The Industry Life Cycle Model Explained

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for Free

Having a good idea of what to expect when starting and maintaining a business can make a huge difference in organizational health and can enable entrepreneurs to craft a winning strategy for their company’s success. Even if a professional is already knee-deep in business ownership, knowledge of its current standing in terms of the typical industry life cycle can be invaluable. Read on to find out more about what to expect when analyzing the stages of company growth.

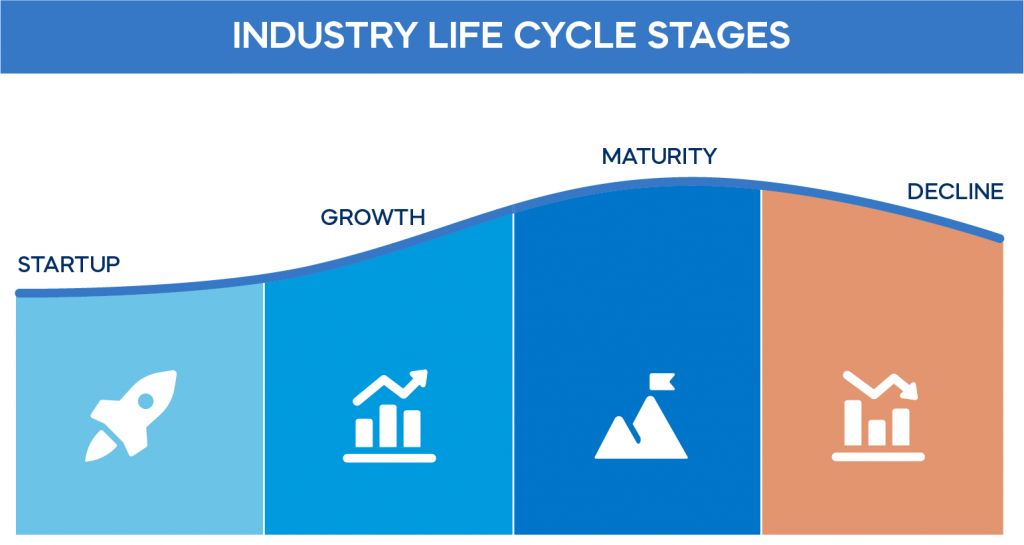

Industry life cycle model

The industry life cycle model is characterized by four stages:

- Startup or introductory phase – companies first enter the market; a new industry is born

- Growth – their revenue begins to stabilize; typically when M&A’s occur

- Maturity – product differentiation, evening out of costs and revenues, monopolization

- Decline –

Startup

This phase includes the business owner presenting the innovation they had in mind to the public and gauging interest. It’s also been called the “introduction” phase. Many businesses fail in this phase of the cycle, due to inadequate market research, lack of funding, or other issues.

This is true of whole emerging industries, as well as individual businesses. In the infancy of any industry, you will always find a technological breakthrough – a solo entrepreneur, a startup, or a small company that managed to come up with an innovation that set the industry life cycle in motion.

In 1998, four businessmen had the idea to start an online payment service, and they began developing and funding their idea. They met with investors, developed their programming, and gauged public interest in their proposed service. This idea later turned into a company called Paypal. In 1998 Paypal was still a startup, and FinTech as a whole was just emerging.

Growth

During the growth phase, the public might begin to understand their need for the product or service in question. Thus, demand begins to grow, sales speed up, and revenue becomes more predictable.

As more competitors enter the market with similar products or services, companies need to invest a substantial amount of resources to grow the business and reach even more consumers.

This is the phase where companies start to grow geographically as well. They may decide to expand to new geographic locations and even start operating at a multinational level. Companies aim to expand their market share and win as many first-time buyers as they can.

Experts have noted that (if applicable) a merger or acquisition is typically conducted during this phase. It can be beneficial to the business owner to hand over operations, but at the same time selling the assets of the business at this point can be a risk to future success, as well as a case of missing out on the monetary benefits of future growth.

Soon after the Paypal founders had developed and created their service, they formed an agreement with eBay to provide payment services to their customers. As competition arose, they merged with Elon Musk’s payment service, X.com. And thus, their growth stage was completed.

Maturity

The maturity phase is key to establishing the health of an organization. Within this phase of the industry life cycle, many operations and functions will become more predictable. An ‘evening out’ of costs and sales will occur, causing operations specialists to capitalize upon the predictability of certain functions, and iron out more efficient and cost-saving procedures.

The maturity stage is characterized by a high level of competition, and companies try to do their best to keep their market share intact. This is when firms start differentiating their products even more and concentrate on specific market niches.

One main goal during this phase tends to be monopolization. With its newfound stability, a business can offer competitive prices and beat out or buy up any competitors that might threaten their position as number one.

As Paypal became more widely used, they went public and offered shares of their company to investors. Their revenue evened out, and their operations became more predictable than they were in the growth phase.

Decline

Up to this point, we can draw a clear parallel between a successful company’s development and the development of the relevant industry. But decline happens when businesses are no longer in step with technological innovations in their area of operations. This is why we refer to the concept as industry life cycle – its beginning is its end; both happen due to innovation.

The decline phase can be difficult for many business owners to accept. It takes a clear view of reality and a desire for excellence to recognize when a business is no longer relevant and profitable to pour resources into. Even if this phase is inevitable, it can be drawn out over a long period of time with the experimentation of different business strategies and the introduction of new goods and services.

Many professionals choose to branch out and stray away from the business’s core competencies during this phase, in a last-ditch effort to continue in a successful path. Diversification can certainly prove helpful during this phase to accrue revenue from different sources, but this won’t work for every organization.

Whether the business owner chooses to accept or deny this phase, it is inevitable. All industries, products, and services will eventually become irrelevant in light of alternate innovations, and it is best for the entrepreneur to expect and work with this reality of the business world in mind.

In 2002, PayPal was sold to eBay and became part of a bigger corporation. This signaled the decline of PayPal as its own entity, but it continues to be used in other forms as an online payment system. The more permanent decline phase of PayPal might be delayed for now, as it is still the most valuable company in its industry.

What’s Next?

If you’re looking for the best next step for your business, it can be helpful to understand where it lies on the continuum of these various life cycle stages. After you’ve gathered where your company is at, and identified what stage it’s headed towards, it can be helpful to develop plans based on your current position in the life cycle continuum.

If you want to learn to capitalize on your organization’s position, our Business Fundamentals Course is the perfect place to start. It provides professionals with strategies and knowledge to implement in order to thrive as a corporation.

Ready to take the next step towards a career in Finance?

From foundational topics in Accounting and Financial Analysis, through Corporate Finance and M&A, to specialized Fintech and Economics courses, the 365 Financial Analyst curriculum is designed to prepare you for the world of Finance as it is today. Whether you are a total beginner or a working professional, our expert-led courses offer the opportunity to upskill at your own pace. Find the right fit for you and start learning today!