Portfolio Management

Master the Science of Portfolio Management: Learn Strategies to Optimize Investment Returns Within Your Desired Investment Horizon

Start for Free

Start for Free

What you get:

- 7 hours of content

- 115 Interactive exercises

- 36 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

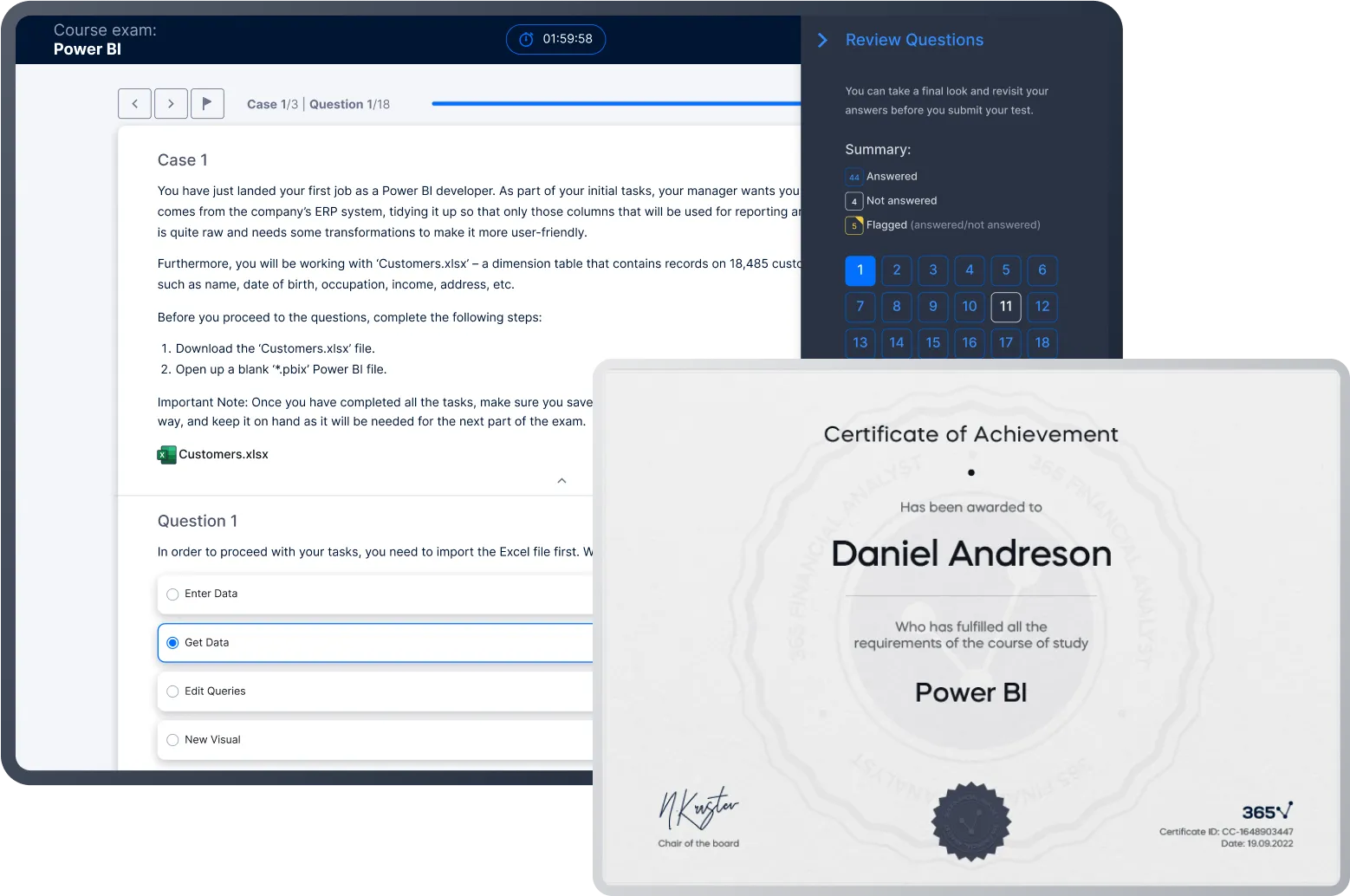

- Course exam

- Certificate of achievement

Portfolio Management

Start for Free

Start for Free

What you get:

- 7 hours of content

- 115 Interactive exercises

- 36 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

$99.00

Lifetime access

Start for Free

Start for Free

What you get:

- 7 hours of content

- 115 Interactive exercises

- 36 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

What You Learn

- Gain a comprehensive understanding of foundational and advanced portfolio management theory essential for effective investment decision-making

- Develop practical skills allowing you to build balanced portfolios that optimize the risk-return trade-off

- Leverage modern portfolio management theory, including models such as the Capital Asset Pricing Model, to determine the expected return on equity when investing in stocks

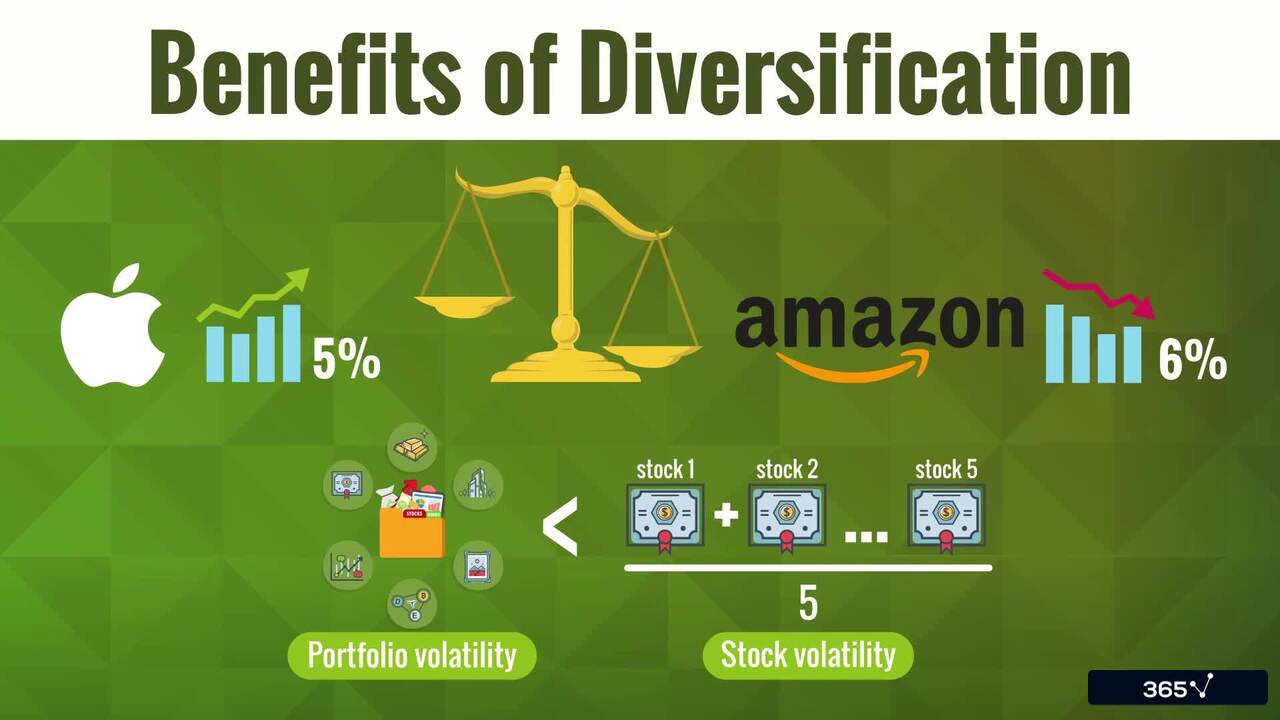

- Understand the critical role of investment diversification and learn how to compute asset and portfolio correlation to minimize portfolio risk

- Measure your investment portfolio's performance by competently calculating risk and return metrics

- Acquire essential technical skills for evaluating investment performance, including the computation of the Sharpe and Treynor ratios, M2, and Jensen’s alpha

Top Choice of Leading Companies Worldwide

Industry leaders and professionals globally rely on this top-rated course to enhance their skills.

