What Drives Company Value?

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

Start for Free

A company’s value is a function of its future cash flows.

In this article, we’ll go a step further and will determine what drives future cash flows.

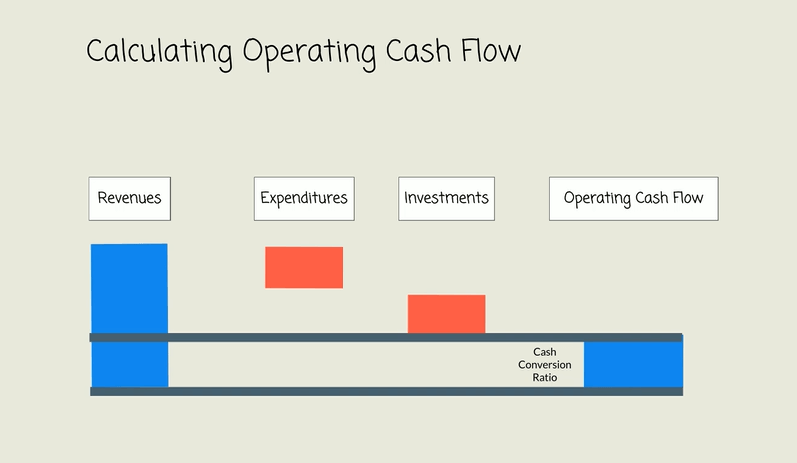

Revenues minus Costs, minus Investments, equals Operating Cash Flow. Some of the money that comes in under the form of revenues is used to pay expenses and make investments. Therefore, at the end of the year, the firm can keep only a portion of the money that came in as revenues. This portion is called Cash Conversion Ratio.

The graph suggests there are two main ways to increase a company’s cash flows – grow its revenues or improve its profitability.

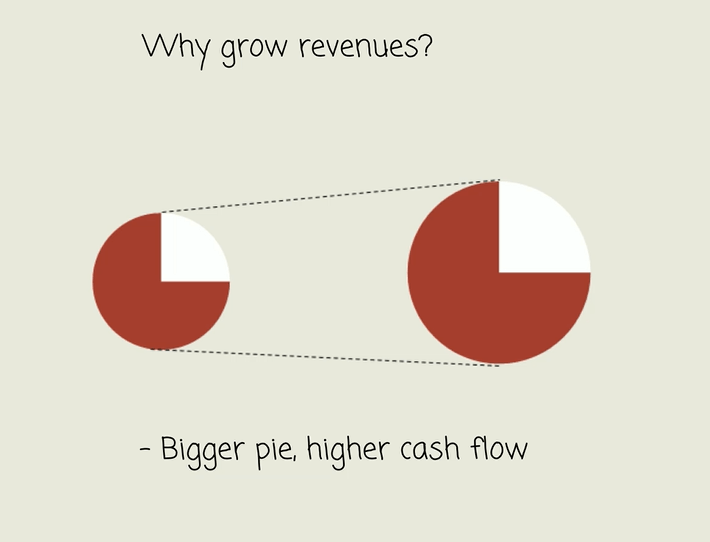

Why would we expect a higher cash flow if we grow revenues?

Well, think of it in the following way. We will have a bigger pie chart with the same conversion ratio. Therefore, the amount of cash flow produced would improve.

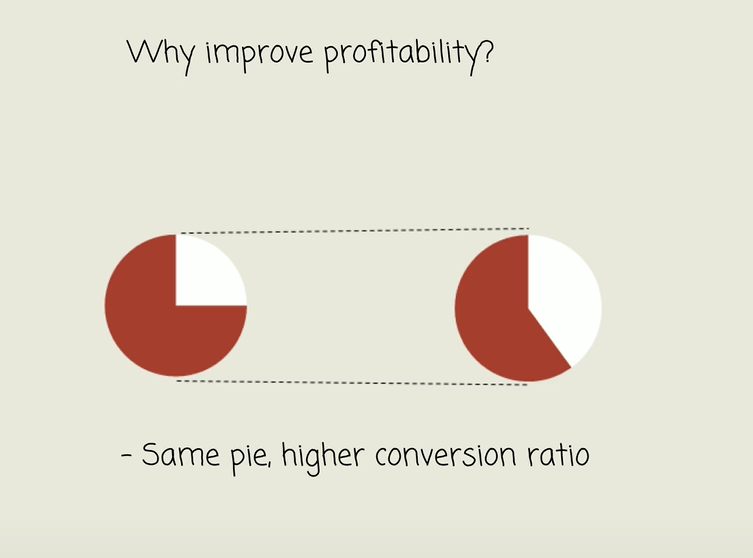

And why can we expect to make more money if the company improves its profitability?

The new pie chart will have the same size, but its conversion ratio would improve; hence, the overall Operating Cash Flow will be higher.

The end result of both events is the same – higher Operating Cash Flows, which leads to an increase in the dividends received by shareholders and a higher valuation of the company.

One more time – the two functions that drive a firm’s future value are its growth and profitability.

This is a key concept that will help us a great deal when valuing a company.