How to Become a Financial Analyst in 2025

Discover how to become a financial analyst in 2024.

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for Free

Are you wondering how to land a financial analyst job? This guide is designed to navigate you through that process. If you enjoy working with numbers and have an analytical mindset, a financial analyst career path might be your calling. This field offers talented individuals robust career prospects and a rewarding journey.

So, what are the key steps in discovering how to get a financial analyst job?

In our article, we share valuable insights on how to become a financial analyst—including the scope, education, tools, salary, typical career progression—all complemented by practical job-hunting tips and tricks.

But before you start applying for financial analyst jobs, you should familiarize yourself with the tasks and responsibilities associated with the role.

Table of Contents

- What Does a Financial Analyst Do?

- Financial Analyst Positions and Types

- Education Needed to Become a Financial Analyst

- How to Become a Financial Analyst – Roadmap

- Financial Analyst Tools

- Financial Analyst Salary

- The Typical Financial Analyst Career Path

- How to Become a Financial Analyst in 2024 – Where to Start?

- FAQs

What Does a Financial Analyst Do?

Before we tackle the steps on how to become a financial analyst, it’s crucial to gain a clearer picture of their day-to-day activities that come with the role. What do financial analysts mainly do?

Depending on the company they work for, financial analyst requirements and responsibilities differ. In small firms, they have a 360-degree visibility on revenue growth rate, product sales, profitability margins, top clients, and may also study the implications of the company’s various business segments. They will also work with different balance sheet items and prepare budgeting projections.

This isn’t the case in big firms where the role of a financial analyst focuses on reporting and analysis of specific P&L and Balance Sheet items. When I worked at Coca-Cola in the UK, for a significant portion of my time, I worked on analyzing the performance of the Monster brand and studied its Sales, Cost of Goods Sold and OPEX—I had no visibility of the firm’s Balance Sheet, and anything below EBITDA. I also didn’t work on the company’s other brands such as Coca-Cola, Fanta, and so on.

Despite their different levels of specialization, financial analyst jobs are essentially about adding value for a business by supporting decisions and analyzing data, forecasting future financial performance, and evaluating investment opportunities.

Generally, companies look for financial analysts to analyze which operations are profitable and how business activities impact the firm’s financial performance.

Financial Analyst Positions and Types

Every financial analyst job description must outline what type of professional they’re looking for. These are the two main categories to consider:

- Buy-Side Analysts: These are investment specialists that manage their own portfolios, focusing on selecting securities that will maximize investment returns for their clients or the firm itself. The skills required for a financial analyst in these firms include conducting in-depth research to inform purchasing decisions for the firm’s managed funds.

- Sell-Side Analysts: Analysts working on the sell-side serve a different role, primarily providing research and recommendations to external clients, rather than investing on behalf of their own firm. A day in the life of such a financial analyst involves influencing the buying decisions of other institutions, including buy-side firms, by offering insights and valuations on various securities.

According to the Bureau of Labor Statistics (BLS), financial analyst jobs can be categorized into four groups, including:

- Portfolio Managers: Oversee investment portfolios, selecting the mix of products for clients.

- Fund Managers: Focus on managing hedge funds or mutual funds.

- Rating Analysts: Evaluate the ability of companies or governments to pay their debts.

- Risk Analysts: Assess the risk in investment decisions, aiming to limit potential losses.

Notе that factors such as industry, company size, and location play a crucial role in determining a financial analyst salary and title.

Education Needed to Become a Financial Analyst

Our research of 1,000 financial analyst job postings reveals that 38% require a bachelor’s degree, 29% a master’s, and 32% do not specify a university degree as a prerequisite. So, while lacking a university degree does not preclude you from securing a financial analyst position, it does reduce the available opportunities. More specifically, the search for MBA finance jobs is competitive, requiring candidates to showcase their unique skills and experiences.

The relevant education requirements for a financial analyst that emerged from our research include: Finance (24%), Accounting (19%), Business Administration (18%), Statistics (12%) Mathematics (8%), Computer Science (4%) and others. This is data we obtained by sampling 1,000 Financial Analyst profiles on LinkedIn.

Мany people obtain additional financial analyst qualifications to strengthen their professional acumen such as CFA, CIMA, FRM, ACCA, etc. We also offer a comprehensive program for a financial analyst with a reputable Certificate of Achievement to kickstart your career.

