Common Investment Banking Interview Questions and Answers

Get interview-ready with our investment banking career guide. Discover what common investment banking interview questions employers ask and find the right answers to stand out on your Superday. We covers both behavioral and technical questions, helping you to effectively showcase your skills and experience.

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for FreeIf you’re preparing for an investment banking interview, you’re likely aware of the competitive nature of the field. This guide walks you through some common yet challenging investment banking interview questions and sample answers, covering both behavioral and technical aspects of the job.

Table of Contents

- How to Prepare for an Investment Banking Interview

- The Investment Banking Interview Process

- Common Investment Banking Interview Questions and Answers

- Investment Banking Brain Teasers

- Questions to Ask an Investment Banker

- Next Steps

- FAQs

How to Prepare for an Investment Banking Interview

An IB interview prep is key to succeeding in an investment banking interview. Here are some steps to help you get ready:

- Research the firm: Understand the company’s history, culture, recent deals, and industry reputation and take notes. During your investment banking interview prep stage, you should explore firms like—Goldman Sachs, J.P. Morgan Chase & Co., Morgan Stanley, Bank of America Merrill Lynch, Citigroup, Credit Suisse, Deutsche Bank, and Barclays.

- Review financial concepts: Be comfortable with explaining financial concepts, valuation techniques, and market trends. Our latest investment banking job report outlines essential topics employers seek in a candidate.

- Practice investment banking behavioral questions: Reflect on your experiences and how they relate to the role.

- Have an investment banking mock interview: Conduct an investment banking mock interview with a friend or mentor to build confidence.

- Master technical investment banking interview questions: Ensure proficiency in relevant financial software and tools and are ready to tackle them on your feet.

Bonus Resource: Here’s a free summary of key investment banking concepts.

The Investment Banking Interview Process

Understanding the investment banking interview process can help you prepare effectively. Here’s an overview of the typical steps involved:

- Application and Resume Screening: Submit your application, which includes your resume, cover letter, and possibly an online application form. Ensure you tailor it according to your desired investment banking job description. Recruiters screen these materials to shortlist candidates for the next round.

- First-Round Interviews: Often conducted over the phone or via video call, first-round interviews typically focus on your resume, investment banking behavioral questions, and some technical questions to assess your basic understanding of finance and investment banking. So, be well prepared for a quick investment banking phone interview.

- Assessment Centers: Some firms use assessment centers where candidates participate in group activities, case studies, and individual presentations. This evaluates your teamwork, problem-solving, and communication skills. Be fully prepared with these technical investment banking interview questions.

- Second-Round Interviews: These are usually in-person interviews at the firm’s office. They are more in-depth and can include multiple interviews with various team members. Expect a mix of investment banking behavioral questions, technical, and situational questions.

- Superday (Final Round): For top candidates, the final round, known as Superday, involves back-to-back interviews with senior bankers, including managing directors and partners. This round is highly intensive, testing your technical knowledge, cultural fit, and overall suitability for the role. Ensure you have an investment banking cheat sheet to recap between meetings.

- Offer and Onboarding: Successful candidates receive an offer letter detailing the role, compensation, and other details. After accepting the offer, you will go through the onboarding process, which includes training and orientation.

Common Investment Banking Interview Questions and Answers

Using the STAR method technique (Situation, Task, Action, Result) is an excellent way to tackle these investment banking interview questions. Below are some examples with corresponding sample answers.

1. Can you walk me through your resume?

- Situation: An investment banking interview process starts with dissecting your resume. Begin with your educational background.

- Task: All IB interview questions must outline your work experience and key achievements.

- Action: Highlight skills relevant to investment banking.

- Result: Show how your experiences have prepared you for this role.

Answer Example: I graduated with a degree in finance from XYZ University. During my studies, I aimed to build a strong foundation in investment banking. I completed internships at ABC Bank and DEF Financial, where I worked on financial modeling and analysis. These experiences equipped me with the necessary skills and insights for a successful career in investment banking, and I am eager to bring this expertise to your firm.

2. What exactly do investment bankers do?

- Situation: Investment banking interview questions aim to provoke and see if you crack under pressure. Start building your skills from the bottom up and know the basics of the role.

