Discounted Cash Flow Valuation

trending topic

Master DCF Valuation: Learn to build real-world company valuation models

Start for Free

Start for Free

What you get:

- 3 hours of content

- 20 Interactive exercises

- 55 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

Discounted Cash Flow Valuation

trending topic

Start for Free

Start for Free

What you get:

- 3 hours of content

- 20 Interactive exercises

- 55 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

$99.00

Lifetime access

Start for Free

Start for Free

What you get:

- 3 hours of content

- 20 Interactive exercises

- 55 Downloadable resources

- World-class instructor

- Closed captions

- Q&A support

- Future course updates

- Course exam

- Certificate of achievement

What You Learn

- Improve your financial modeling skills by learning to build sophisticated valuation models

- Learn from an experienced instructor and adopt industry-standard best practices in financial modeling

- Gain a deep understand of the key drivers of business value: growth and profitability

- Develop the skills to forecast P&L and Balance sheet items and integrate them into a comprehensive 3-statement model

- Learn to format your Excel work professionally to improve the presentation of your financial models

- Acquire practical skills that will impress hiring managers

Top Choice of Leading Companies Worldwide

Industry leaders and professionals globally rely on this top-rated course to enhance their skills.

Course Description

Learn for Free

1.1 Why value a company?

4 min

1.3 An investor's perspective

4 min

1.4 Defining the two main value drivers

2 min

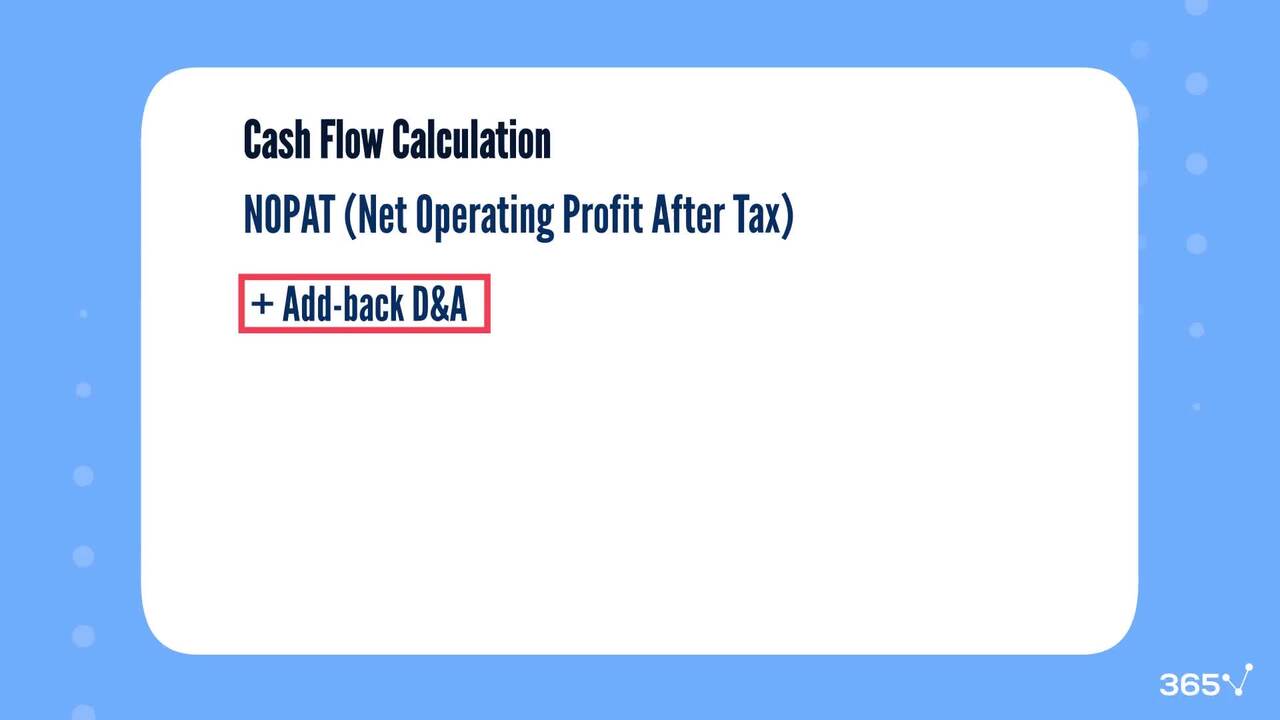