How to Become a Financial Analyst – Roadmap

Step 1: Obtain a Financial Analyst Degree

Graduating university is not a formal requirement in a third of the finance job postings we studied, but having a diploma will certainly help. This is why completing your formal education is the first step in your financial analyst career path.

In my experience, I have seen plenty of exceptions. While working at Coca-Cola, I met a Finance Director who managed around 50 people (including me). She had graduated only high school and had managed to land a financial analyst position thanks to acquiring a CIMA certification. The fact that she didn’t have a university diploma did not hurt her career, but that is more of an exception rather than a general rule.

Step 2: Acquire the Skills Required for a Financial Analyst

There are a few skills you need to master if you want to become a financial analyst. Fortunately, the list isn’t overwhelming.

If you want to succeed in this field, you must have solid knowledge in:

- Accounting

- Financial Mathematics

- Corporate Finance

- Financial Reporting

- Building a 3-Statement Model

Begin by acquiring these fundamental financial analyst skills and learning them well. Everything else simply expands upon this solid foundation.

Unfortunately, I learned this the hard way. After I’d landed my first financial analyst internship in the M&A department of a German company, I felt lost when my colleagues discussed accounting transactions, like what the contra-account for ‘allowance for doubtful accounts’ in the Balance Sheet means.

I had studied accounting at university, but not in a sustainable, understanding way. I soon came to realize that the required skills for a financial analyst had to function in harmony. To avoid the difficulties I faced in the workplace, ensure you learn the fundamentals right from the start, and build a good foundation for everything that follows. You’ll find that more specialized sciences expand upon what you already know.

You should also remember that Excel mastery is pivotal in the financial analyst skills’ toolbox. Virtually everyone relies on Microsoft Excel, with some dedicating over half their workdays to it. And yet, over 90% don’t utilize its advanced features.

From day one, you must prioritize learning:

- Shortcuts

- IF statements like SUMIF, SUMIFS, COUNTIF, COUNTIFS

- Pivot tables

- GETPIVOTDATA

- Filters

- Basic data handling (dates, text, numbers) and

- Excel cell formatting

Embrace the use of essential financial analyst tools like Excel. You can gain two extra hours weekly for other tasks and error-checking by boosting your Excel efficiency with 10% and using the software daily for four hours. In our 365 program, a financial analyst can obtain key skills that can propel their career to the top, with lots of practical exams and projects to polish their abilities.

What if you could become highly skilled, achieving two to three times greater speed? This would certainly make your effort worthwhile.

365 Financial Analyst offers a series of financial analyst courses online that will teach you all theoretical and practical skills required to become a financial analyst from scratch. Take advantage of the interactive, engaging, and well-crafted videos we have prepared for you.

Step 3: Work on Projects and Develop Practical Skills

A significant challenge for a financial associate is locating resources like websites, textbooks, or programs that provide practical projects for applying theoretical knowledge. Typically, the industry relies on on-the-job training, which can be inefficient and stressful.

To address this, my colleagues at 365financialanalyst.com and I created a directory of datasets and real-world projects—enabling skill enhancement before entering the workforce.

Preparing and excelling in the initial workdays requires actively engaging in projects. This is a clever way of how to become a financial analyst with no experience.

Step 4: Create an Outstanding Financial Analyst Resume

The main function of a financial analyst resume is to get you past the first screen and into an interview. However, given that recruiters go through hundreds of resumes per day, this is not an easy task after all. A single typo or mistake is enough to ruin an otherwise interesting application. Here is a quick list of financial analyst resume mistakes you should avoid and best practices to implement.

Mistake #1: Unprofessional Formatting

Look for a good-looking financial analyst resume template to use.

Mistake #2: Typos and Mistakes

Ensure you proofread your financial analyst resume and ask friends and relatives to help too.

Mistake #3: Sending Out the Same Resume for Different Positions

You should tailor your resume when applying for financial analyst positions and add relevant keywords.

Mistake #4: Too Мany Pages

Be concise and try to stick to a 1-page format for your financial analyst resume.

Mistake #5: Passive Tone and Language

Use engaging tone and specific examples to highlight your financial analyst skills, e.g., “Graduated from the London School of Economics with an excellent degree, in the top 10% of a class of 120.”

Step 5: Apply for Financial Analyst Jobs

Once you have acquired the skills required to become a financial analyst, worked on practical projects, and prepared an outstanding resume, it is time to start applying for financial analyst jobs.

