What’s the Difference Between Nominal GDP and Real GDP?

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for Free

The Gross Domestic Product is solely based on market values, which makes it as volatile as the general price level changes over time. Considering the tremendous impact inflation has on the GDP figure, economists have started using two variations of GDP measures – nominal GDP and real GDP.

What is Nominal GDP?

The nominal GDP is the sum of all current-year goods and services, measured at current-year price levels. So,the nominal GDP is equal to current-year prices times the quantity produced in the current year:

Nominal~GDPt = Pt × Qt

Therefore, the nominal GDP is highly dependent on market price changes, or the level of inflation. In other words, it is composed of actual economic growth (change in quantity) and inflation growth (change in price).

t = Current year

b = Base year

Pt = Prices in year t

Pb = Prices in base year

Qt = Quantity produced in year t

What is Real GDP?

Real GDP is an inflation-corrected GDP measure that takes the sum of all goods and services produced in a current year, measured at base-year prices. A base year is the first year in a series of annual periods, used to measure an economic or financial index. Once you pick up a base year, you take the prices in that period and then measure the quantity of goods and services produced in the economy in the current year, using the prices observed in the base year. These prices are constant and hence unaffected by inflation changes over time. So, the real GDP equals the prices at a base year, times the quantity produced in the current year:

Real~GDPt = Pb × Qt

It measures the actual increase in physical output rather than the changes of output in monetary terms.

What if the current year and the base year coincided? In this case, current-year prices would be equal to the base-year prices, making the nominal GDP be the same as the real GDP.

Nominal GDP vs. Real GDP: Comparison

It is important to understand fully the difference between nominal and real GDP. The former is based on current prices, while the latter is an inflation-corrected measure, calculated at base-year prices. The real GDP examines the actual value of goods and services produced, excluding inflation. It measures the true economic growth in the country, unaffected by price level changes. Using nominal GDP, on the other hand, does not allow us to compare the economic growth over time or across countries, because it is not clear how much of this growth is due to inflation and what part is owed to actual growth. It is simply an indicator of the total growth plus the inflation rate in a given country. Thus, one may conclude that the real GDP reflects better the economic growth of a country.

What is the GDP Deflator?

The GDP deflator is an indication of the inflation within an economy – it starts out as 100, a conceptual measure of price levels at base year. Then, it reflects the value of all newly produced goods and services at current-year prices. The GDP deflator for a given year is equal to the nominal GDP in a year, divided by the value of the current year output at base-year prices (the real GDP), multiplied by 100.

GDP~Deflator = \frac{Nominal~GDP}{Real~GDP}\times100Example

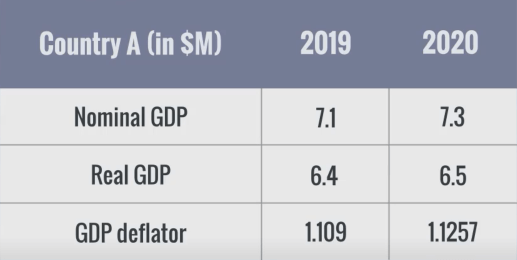

Suppose that the nominal GDP of Country A is 7.3 million dollars in 2020. If we know that the GDP deflator is 1.1257, we can easily calculate the real GDP as the nominal value over the GDP deflator. This is 7.3 million dollars over the 1.1257, which gives us a real GDP of 6.5 million dollars.

Alternatively, we may want to find the implicit price deflator in a given year. If we know the values of nominal and real GDP for 2019, we can calculate the GDP deflator.

Generally speaking, a deflator ratio higher than one corresponds to a nominal GDP that is higher than the real GDP, hence the positive inflation. When the deflator is less than one, or the nominal GDP is lower than the real GDP, we have had deflation over the given period.

What is Real GDP per Capita?

The real GDP per capita measures the total economic output of a country divided by the number of people living in that country and adjusted for inflation.

It is a valuable source of information that is used when comparing the standard of living of people residing in a given country. This is one of the main factors when assessing the economic development of a nation. Evidently, there are other influencing drivers, such as infrastructure, healthcare, security, and the educational system that also contribute to the standard of living in a region, but we won’t discuss those now.

Key Takeaways

- Nominal GDP takes inflation into account, and real GDP doesn’t.

- To convert between the two, one can use the GDP deflator.

- The real GDP per capita measure helps to compare the real growth of different countries

The Gross Domestic Product is one of the most important concepts of macroeconomics. To find out more about it, read our articles on calculating GDP using the expenditure approach and the income approach.

Author: Antoniya Baltova, FCCA