How to Calculate Beta and Interpret the Cost of Capital for Investment Decisions

Understanding how to calculate beta is essential for evaluating a stock’s risk relative to the market and estimating the cost of capital. This guide explains beta’s role in CAPM, WACC, and investment decisions—helping investors align risk with return.

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for FreeGrasping the relationship between a stock and the broader market is crucial for making informed investment decisions. One of the key measures that helps investors gauge this relationship is beta. Beta measures a stock’s sensitivity to market movements, playing a fundamental role in evaluating risk and calculating the cost of capital, which in turn influences capital budgeting and project evaluation.

This guide explores how to calculate beta, what it reveals about a company’s risk, and how to incorporate it into investment decision-making using tools like the Capital Asset Pricing Model (CAPM) and the Weighted Average Cost of Capital (WACC).

What Is Beta and How Do We Calculate It?

Beta (β\betaβ) is a statistical measure that captures how a stock’s returns move about the market. It’s a core component in assessing the riskiness of a stock and is central to the CAPM formula for determining the cost of equity.

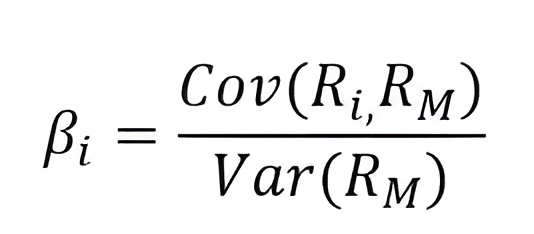

The formula for how to calculate beta compares a stock’s returns to those of the market. A higher covariance or a lower market variance leads to a higher beta, indicating greater sensitivity to market changes.

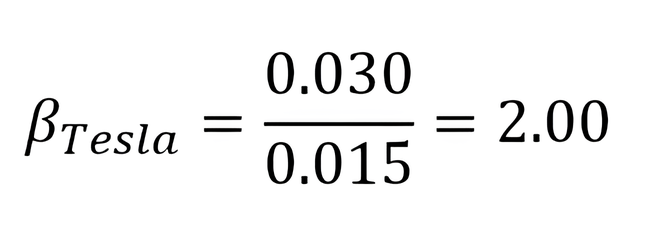

Assume an investor wants to calculate Tesla’s historical beta relative to the S&P 500. Based on five years of historical data, the covariance between Tesla and the S&P 500 is 0.030, while the variance of the S&P 500 is 0.015. By substituting these values into the formula, we find that Tesla’s beta is as follows:

This result indicates that Tesla’s stock is twice as volatile as the market.

Note: Most investors rely on financial data providers—such as Bloomberg, Yahoo Finance, or Thomson Reuters—for beta values because they regularly update these figures using market data.

Interpreting Beta: What Does It Tell Us?

Understanding how to calculate beta and the implications of a stock’s beta helps investors match their risk tolerance with appropriate investments.

- Beta < 1: The stock is less volatile than the market (defensive stock).

- Beta = 1: The stock moves in line with the market.

- Beta > 1: The stock is more volatile than the market (aggressive stock).

In Tesla’s case, a beta of 2 means that if the market rises by 1%, Tesla’s stock will be expected to increase by 2%, and vice versa. High-beta stocks carry more risk but also offer greater potential reward.

What Affects Beta?

Beta is influenced by two types of company risk: business risk and financial risk.

1. Business Risk

Business risk refers to fluctuations in a company’s operating income and is primarily driven by two factors. The first is sales risk, which arises from uncertainties related to product demand, pricing strategies, market competition, and changes in the economic cycle. The second is operational risk, which is linked to the company’s cost structure, particularly the proportion of fixed costs relative to variable costs.

Some industries (e.g., automotive, tech, retail) are more affected by business cycles, causing higher beta values. In contrast, sectors like utilities and food tend to be stable, exhibiting lower betas.

A company with high fixed costs relative to variable costs has high operating leverage, which amplifies beta. For example, owning a factory (high fixed cost) leads to greater beta volatility compared to outsourcing production (high variable cost). Understanding how to calculate beta is essential for quantifying the effects of industry and cost structure on risk and market sensitivity.

2. Financial Risk

Financial risk arises from the use of debt (or leverage) to finance a company’s operations. When a company takes on more debt, it faces higher fixed obligations, such as interest payments. This increases the volatility of its net income and results in a higher beta—indicating greater sensitivity to market movements.

The debt-to-equity ratio is a standard measure of financial leverage. The more leveraged a company is, the greater its financial risk and the higher its beta. A company’s beta reflects three key factors:

- The cyclicality of its revenue

- Degree of operating leverage in its cost structure

- The level of financial leverage it employs

Beta and WACC in Project Evaluation

When valuing investment opportunities, companies often use the Weighted Average Cost of Capital (WACC) to discount future cash flows. Understanding how to calculate beta is crucial here, as WACC is only appropriate if the project’s risk matches the company’s average risk profile.