1.6 How to calculate Unlevered Free Cash Flow

6 min

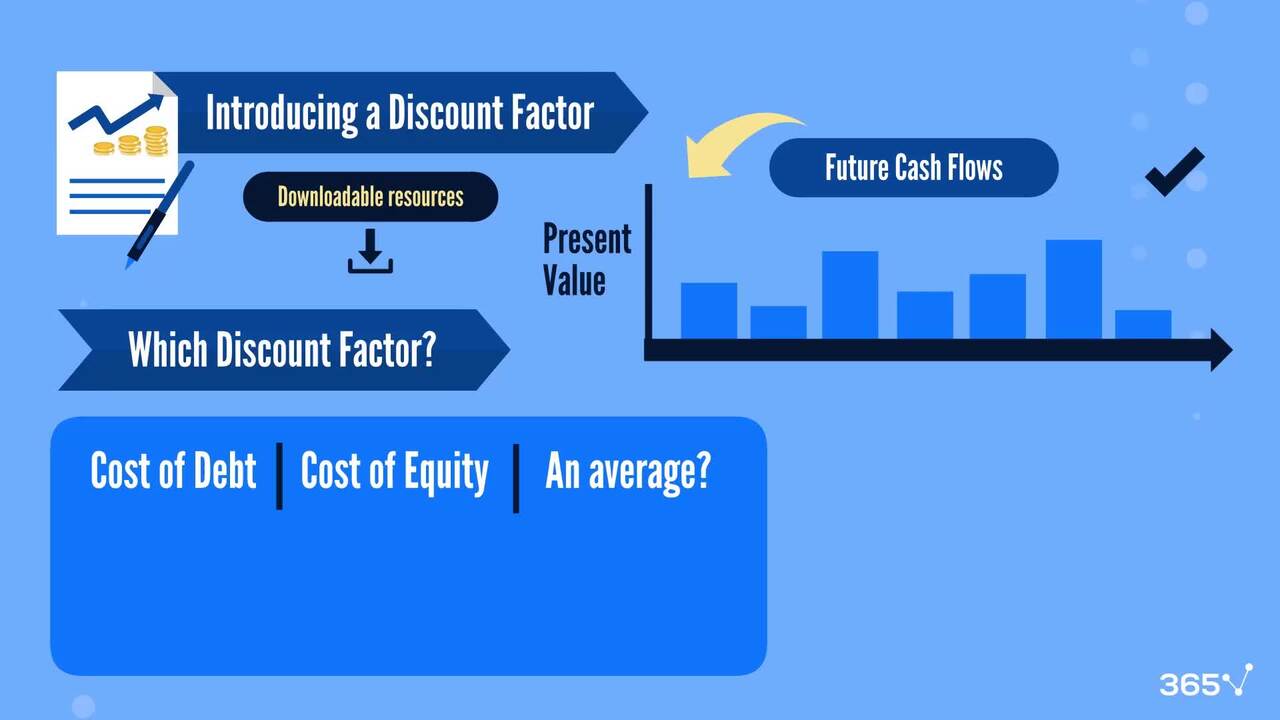

1.7 Introducing a discount factor: Weighted average cost of capital

5 min

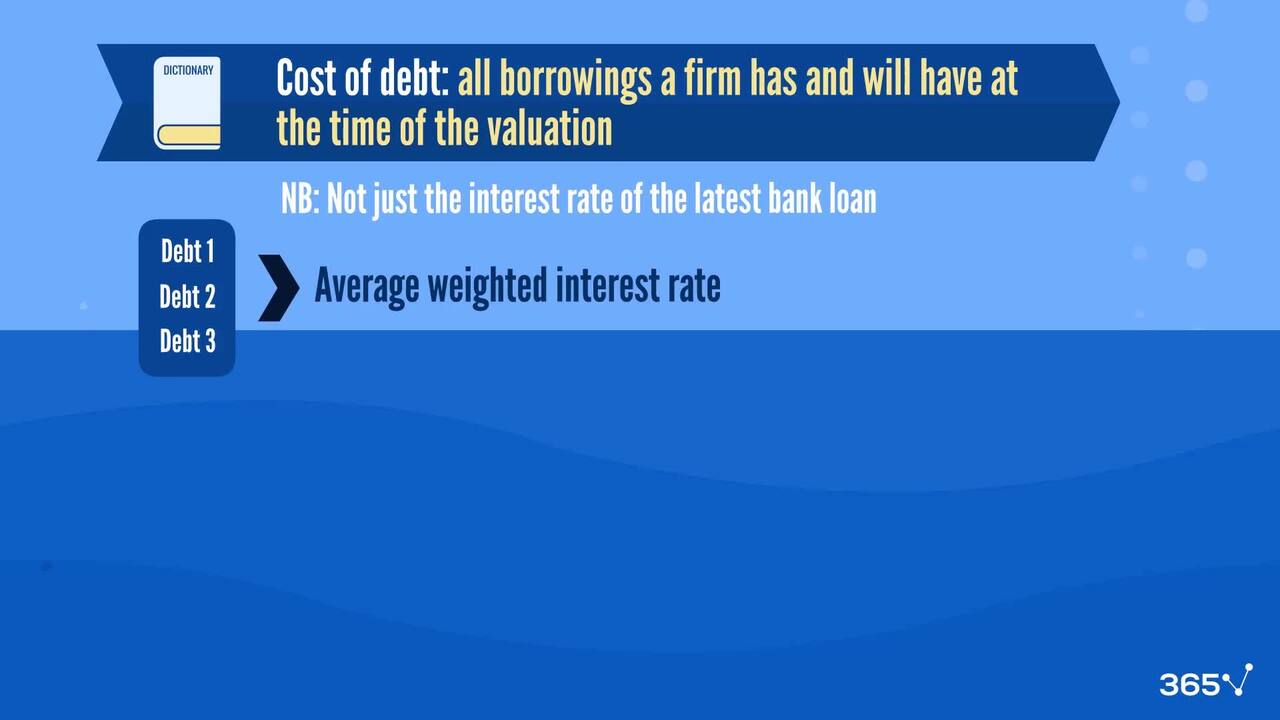

1.9 Calculating cost of debt

2 min

Curriculum

- 2. Building a DCF model in practice28 Lessons 77 MinIn the second part of the course, students are engaged in their own real-life DCF modeling in Excel. The lessons are easy to understand and allow a hands-on learning experience with the theory learned earlier.Structure of the DCF Model we will create3 minThe company we will value1 minForecasting revenue growth4 minModeling for multiple scenarios2 minForecasting Other revenue and Cogs4 minCalculating Opex and Depreciation and Amortization2 minObtaining the rest of Profit and Loss items3 minOverview of Balance sheet items1 minIntroducing the Days methodology to forecast working capital items2 minCalculating DSO, DIO, DPO for the historical period1 minForecasting DSO, DPO, DIO2 minForecasting PPE, Other assets, Other liabilities2 minP&L structure3 minFilling in the P&L sheet2 minFilling in the Balance sheet2 minCompleting the Balance sheet4 minWorking on a Cash Flow structure3 minBridging Unlevered Free Cash Flow to Net Cash Flow2 minCalculating Unlevered Free Cash Flow7 minCalculating Net Cash Flow4 minFilling in the entire forecast period4 minIntroducing a discount factor and a perpetuity growth rate2 minCalculating the present value of future cash flows3 minObtaining Terminal Value and Enterprise Value2 minCalculating Equity Value1 minPerforming a sensitivity analysis5 minA modeling application of Goal Seek2 minVisualizing DCF: Understanding financial projections through charts4 min

