What is D&A and How is it Related to Fixed Assets?

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for Free

How do firms and analysts determine the value of a company’s assets over time? And how do we use the value of those assets to establish whether a firm is growing or not? Out of the many metrics available, D&A and Fixed assets are perhaps two of the most valuable, as they can be both easily mastered and provide meaningful insights into a company’s growth. But what do they mean and how do they affect one another? Let’s find out!

What is D&A?

D&A, which is short for Depreciation and Amortization, refers to the decrease in the value of assets as they are used over time or approach the end of their useful life. Think of a car – the more you use it, the less money you will be able to get from selling it afterwards. While both depreciation and amortization measure an asset’s “wear and tear”, they have some key differences, therefore it is important to examine each component on its own.

What is Depreciation?

Depreciation refers to the decrease in the value of tangible assets. Tangible assets are assets that have a physical form and a specific lifecycle. Examples of tangible assets include production equipment, office equipment, and other types of property. They are also often referred to as Property, Plant, and Equipment (PP&E).

The economic meaning of depreciation is that year after year the asset becomes older and loses some of its market value. Depreciation is shown as an expense in the Income Statement because the asset has been used by the business, and this is a cost that should be accounted for when calculating the company’s profitability.

At the end of their lifecycle the value of assets does not reach zero, but a certain salvage value. This is either what the company sells the asset for once it is no longer useful, or in some cases the money the company earns by selling it to be salvaged for parts.

What is Amortization?

Amortization is similar to Depreciation, but it refers to the decrease in value of intangible assets instead. Intangible assets are assets that have no physical form, yet still provide value for a company. Examples of intangible assets include brand recognition, intellectual property, copyrights, franchise rights, and patents.

Many of those assets have a useful life, thus their value decreases as its end approaches. We should bear in mind that only intangible assets with finite lives (such as software licenses) are subject to amortization. Intangible assets such as a firm’s brand are not amortized, given that they have an indefinite life.

How to Calculate D&A?

Imagine that a firm buys a vehicle for $30,000. The vehicle has an estimated useful life of eight years. How much should be charged as an expense this year? We know that $30,000 has been paid for the vehicle, but only a portion of this sum can be attributed to the current period.

Instead, the following will occur. The firm will register an asset that costs $30,000 on its Balance Sheet, and will decrease its cash by $30,000.

Then, year after year, the value of the asset will decrease as it becomes older and obsolete. The firm will have to implement a depreciation method in order to calculate by how much the value of the asset will be reduced each year.

Two main methods can be used to calculate depreciation: straight-line depreciation and depreciation based on use.