- Task: Explain that investment bankers help companies raise capital and advise on mergers and acquisitions.

- Action: Provide specific examples of tasks.

- Result: During your investment banking mock interview, find a way to demonstrate a clear understanding of the job.

Answer Example: Investment bankers play a crucial role in the financial industry. They assist companies in raising capital by issuing stocks or bonds and provide strategic advice on mergers and acquisitions. For example, at my previous internship, I was involved in preparing pitch books for potential M&A deals. Through this, I developed a comprehensive understanding of the process and the importance of investment bankers in maximizing value for their clients.

3. Why did you choose to apply to our firm?

- Situation: Before your investment banking phone interview, ensure you research the firm.

- Task: Identify unique attributes or initiatives.

- Action: Explain how these align with your career goals.

- Result: Show genuine interest and thorough preparation.

Answer Example: Your firm’s commitment to innovation and excellence has always been admirable. Researching the company’s history, culture, and recent deals revealed impressive mentorship programs and professional development opportunities. I believe that joining your firm would provide the perfect environment for me to grow and contribute meaningfully to your team.

4. What are the different investment banking valuation methods?

- Situation: Breaking into Wall Street requires in-depth knowledge of certain topics. You must demonstrate a strong understanding of the various investment banking valuation methods.

- Task: Identify and explain different methods, such as DCF, comparable company analysis, and precedent transactions.

- Action: Describe how each method is used and its advantages and limitations.

- Result: Show a comprehensive understanding of investment banking valuation methods.

Answer Example: As I said, in investment banking, several valuation methods are used, including DCF analysis, comparable company analysis, and precedent transactions. DCF analysis involves projecting future cash flows and discounting them to present value using the company’s WACC. Comparable company analysis involves comparing the target company’s financial metrics with those of similar public companies. Precedent transactions involve analyzing prices paid for similar companies in past transactions. Each method provides unique insights, and using multiple methods helps ensure a comprehensive valuation.

5. How would you value a company?

- Situation: This is a follow-up question where you mention any related experience, such as your previous role as a financial analyst.

- Task: Determine a fair and comprehensive company valuation.

- Action: Use investment banking valuation methods like DCF analysis, comparable company analysis, and precedent transactions.

- Result: Present a well-rounded valuation to your team.

Answer Example: In my role as a financial analyst, I was tasked with valuing a mid-sized manufacturing company. I employed various investment banking valuation methods such as the DCF analysis, comparable company analysis, and precedent transactions. I projected future cash flows, compared financial metrics with similar companies, and analyzed past transactions. This multifaceted approach provided a well-rounded valuation, guiding our investment decision-making process.

6. What’s the difference between enterprise value and equity value?

- Situation: Through investment analyst interview questions, candidates are often tested on their understanding of commonly used financial metrics.

- Task: Explain the components of each value.

- Action: Provide calculations and real-world examples. You can create an investment banking interview cheat sheet to refer to while practicing.

- Result: As one of the crucial investment banking technical questions, it’s important to clarify the difference clearly and concisely.

Answer Example: Understanding financial metrics is crucial in investment banking. Enterprise value includes equity, debt, and cash, reflecting the total company value. Equity value, or market capitalization, is the value of a company’s outstanding shares. This distinction helps in evaluating a company’s overall worth and the value available to shareholders.

7. How do you calculate the terminal value of a company?

- Situation: In DCF analysis.

- Task: Choose between the perpetuity growth model and the exit multiple approach.

- Action: Explain both methods and their applications.

- Result: Show a deep understanding of valuation techniques.

Answer Example: Terminal value is a critical component in DCF analysis. The perpetuity growth model assumes constant growth of cash flows, while the exit multiple approach estimates terminal value based on a multiple of financial metrics like EBITDA. Both methods provide insights into a company’s long-term value, aiding in comprehensive valuation analysis.

8. Walk me through an LBO.

- Situation: Leveraged Buyout (LBO) is a key concept in investment banking.

- Task: Explain the process and components of an LBO.

- Action: Discuss the acquisition, financing structure, and exit strategy.

- Result: Demonstrate an understanding of how value is created through an LBO.

