Types of Risk in Business and Corporate Finance

Grasping the different types of risk in business (sales, operating, and financial) is essential for making sound financial decisions. This guide explains how leverage, through fixed costs and debt, can amplify both profits and losses—shaping a company’s overall risk profile.

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for FreeIn the world of corporate finance, understanding different types of risk is essential for making informed investment, financing, and operational decisions. Businesses face uncertainty from multiple angles, and the structure of their operations and financing choices can significantly affect their profitability, stability, and growth potential. Among the key risk categories are business risk and financial risk, both of which are heavily influenced by a firm’s use of leverage—a concept deeply tied to fixed costs in the company’s cost structure.

This guide examines the various types of leverage, their ability to magnify risks, and how different risk types, including sales risk, operating risk, and financial risk, impact firm performance.

What Is Leverage in Corporate Finance?

Leverage in corporate finance refers to the use of fixed costs in a company’s cost structure. It represents how sensitive a firm’s earnings are to changes in revenue. While leverage can also refer to using debt to enhance returns for shareholders, in this context, it deals explicitly with the use of fixed operating and financial costs.

A firm’s cost structure comprises both variable costs, which fluctuate with production (such as raw materials and labor), and fixed costs, which remain constant regardless of output (like rent, depreciation, and loan interest); understanding this balance is essential for managing different types of risk.

Variable vs Fixed Costs

Variable costs change with production levels. For instance, if labor costs $10 per unit, producing 10 units costs $100.

Fixed costs remain constant regardless of output. Examples include rent, insurance, and loan interest. Fixed costs can be further divided into:

- Fixed Operating Costs (e.g., depreciation, rent)

- Fixed Financial Costs (e.g., interest expense)

High reliance on fixed costs means that even minor changes in sales can result in significant swings in profitability—this is the essence of operating and financial leverage.

How Leverage Affects Profitability

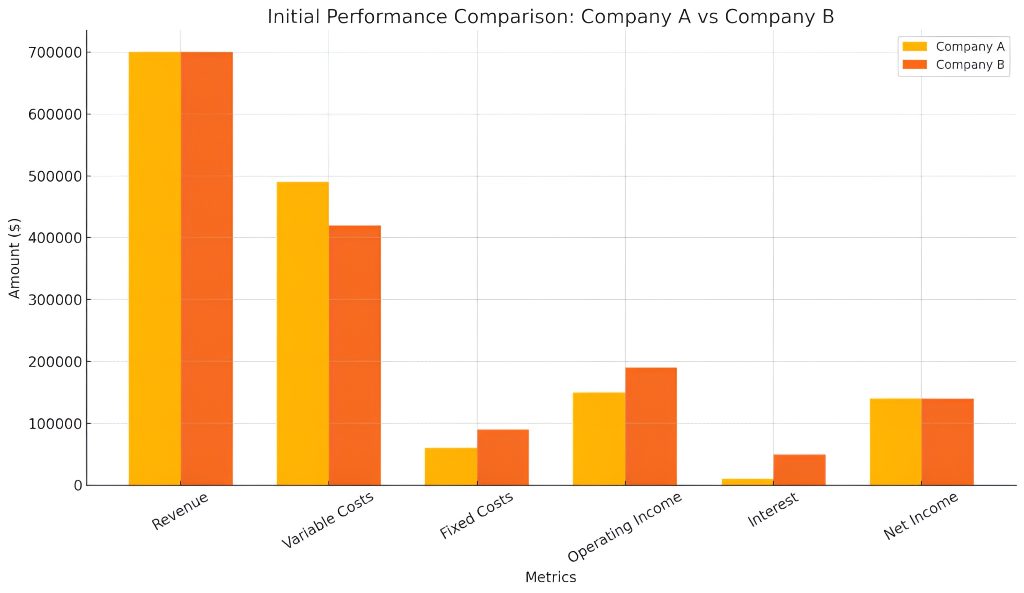

Leverage acts like a magnifying glass for a company’s profits. Small changes in revenue can lead to disproportionately large changes in net income—both positive and negative. Consider the financial performance of two companies with identical revenue but different cost structures, each exposed to other types of risk.

Initial Performance Comparison

Chart 1: Although Company A and Company B have the same revenue and net income, Company B has a higher proportion of fixed costs. This sets the stage for greater sensitivity to output changes.