Create a list of at least 10, but much better 15 or 20, companies that you are interested in. You can have favorites, but limiting your financial analyst resume submissions to just a few job openings carries considerable risks. It’s much better to create multiple opportunities for yourself.

Let’s play the game of numbers for a second. If you apply for 20 financial analyst jobs and put a lot of effort in each, you will probably be invited to sit an online test for 18 of them.

If you practice hard enough with aptitude tests, you’ll be able to pass this stage successfully and get approximately 12 phone interviews thereafter. Now, let’s assume you’ll pass eight of these phone interviews.

You’ll be called in for eight assessment day interviews, during which the odds of being hired are statistically one in four—or even worse in some situations.

This leaves you with two financial analyst jobs or internships to consider—a satisfactory outcome. As a rule of thumb, aim to position yourself with at least two options to choose from. Of course, success rates during each of the described steps may vary according to a number of factors. But the principle holds true.

Nowadays, the Internet has become the official channel for finding financial analyst jobs. Almost all companies publish their job openings on their webpage, including those for junior financial analysts. In most cases, it is very simple to navigate through corporate sites and find the “Career” section, where the open positions would be posted. Once again—apply to a sufficient number of financial analyst jobs.

Step 6: Use Less Traditional Job Searching Methods

Wondering how to get a financial analyst job in an unorthodox way? This is something that most job seekers want to know. There are a number of ways to find opportunities and quite often the process is much simpler than with online applications, for which you need a full day of work to complete.

These channels are extremely useful for people who are looking for an “off-cycle” financial analyst internship or a full-time placement. Most online applications run during the period October – February.

So, these are some tips and tricks on how to get a financial analyst job in a less traditional way.

Career Events & Job fairs

The benefit of visiting these events is two-fold—companies give really nice gadgets (you’ll have a lifetime supply of pens), and you directly hand over your financial analyst resume to many human resource professionals. Some of them might need to fill a position that was not planned earlier.

University Job Board

Keep an eye on your university’s job board, especially if you are enrolled in a school that maintains good connections with companies looking to fill numerous financial analyst jobs. Sometimes, firms announce certain job openings exclusively through the university’s job board to nurture their relationship.

Career Sites

Career sites such as efinancialcareers.com, monster.com, and glassdoor.com are another potential opportunity to submit your financial analyst resume to employers.

We know that it can be difficult to source your financial analyst skills to be able to pursue bigger opportunities in the beginning, so proactivity is key in these situations. You should turn every stone and utilize your time to the fullest rather than sit back and do nothing.

Websites specializing in career listings often feature sections dedicated to MBA finance jobs, catering to those with a higher education in finance. In fact, an MBA with a focus on finance can open up numerous opportunities, as these roles frequently seek candidates with specialized knowledge and skills. This targeted education not only enhances your expertise but also increases your competitiveness in the job market.

If nothing else works, you may want to consider the following two options as measures of last resort:

- Reach out to startup companies and ask if they need help pro bono (and potentially create the demand for a financial analyst position if you do well).

- Cold call executives and offer pro bono help, emphasizing that your recently acquired financial analyst skills may provide fresh perspective to their teams.

Whatever steps you take, don’t forget to connect with other professionals along the way. Don’t shy from exploring the power of networking. For instance, it plays a crucial role in securing MBA finance jobs, as many opportunities are found through professional connections.

Financial Analyst Tools

If you want to impress recruiters, it will certainly help to demonstrate proficiency in office productivity and ERP software on your resume. It comes as no surprise that among the most frequently listed financial analyst skills is the ability to work well in Excel.

In terms of ERP software frequently mentioned by employers, we have SAP and Oracle ahead of every other resource planning platform.

Financial Analyst Salary

What’s the average financial analyst salary? Glassdoor and Indeed are kind enough to share their insights.

