Inventory Valuation Methods: LIFO vs FIFO vs WAVCO

Inventory valuation methods like LIFO vs FIFO and WAVCO play a crucial role in how companies report their assets and costs. These techniques affect the calculation of the cost of goods sold and, consequently, a company’s overall financial health. Understanding these differences is essential for accurate financial reporting and strategic decision-making.

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for FreeInventory is one of the most critical assets in a company’s statement of financial position. It primarily includes raw materials, work-in-progress, finished goods, and spare parts. Inventory valuation methods—such as Last In, First Out (LIFO) and First In, First Out (FIFO)—significantly influence Firms’ stock valuation and directly impact the costs of goods sold. Consequently, the choice between LIFO vs FIFO in inventory valuation also affects the statement of comprehensive income.

In general, companies can choose between four inventory costing methods:

- First-In, First-Out (FIFO)

- Last-In, First-Out (LIFO)

- Weighted Average Cost (WAVCO)

- Specific Identification

1. First-In, First-Out (FIFO)

Under the FIFO method in the LIFO vs FIFO comparison, we assume that firms use stock in the order it’s received from suppliers. The items acquired first are the ones to be utilized or sold first. So, whatever is left in a company’s warehouse will be the last purchased goods at current prices.

Suppose Vintage Co. (a furniture manufacturer) buys and stores wood components weekly, with prices fluctuating due to market supply and demand.

In the current financial year, a batch of fiberboard—commonly used in furniture manufacturing—costs $10 in Week 1. In Week 2, it rises to $13. And in Week 3, the price is $11 per item. With several ups and downs, a batch of wooden boards goes up to $14 in Week 52—the last working week in December.

Over the past 12 months, Vintage Co. has used some raw materials in furniture production. Now, the accounting department needs to know the inventory value remaining in the warehouse as of December 31. What’s the total cost of the wooden components left unsold?

According to FIFO, the fiberboards that cost $10 (those purchased in Week 1) would be used in production first for as long as they last. Only after the firm empties that batch will it utilize the ones purchased for $13 (in Week 2).

The last purchased assets stay in the warehouse until the initially purchased quantities are depleted. Assuming the only inventory left in store as of December 31 was bought in Week 52, Vintage’s stock value at year-end would be $14 per batch of fiberboard.

2. Last-In, First-Out (LIFO)

In the LIFO vs FIFO comparison, the LIFO approach assumes that the items acquired last are the first to be utilized. As a result, the components used in production are part of the most recent delivery, and inventory in the warehouse corresponds to the oldest receipts. Unlike the chronological nature of FIFO, the LIFO method always looks backward.

If Vintage Co. applied the LIFO approach to value inventory, it would assume that the production line first used up the inventory bought in Week 52, then in Week 51, and so on. Provided all inventory items that remained unsold as of December 31 had been bought in Week 1, Vintage’s inventory value at year-end would have been $10 per batch of fiberboards.

3. Weighted Average Cost (WAVCO)

In the context of LIFO vs FIFO, some companies may value their inventory at a weighted average cost. Since the purchase prices of raw materials typically change with each new consignment. It makes sense that the cost of each component held at any moment equals the average price of all items bought.

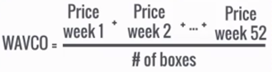

In the context of Vintage Co., the firm should estimate the average cost of purchasing wooden boards in Weeks 1, 2, and 3, up to 52, and assign an average value to the items sold, used, or remaining in inventory balance. The following formula can be used to calculate the average cost of fiberboard.

4. Specific Identification Method

In the LIFO vs FIFO discussion, the specific identification method matches each unit sold to its actual price. It requires companies to keep track of the individual prices of all items bought, which might prove impractical for businesses buying and selling various types of products.

Vintage Co. will find it costly and cumbersome to estimate the cost of each fiberboard, piece of metal, or plastic used in the production process separately.

Choosing the Right Inventory Valuation Method

Choosing an inventory valuation method is more than just an accounting formality. In the context of LIFO vs FIFO, it helps companies to estimate the value at which they will report stock in their books and to achieve a fair and reasonable representation of a firm’s performance. Essentially, you must remember that there is diversity in how financial reporting standards work with these approaches.

The main difference between International Financial Reporting Standards (IFRS) and US Generally Accepted Accounting Principles (GAAP) is that IFRS does not allow the LIFO method. Although it may manipulate a firm’s profitability, the LIFO method may be suitable for large-scale businesses whose rising costs may reduce taxes.

On the other hand, FIFO —an inventory valuation method—is a good option for firms that trade with short shelf-life products—such as fruits and vegetables—to meet the need to sell the oldest items first. It’s also a recommended approach for industries with stable product costs.

The WAVCO technique works best for industries with fluctuating product costs. Cost averaging will likely be the most effective method when a firm has stock that cannot be easily itemized—such as natural rubber.

The specific identification method is far more appropriate for entities whose products are not interchangeable or those with a serial number. For example, an art gallery will use this approach because each masterpiece’s value differs.

Inventory Valuation Methods and Insights

Even though companies can choose among these cost valuation techniques—such as LIFO vs FIFO—purchased inventory value often changes due to market factors. You must know the Lower of Cost or Net Realizable Value (LCNRV) rule.

Understanding inventory valuation methods helps ensure that inventory is not overvalued on the financial statements when market prices decline. The 365 Financial Analyst program can provide in-depth training and practical examples to help you master this and other valuation techniques—enhancing your ability to make informed financial decisions for your company.