Profit Centers/Cost Centers Classification Guide

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for Free

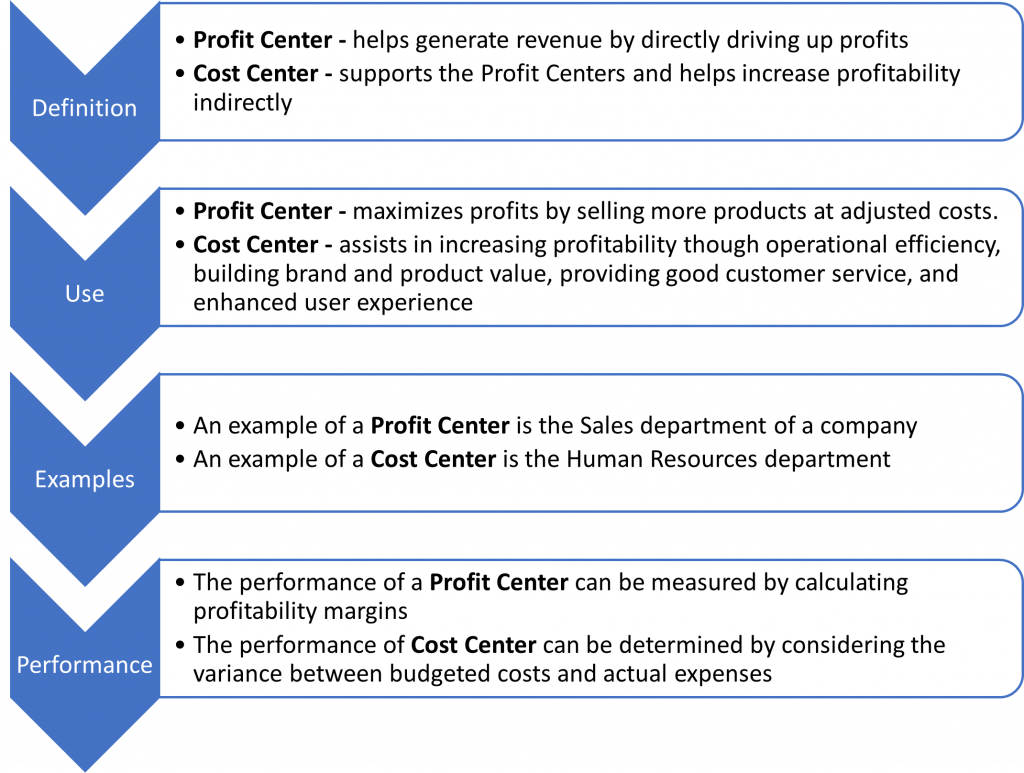

It is standard business practice to distinguish between profit- and cost-generating units. In that sense, classifying departments as either Profit Centers or Cost Centers is an entry-level insight that has far-reaching implications. It allows CFOs and financial managers to make better strategic decisions. Once you’ve gained a solid understanding of these two concepts, you will be one step closer to seizing the decision-making levers within your organization.

What is a Profit Center?

A Profit Center is a department of the company that not only adds to its Expenses but helps generate significant Revenue. Its activities should result in Net Profits. Each Profit Center within an organization operates more or less separately and has its own Revenue and Expenses.

In general, there are two types of Profit Centers:

- A profit-making unit within an organization. For example, the Sales Department of a company.

- A subsidiary firm in a large international conglomerate. In expansive corporations, a Profit Center would be a profitable auxiliary business.

Why are Profit Centers Important?

Profit Centers have a direct influence on essential business metrics and operations:

- Profitability: Profit Centers are involved in generating revenues and hence directly contribute to increasing profitability.

- Profit Margins: By analyzing the performance of profit centers, managers can adjust pricing and operating expenses to generate economies of scale.

- Budgetary Control: Manager often benchmark the results of Profit Centers against planned budgets. They then address any deviations from revenue targets and projected costs. The goal is to manage expectations, project variability, and rectify any steps that didn’t produce the desired effect.

- Investment: Profit Centers help determine if investment decisions are profitable or not. They are convenient for calculating potential returns.

- Capital Budgeting: Analysts look at past performance and future growth potential to budget capital properly. This helps them allocate scarce resources judiciously and effectively.

Even though Profit Centers are directly involved in so many core business operations they still can’t function in total isolation. They need supporting structures, and this is where Cost Centers come in.

What is a Cost Center?

Any division of the organization that does not directly contribute to Net Profits but still generates costs while assisting key operations. All support departments are thus classified as Cost Centers.

Similar to Profit Centers, there are 2 types of Cost Centers:

- Production Cost Centers: Divisions indirectly involved in the in the manufacturing or distribution process. For example, the packaging department of an FMCG company can be considered a Cost Center.

- Service Cost Centers: Units that deal with marketing, brand reputation, and customer support. Or ones that have to do with internal affairs – accounting team, legal, HR.

Cost Centers function best in cooperation with other divisions and departments. Some cost centers like Human Resources work with every department of the company and support multiple processes. The larger the company, the more and better-integrated Cost Centers it will have.

Why are Cost Centers important?

Unlike Profit Centers, it is not as straightforward to determine the efficacy of a Cost Center. To do that, analysts often resort to variance analysis. What we mean by variance analysis is comparing the difference between the budgeted and actual costs incurred by the Center:

Performance of Cost Center = Actual Costs – Budgeted Costs

To reduce its costs and drive up profits what the cost center must do is work towards greater operational efficiency. For example, optimizing customer service solutions empowers retention and increases product value, which in turn translates to bolstered brand reputation and ultimately higher sales.

Profit Centers vs Cost Centers

Profit Centers may be part and parcel of revenue generation, but Cost Centers are just as integral to the smooth running of the company. No business can run efficiently without proper coordination between profit- and cost-making units.

What’s Next?

In conclusion, the seamless coordination and operation of Profit Centers and Cost Centers ensure that business run smoothly and at scale. Consequently, monitoring and optimizing the various sub-units of a company is a top-tier qualification that often leads to senior management and CFO positions. Learn how you can advance to such heights with our beginner-to-advanced Corporate Finance Course.

Ready to take the next step towards a career in Finance?

From foundational topics in Accounting and Financial Analysis, through Corporate Finance and M&A, to specialized Fintech and Economics courses, the 365 Financial Analyst curriculum is designed to prepare you for the world of Finance as it is today. Whether you are a total beginner or a working professional, our expert-led courses offer the opportunity to upskill at your own pace. Find the right fit for you and start learning today!