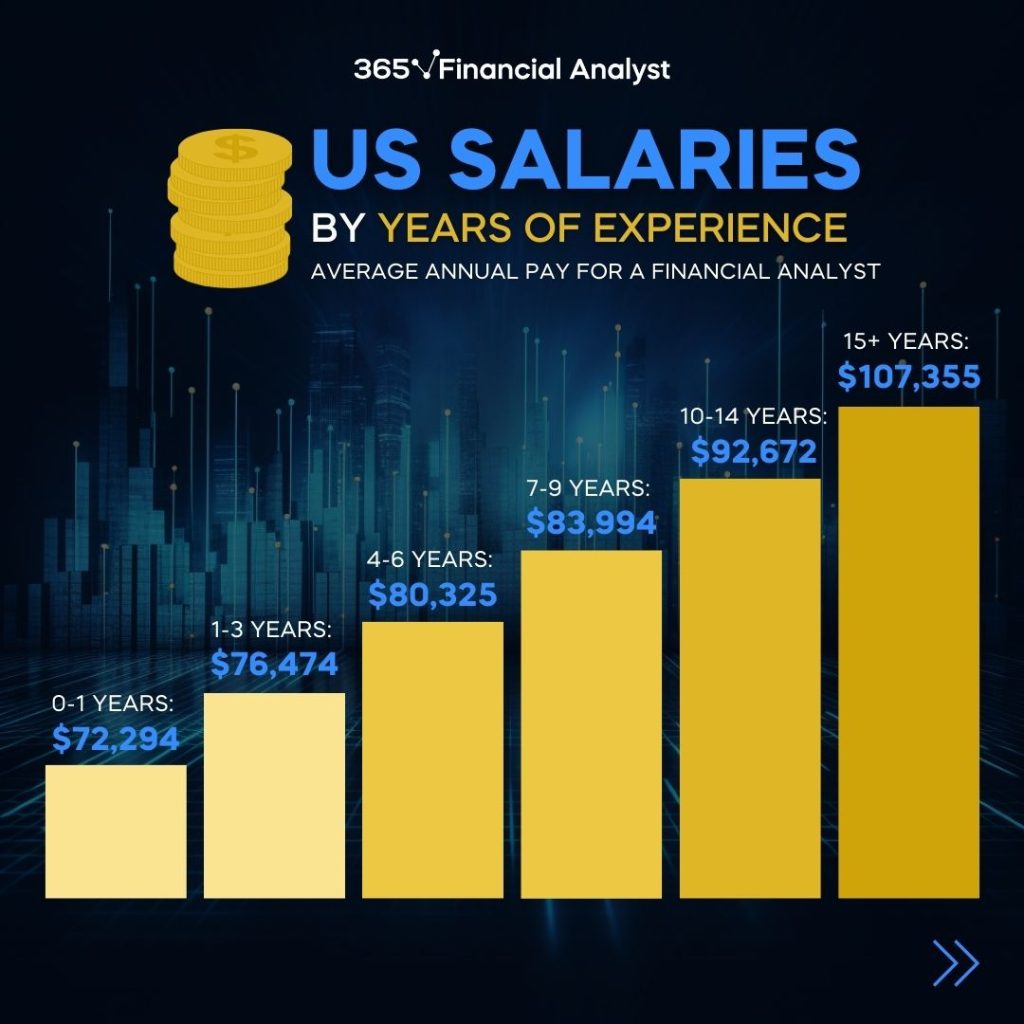

Embarking on a financial analyst career path, you can anticipate an average salary of $85,400. A junior financial analyst salary can vary depending on the industry and company, but you can expect to earn approximately $73,000 per annum. As your career progresses, your pay will increase—with more experienced professionals making over $90,000 annually.

This is a lucrative career opportunity, which offers significant compensation opportunities as you gain experience and become more productive. In practice, researching the average financial analyst salary can help candidates set realistic expectations during job negotiations and task allocation.

The Typical Financial Analyst Career Path

When you become a financial analyst, you will have to go through a steep learning curve. It takes time to get a good grasp of the financial analyst position before getting promoted. Once you do climb up the corporate ladder, you can expect to become a finance manager.

Every firm has a different job title structure, but in general, the idea is that a finance manager should work independently and understand all financial transactions and processes that take place in the company. Moreover, a good finance manager is capable of steering a team in the right direction and delegating their work to other employees from the finance team.

In large companies, we also have the role of CFO (Chief Financial Officer)—an individual capable of organizing the work of several teams run by finance managers. Usually, the CFO is considered the second most-senior person in a company besides the CEO.

How to Become a Financial Analyst in 2024 – Where to Start?

A financial analyst position gives you the opportunity to advance your career and offers a natural progression towards the finance manager and CFO career paths. This is a rewarding career path and we will be happy to offer you the financial analyst tools to embark on this journey.

We provide the perfect theoretical and practical financial analyst courses online you can use to learn the necessary skills, save time, and get hired. You will also have the unique opportunity to work on practical assignments that will simulate real-world experience and projects. In our platform, you can find more valuable insights on how to get a financial analyst job. Sign up for free now.

FAQs

To be a finance analyst, you generally need a combination of education, skills, experience, and sometimes certifications.

