Depository Institutions

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for Free

Intermediaries are vital for a well-functioning financial system and allow their clients to solve the problems they face more efficiently than they could by themselves.

We find several types:

- Brokers, Exchanges, and Alternative trading systems

- Dealers and Securitizers

- Depository Institutions

- Insurance Companies

- Arbitrageurs, and

- Clearinghouses and Custodians

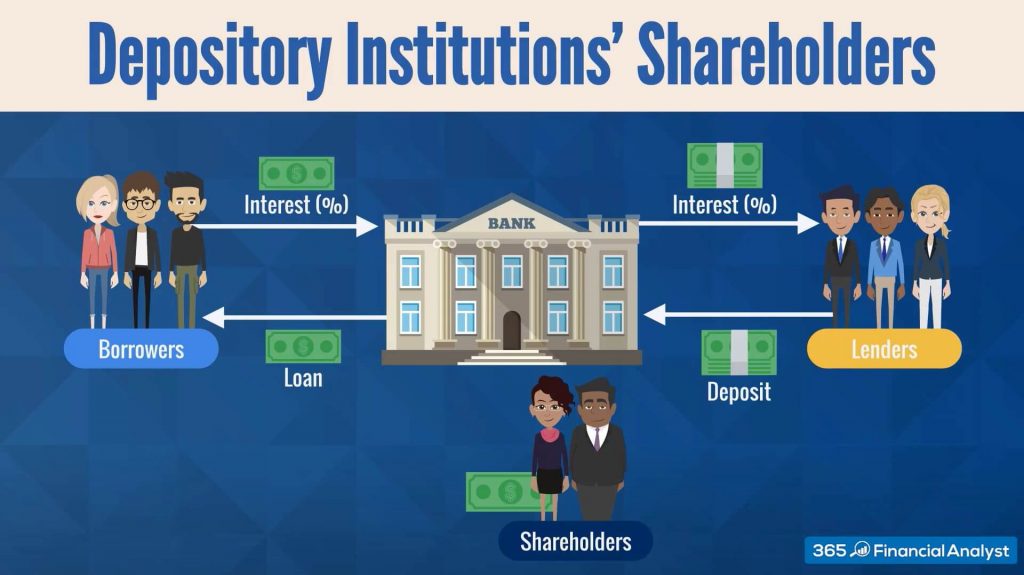

Let’s take a closer look at Depository Institutions. These may be banks, credit unions, and other institutions that raise and lend capital.

Commercial Banks

As we know, banks collect deposits from customers and pay them interest. The accumulated funds are then loaned to borrowers at a higher interest rate. The bank’s return objective is to earn a positive interest rate spread – that is the difference between the cost of funds and the interest earned on loans.

The banks serve as financial intermediaries because they transfer funds from their depositors to their borrowers.

The depositors benefit as they receive a return on their funds without having to contract with the borrowers and manage their loans. The borrowers, on the other hand, obtain the funds that they need without having to search for investors who will trust them to repay their loans.

Other Creditors

Many other financial corporations provide credit services as well. For example, payday advance and factoring companies provide money to individuals and firms based on future paychecks and accounts receivable. These intermediaries often finance the loans by issuing commercial paper (CP) or other debt securities.

In finance, these organizations play a valuable role- they bridge the gap between investors and borrowers. At the same time, the former obtains investments secured by a diversified portfolio of loans, while borrowers gain access to capital without having to search for investors.

Sometimes, brokers can also serve as a creditor, and they lend clients who buy securities on margin funds. The funds are usually financed by other investors who deposit money in the brokers’ accounts. When this margin lending is provided to institutions such as hedge funds, the brokers are referred to as prime brokers.

Depository Institutions’ Shareholders

Generally speaking, shareholders own residual rights to the assets of a company. In other words, they get the remainder of what’s left after all the assets liquidate and the company’s debt is paid off.

In the context of depository institutions, this means that when borrowers default, they use the equity capital to cover the losses before depositors take a hit. Therefore, the more equity capital an intermediary has, the lower the risk for its depositors.

Why?

Because poorly capitalized intermediaries (those with less equity) have less capital at risk, which is not much of a stimulus to reduce the risk of their loan portfolios anyway.

What makes matters worse is the fact that owners can even choose to lend cash to borrowers with a poor credit rating, because the interest rates that they can charge such borrowers are higher. By the time those loans default, the higher income will be making the corporation appear to be more profitable than it actually is.

Summary

An organization that helps buyers trade securities is known as a depository. In simple terms, depositories store securities in the same way bank accounts hold money. Ultimately, these institutions allow the funds held to be used for investing in other types of securities and by other businesses. As such, they provide liquidity in the exchange market.

You may now want to find out more about the third financial intermediary ― Insurance Companies.