What Are Defined-Contribution and Defined-Benefit Pension Plans?

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for Free

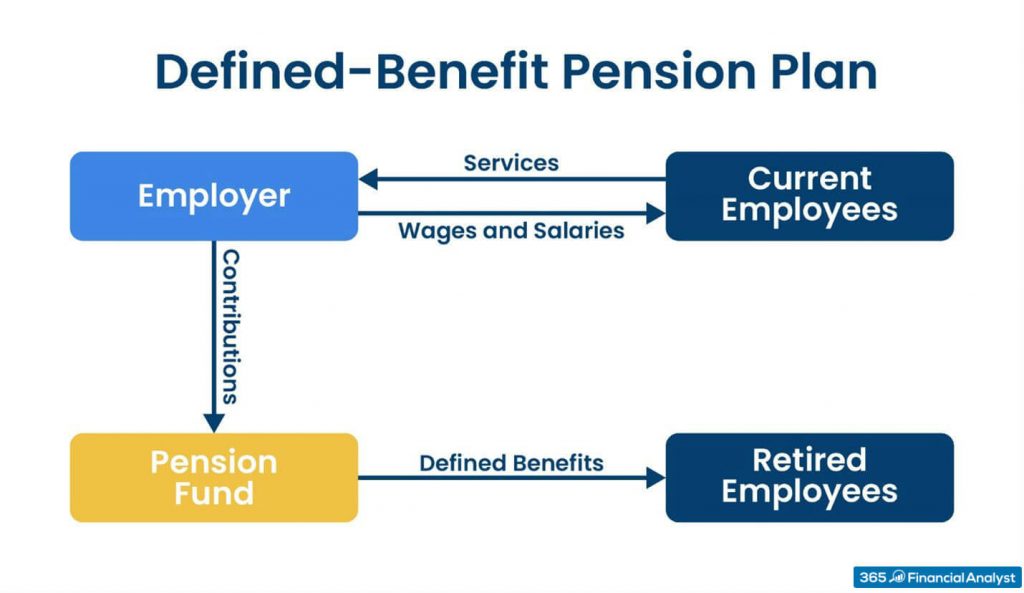

A pension plan requires an employer to contribute to the retirement income of its employees by investing in a pool of funds. Any gains are placed in an employee’s retirement account as a form of future benefit. The two most common types of retirement plans are known as defined benefit (DB) and defined contribution (DC).

What Are Defined-Benefit Pensions?

A defined benefit plan, also known as a traditional pension plan, offers a company’s employees a predefined benefit on retirement. It is based on the worker’s years of service and compensation history. Most DB schemes do not expect the workers to contribute a portion of their salaries to their tax-deferred retirement earnings account. Instead, the employer is responsible for funding the plan on an annual basis and making any investment decisions, thus bearing the investment risk in full.

Assume that a firm’s DB scheme pays a retirement benefit of 3% of the employee’s final salary for each year of service. As a result, a worker who has been with the company for 25 years and had a final salary of $100,000 would receive $75,000 per year upon retirement ($100,000 multiplied by 3% multiplied by 25 years).

So, the longer an employee works for a company and the higher the salary upon retirement, the higher the amount of the pension. Typically, defined-benefit plans seem expensive to companies due to the lack of shared responsibility. Should an investment fund fail to generate sufficient profit, the employer would still be obliged to provide the fixed amount promised to employees.

Generally, employees are not entitled to early withdrawals, unless otherwise stated. The retirement benefit is mostly paid out in the form of a lifetime annuity at a predetermined age. At times, lump-sum payments may be allowed for, too. Of course, to make use of the plan, conditions relative to the number of years worked with the company apply ― this is what we refer to as a vesting period.

What Are Defined-Contribution Pensions?

