Is Finance a Good Career Path?

The finance industry presents a stable and rewarding career landscape, offering some of the best-paying jobs and a variety of specialized opportunities. From corporate finance to investment banking, and even the evolving role of AI in finance, this field is marked by high demand and significant impact, making it an excellent choice for driven professionals. Is finance a good career path? Explore our article to learn why finance might be the right fit for your goals.

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for FreeIf you ever google “Is finance a good career path?”, you might find yourself feeling both puzzled and overloaded with information. Don’t worry! You’re not alone. In fact, millions of people worldwide have been in your shoes. But here’s the key point that many overlook—a “good career path” isn’t just about current perks like finance salary and work benefits—it’s also about the industry’s long-term outlook and your goals.

In our article, we discuss why a finance career path is a top choice for ambitious professionals like you. And we elaborate on four compelling reasons that boost your finance job prospects.

Table of Contents

- Finance Careers: Job Market Overview

- 4 Reasons Why a Finance career path is Worth It

- Best Places to Work in Finance

- Artificial Intelligence in Finance

- Is Finance a Good Career for the Future?

- FAQs

Finance Careers: Job Market Overview

Finance as a career path has been highly sought after since the 1980s. But will it remain as attractive over the next decade?

Finance Job Stability

According to the U.S. Bureau of Labor Statistics (BLS), finance-related jobs, such as financial managers, are expected to grow by 16% until 2032, much faster than the average for all occupations. This surge is driven by the increasing complexity of financial regulations and the global expansion of businesses, creating a continuous demand for skilled finance professionals.

Bonus Insight: Discover how many jobs are available in finance in our free finance career guide.

A Lucrative Finance Salary

In terms of compensation, some of the best-paying jobs are in finance. The median pay in finance was $79,050—significantly higher than the median for all jobs ($48,060) in 2023. More specifically, finance managers earned a median pay of $156,100, reflecting the high value companies place on financial expertise in the business world.

Diverse Finance Career Pathways and Industries

The sector offers diverse finance career pathways and opportunities for growth. The field also allows for specialization in areas such as—investment banking, asset management, and corporate finance—enabling professionals to tailor their careers to their interests and strengths.

A financial analyst career path is among the most popular choices for entry-level job seekers. Financial analysts help businesses and individuals make informed decisions.

For those interested in careers in investing, the finance sector offers varied opportunities, including roles in asset management, hedge funds, investment banking, and private equity. These often involve managing investment portfolios, conducting market research, and making strategic investment decisions that can lead to substantial financial returns.

Another promising option within finance is the corporate finance career path. Professionals in this field focus on managing a company’s financial activities, including capital raising, budgeting, and strategic financial planning. This finance career path not only offers high earning potential but also the chance to influence a company’s long-term growth.

The capital goods sector, which involves the production of machinery and equipment used across various industries, has been increasingly intertwined with finance job prospects lately. As companies in this sector continue to expand and modernize, there is a growing need for finance professionals who can manage large-scale investments and financial strategies.

So, is capital goods a good career path? Yes, it is, and job prospects are expected to remain strong. Jobs in this sector often involve roles in corporate finance, financial analysis, and investment, particularly as companies in the capital goods sector require sophisticated financial strategies to manage their capital expenditures.

Bonus Insight: In our YouTube video, you have a breakdown of the main finance career pathways explained in 10 minutes.

4 Reasons Why a Finance Career Path Is Worth It

Is finance still a good career path? Here are four compelling reasons to consider when breaking into finance.

1. Finance Is a Timeless Career Choice

The first reason finance is a strong career path is its evergreen nature. Companies consistently need financial expertise to make sound financial decisions, operate efficiently, and allocate resources effectively. The core principles of finance remain constant, even as the tools and technologies used to apply these principles evolve.

While technological advancements like AI and ERP systems have transformed many financial processes, the essential financial skills that companies require will continue to be in high demand. By building a solid foundation and staying current with technological changes, you’ll find ample finance jobs available. It’s important to keep your skills sharp and be adaptable to changes in the industry.

2. Strong Demand for Finance Experts

There’s no denying the high demand for finance professionals. According to the U.S. Bureau of Labor Statistics, career paths in finance, such as finance managers, accountants, auditors, and financial analysts, have impressively low unemployment rates—well below the national average. Furthermore, the finance industry is projected to experience solid growth in the coming years, with financial analysts expected to see an 8% job increase and accountants and auditors a 4% rise.

Choosing a career in a growing field is always a smart move. The shortage of skilled finance professionals means that the average finance salary in this sector is likely to continue increasing, making it an attractive choice for those seeking both job security and financial rewards.

Bonus Insight: Read our FREE finance career guide on how to get into finance and land a finance internship with no prior experience.

3. Finance as a Launchpad for Entrepreneurs

One of the unique advantages of finance as a career is its potential to serve as a launchpad for entrepreneurship. Many successful entrepreneurs, CEOs, and board members began their journeys in finance where they acquired the technical expertise and business acumen necessary to succeed.

In finance career pathways, many people view their education as a critical stepping stone toward becoming an entrepreneur. Pursuing a master’s degree in finance equips individuals with essential technical skills while keeping them closely involved in business decision-making. As finance professionals, they learn how to create value for companies, understand profitable business models, and gain invaluable experience that can pave the way for successful entrepreneurial ventures.

Whether you aspire to start your own business or rise through the ranks in a corporate setting, having experience in a finance role provides a robust foundation that opens numerous doors.