Education: A bachelor’s degree in finance, economics, accounting, business administration, or a related field is typically required. Advanced positions may benefit from a master’s degree, such as an MBA.

Skills:

Analytical Skills: Ability to interpret financial data and market trends.

Technical Skills: Proficiency in financial software, databases, and Excel.

Communication Skills: Strong written and verbal communication for reporting findings.

Math Skills: Good with numbers for analyzing financial reports.

Attention to Detail: Precision in analyzing financial documents.

Experience: Entry-level positions may not require prior work experience, though internships or work placements can be advantageous. Progressing to more senior roles typically requires several years of experience in financial analysis or related fields.

Certifications: Certifications such as the Chartered Financial Analyst (CFA) or Certified Public Accountant (CPA) can enhance a finance analyst’s credentials and prospects.

The path to becoming a financial analyst can take anywhere from 4 to 8 years, depending on the speed at which you complete your education, gain necessary experience, and achieve professional certifications.

Becoming a financial analyst typically involves several steps, and the time required can vary based on educational and career choices:

Bachelor’s Degree: 4 years of undergraduate study in finance, economics, accounting, or a related field.

Financial Analyst Internship: Concurrent with undergraduate study or shortly after, internships can range from a few months to a year.

Junior Financial Analyst: After obtaining a bachelor’s degree, you can start in an entry-level analyst position. The experience required to move up can vary, often between 1 to 3 years.

Certifications: Pursuing certifications like the Chartered Financial Analyst (CFA) can add to the timeline. The CFA, for example, requires passing three levels of exams, which candidates typically complete over 2 to 4 years, alongside gaining relevant work experience.

While it can be competitive and demanding to break into, with the right preparation and persistence, entering the field of financial analysis is achievable. Entering the field of financial analysis can be competitive, but whether it’s hard depends on several factors:

Education: Having a relevant degree in finance, economics, accounting, or business can provide a strong foundation.

Certifications: Obtaining professional certifications like the Chartered Financial Analyst (CFA) or Certified Financial Planner (CFP) can enhance your attractiveness to employers but requires significant effort and dedication.

Experience and Skills: Gaining relevant internships or work experience in finance-related roles can be challenging but is crucial for standing out. Strong analytical, technical, and communication skills are also key.

Networking: Building a professional network can significantly influence your ability to enter the field, as opportunities often come through connections.

Market Conditions: Economic factors and the financial industry’s health can impact the availability of roles.

To qualify as a financial analyst in 2024, you typically need:

Education: A bachelor’s degree in finance or a related field.

Skills: Strong analytical abilities and proficiency in Excel.

Experience: Internships or work experience in finance can help.

Certifications: Credentials like the Chartered Financial Analyst (CFA) can boost job prospects.

Continuing Education: Keeping up with financial trends and regulations is essential.

To get your foot in the door and embark on a career as a financial analyst, start by building a solid foundation in finance, economics, or a related field through your education. Internships play a critical role, offering hands-on experience and networking opportunities.

Enhance your resume with relevant certifications such as the CFA (Chartered Financial Analyst) or an MBA with a focus on finance. Engage with finance professionals through networking events, LinkedIn, and professional forums to learn about openings and gain referrals. Finally, showcase your analytical skills, proficiency in financial modeling, and understanding of market trends in your job applications.

Pursuing a career as a financial analyst involves a combination of formal education, skill development, and networking. Obtain a bachelor’s degree in finance, accounting, economics, or business administration as a starting point. Consider furthering your qualifications with an MBA or CFA certification to stand out. Gain practical experience through internships or entry-level positions in finance-related fields.

Develop a strong skill set in financial modeling, data analysis, and software relevant to financial analysis (e.g., Excel, Bloomberg, SAS). Stay informed about the financial markets and industry trends. Build your professional network by connecting with industry professionals and attending finance-related events.

As an incoming college graduate aiming to become a financial analyst, focus on tailoring your education towards finance or related fields. Seek out internships in finance to gain practical experience and make industry connections. Work on acquiring key skills such as financial modeling, statistical analysis, and proficiency in Excel and financial analysis software.

Consider certifications like the CFA to enhance your credentials. Start networking early by joining finance clubs, attending industry seminars, and using platforms like LinkedIn to connect with financial professionals. Prepare a strong resume that highlights your education, internships, and relevant skills. Finally, apply for entry-level financial analyst positions or related roles to start building your career path.