice of Leading Companies Worldwide

Industry leaders and professionals globally rely on this top-rated course to enhance their skills.

Course Description

Are you looking for a comprehensive guide that helps you understand how the investment banking industry functions? Do you wish to learn in-depth details about the four main areas of investment banking activity? This is the perfect Investment Banking course for you. Take advantage of an industry primer that will prepare you for investment banking interviews, internships, and your first days on the job. The course introduces you to the four main areas of investment banking activity: capital markets, advisory, trading and brokerage, and asset management. Then upon learning the foundational concepts, we delve deeper into the intricacies of each investment banking business line with dedicated course sections to each. The capital markets division provides equity and debt underwriting services. Equity Capital Markets (ECMs) serves companies that raise equity in Initial Public Offerings (IPOs) and Seasoned Equity Offerings (SEOs). This part of the Investment Banking course addresses questions related to the motivation of companies to get listed, investors in an IPO, various IPO price-setting mechanisms employed by investment bankers, the execution of an IPO, and much more. The Debt Capital Markets (DCMs) division works with debt issuances. You’ll learn about the four types of bonds, why companies issue bonds instead of borrowing capital from commercial banks, the purpose of securitization and loan syndication, and much more. The advisory division of investment banks offers M&A and Restructuring services to companies. Mergers & Acquisitions (M&A) is one of the most popular areas of investment banking. In this section, you’ll gain valuable knowledge about the practical reasons for a company’s desire to acquire another firm, the differences between corporate and financial buyers, a typical M&A deal process, and payment options in an M&A deal. The trading and brokerage section of the courses focuses on the different types of securities traded by investment banks and the outlook of trading activities in an ever more algorithmic-driven environment. The asset management activity of investment banks is discussed briefly by providing an overview of the types of asset management services offered by investment banks and making a risk-return comparison of different investment asset classes. This comprehensive Investment Banking training course gives you a ringside view of how the banking industry functions. Make sure to enroll today, and see you on the inside.

Learn for Free

1.1 The origins of investment banking

2 min

1.2 The rise of investment banking

4 min

1.4 The difference between commercial and investment banks

2 min

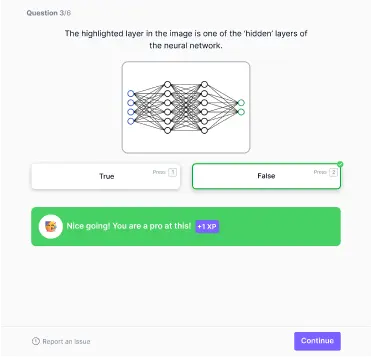

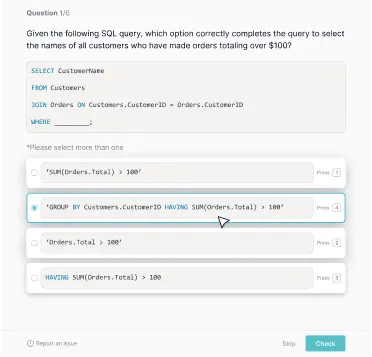

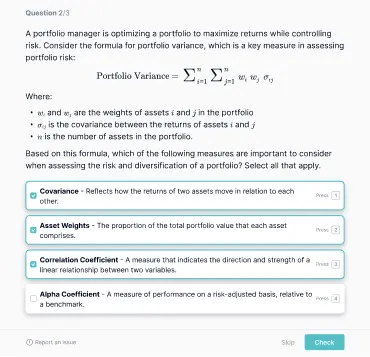

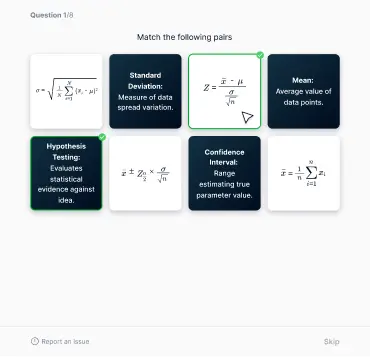

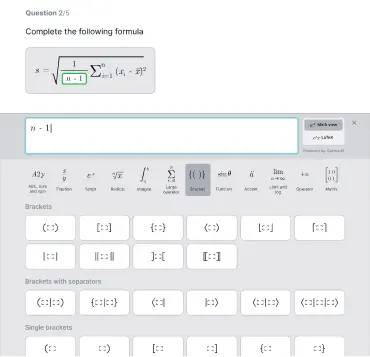

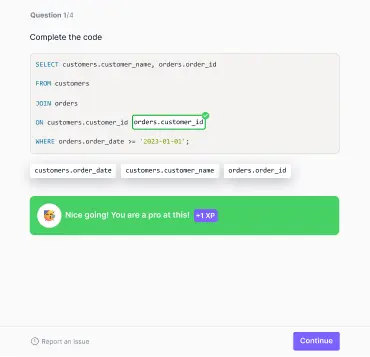

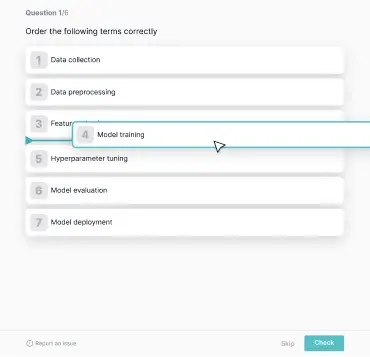

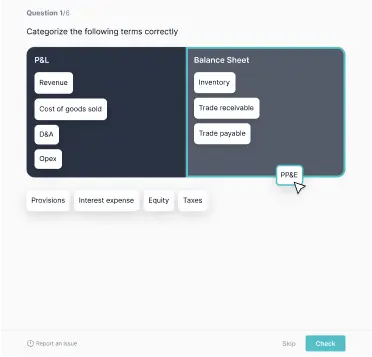

Interactive Exercises

Practice what you've learned with coding tasks, flashcards, fill in the blanks, multiple choice, and other fun exercises.

Practice what you've learned with coding tasks, flashcards, fill in the blanks, multiple choice, and other fun exercises.

Curriculum

Topics

Course Requirements

- No prior experience or knowledge is required. We will start from the basics and gradually build your understanding. Everything you need is included in the course

Who Should Take This Course?

Level of difficulty: Beginner

- Aspiring investment bankers

- Existing investment bankers who have recently started their career and want to gain a high-level understanding of the industry

- Business executives

- Entrepreneurs

Exams and Certification

A 365 Financial Analyst Course Certificate is an excellent addition to your LinkedIn profile—demonstrating your expertise and willingness to go the extra mile to accomplish your goals.

Meet Your Instructor

Nedko earned a Master’s degree in Finance from Bocconi University (Milan, Italy) in 2012. Then, he gained valuable working experience with exciting firms like PwC Italy (Financial Advisory and M&A), Coca-Cola European Partners (Financial Analyst), and Infineon Technologies (M&A). In 2014, he published his first online course on financial modeling and valuation when he realized that creating educational materials is his true calling. The amazing students and content creators in the data science community, the 365 team, and the strong desire to build the perfect learning platform drive Nedko to continue on this exciting journey. His goal is to establish 365 Data Science as the learning platform that bridges the gap between theoretical knowledge and practical business application.

What Our Learners Say

365 Financial Analyst Is Featured at

Our top-rated courses are trusted by business worldwide.