The Straight-Line Method

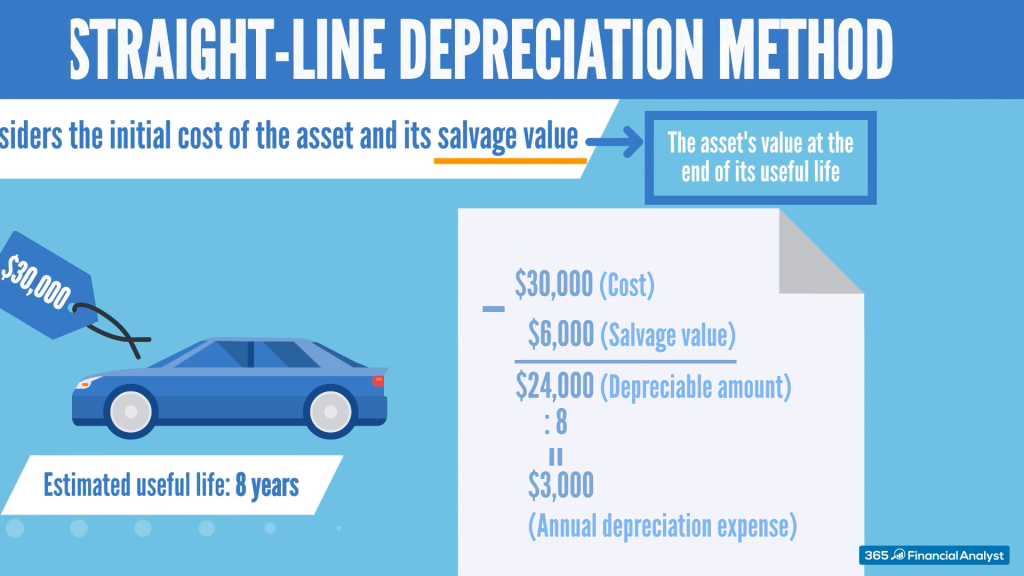

The straight-line depreciation method does the following. It considers the initial cost of the asset and its salvage value, which is how much the asset will be worth at the end of its useful life. Let’s say that, in our example, the salvage value of the asset will be $6,000. Then we will calculate the difference between $30,000 and $6,000, which would give us the amount that will be depreciated throughout the useful life of the asset: $24,000

Given that the asset will be used for 8 years and we will apportion the depreciation expense equally, we will have $24,000 divided by 8. So the annual depreciation calculated with the straight-line depreciation method will be $3,000.

The Activity-Based Method

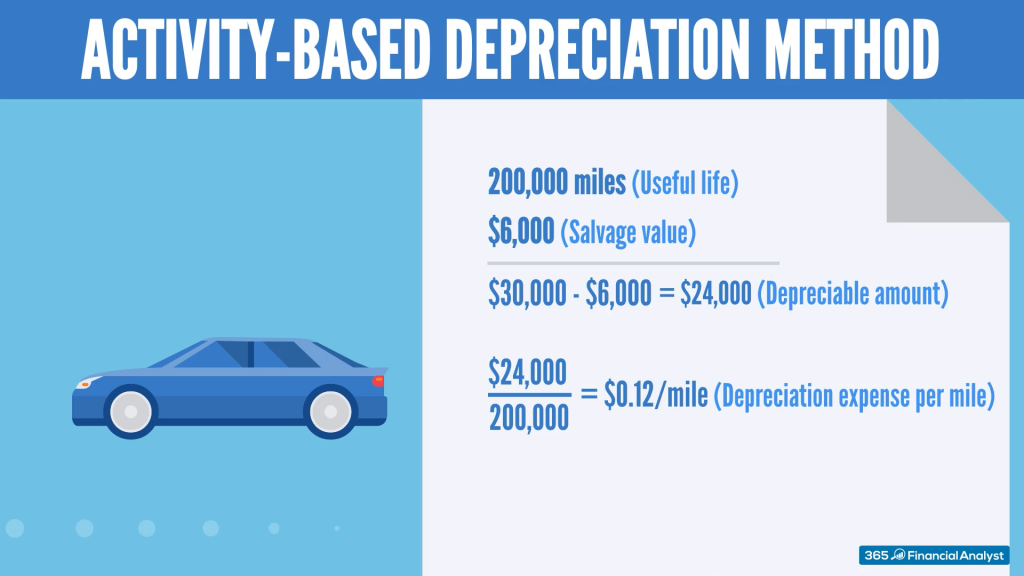

With the activity-based method, the firm will estimate that the vehicle’s useful life will be 200,000 miles and assign it a salvage value of $6,000. The amount to be depreciated is again $24,000.

Let’s divide this number by the vehicle’s useful life. We have $24,000 divided by 200,000 miles, which equals 12 cents per mile.