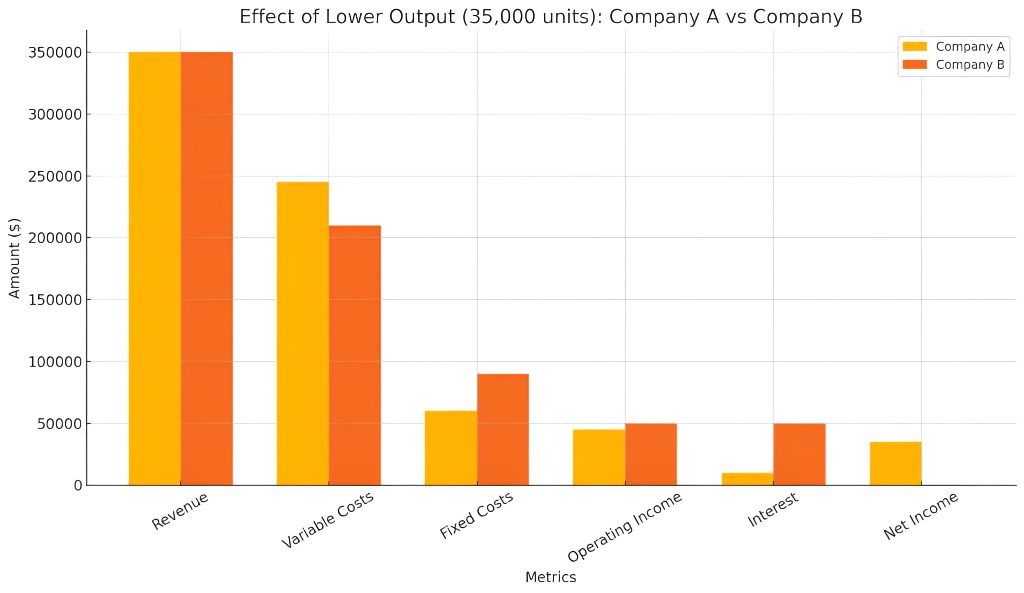

Chart 2: When output drops, Company B’s high fixed costs cause a steep decline in operating and net income. Company A’s more flexible cost structure enables it to absorb the shock more effectively.

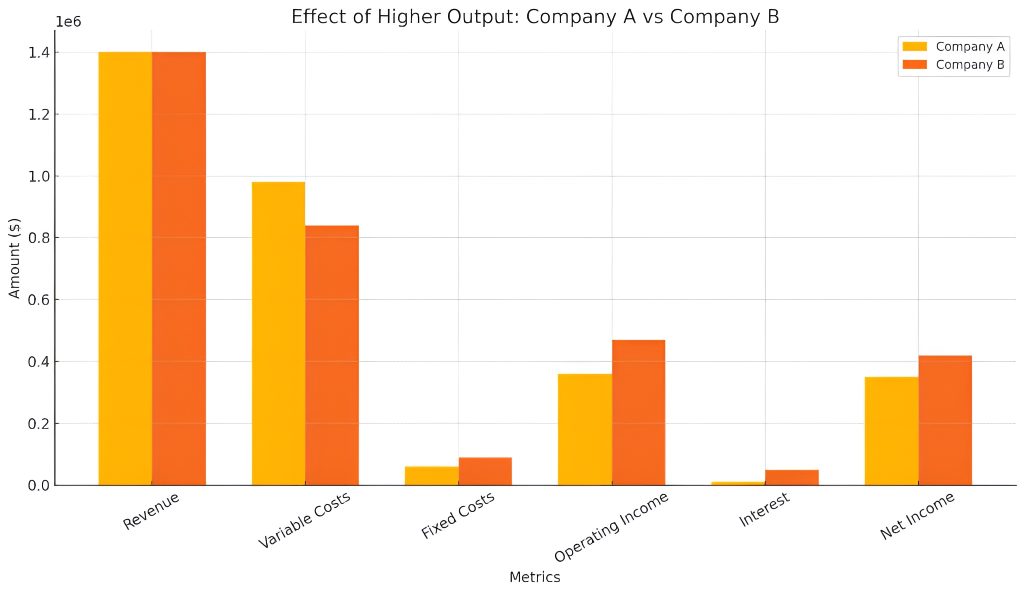

Effect of Higher Output (140,000 units)

Chart 3: In a high-output scenario, Company B earns significantly more net income due to the leverage effect. Its higher fixed cost structure magnifies the profit upside.

Types of Business Risk

1. Sales Risk

Sales risk refers to the uncertainty surrounding the quantity of product a company can sell and at what price. Factors influencing sales risk include:

- Product demand elasticity

- Market competition

- Seasonal and economic cycles

- Customer preferences

High sales risk means a company might face unpredictable revenues, making long-term planning more challenging.

2. Operating Risk

Operating risk is tied to a company’s internal cost structure—specifically, the proportion of fixed vs variable costs. High fixed operating costs increase operating leverage, making profits more sensitive to changes in sales and exposing the firm to certain types of risk.

Firms face a trade-off:

- Higher fixed costs (e.g., owning a factory) yield economies of scale but add rigidity.

- Higher variable costs (e.g., outsourcing) add flexibility but reduce profit margins.

Companies with high operating leverage are more susceptible to fluctuations in sales, thereby increasing their overall business risk.

3. Financial Risk

Financial risk arises from a company’s capital structure, particularly the use of debt. Firms that rely on external financing—such as loans, bonds, or leases—incur fixed financial costs like interest payments.

A highly leveraged firm must meet these obligations regardless of business performance—making it more vulnerable to certain types of riskduring downturns.

- Low financial risk: Equity-financed companies with fewer fixed obligations

- High financial risk: Debt-heavy companies with high interest burdens

The more debt in the capital structure, the more volatile net income becomes due to the unyielding nature of financial commitments.

Managing Types of Risk Through Cost and Capital Structure

Companies face two overarching types of risk: business risk (which includes sales and operating risk) and financial risk. Both are directly influenced by a company’s level of leverage, or reliance on fixed costs.

- Higher leverage amplifies both profits and losses.

- Operating leverage stems from fixed operational costs.

- Financial leverage comes from fixed financing obligations.

Understanding how these forms of leverage impact earnings volatility is crucial for managers, investors, and analysts alike. Firms that carry high leverage can achieve substantial gains during favorable conditions, but they are also more susceptible to losses during downturns. These outcomes highlight the importance of recognizing the different types of risk associated with financial and operational leverage.

The key to effective risk management lies in striking the right balance between fixed and variable costs, as well as between debt and equity financing, to maintain financial health across various economic environments.

Mastering this balance between cost structures and financing choices is key, and the 365 Financial Analysis platform offers the tools and guidance to help you apply these principles with confidence.