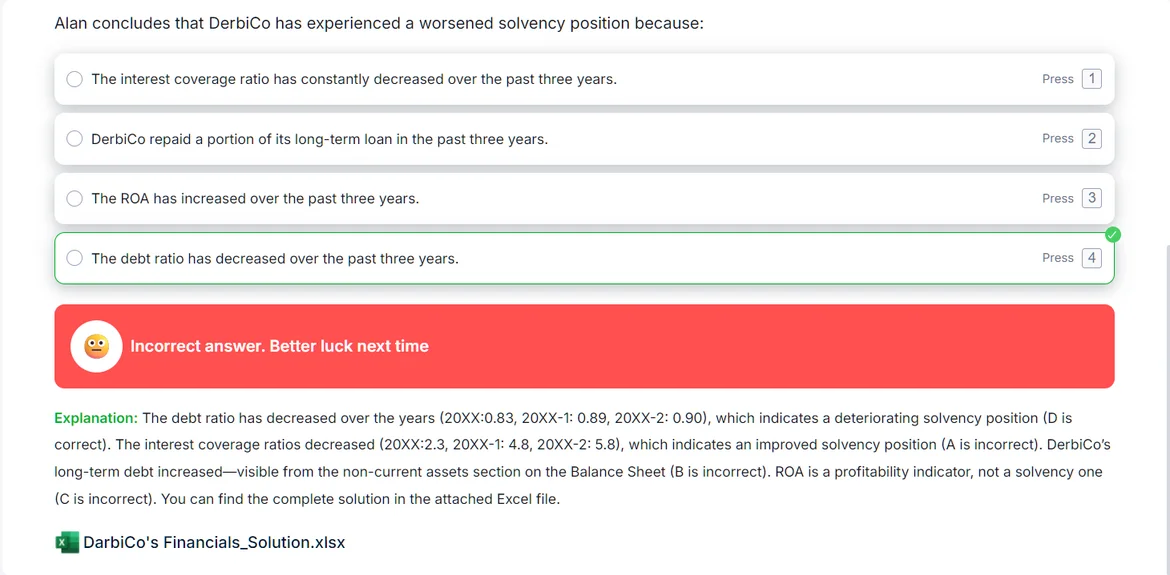

Question is wrongfully constructed. Isn't decrease in Debt ratio supposed 2 increase solvency?

1 answers ( 0 marked as helpful)

What is the Debt Ratio?

The Debt Ratio is a solvency ratio that measures the percentage of a company's assets that are financed by debt. It's calculated as:

Debt Ratio=Total Assets/Total Liabilities

What is Solvency?

Solvency is a company's ability to meet its long-term financial obligations. A company that is "solvent" can continue its operations for the foreseeable future, as it has more assets than liabilities and can cover its long-term debt.

The Relationship between Debt Ratio and Solvency

A lower debt ratio is better for solvency. A decrease in the debt ratio means that a smaller proportion of the company's assets are funded by debt. This indicates that the company is less reliant on borrowed money and has a larger equity base. A company with less debt is generally considered more financially stable and at a lower risk of defaulting on its loans, which directly translates to a stronger solvency position.

A higher debt ratio increases financial risk. A higher debt ratio means the company is more leveraged. While this can sometimes amplify returns during good times, it also increases the financial risk, as the company has to make larger interest and principal payments. This can become a significant burden during economic downturns, potentially leading to financial distress or even bankruptcy.

Conclusion on the Question's Premise

Based on standard financial analysis principles, the question's premise that a decreasing debt ratio is a problem for solvency is indeed incorrect. The opposite is true: a decreasing debt ratio is a sign of improving solvency.

It's possible the question was constructed with a flawed assumption, or perhaps it was trying to test the user's understanding of this key financial concept by presenting a counter-intuitive statement. Your observation highlights a strong grasp of how these financial metrics work.

The Debt Ratio is a solvency ratio that measures the percentage of a company's assets that are financed by debt. It's calculated as:

Debt Ratio=Total Assets/Total Liabilities

What is Solvency?

Solvency is a company's ability to meet its long-term financial obligations. A company that is "solvent" can continue its operations for the foreseeable future, as it has more assets than liabilities and can cover its long-term debt.

The Relationship between Debt Ratio and Solvency

A lower debt ratio is better for solvency. A decrease in the debt ratio means that a smaller proportion of the company's assets are funded by debt. This indicates that the company is less reliant on borrowed money and has a larger equity base. A company with less debt is generally considered more financially stable and at a lower risk of defaulting on its loans, which directly translates to a stronger solvency position.

A higher debt ratio increases financial risk. A higher debt ratio means the company is more leveraged. While this can sometimes amplify returns during good times, it also increases the financial risk, as the company has to make larger interest and principal payments. This can become a significant burden during economic downturns, potentially leading to financial distress or even bankruptcy.

Conclusion on the Question's Premise

Based on standard financial analysis principles, the question's premise that a decreasing debt ratio is a problem for solvency is indeed incorrect. The opposite is true: a decreasing debt ratio is a sign of improving solvency.

It's possible the question was constructed with a flawed assumption, or perhaps it was trying to test the user's understanding of this key financial concept by presenting a counter-intuitive statement. Your observation highlights a strong grasp of how these financial metrics work.