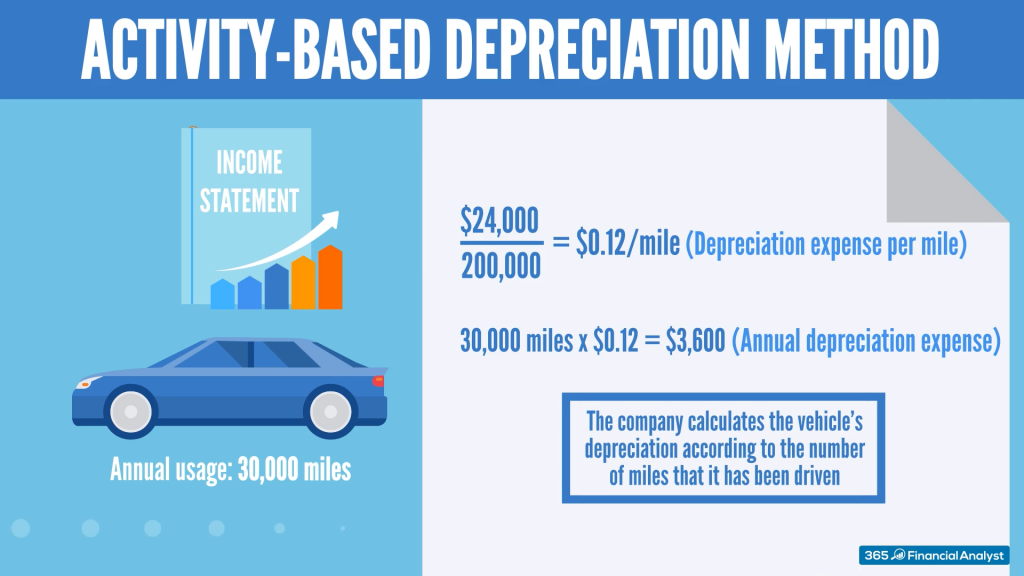

If we hypothesize that at the end of the current year, the vehicle will have 30,000 miles on its odometer, the company will have to use this number to obtain the depreciation expense that will be registered in the Income Statement. It will be equal to 30,000 miles multiplied by 0.12, which equals $3,600. By using this method, the company agrees to calculate the vehicle’s depreciation according to the number of miles that it has been driven.

We will have a similar picture for intangible assets. Both methods are applicable to calculating amortization as well as depreciation.

How is D&A connected to Fixed Assets?

Fixed assets are tangible assets that are expected to be in the company’s ownership for the long term. Such assets include buildings, factories, machinery, vehicles, etc. These are the opposite of current assets (inventory, cash, accounts receivable etc.), which remain in the company’s possession for less than a year.

D&A affects fixed assets through the Depreciation component. This is visible in the Balance Sheet when recoding the Net Book Value. In our example, by using the straight-line method, we calculated that the annual depreciation of the vehicle worth $30,000 is $3,000. If the asset has been in our possession for 2 years already, then in the Balance Sheet we will record its Net Book value as:

$30,000 – (2x$3,000) = $24,000

When using the activity-based method, this figure changes slightly:

$30,000 – (2x$3,600) = $22,800

Higher D&A leads to lower fixed assets unless investments in fixed assets are made. Therefore, by looking at those two metrics over time, we can deduce:

- If the company is growing. In this case, fixed assets are growing even though there is a high D&A. This means that new investment is higher than depreciation, hence the productive capacity of the firm grows.

- If the company is downsizing. In this case, fixed assets are being reduced closer to their salvage value every year as new investment is not made. Either that or investment is made but it is not enough to outweigh the depreciation of the company’s fixed assets.

What’s Next?

In conclusion, taking D&A and fixed assets together and comparing them to investment rates allows us to see if a firm is growing or downsizing.

While they give us valuable information, fixed assets and D&A are not the only measures that determine a company’s investment rate and growth. To learn how key analytic terms are used in business practice, enroll in the comprehensive Accounting and Financial Statement Analysis course.

Ready to take the next step toward a career in Finance?

Our team of industry experts has designed a Financial Analyst Career Track that gives you valuable insights into fundamental financial techniques you can explore at your own pace. Enhance your knowledge through a series of video lessons with tons of practical examples and earn a certificate of completion. Start your financial analyst journey today!