Measuring Returns: Bank Discount Yield and Other Metrics

Investors use metrics like bank discount yield (BDY), holding period yield, and effective annual yield to evaluate returns on short-term debt instruments, such as treasury bills. This guide explains how each metric is calculated and highlights the strengths and limitations of BDY. Understanding these yields helps investors make informed decisions in the money market.

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for FreeInvestors often choose short-term debt securities—such as U.S. Treasury bills (T-bills)—to diversify their portfolios due to their liquidity and low risk. Evaluating the returns on these instruments requires specific financial metrics, including bank discount yield (BDY), holding period yield, effective annual yield, and money market yield. This guide introduces these terms and explains how they are calculated and interpreted.

The Money Market

The money market refers to trading short-term debt instruments characterized by high liquidity, allowing investors to convert securities into cash quickly. Money market instruments generally fall into two categories:

- Interest-bearing instruments are securities that require repayment of the principal amount plus explicit interest.

- Pure discount instruments do not pay explicit interest; instead, the investor earns implicit interest from purchasing the security below its face value.

The following summarizes standard instruments traded in the money market:

Pure Discount Instruments and Treasury Bills

U.S. Treasury bills (T-bills) are prominent examples of pure discount instruments. These are issued by the U.S. federal government, making their default risk virtually non-existent. Investors purchase T-bills at a price lower than their face value—the difference represents the interest earned. For instance, an investor might buy a $1,000 T-bill for $980. The $20 difference is the investor’s profit upon maturity.

Calculating Bank Discount Yield (BDY)

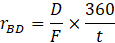

Bank discount yield is a typical method for quoting the yield on T-bills. It annualizes the discount rate based on the bill’s face value, following this formula:

- D = Dollar discount (Face value – Purchase price)

- F = Face value of the T-bill

- t = Days remaining until maturity

- 360 = Banking convention for days in a year

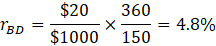

Calculation Example

Consider a T-bill purchased for $980 with a face value of $1,000 and 150 days until maturity. The BDY calculation is:

This yield indicates the annualized interest rate earned if the security is held until maturity.

Limitations of Bank Discount Yield

Although widely used, BDY has notable shortcomings:

- Face value reference: BDY calculates yield based on the face value rather than the actual investment amount, potentially misrepresenting the true return.

- 360-day year assumption: Using a 360-day year rather than the actual 365-day year inflates the yield slightly, reducing its accuracy.

- Simple interest assumption: Bank discount yield ignores compound interest, failing to account for the potential to earn “interest on interest.”

Due to these limitations, investors often supplement BDY with alternative yield metrics.

Other Essential Yield Measures

- Holding Period Yield (HPY) reflects the actual return based on the purchase price and holding period without annualizing.

- Effective Annual Yield (EAY) accounts for compounding over a 365-day year, offering a more accurate measure of annualized returns.

- Money Market Yield (MMY) annualizes returns based on the purchase price, providing a more realistic view of investment performance than BDY.

Assessing Bank Discount Yield and Other Measures

Understanding bank discount yield and alternative measures like holding period yield, effective annual yield, and money market yield is essential for accurately assessing returns from short-term debt securities. Each measure provides unique insights, and comprehensively evaluating these instruments ensures better investment decisions in the money market.

If you’re looking to strengthen your ability to evaluate short-term investment returns—including bank discount yield and its alternatives—the 365 Financial Analyst platform offers structured, practical courses designed to help you master these essential concepts.