Course Description

Learn for Free

1.1 Course Introduction

3 min

1.2 Portfolio Approach

5 min

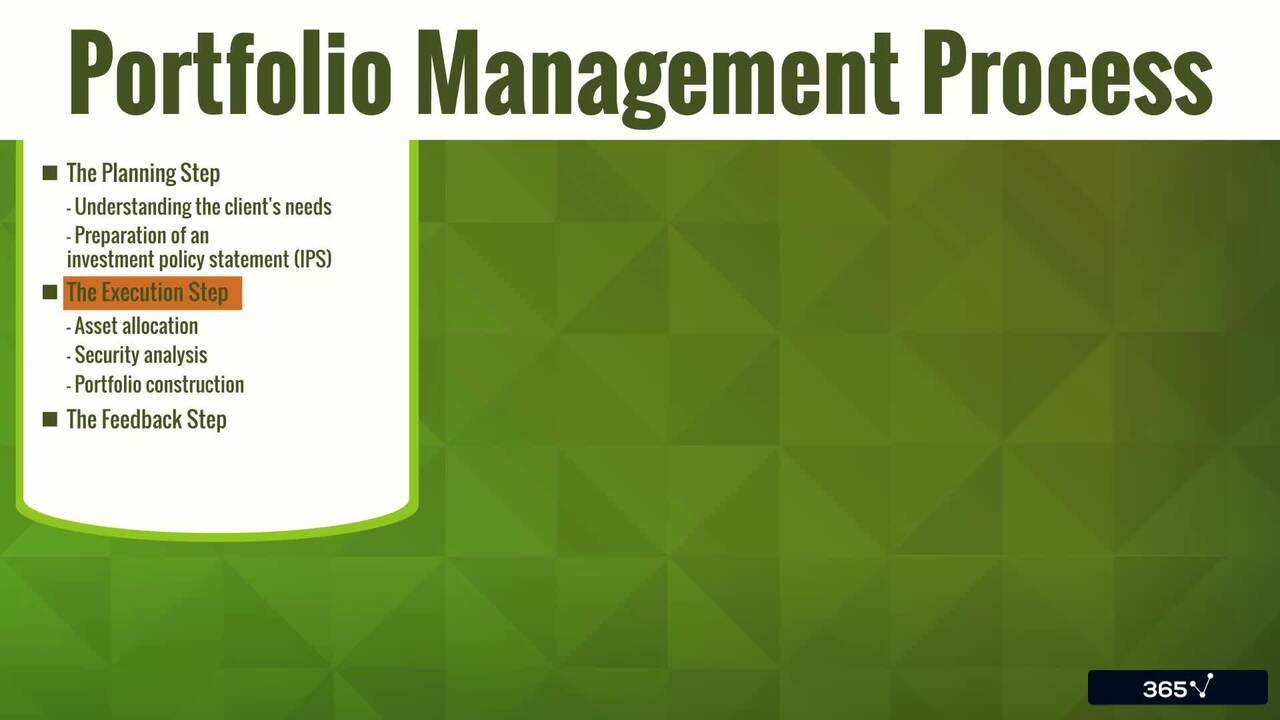

1.3 Portfolio Management Process

7 min

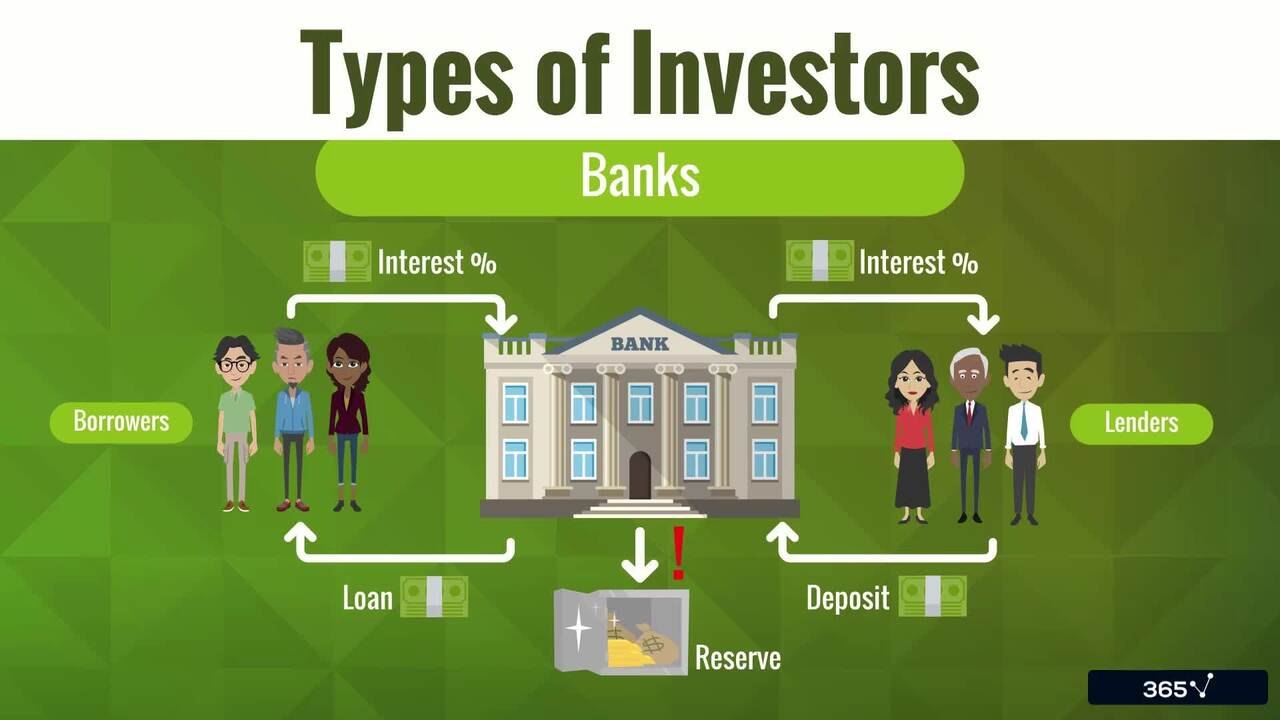

1.4 Types of Investors

7 min

1.5 DC and DB plans

6 min

1.7 The Asset management Industry

6 min

Curriculum

- 2. Portfolio Risk and Return (Part 1)28 Lessons 123 MinThis section of the Portfolio Management course covers the basics of the major return measures. We start with the calculations, then we highlight the key differences between them. The most important factors we need to consider when creating a portfolio are the risk and return of the individual assets. In this section, you will learn how to calculate and interpret the mean, variance, and covariance of asset returns. We also discuss the main types of investors and their risk-return preferences. Then, we delve deeper into the role of correlation in determining a portfolio’s risk. And finally, we describe the efficient frontier of risky assets and the global minimum-variance portfolio.Holding Period Return (HPR)5 minHow to download historical price data in Excel using Yahoo Finance3 minHow to format an Excel Spreadsheet1 minLog Return (Bonus)6 minArithmetic vs Geometric Mean Return3 minHow to calculate rates of return in Excel4 minMoney-weighted rate of return6 minTime-weighted rate of return4 minMoney-weighted vs time-weighted6 minAnnualized return3 minThe Effect of Fees, Taxes, Inflation and Leverage5 minMajor Asset Classes6 minHistorical vs Expected Returns4 minMean, Variance and Covariance of Asset Returns6 minVariance and Standard Deviation of Returns (Excel)2 minCovariance and Correlation between two assets (Excel)3 minRisk Aversion5 minRisk Aversion (Implications)9 minPortfolio Risk and Return4 minPortfolio Risk and Return (Excel)3 minThe Correlation Coefficient5 minInvestment Opportunity Set3 minMinimum-Variance Frontier3 minMinimum-Variance Frontier (Excel)5 minCapital Allocation Line6 minOptimal Risky Portfolio (Excel)4 minCapital Allocation Line (Excel)6 minOptimal Investor Portfolio3 min

