Technical Analysis

Unlock the power of technical analysis: Learn to spot market trends and make smart trading decisions

Start for Free

Start for Free

What you get:

- 1 hour of content

- 15 Interactive exercises

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

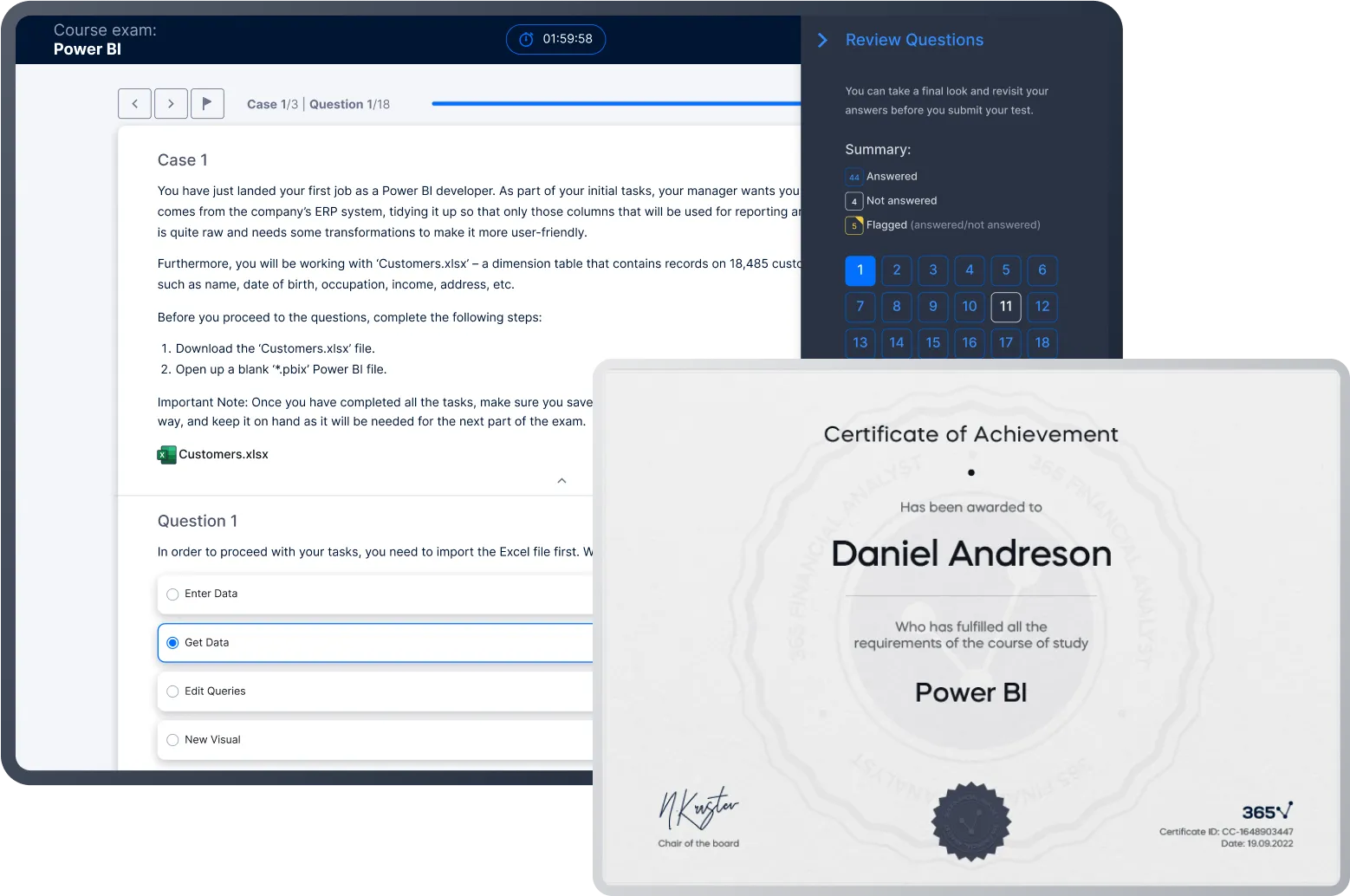

- Course exam

- Certificate of achievement

Technical Analysis

Start for Free

Start for Free

What you get:

- 1 hour of content

- 15 Interactive exercises

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

$99.00

Lifetime access

Start for Free

Start for Free

What you get:

- 1 hour of content

- 15 Interactive exercises

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

What You Learn

- Develop an in-depth understanding of the core principles and underlying assumptions of technical analysis

- Learn to interpret different chart patterns through the lens of behavioral finance and understand how investor psychology influences market movements

- Create successful trading strategies based on technical indicators to capitalize on market trends

- Explore how bonds, stocks, currencies, and commodities interact through the lens of technical analysis

- Explore common technical analysis indicators and their practical application

- Grasp how technical analysts use market cycles to boost their trading performance

Top Choice of Leading Companies Worldwide

Industry leaders and professionals globally rely on this top-rated course to enhance their skills.

Course Description

Learn for Free

1.1 Course Introduction

2 min

1.2 Technical Analysis - Principles, Applications, Assumptions

3 min

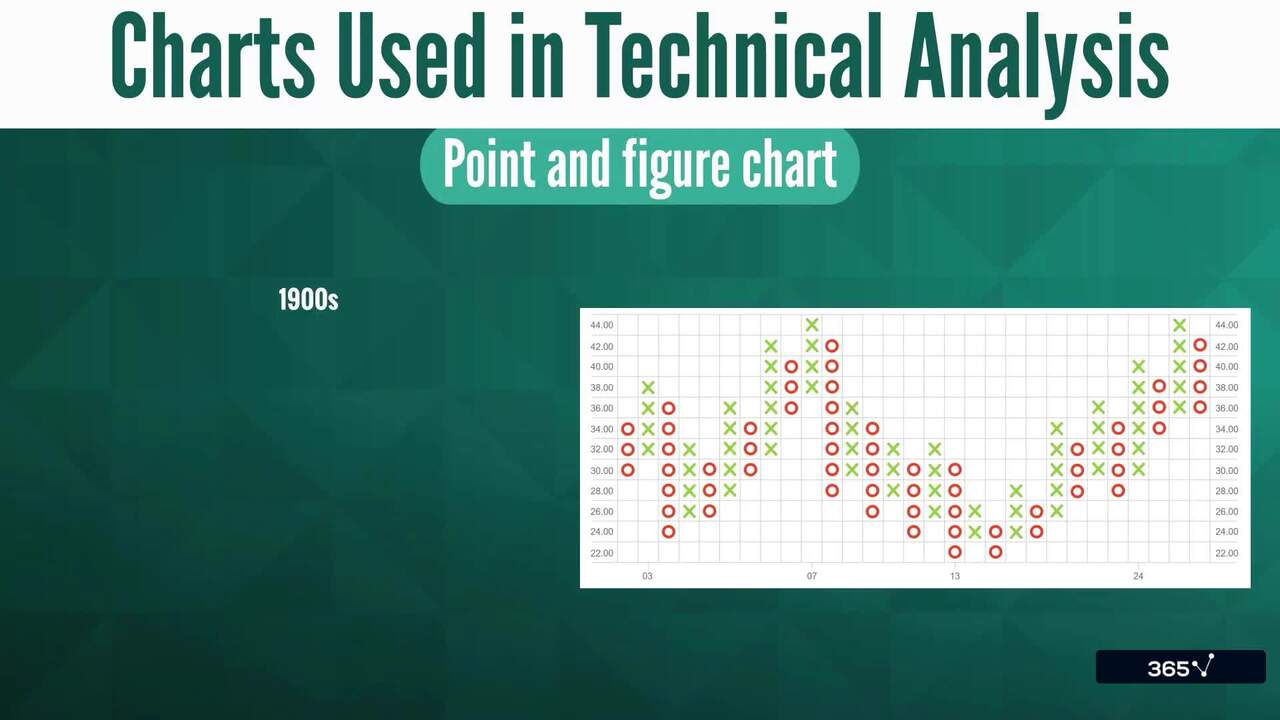

1.3 Charts Used in Technical Analysis

6 min

1.4 Other Tools Used in Technical Analysis

2 min

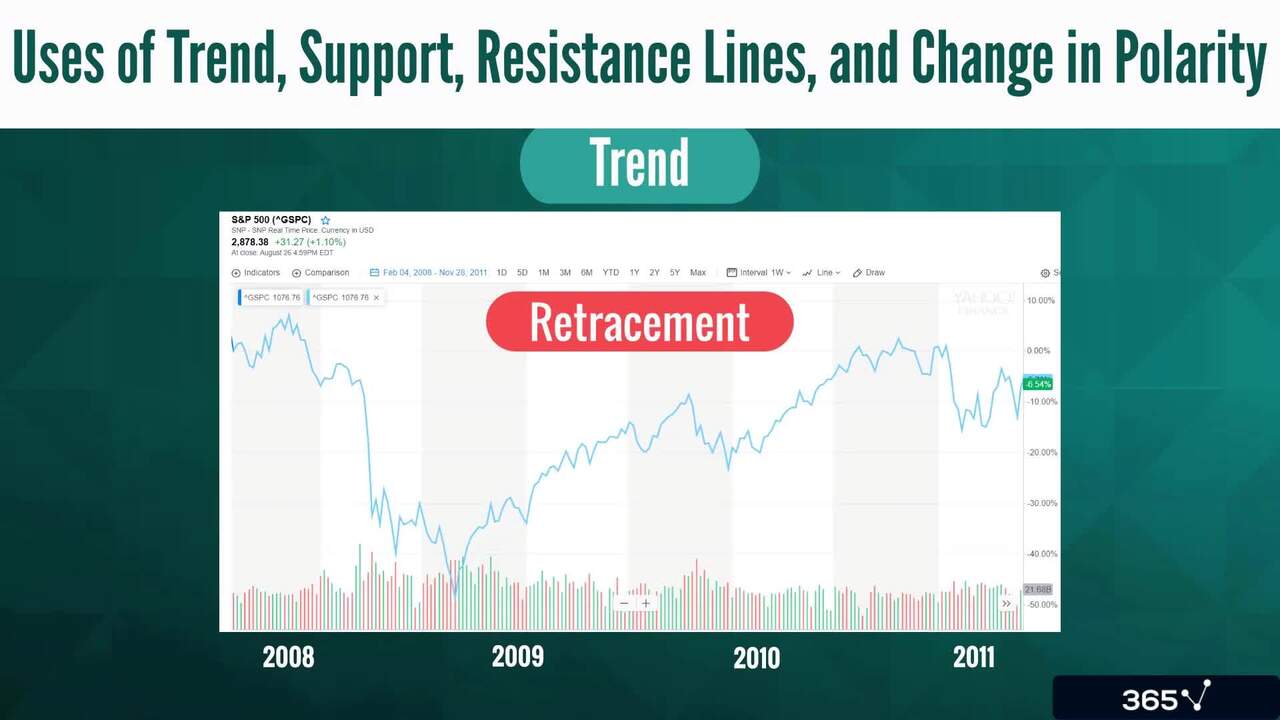

1.6 Trend, Support and Resistance Lines

4 min

1.7 Common Chart Patterns

4 min

Curriculum

Topics

Course Requirements

- No prior experience or knowledge is required. We will start from the basics and gradually build your understanding. Everything you need is included in the course

Who Should Take This Course?

Level of difficulty: Intermediate

- Aspiring traders

- Everyone who wants to invest funds in public markets and understand short-term performance

Exams and Certification

A 365 Financial Analyst Course Certificate is an excellent addition to your LinkedIn profile—demonstrating your expertise and willingness to go the extra mile to accomplish your goals.

Meet Your Instructor

Ivan is the COO of 365 Data Science and a CFA charterholder with over 12 years of professional experience in the financial sector. He earned his Master’s degree in Financial Economics from the Erasmus University of Rotterdam, the Netherlands in 2010 and has been fascinated by the world of artificial intelligence and machine learning ever since. Seeing how data science truly redefined the finance industry over the last decade, Ivan knew that he couldn’t stay on the sidelines. In 2019, he published his first online course on corporate finance, combining his expertise with his love of teaching. His goal is to establish 365 Data Science as the best learning platform for aspiring data professionals in the world.

What Our Learners Say

365 Financial Analyst Is Featured at

Our top-rated courses are trusted by business worldwide.