Why Invest in a Company?

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for Free

If you were an investor, why buy a company?

Because they make great soft drinks and are called Coca-Cola, or because their stock promises a good return on investment?

Hopefully, it’s the second option! Every investor’s main objective should be to make money.

So, let’s think of the following situation.

I want to buy shares in a company traded on the Stock Exchange.

What is the cost to do that?

I will have to make an initial investment – purchase the shares from their current owner.

And what is the benefit I will have after acquiring the shares?

The stock will pay dividends regularly, and if everything goes as planned, it will increase in value.

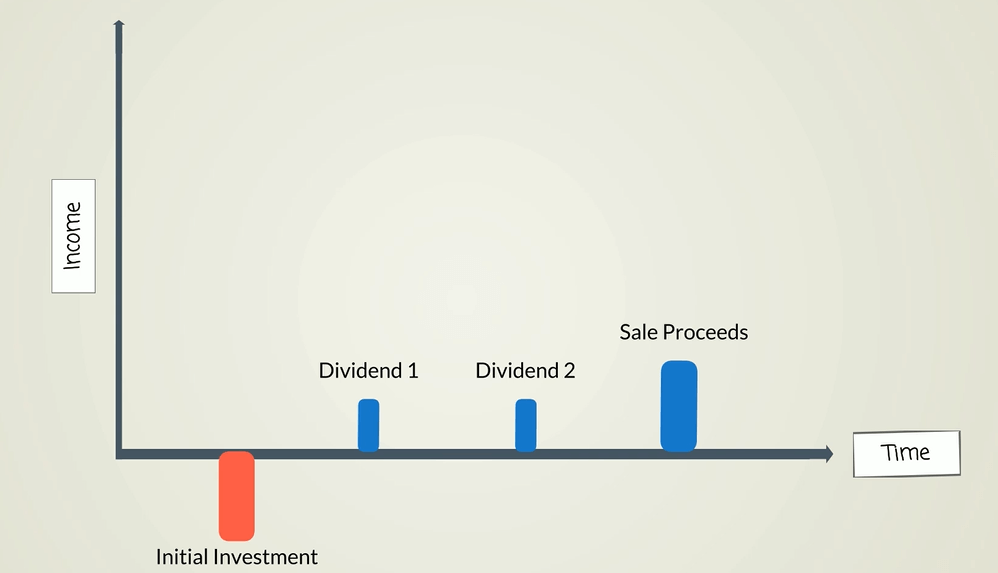

Here’s my investment horizon.

I buy the stock today and experience a negative cash flow. In the next few years, I will hold the stock and will receive a regular dividend payment, as this is a mature and profitable company. And then, when the market is good and I decide the right moment has come, I will sell the stock to its next buyer and will hopefully benefit from the market’s price having increased in the meantime.

One can rightly point out that whether or not I will buy a certain stock is related to three variables:

- Purchase Price

- Dividends

- Selling Price

It has to be true! These are the three parameters that will determine an investor’s rate of return.

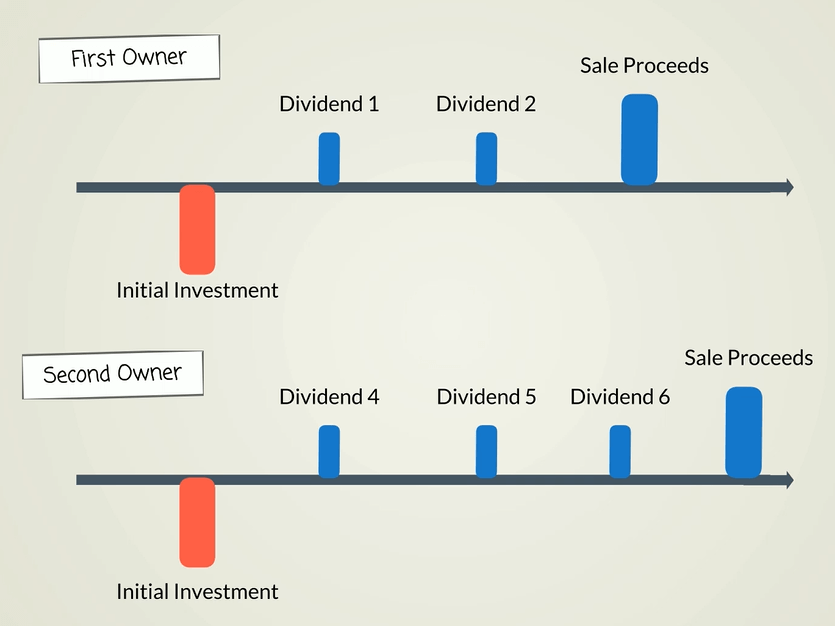

But hold on. What about the next investor?

How does the next investor determine the price he will pay for the company’s shares? He uses the exact same reasoning, right? He’s interested in the stock’s future dividends and the price at which he can sell the stock to the next investor and so on. If we reiterate this process a few times, we will inevitably come to the following conclusion.

The price of a stock today is a function of the sum of the dividends the stock will pay in the future. That’s it! It’s very simple and makes perfect sense! The investors who will invest in a stock will measure its price by estimating the value of the dividends the stock will pay in the future.

We need to answer one more question, though.

What is the main driving force that determines a company’s dividends?

If a company makes no money, its management would have no choice but to slash dividends and communicate that the firm is going through some tough times.

In a different context, if a company’s business is growing and it needs to reinvest the cash it makes, it won’t be able to distribute dividends.

So, cash flow, the money a company makes, is the main driving force that determines dividend payments.

And given that a company’s share price is a function of its expected dividends, we won’t make a mistake if we conclude that a company’s share price depends on its expected future cash flows.