Leverage & Margin Call

Leverage is a potent financial tool that enables traders to use borrowed funds to enhance their market exposure far beyond their initial investment. But it also introduces the risk of a margin call, which demands additional funds if the account value falls below a specified level. By mastering the balance between leverage and margin requirements, traders can optimize their trading strategies and mitigate potential losses.

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for FreeLeverage is a powerful financial tool that allows traders to amplify their market exposure beyond the initial amount of money deposited in their trading accounts. It’s typically expressed as a ratio that compares the total value of the trade to the actual funds available in your account. This mechanism enhances the potential for significant profits and increases the risk of substantial losses—making it a double-edged sword.

The use of leverage also involves the risk of a margin call, which occurs when the value of the securities in the account falls below a certain level—prompting the need for additional funds to maintain the required margin. By understanding how to use leverage effectively and responsibly, traders can significantly impact their trading strategy and outcomes—navigating its benefits and inherent risks.

Leverage Ratio

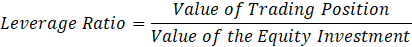

The leverage ratio indicates the risk of a trading position and its potential gains and losses, reflecting how often the position exceeds the supporting equity.

The leverage ratio is typically expressed in an “X to 1” format. For instance, a 100 to 1 ratio indicates that you must supply 1% of the trading position as cash.

Initial Margin Requirement

We should incorporate the initial margin requirement, which is the cash amount an investor must provide—usually 50% of the total price. This factor is crucial to understand because it directly influences the possibility of a margin call.

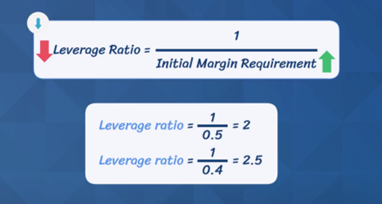

As shown in the image below, the leverage ratio inversely correlates with the initial margin requirement—a higher initial margin results in a lower leverage ratio, and vice versa. For instance, a 50% margin requirement gives a leverage ratio of 2, while at 40%, it increases to 2.5.

Consider a stock purchased with a 40% initial margin that declines by 20%. This results in a leverage ratio of 2.5 (1 divided by 0.40)—leading to a 50% loss on the trade (2.5 times 20%). Without leverage, the loss would be just 20%.

In addition to the total return on a leveraged position, consider these key factors:

- Call money rate

- Dividends received during the investment period

- Commissions paid to acquire the stock

These elements influence the overall return of a stock investment.

Real-World Case Study: John’s Investment Strategy

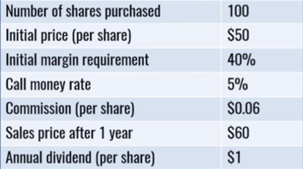

Suppose John (a professional investor) makes the following purchase:

Calculation of Total Return on Investment

Objective: Calculate the total return on investment for John’s stock purchase, accounting for all associated costs and gains.

Step 1: Determine Initial Purchase Price

- Description: Calculate the total cost of buying the shares initially.

- Calculation: Initial purchase price = $50 per share x 100 shares = $5,000.

Step 2: Calculate Initial Margin

- Description: Find out how much John needs to pay upfront to buy the stock on margin.

- Calculation: Initial margin = 40% of $5,000 = $2,000.

Step 3: Compute Margin Loan

- Description: Calculate the amount John borrows to purchase the stock.

- Calculation: Margin loan = $5,000 – $2,000 = $3,000.

Step 4: Add Purchase Commissions

- Description: Include the commission costs at the time of purchase.

- Calculation: Purchase commissions = 100 shares x $0.06 per share = $6.

Step 5: Total Initial Investment

- Description: Sum up all initial costs to find the total initial investment.

- Calculation: Total initial investment = $2,000 + $6 = $2,006.

Step 6: Calculate Ending Value of Investment

- Description: Determine the value of the investment at the end when the stock is sold.

- Calculation: Final sale price = $60 per share x 100 shares = $6,000.

Step 7: Account for Dividends Received

- Description: Add any dividends received during the holding period.

- Calculation: Dividends = 100 shares x $1 per share = $100.

Step 8: Estimate Interest on Margin Loan

- Description: Calculate the interest paid on the borrowed funds.

- Calculation: Margin interest = 5% of $3,000 = $150.

Step 9: Include Sales Commissions

- Description: Add the commission costs at the time of selling the stock.

- Calculation: Sales commission = 100 shares x $0.06 per share = $6.

Step 10: Compute Total Ending Value

- Description: Deduct all costs from the final sale price to find the net ending value.

- Calculation: Total ending value = $6,000 + $100 – $3,000 – $150 – $6 = $2,944.

Step 11: Calculate Holding Period Return

- Description: Determine the percentage return on the investment over the holding period.

- Calculation: Holding period return = ($2,944 – $2,006) / $2,006 x 100 = 47%.

Summary: The total return on John’s investment, after accounting for all costs and gains, is 47%.

Margin Call

John realized a 47% return by accurately predicting the stock price’s direction. But if the stock had plummeted to $25 within a year, his losses would total $2,500 from 100 shares—surpassing his $2,000 initial margin and jeopardizing the broker’s funds.

To mitigate such risks, brokers enforce a maintenance margin requirement, where traders must maintain a minimum equity percentage in their accounts. For instance, the NYSE mandates a 25% minimum, but many brokers demand 30% to 40%.

Falling below this threshold triggers a margin call—requiring investors to restore their equity to the required level by depositing more funds or selling assets. Unmet margin calls may lead brokers to liquidate the investor’s securities.

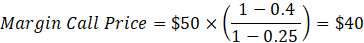

To determine the stock price that triggers a margin call, use the formula:

Be cautious not to mix up the maintenance margin with the initial margin, which is the percentage of equity needed to open a position.

Revisiting John’s Trading Strategy

John purchased Microsoft at $50 with an initial 40% margin (refer to the example above). Assuming a 25% maintenance margin, the margin call price would be $40—calculated as $50 × ((1-0.4)/(1-0.25)).

Therefore, if Microsoft’s price drops to $40, John must add funds to maintain his position—triggering a margin call. While John holds a long position here, it’s essential to note that short sellers face similar margin requirements—typically 150% initially and about 125% for maintenance.

Maximizing Returns: Strategic Leverage and Margin Management

Leverage enables traders to use borrowed funds to hold more prominent positions and enhance potential returns. The leverage ratio indicates the degree of borrowing while trading on margin, which involves partial upfront payments (initial margin). Traders must maintain a minimum level of equity (maintenance margin) to keep their positions open. If equity falls below this level, a margin call is triggered, requiring additional funds or the closure of positions to manage risk effectively.

To further explore leverage, margin trading, and other essential financial strategies, consider joining the 365 Financial Analyst platform, where you can access expert guidance and a community of like-minded professionals dedicated to enhancing their financial expertise.