Financial Ratio Analysis- Different DSO, DIO, DPO calculation

Hi Antoniya,

Thanks for your great lesson. I have question right now.

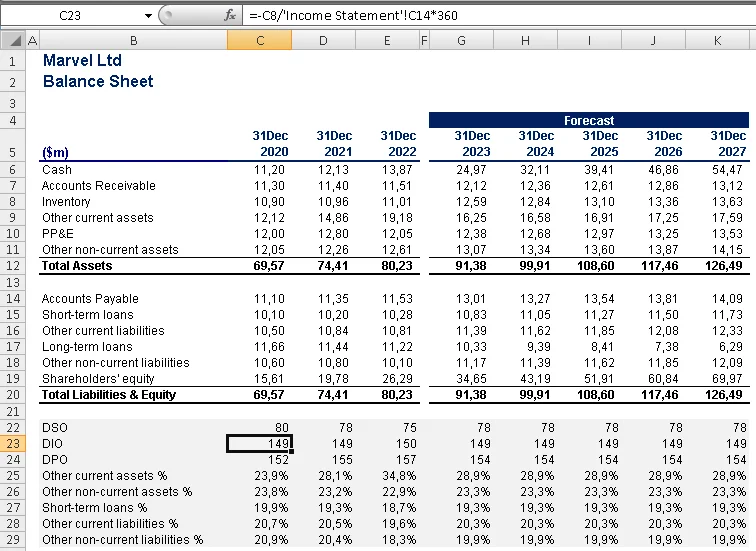

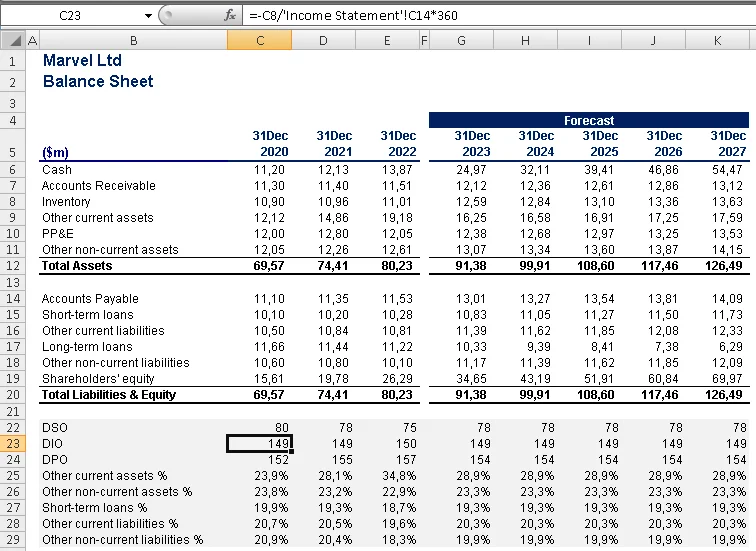

In Building a 3 Statement Model in Excel lesson with Ned as a teacher, he used the DIO, DPO, and DSO without using turnover ratio on those formula. This picture below was using in balance sheet forecasting in that lesson.

When i was doing the practice exam in the end of this chapter, I tried to use Ned formula and your formula. The result was different. I still don't understand this different.

Could you explain this to me?

Thank you for your attention

Best regards,

Muhammad Oktavi Zikra

Thanks for your great lesson. I have question right now.

In Building a 3 Statement Model in Excel lesson with Ned as a teacher, he used the DIO, DPO, and DSO without using turnover ratio on those formula. This picture below was using in balance sheet forecasting in that lesson.

When i was doing the practice exam in the end of this chapter, I tried to use Ned formula and your formula. The result was different. I still don't understand this different.

Could you explain this to me?

Thank you for your attention

Best regards,

Muhammad Oktavi Zikra

1 answers ( 0 marked as helpful)

Hi Muhammad,

that's right, slightly different formulas are used in the two courses. This often happens in reality - companies might use variations of the same formula, so it's really important to understand the calculations.

In Ned's course, we use a more simple version of DSO, DPO, and DIO, where you take AR, AP, or Inventory for the respective year.

In the Financial Ratios course, on the other hand, we take the average accounts receivable for two consecutive years so that we smooth the balance deviations.

Both approaches are correct. Your choice will depend on whether you need more simplistic or accurate calculations.

I hope this makes sense. Please let me know if you need more help on the topic. This was a really good question, thank you for it!

Best,

Antoniya

that's right, slightly different formulas are used in the two courses. This often happens in reality - companies might use variations of the same formula, so it's really important to understand the calculations.

In Ned's course, we use a more simple version of DSO, DPO, and DIO, where you take AR, AP, or Inventory for the respective year.

In the Financial Ratios course, on the other hand, we take the average accounts receivable for two consecutive years so that we smooth the balance deviations.

Both approaches are correct. Your choice will depend on whether you need more simplistic or accurate calculations.

I hope this makes sense. Please let me know if you need more help on the topic. This was a really good question, thank you for it!

Best,

Antoniya