Answer Example: An LBO involves acquiring a company using a significant amount of borrowed money (leverage) to meet the cost of acquisition. The assets of the company being acquired often serve as collateral for the loans. The process typically includes identifying a target company, securing financing from various sources (like debt and equity), and planning the exit strategy, which could be through an IPO or a sale. By improving operational efficiencies and paying down debt, the acquiring company aims to increase the value of the business and achieve a high return on investment.

9. Walk me through a DCF.

- Situation: Discounted Cash Flow (DCF) is a common valuation method.

- Task: Explain the steps involved in performing a DCF analysis.

- Action: Describe projecting cash flows, determining the discount rate, and calculating the present value.

- Result: Show how DCF helps in valuing a company based on its future cash flows.

Answer Example: To perform a DCF analysis, start by projecting the company’s free cash flows for a specific forecast period. Next, determine the appropriate discount rate, often the company’s Weighted Average Cost of Capital (WACC). Then, calculate the terminal value using either the perpetuity growth model or the exit multiple approach. Finally, discount the projected cash flows and terminal value back to their present value using the WACC. The sum of these present values gives you the company’s intrinsic value.

10. What are some key considerations in restructuring?

- Situation: Restructuring involves reorganizing a company’s structure and operations.

- Task: Any restructuring interview questions must tackle key considerations, such as financial health, operational efficiencies, and stakeholder interests.

- Action: Discuss strategies like debt restructuring, asset sales, and cost-cutting.

- Result: Show how restructuring can improve a company’s financial stability and operational performance.

Answer Example: Restructuring involves assessing the company’s financial health and identifying areas for improvement. Key considerations include reducing debt through negotiations with creditors, selling non-core assets to raise capital, and implementing cost-cutting measures to enhance operational efficiencies. The goal is to improve the company’s financial stability and position it for long-term success while considering the interests of all stakeholders involved.

11. Why investment banking?

- Situation: Reflect on your motivation for pursuing a career in investment banking.

- Task: In your investment banking interview guide, you must outline specific reasons why you are drawn to this field.

- Action: Explain how your skills and experiences align with the demands of investment banking.

- Result: An impeccable ‘Why Investment Banking’ answer must demonstrate your passion and suitability for the role.

Answer Example: I am passionate about investment banking because it combines my interest in finance with my desire to work in a fast-paced, dynamic environment. My background in financial analysis and modeling has equipped me with the technical skills needed for this role. Additionally, I thrive on challenges and enjoy working on complex transactions that have a significant impact on companies and industries. Investment banking offers the perfect platform for me to leverage my skills and contribute to meaningful financial decisions.

12. How do you approach networking in investment banking?

- Situation: Investment banking networking questions are paramount for those entering the field. Networking is crucial in this line of work for career growth and deal sourcing.

- Task: Identify effective networking strategies.

Action: When preparing for such investment banking informational interview questions, discuss attending industry events, leveraging alumni networks, and building relationships with colleagues.

- Result: Show how networking can lead to career opportunities and successful deals and include it in your IB interview prep set.

Answer Example: Networking is essential in investment banking, and I approach it strategically to build meaningful connections that can lead to career opportunities and successful deals. To achieve this, I attended various industry events such as finance conferences, seminars, and networking mixers. I made a point to introduce myself to speakers and other attendees, engaging them in conversations about their work and experiences. Additionally, I leveraged my alumni network by reaching out to former classmates and professors who are now working in the field. I also actively participated in online professional groups and forums related to investment banking to stay updated on industry trends and connect with professionals worldwide.