- 3. Practical Example8 Lessons 36 MinTo earn a portfolio management certificate, you need not only theoretical knowledge but practical experience as well. So, in this section, we calculate the risk and return of a five-asset portfolio in Excel. Then, using matrix algebra and the Markowitz optimization process, we find the minimum variance and optimal risky portfolio.Introduction6 minWhat is a matrix?3 minScalars and vectors3 minThe Transpose of Vectors and Matrices3 minDot product7 minPortfolio Variance (Multi-Asset Case)3 minVariance-Covariance Matrix6 minOptimal Risky Portfolio5 min

- 4. Portfolio Risk and Return (Part 2)14 Lessons 71 MinOur goal in this section of the Portfolio Management training is to identify the optimal risky portfolio by using the Capital Asset Pricing Model. We lay the foundations by discussing the consequences of combining a risk-free asset with the market portfolio and some key concepts to help you see the big picture. Then, we explain the differences between Capital Allocation Line and Capital Market Line. We decompose total risk into systematic and nonsystematic risk and discuss their characteristics. After building the necessary theoretical background, we calculate the expected return of an asset. Finally, we examine the security market line and its applications and cover some of the most popular measures for evaluating the performance of a portfolio.Two-fund Separation Theorem4 minSystematic vs. Unsystematic Risk4 minReturn-generating Models7 minCalculate and Interpret Beta5 minRegression analysis3 minCalculate Beta in Excel11 minCapital Asset Pricing Model (CAPM)6 minSecurity Market Line (SML)4 minExpected Return (CAPM)4 minCAPM (Applications)4 minSharpe Ratio and M2 Ratio4 minTreynor Ratio and Jensen’s Alpha5 minPerformance Measures (Example)5 minPerformance Measures (Excel)5 min

- 5. Basics of Portfolio Planning and Construction9 Lessons 41 MinIn this section, we study investment policy statements from a practical perspective. First, we discuss the importance of written statements and break down the concept into its constituent parts. We move on to the investor’s risk and return objectives, the difference between the ability and willingness to take risks, and the resulting investment and portfolio management constraints. Next, we examine the various asset classes and their role in strategic asset allocation. Lastly, we describe the principles of portfolio construction and the extent of ESG integration into the investment processes.Investment Policy Statement (IPS)3 minIPS Components6 minRisk and Return Objectives4 minWillingness vs. Ability to take risk5 minInvestment Constraints4 minAsset Allocation4 minPortfolio Construction (Principles)3 minTactical Asset Allocation6 minESG Investing6 min

- 6. Introduction to Risk Management9 Lessons 20 MinAfter the 2008 financial crisis and the 2001 Enron scandal, risk management became an integral part of the decision-making process of investors and companies. In the last section of the Portfolio Management training, we discuss the definitions and elements of effective risk management, governance, and budgeting. Next, we examine the differences and interactions between financial and non-financial sources of risk. At the end of the Portfolio Management course, we present the ways of modifying risk exposures.Risk Management (Definition)2 minThe Risk Governance Process1 minRisk Tolerance2 minRisk Budgeting2 minFinancial and Non-financial Sources of Risk5 minRisk Measures (Part 1)1 minRisk Measures (Part 2)2 minSubjective and Market-based Risk Estimates2 minRisk Management Framework3 min

Topics

Course Requirements

- Highly recommended to take the Corporate Finance and Introduction to Equity Instruments courses first

Who Should Take This Course?

Level of difficulty: Intermediate

- Aspiring financial analysts, investment analysts, investment bankers, valuation experts

- Everyone who wants to work in investment finance

Exams and Certification

A 365 Financial Analyst Course Certificate is an excellent addition to your LinkedIn profile—demonstrating your expertise and willingness to go the extra mile to accomplish your goals.

Meet Your Instructor

Ivan is the COO of 365 Data Science and a CFA charterholder with over 12 years of professional experience in the financial sector. He earned his Master’s degree in Financial Economics from the Erasmus University of Rotterdam, the Netherlands in 2010 and has been fascinated by the world of artificial intelligence and machine learning ever since. Seeing how data science truly redefined the finance industry over the last decade, Ivan knew that he couldn’t stay on the sidelines. In 2019, he published his first online course on corporate finance, combining his expertise with his love of teaching. His goal is to establish 365 Data Science as the best learning platform for aspiring data professionals in the world.

What Our Learners Say

365 Financial Analyst Is Featured at

Our top-rated courses are trusted by business worldwide.