Topics

Course Requirements

- Highly recommended to take the Intro to Excel, Accounting and Financial Statement Analysis, and Corporate Finance courses first

- You will need Microsoft Excel 2016, 2019, or Microsoft Excel 365

Who Should Take This Course?

Level of difficulty: Beginner

- Aspiring investment bankers, financial analysts, investment analysts

- Existing investment bankers who have recently started their career and need to improve their valuation skills

- Business owners and startup founders who want to learn how to value their business

Exams and Certification

A 365 Financial Analyst Course Certificate is an excellent addition to your LinkedIn profile—demonstrating your expertise and willingness to go the extra mile to accomplish your goals.

Meet Your Instructor

Nedko earned a Master’s degree in Finance from Bocconi University (Milan, Italy) in 2012. Then, he gained valuable working experience with exciting firms like PwC Italy (Financial Advisory and M&A), Coca-Cola European Partners (Financial Analyst), and Infineon Technologies (M&A). In 2014, he published his first online course on financial modeling and valuation when he realized that creating educational materials is his true calling. The amazing students and content creators in the data science community, the 365 team, and the strong desire to build the perfect learning platform drive Nedko to continue on this exciting journey. His goal is to establish 365 Data Science as the learning platform that bridges the gap between theoretical knowledge and practical business application.

What Our Learners Say

365 Financial Analyst Is Featured at

Our top-rated courses are trusted by business worldwide.