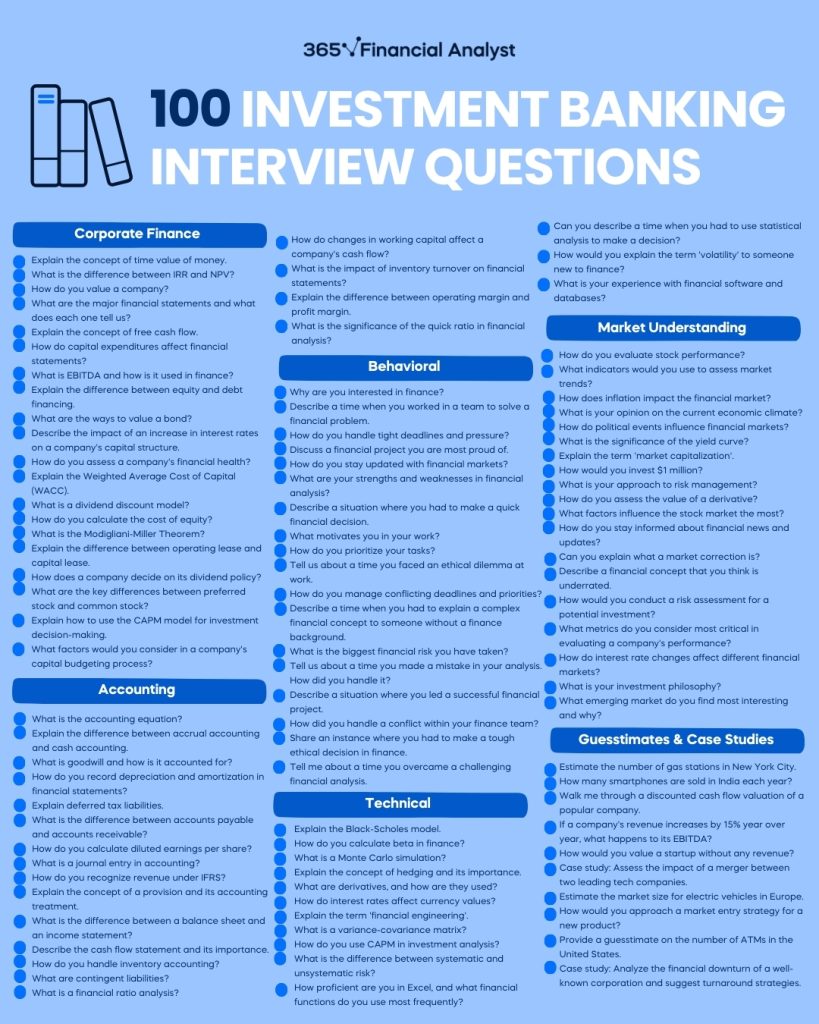

Top 100 Investment Banking Interview Questions

Investment banking is a multidisciplinary field, requiring a broad knowledge base across various domains. As a result, you may encounter interview questions spanning multiple areas of finance.

Investment Banking Brain Teasers

Investment banking brain teasers are a common part of such interviews. They test your analytical thinking, problem-solving skills, and ability to handle pressure. Here are a few examples:

Investment Banking Brain Teasers: The Light Bulb Problem

Question: You are in a room with three light switches. Each switch controls one of three light bulbs in another room. You cannot see the bulbs from where the switches are. You can turn the switches on and off and leave them in any position. How would you identify which switch controls which bulb if you are allowed only one trip to the room with the bulbs?

Solution: Turn on the first switch and leave it on for a few minutes. Then turn it off and turn on the second switch. Immediately go to the room with the bulbs. The bulb that is on corresponds to the second switch. If it’s off but warm, it corresponds to the first switch, and the one that’s off and cold corresponds to the third switch.

Investment Banking Brain Teasers: The Three Hats Problem

Question: Three people are wearing hats that are either red or blue. Each person can see the other two hats but not their own. They need to guess the color of their hat or pass, and they can’t communicate with each other once the game starts. What strategy should they use to maximize the number of correct guesses?

Solution: One strategy is for each person to assume that if they see two hats of the same color, they must be wearing the opposite color. If they see one red and one blue, they pass. This way, if the hats are RR or BB, one person will guess correctly and the other two will pass. If the hats are RB or BR, they all pass. Over many iterations, this strategy maximizes correct guesses.

Investment Banking Brain Teasers: The Bridge Crossing Problem

Question: Four people need to cross a bridge at night. They have one flashlight, and the bridge is too dangerous to cross without it. Only two people can cross at a time. Each person walks at a different speed: 1 minute, 2 minutes, 7 minutes, and 10 minutes. What is the fastest time for all four to cross the bridge?

Solution: The fastest solution is as follows:

- First, the 1-minute and 2-minute people cross the bridge (2 minutes).

