Insurance Companies

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for Free

Intermediaries are vital for a well-functioning financial system and allow their clients to solve the problems they face more efficiently than they could by themselves.

We find several types:

- Brokers, Exchanges, and Alternative trading systems

- Dealers and Securitizers

- Depository Institutions

- Insurance Companies

- Arbitrageurs, and

- Clearinghouses and Custodians

Let’s examine Insurance companies.

People say that insurance is what nobody wants but everybody needs… The concept has been in existence for centuries, dating back to the 2nd and 3rd century BC when merchants paid an extra fee to shipping companies for the reimbursement of their cargo, in the event it got lost on the way.

Contrary to popular belief, this financial product hasn’t changed much since then.

What Is Insurance?

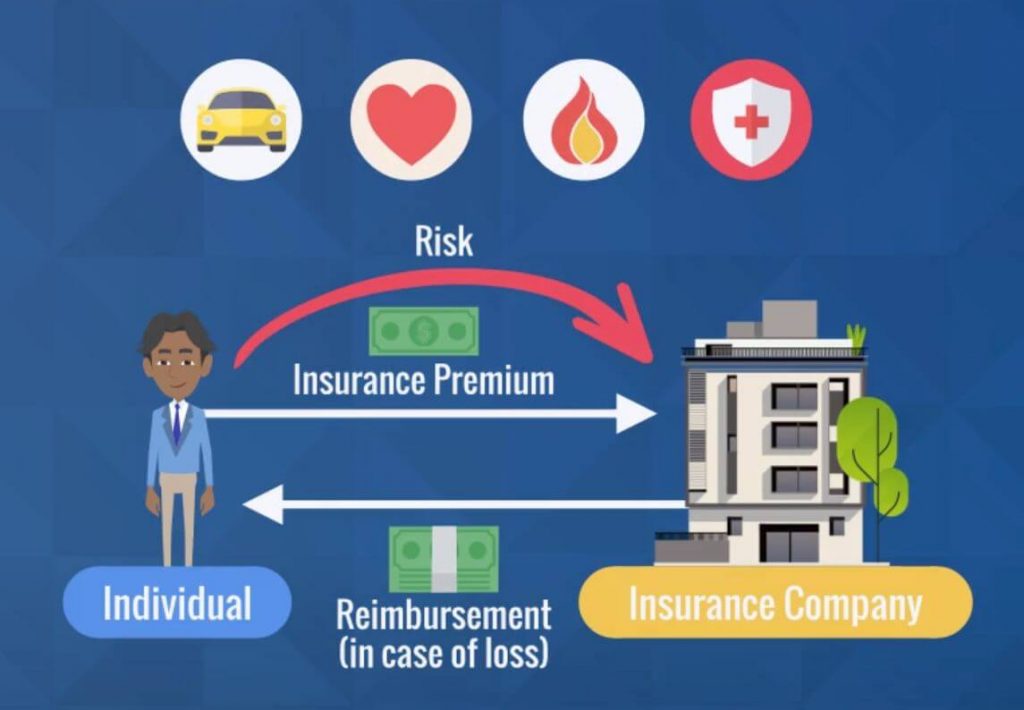

We define insurance as a contract in which individuals or companies receive financial protection against losses, from another firm. In return, the insured agrees to pay a premium (the cost of the contract) for the coverage they receive.

Put simply, insurance contracts transfer risk from the ones who buy them to those who sell them. Common examples are hedging auto, life, fire, or medical agreements. Most people in the United States have at least one of these types, while car insurance is required by law.

Insurance Mechanisms

At this point, you must be wondering, “How can insurance companies possibly manage so many types of risks at the same time?” The answer lies in the “portfolio approach” to investing.

I’m sure you still remember the saying, “Don’t put all of your eggs in one basket.” If we invest our capital in a single security and it fails, we lose all our money at once. On the opposite, if we diversify our funds by holding multiple assets, our portfolio will continue to be safe even if one of them crashes.

Similarly, insurers protect a diversified pool of policyholders whose profiles and risks of losses are typically uncorrelated. This presupposes more predictable cash flows compared to a single insurance contract.

Insurance Industry – Challenges

Like any other economic activity, the insurance industry has to deal with a number of challenges.

“Moral hazard” is a difficulty for all insurers. It occurs when the insured is ready to take more risks than necessary because they know that they have protection against the possible losses.

“Adverse selection”, on the other hand, takes place when those who are most likely to experience losses are the ones buying insurance contracts. That’s where exclusions come in handy!

Another critical aspect the insurance business encounters is “fraud”. This is when someone deliberately causes damage or reports a fictitious loss to collect on insurance. Therefore, such events are under close scrutiny at all times.

All these external risks put insurers in a difficult situation and require carefully designed underwriting policies in order to avoid any subjectivity matters.

Concluding Remarks

Insurance companies are large investors in financial markets. As such, they contribute to the overall stability of the financial system in that they insure the risks of many households and corporations. In this way, they reallocate associated future risks, making the insurance business a long-term investment.

You may now want to find out more about the fifth financial intermediary ― Arbitrageurs.