4. Meaningful Impact Through Your Finance Role

A finance career path offers the chance to engage in work that has a significant impact. Whether you’re helping businesses improve their cost efficiency, making strategic investment decisions, or providing analyses that guide executive decisions, your contributions can play a crucial role in a company’s success.

The fast-paced and ever-evolving nature of a finance career path means you’ll constantly be challenged to grow your analytical and problem-solving skills. With the right approach, a finance career goes far beyond just crunching numbers—it’s an opportunity to develop your strategic thinking and make a tangible difference in the organizations you work for.

If these reasons resonate with you, then climbing the finance career ladder might be the right choice for you.

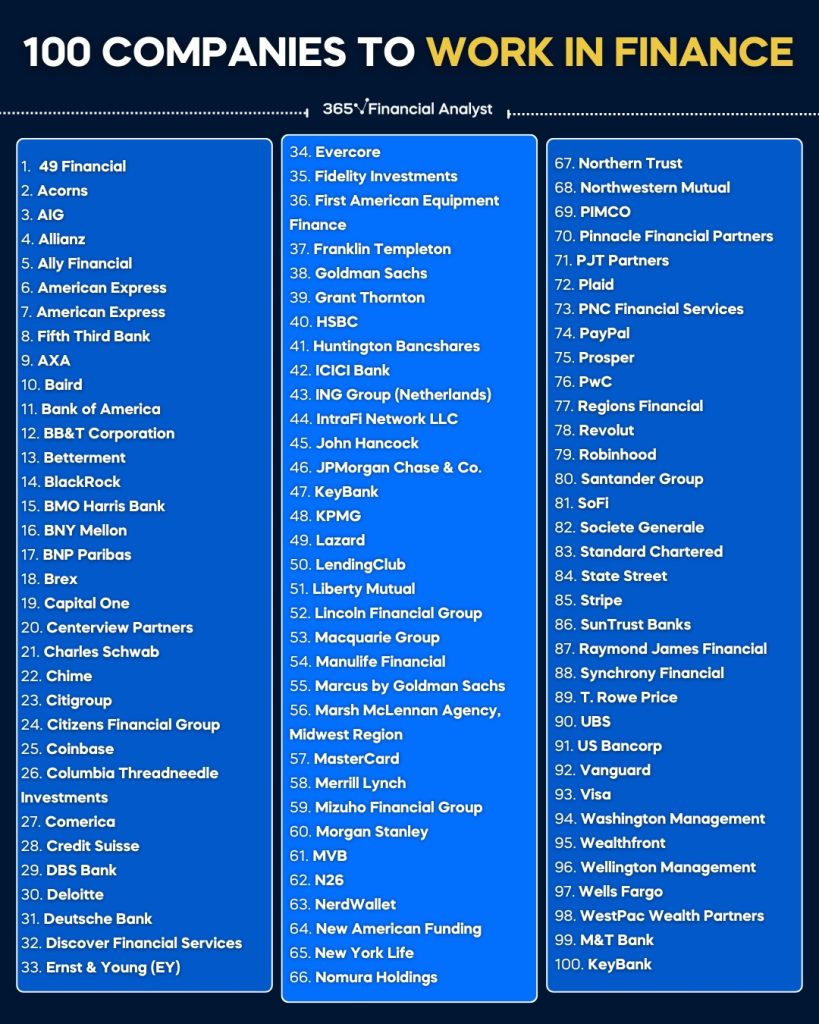

Best Places to Work in Finance

Here is a list of the best places to work in finance.

Artificial Intelligence in Finance

While there’s been a lot of concern about AI replacing jobs, particularly in finance, the reality is more nuanced. According to a report by PwC, AI is expected to contribute up to $15.7 trillion to the global economy by 2030, with a significant portion of that growth coming from increased productivity in sectors like finance.

The World Economic Forum (WEF) also predicts that AI in finance will create more jobs than it displaces, especially in roles that require complex decision-making, creativity, and human interaction. AI in finance is seen as a tool to enhance, rather than replace, the work done by professionals. For example, it can automate routine tasks such as data entry and analysis, freeing up finance professionals to focus on higher-level strategic work.

Additionally, AI-driven tools are improving risk management, enhancing fraud detection, and providing more personalized financial advice—all areas where human oversight and decision-making remain crucial.

Is Finance a Good Career for the Future?

According to the U.S. Bureau of Labor Statistics (BLS), the finance sector is expected to experience steady growth in the coming years. Now is the time to pursue a financial analyst career path, with 8% job growth projected by 2030, outpacing the 4% growth (on par with industry averages) for accountants and auditors.

This continued demand for finance professionals indicates strong prospects for those entering or advancing in the field, making it a promising career path for the future.

Is finance a good career path?

Yes, it is, and you can enhance your prospects by enrolling in our 365 Financial Analyst program. Our program is designed to bridge the gap between traditional education and the practical skills needed for a finance role, preparing you for careers as a financial analyst, consultant, or investment banker.

Take the first step toward a fulfilling finance career today.

FAQs

Getting into finance can be competitive, as it often requires a strong educational background, relevant skills, and networking. However, with the right qualifications and dedication, it is achievable and can lead to rewarding opportunities.

Yes, finance jobs generally offer higher salaries compared to many other industries. However, compensation can vary widely depending on the specific role, level of experience, and location.

Working in finance can be very rewarding, both financially and intellectually. It offers diverse career paths, continuous learning opportunities, and the chance to make a significant impact within organizations.

A degree in finance is often worth it, as it provides the foundational knowledge and skills needed to pursue various high-paying and in-demand careers within the finance industry.