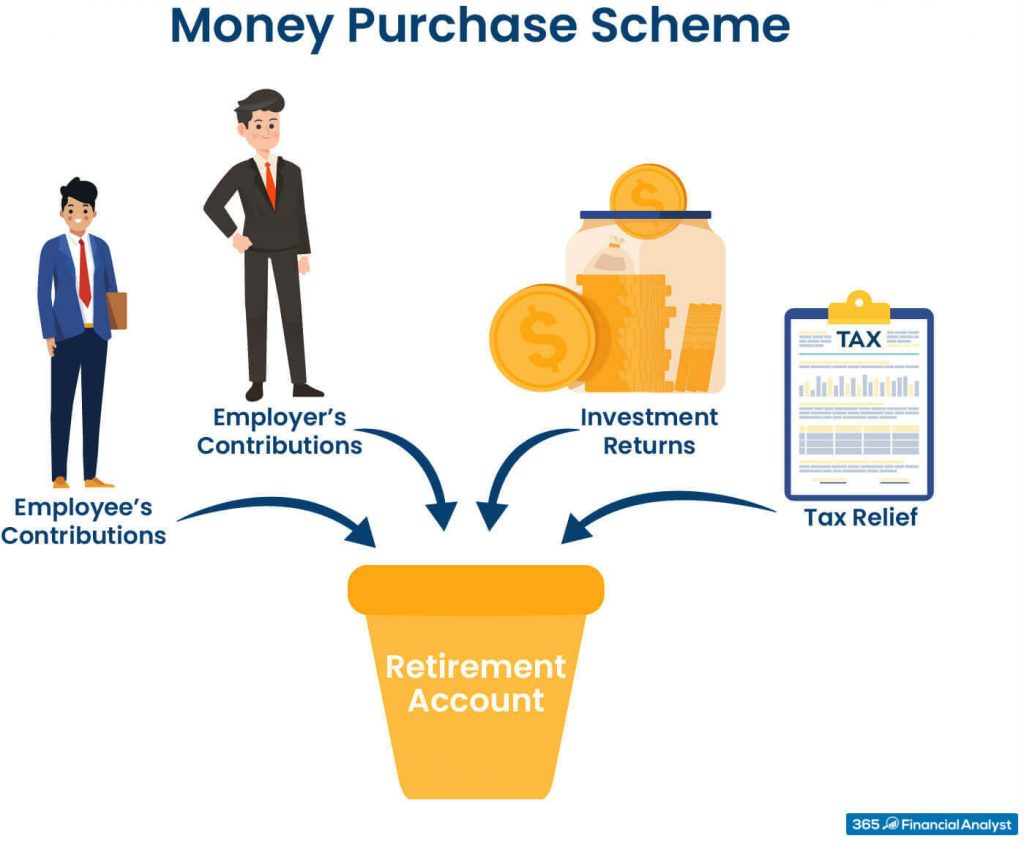

A defined-contribution plan, also known as a money purchase scheme or 401 (k), offers a company’s employee to voluntarily invest a percentage of their monthly salary in the capital market. The return on investment is then added to their retirement accounts. Employers do not guarantee any contribution to the retirement fund.

At times, the employer agrees to make a payment to employee’s retirement account in the form of an added benefit. In such an arrangement, companies contribute a fixed amount to the employee’s tax-deferred retirement account at each period. Once the regular payment has been made, the firm does not have any further pension obligations towards its employees. The employer makes no promise regarding the future value of the plan assets. So, the contribution and the investment performance jointly determine the ending value of the scheme.

Typically, the amounts invested by employers depend on a number of factors, such as an employee’s years of service, age, salary level, and so on. The money is placed in an investment vehicle as per the worker’s choice. Therefore, the investment decisions on where and how to invest are made by the worker, making them the sole risk-bearer.

In reality, defined-contribution plans bring a serious investment risk to employees who are not financially savvy ― a wrong decision may easily unfold a disastrous sequence of events for their retirement accounts. That’s why a DB plan requires discipline and wise management.

DC vs. DB: Comparison

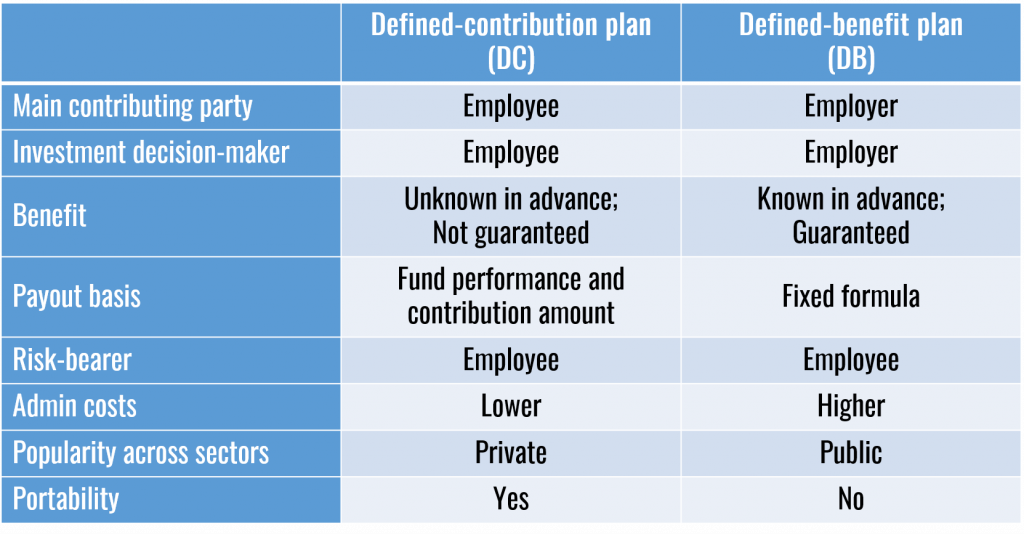

The main distinction between defined-benefit plans and money purchase schemes lies in the contribution structure. With DB plans, the employer predominantly contributes to the retirement fund, and it chooses where and how much to invest. In fact, some firms may allow employee contribution as well, but this is isn’t very common. Ultimately, the employee benefit upon retirement is based on a formula that does not depend on the portfolio’s investment performance.

With DC plans, the employee contributes to the plan, and the employer often makes a matching contribution. The portfolio investment decisions are made by the worker who is responsible for choosing where and how much to invest. The company makes no promises regarding the future value of the plan assets. Therefore, the retirement benefit is unknown in advance and depends on the investment performance and the contribution number.

Another difference between defined benefit and defined contribution plans has to do with portability. With defined contribution plans, employees can roll over the vested portion of their retirement benefits into another plan when they change jobs. Defined benefit plans, on the other hand, don’t have this type of provision. That is one of the reasons defined benefit pension plans have decreased in popularity.

Overall, DB plans have a higher investment risk for the plan sponsors as compared to money purchase schemes. That’s because DB’s funds require complex actuarial projections and insurance for guarantees, resulting in substantial administrative costs.

Summary

The amount of money dedicated to employees’ retirement is referred to as a pension.

With respect to defined-contribution schemes, companies are only responsible for defining the contribution they make to employees’ pension funds. Instead, employers handling defined-benefit pension plans define the benefit that employees will receive from their pension funds.

To assure greater financial security upon retirement, we may seek alternative ways to grow money, apart from the regular pension plans. For many people, investing in various types of Commodities remains one of the most attractive options to date.