If a retailer opens a new store or a manufacturer expands existing production lines, the project’s risk is consistent with the core business. In such cases, using the firm’s current WACC as the discount rate is valid.

When WACC Is Inappropriate

Problems arise when a company explores projects outside its usual line of business. For example, Samsung operates across various industries, including electronics, shipbuilding, insurance, and more. Each segment has a distinct risk profile. Therefore, using a single WACC to evaluate all projects would be misleading.

Even within a focused firm like Cisco Systems, purchasing real estate involves different risks than developing networking software. A more precise approach is needed.

Estimating Cost of Capital Using the Pure-Play Method

When a project’s risk differs from the firm’s overall risk, we use the pure-play method. This approach identifies comparable companies that focus solely on the business the project resembles, to derive an appropriate discount rate. Knowing how to calculate beta for these comparable firms is a key step in estimating a risk-adjusted cost of capital.

Steps in the Pure-Play Method:

- Identify a comparable company – Choose a firm that operates in the same business as the proposed project.

- Estimate the comparable firm’s beta – Use data providers or regression analysis.

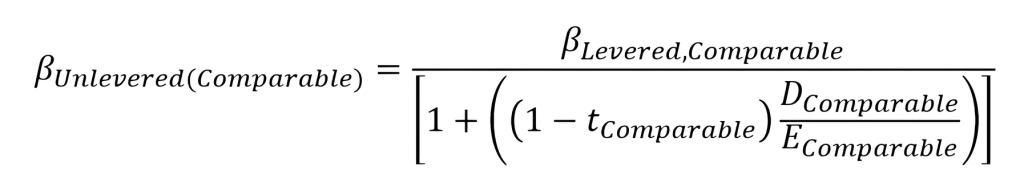

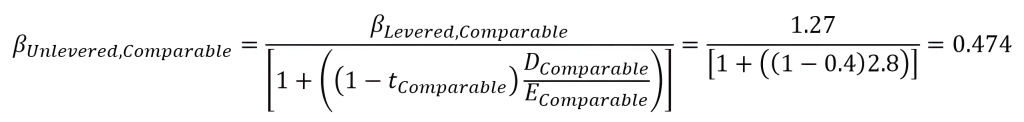

- Unlever the beta – Strip away the effect of financial leverage using:

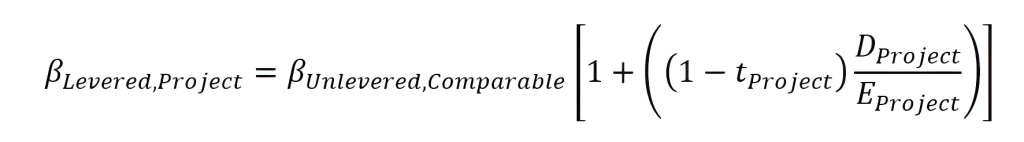

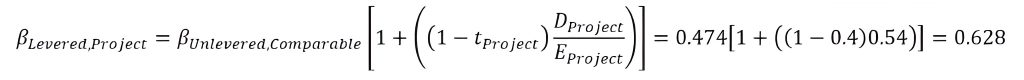

- Re-Lever the beta – Adjust for your own project’s capital structure:

Suppose Amazon wants to enter the PC and server business. In doing so, it chooses to compare itself to Dell, a pure-play company in that space, rather than IBM, which is a more diversified firm. Dell has a beta of 1.27 and a debt-to-equity ratio of 2.8. The applicable tax rate is 40%.

Amazon’s debt-to-equity = 0.54

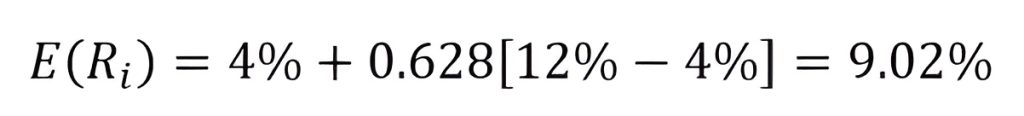

To calculate the cost of equity, we use the CAPM as follows:

This tailored cost of capital reflects the actual risk of Amazon’s new venture, ensuring better investment decisions.

How to Calculate Beta and Why Risk-Specific Capital Costs Matter

Beta is more than just a number—it represents the risk sensitivity of a company or project relative to the market. Learning how to calculate beta is a crucial step in assessing risk and determining the appropriate cost of capital.

While using WACC is convenient, it’s only accurate when the project’s risk mirrors the firm’s current operations. For ventures that deviate from the core business, the pure-play method provides a more refined approach to estimating the project-specific cost of capital. Ultimately, using beta properly leads to more informed capital budgeting decisions, better risk management, and higher shareholder value.

Master beta-driven decisions and enhance your capital budgeting skills with practical, expert-led training on the 365 Financial Analysis platform.