- The 1-minute person returns with the flashlight (1 minute, total: 3 minutes).

- The 7-minute and 10-minute people cross the bridge (10 minutes, total: 13 minutes).

- The 2-minute person returns with the flashlight (2 minutes, total: 15 minutes).

- Finally, the 1-minute and 2-minute people cross the bridge again (2 minutes, total: 17 minutes).

- Total time: 17 minutes.

Investment Banking Brain Teasers: The Weighing Problem

Question: You have 12 identical-looking balls, but one is either heavier or lighter. You have a balance scale. So, how can you determine which ball is the odd one out and whether it is heavier or lighter in just three weighings?

Solution: Divide the balls into three groups of four. Weigh two groups (Group A vs. Group B). If they balance, the odd ball is in the third group (Group C). If they don’t balance, the odd ball is in the heavier or lighter group. Take the suspected group, divide it into three smaller group, and repeat the process. With careful elimination, you can determine the odd ball in three weighings.

Investment Banking Brain Teasers: The Jelly Beans Problem

Question: You have a jar with 50 red jelly beans and 50 blue jelly beans. You want to separate them into two jars such that each jar contains at least one jelly bean, and the probability of picking a red jelly bean from one of the jars is maximized. How do you do it?

Solution: Put one red jelly bean in the first jar. Put the remaining 49 red jelly beans and all 50 blue jelly beans in the second jar. As a result, the probability of picking a red jelly bean is now maximized because:

- Probability from the first jar = 1.

- Probability from the second jar = 49/99.

- The overall probability of picking a red jelly bean is maximized to (1/2)(1) + (1/2)(49/99) = 0.745.

Questions to Ask an Investment Banker

Asking insightful investment banking interview questions demonstrates your genuine interest in the position and the company. Here are some examples:

- Can you tell me more about the team I would be working with and how this position contributes to the overall success of the finance department?

- What are the most immediate projects that need to be addressed by the person filling this position?

- What are the company’s growth plans for the next few years, and how does the finance department contribute to achieving these objectives?

Questions to ask in an investment banking interview should be specific to the company and not overly complicated to avoid putting the interviewee in a tough spot.

Next Steps

After preparing and practicing for your investment banking interview questions, ensure you:

- Stay Updated: Keep abreast of the latest industry trends and news.

- Follow Up: Send a thank-you email after the interview, reiterating your interest in the role.

- Reflect: Assess your performance and identify areas for improvement for future interviews.

Looking to improve your investment banking skills?

Enroll in our investment banking training and receive a certificate for your knowledge. You can try our learning platform for free.

FAQs

To prepare for an interview at an investment bank, start by thoroughly researching the firm. Understand its history, culture, recent deals, and industry position. This background knowledge will help you tailor your answers and show your genuine interest in the company.

Next, review key financial concepts, including valuation techniques, financial modeling, and market trends. Practice answering behavioral questions using the STAR method (Situation, Task, Action, Result) to reflect on your past experiences. Conduct an investment banking mock interview to build confidence and refine your responses. Finally, ensure you are proficient in relevant financial software and tools, as technical skills are crucial in investment banking roles.

Investment banking interviews typically include a mix of behavioral and technical questions. Behavioral questions might include “Can you walk me through your resume?” and “Why investment banking?” These assess your experiences, motivations, and fit for the firm.

Technical questions often cover core financial concepts and practical applications. Examples include “How would you value a company?” and “What’s the difference between enterprise value and equity value?” These questions test your understanding of financial principles and your ability to apply them in real-world scenarios.

The preparation time for an investment banking interview can vary but starting at least a month in advance is generally recommended. This timeframe allows you to review financial concepts, practice technical skills, conduct mock interviews, and research specific firms. Dedicating consistent, focused effort over this period will help you build the knowledge and confidence needed to perform well in your interviews.

EBITDA is a measure of a company’s overall financial performance and operational profitability. The formula is Net Income + Interest + Taxes + Depreciation + Amortization. You might also be asked, “Why might EBITDA be considered a better measure than net income?” The answer is that EBITDA excludes non-operational expenses, providing a clearer view of a company’s operational performance.